The next stage of the Amex war on gaming begins tomorrow, November 1st. In August we reported that Amex had added anti-gaming terms to their signup offers. Signup offer terms now state:

If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome bonus offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome bonus offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit Membership Rewards® to, we may freeze Membership Rewards® credited to, or we may take away Membership Rewards® from, your account. We may also cancel this Card account and other Card accounts you may have with us.

And in September we reported that Amex was actually enforcing their age-old terms against gift cards counting towards minimum spend requirements. So far, we only know this to be true of gift cards purchased at Simon Malls, but it seems likely that they’ll spread the joy to other gift card markets.

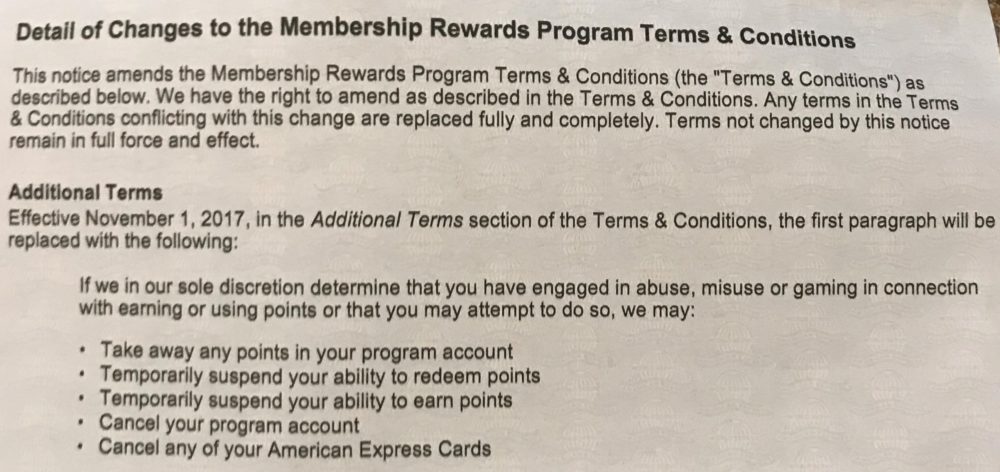

And now, effective November 1st, Amex has updated the terms on their Membership Rewards cards to disallow abuse, misuse, or gaming in connection with earning or using points.

Amex has declared that they have sole discretion to determine if you’ve broken their rules. If you have, they may take away your points, cancel your accounts, or temporarily suspend point earning or redeeming.

What is abuse, misuse, or gaming?

The definitions of these terms haven’t been spelled out. Basically, Amex has declared that they will decide if you’ve done these things after you’ve done them, and that punishment will follow. They did give some hints in their anti gaming signup bonus language, though. They gave the following examples:

…for example, if you applied for one or more cards to obtain a welcome bonus offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount

In other words, with respect to signup offers, “abuse, misuse, or gaming” equates to any ways of obtaining a signup offer other than how they intended. You should only use signup offers that are meant for you, you shouldn’t do anything “sneaky” to meet minimum spend requirements (such as buying gift cards or buying and returning items), and you shouldn’t cancel the card soon after getting the bonus.

If we apply similar logic, we can try to figure out the definition of “abuse, misuse, or gaming” in connection with earning or redeeming points. Amex wants us to earn points through regular spend and to redeem points for ourselves. I can then guess at the banned activities…

Abuse, misuse, or gaming when earning points

My educated guess is that Amex is on the lookout for the following activities with respect to earning points:

- Large gift card purchases.

- Frequent gift card purchases with vendors that trigger bonus categories.

- Abnormally large purchases within bonus categories, especially if there’s any sign that there is some sort of purchase and return scheme going on.

- Very large credit card spend that far exceeds a person’s apparent ability to pay. My guess is that they will watch this more closely with personal cards than business cards since large business purchases are common and normal.

- Earning points through Amex offers on many different authorized user cards.

As I learn about other examples, I’ll update this list.

Abuse, misuse, or gaming when redeeming points

My educated guess is that Amex is on the lookout for the following activities with respect to redeeming points:

- Selling points. Indicators of this may be frequent point transfers to many different authorized users’ frequent flier accounts, for example.

- Buying airfare with the Business Platinum buy with points rebate and somehow getting the airfare refunded.

As I learn about other examples, I’ll update this list.

Analysis

In the last few years Amex has made their credit card lineup more and more competitive. They’ve continued to offer great signup bonuses and they’ve added bonus categories to existing cards and introduced compelling new cards such as the Everyday Preferred and the Blue Business Plus. With the latter, for the first time ever, we have have a card that earns 2 points per dollar for all spend (up to $50K per year), and those points are transferable to airline miles. It’s an unbeatable combination.

Obviously I’m unhappy about the Amex war on gaming, but I get it. Amex naturally wants those signup bonuses and card features to attract profitable new customers and to retain existing ones. Customers who use them only for signup bonuses or only for bonus category spend are financial drains. Amex quite reasonably wants to discourage that behavior.

I also can’t fault Amex for failing to spell out the definition of “abuse, misuse, or gaming.” They know very well that if they did so, people would seek out and find loopholes. What are the opportunities that Amex hasn’t banned? Heck, I’ll admit it… I’d be working on that too.

Amex hasn’t yet applied anti-gaming rules for earning and spending points to their other cards (cash back cards or co-branded cards), but I’d guess that it’s just a matter of time. We need to live within the new Amex reality if we want to continue to enjoy the benefits that their cards offer.

What to do

You can still sign up for Amex cards for the signup bonuses, but you need to be careful to meet spend requirements in ways that Amex won’t see as gaming. Obvious options are to use the cards for all spend, and to prepay utilities and other bills where possible. You can organize events and ask friends to pay you back. You can pay for covered healthcare expenses and have the insurance company pay you back. You can fund Kiva loans. You can pay estimated federal taxes. You may be able to pay miscellaneous bills where credit cards aren’t usually accepted if Plastiq ever fixes their current Amex problem.

Once you’ve earned your signup bonus, ideally you will continue to use the card for everyday spend. I don’t think that Amex will complain if you restrict a card’s use to it’s bonus categories — as long as it is regular spend. If you buy lots of gift cards, especially within bonus categories, I doubt your account will last long.

If you don’t want to pay a card’s second annual fee, wait until the annual fee posts to your account and then call to see if they’ll give you a retention offer. There’s nothing wrong with that. If they offer you something that is worth the annual fee, then pay it. Otherwise cancel or downgrade to a lower annual fee card. If you want to do that latter, though, make sure that you’ve had the lower fee card before. If not, you should look to signup new for that card so that you can get a new signup bonus before it’s too late. Amex has a pretty strict “once per lifetime” rule with their cards, so you don’t want to blow your chance at a signup bonus by downgrading your card.

Keep in mind that Amex cards tend to have the best benefits around. Many are worth their annual fee for their benefits alone.

[…] terms against meeting spend requirements by buying gift cards, buying & returning items, etc. (The Amex war on gaming heats up). So, let’s assume that the primary new gotcha here is the “number of American […]

[…] The Amex war on gaming heats up Amex fires another shot in the war on gaming […]

[…] Amex is the most restrictive, but if you have bills that qualify, Plastiq is a great option since Amex is cool with these payments (see: The Amex war on gaming heats up). […]

[…] the first authoritative steps toward slowing down outlying behaviors came out this fall. First, the Amex War on gaming heated up, and then Amex fired another shot earlier this month. The short of it is this: Amex has made it […]

[…] Miles Per Day and Doctor of Credit reported a new development in the Amex War on Gaming. The Amex Rewards Abuse Team (RAT team) has been sending emails to some people who recently […]

This never got answered above, but wondering if adding Amex Offers across several cards (using the new browser page trick) be considered “gaming” the system with the potential to be shut down?

That’s a very good question. I sure hope not because I absolutely love maximizing those offers.

U think I should attempt to cancel my amex delta within the 2 months so I don’t pay the annual fee ? I already got the points but nervous abt amex new rules which r written on delta apps

See above for my suggestion.

Yes, I noticed this on my recent Delta app (targeted as well). Makes it hard as my largest payments cannot be made using AMEX (only VISA or MC), so I used to buy VISA gift cards which could then be used to make those payments.

Has amex added these rules to the delta cards yet? Looks like they did

The terms restricting gaming have been on all applications for a while now but were specific to the signup bonus terms. This article references changes to the Membership Rewards program where they are restricting “gaming” overall, not just for the signup bonus. I don’t think such a change has been applied to Delta cards (beyond the signup bonus terms)

I’ve noticed these terms on the delta cards as well. I just got the delta platinum and wanted to cancel with In 2 months so as not to pay the annual fee. Do u think they’ll take away my bonus?

I don’t know if it is likely that they’ll take your bonus, but it’s possible. It’s much less likely once the miles have been deposited to your Delta account. Personally I never sign up for cards with a first year annual fee unless I believe that the signup bonus more than offsets that fee. I’d like to give the cc company a year to try to win me over

I already have all the miles deposited. You think it’s worth cancelling yo save the 195?

Moshe, I would not do that. I think AMEX could be more valuable in the future and not worth annoying them. Don’t be greedy. You got the 80,000 miles already didn’t you? Last month I was offered a targeted option of 70K Delta for no fee or 80K Delta for the $195. I tried for both but they denied the second one – both were missing the nasty language and I had just cancelled one a couple of months earlier!

So, slowly I am getting somewhere with AMEX. When they took away my 100,000 (and my wife’s) in a very nasty way, essentially leaving me no way to recover, I was really annoyed but I decided to play the long game and since then (about 14 months ago) we have accumulated a further 250,000 MR between us, an now a second chance on Delta. תהיה סבלני

And how about property taxes?

All tax payments are fine

Thanks, Greg. I will give it a go maybe. I am still smarting from the 100,000 points the confiscated last year. Don’t want to set a foot wrong here.

What did they confiscate it for? Was it Mr points or delta?

Moshe, it was MR points. They never said what I had done to offend them, but one could assume it was the large purchase at my local Simon Mall.. But I am still hopeful I may convince them to return the points even though a year has passed. I have enlisted some legal aid.

So, is it certain that paying estimated federal income taxes is OK for AMEX spending, particularly for the initial bonus?

[…] grab a Big Spend Bonus. We still don’t know how Amex will view promotions like this now that the war on gaming has heated up. I suspect that their aim is not to discourage you from using your Amex card to buy a few hundred […]

If I Am going to cancel a card without paying the (second year ) annual fee, when is the wisest time to cancel — at 11 months, days before the fee posts, or within a couple of weeks of the fee posting?

Also , is it ok if my minimum spend is met on day 1 with a plastiq payment for (Canadian ) taxes? I am Canadian and my Amex cards are Canadian.

Thank you

I think the consensus was to cancel 29 days after the fee posts.

You’ll get a full refund of the fee plus it gives you 29 days to use Amex offers should you get any.

In any case, there have been retention offers lately too so you may get one as well if you call.

Yes, meeting minimum spend in 1 day should be fine as long as your credit limit supports that.

[…] Amex War on Gaming: If you cancel before January 18th in order to possibly be eligible for signup bonuses on the new cards, you’ll likely be put on Amex’s naughty list. See: The Amex war on gaming heats up. […]

I have been using my American Express Preferred Cash card to buy Amazon gift cards at my local Kroger when they offer 4 times fuel points along with my normal grocery spend. I would guess my spend is about half on groceries and half on gift cards. Will this affect me?

I buy most of my groceries at the local Kroger and don’t own a car. Is there any kind of secondary market in this fuel points?

There is, but it’s harder than it used to be. Used to be able to just grab new loyalty cards, load them up, and sell before registering. Now usually you have to download/activate a coupon first.

Check ebay to see what’s current.

What this tells me, at least, is that if one is angling to get a bonus but nix the card after less than a year, one should probably have a transfer partner (and ideally a short-term redemption) in mind. Of particular interest is the fact that when pushing the DL Gold Amex, Delta’s representatives explicitly (and repeatedly) pushed that the fee was waived for a year “so you can decide if the card is right for you” (or very similar words). If Amex were to try and claw points back on the basis of cancelling a card sold as such, that would make for an interesting court case.

Also interesting will be any clawback attempts where the card was acquired prior to this change…I can just see the argument going around in circles: “You cancelled your card because you never intended to keep it.” “No, I cancelled it because you altered your T&C and I didn’t agree to the changes.”

Of course, /that/ raises an interesting question: If someone cancels a card shortly after a T&C change is announced and Amex decides to penalize them for it, “sole discretion” aside I’d like to hear a lawyer talk about /that/, since a (potentially quite punitive) penalty for cancelling a contract after the other party unilaterally altered it seems rather coercive (and potentially unconscionable) to me.