| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

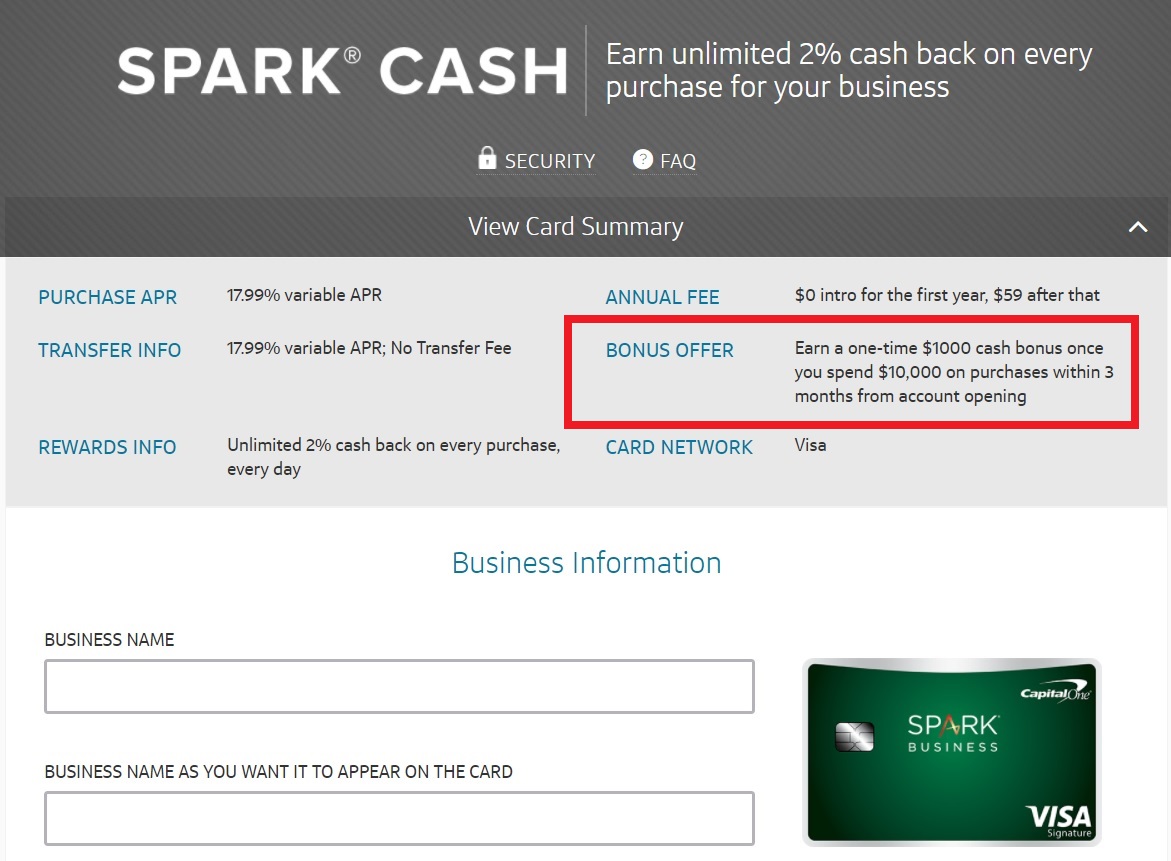

There is a new public offer out on the Capital One Spark Cash business credit card that looks terrific if you like cash back: $1,000 cash back after $10,000 spend in the first 3 months. We previously wrote about a targeted mail offer for this — but now there is a public signup link. That’s a lot of spend, but with the 2% back everywhere offered by this card, that’s a total of a 12% return ($1200) back after you’ve spent $10K. For those who can make the spend, this is a very attractive offer. If you can’t spend quite that much, there is also an offer for $750 cash back after $7,500 spend (and the usual $450 back after $4,500 spend). I don’t know whether the $1,000 cash back offer will last, but here are the details:

The Offer

- Earn a bonus $1,000 cash back after spending $10,000 on purchases within the first 3 months

Key Card Details

- Earn 2% cash back everywhere

- $59 annual fee is waived the first year

Quick Thoughts

I usually prefer to earn miles over cash back because I use the miles for experiences that I wouldn’t otherwise buy. However, cash is king for many people — and when it comes to cash back, this offer is hard to beat and hard to ignore. The spending requirement is high, but so too are the rewards. If you have the capacity to spend $10,000 in three months, this offer is probably worthwhile. It’s probably the right time of year for hitting spend, especially if you resell things as a business.

An interesting note — the annual fee in the offer is listed as $59. That’s less than the annual fee on other public offers, making this an even better deal of you’re going to keep it (though keep in mind the fact that there are cards on the market offering 2% cash back everywhere with no annual fee like the Citi Double Cash and Fidelity cash back Visa). With the fee being waived the first year, it’s probably not much of consideration.

Also worth noting is the fact that Capital One is known to pull credit reports from all three bureaus when you apply. In the past, I have applied for a Capital One card with my Experian report frozen and been instantly approved with pulls from both Transunion and Equifax.

You should additionally keep in mind the fact that Capital One reports business cards to the personal credit bureaus, so this card will count against your 5/24 status. One other thing to consider: Doctor of Credit reported a rumor from Reddit that Capital One may have recently instituted its own 5/24 rule. My initial read-through shows some conflicting information, so I can’t say for sure one way or the other.

As always, we have added a link to this offer on our Best Offers page.

H/T: Doctor of Credit

[…] [Expired] New monster $1K signup bonus after $10K spend (this one is expired, but there has been a targeted mail offer for the same) […]

Link is not working?

So those above saying that you were denied, do you actually get something on your screen or in your e-mail saying you were denied or do you just get the following message:

“All set! Your application is complete.

Thank you for submitting an application for a Capital One credit card! Notification of your application status will typically be sent in 7 to 10 business days; however, in certain circumstances it may take up to 15 days.”

In other words, does the above verbiage mean I’m denied?

Thank you! I suppose I can make a Q4 Estimated Tax Payment to fulfill the requirement and still come out roughly $800 ahead.

PS, the question re: carrying balance was optional and she didn’t provide a reply. Not sure how that factored in.

My wife applied today. Denied; letter coming. She’s officer of our company. She doesn’t have a C1 card. She’s probably 4/12 with 2 new cards and 1 dropped card past 3mo. I have Spark rewards card for our biz (long time customer) and Venture. I thought she might qualify. I suspect too much recent activity. I have even more activity so likely will not apply myself.

Denied:-( No reason stated… letter coming in 7-10 days.

Was asked if I carry a balance on my credit cards: always, never, sometimes, rarely?

I selected never on my application… I don’t recall be asked that question on any other cc application in the past. Maybe I should’ve selected always. C1 needs to cover that $1K bonus somehow!

My wife responded ‘never’ and was approved instantly. She was 6/11.

I posted recently that Capital One is now using the Chase method of approvals. On the latest offer for the Venture, my wife and I were turned down for too many cards in 24 months.So tred lightly on this offer, my guess is the one above who will receive the letter in 7-10 days will soon find this out. It’s a new era.

https://travelupdate.boardingarea.com/capital-one-using-the-24-month-card-limit-rule/

tl;dr little value here, move along

I know. Words are tough sometimes.

Applied tonight and approved immediately with generous limit. I do have a legit business that spends a lot of money on credit cards each month and have a EIN as well for the application. First Capital One card and approved in 30 seconds.

Does anyone know if this $1000 is a statement credit or cash back in your bank account?

Can you apply for this business card and the Capital One Venture personal card on the same day?

Nice offer! Instantly denied lol. Said they’d send a letter in 7-10 days.

Thanks for sharing this!

I have Spark card for my biz. Can my wife, who is also officer of same company, get this card? I presume answer is yes, but would appreciate informed response. Thank you.

Interesting. I could do the spend by paying estimated taxes. For me, the math would be $1,200 for an outlay of $189 in fees for the taxes plus $59 annual fee. My opportunity cost for the same taxes on Amex blue at 2x would be 20,000 MR points for the same $189. I value those points around $370, net of the $189 it’s around $180 in opportunity costs. So, the sign up bonus would end up being worth $570, which isn’t quite enough for me to burn a hard inquiry on a card reported as personal to all 3 agencies. Probably makes sense for those way over 5/24 who MS though.

Oh, looks like the annual fee is waived.

Can multiple people get Cap1 cards for the same business, like they can with Amex?

Good question. I don’t know.