Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

Through February 28, 2018, Bank of America is offering a big bonus for those who can open certain types of business accounts and meet their deposit requirements: up to $2,500 in bonuses for qualifying activity. There are a couple of hoops to jump through, but the payoff might be worth it. Note that this offer is in-branch only, so you’ll have to be able to go into a Bank of America branch and talk to a small business banker. The full $2,500 requires a number of steps, but It won’t be too hard for some readers with cash on hand to earn at least a thousand dollars with this deal.

The Deal

- Get up to a $2,500 bonus with new Bank of America business accounts (read on for the details)

How to do it

First thing’s first — you’ll have to do this in-branch. You can not get this offer online. It has been reported at Doctor of Credit as being widely available, so it’s very likely that you can get the offer. It will, however, require speaking to a small business banker.

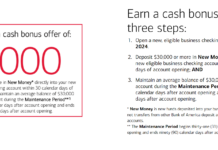

The first part of the offer is the following:

Receive a $1,000 bonus when you do both of the following:

| 1) Open a Business Advantage checking account (depositing at least $50,000 of outside funds into the checking account within 90 days) |

| AND |

| 2) ALSO open one of the following account types (A–>D): |

| A) Small Business Credit Card (in addition to applying and being approved, must spend at least $2,000 on it within 90 days) |

| B) Business Term Loan |

| C) Business Line of Credit |

| D) Bank of America Merchant Services Account (must open and activate a merchant services account and settle $10,000 of funds into your Business Advantage account within 90 days of opening it) |

In addition to a $1,000 bonus for opening the Business Advantage checking account (with $50K in new deposits) and ONE of the account types listed above (A->D), you can earn an additional $500 bonus for each additional account type (A–>D) opened within 90 days of the Business Advantage checking account. In other words, if you were to open the Business Advantage checking account and all four of the additional account types listed above, you would get $2,500. That is in addition to the signup bonus on whichever small business credit card you choose.

The challenge for many people will be in meeting the $50,000 deposit requirement for the checking account. According some reports, it may be possible to meet this requirement with multiple deposits. In other words, you could theoretically deposit $10,000 at account opening, and later withdraw and re-deposit that amount repeatedly to hit $50,000 in deposits. YMMV as to whether or not that will work, but it may be possible.

The Business Advantage checking account has a monthly fee of $29.95 per month, which is waived for the first three months. After that, you’ll need to keep an average monthly balance of $15,000 or more, make $2,500 in purchases on your small business credit card, or meet one of a couple of other requirements to keep it fee-free. Past reports indicate that the bonus takes 5-6 months to post, so you’ll need to do something to keep it fee-free or pay for a couple of months.

Bottom line

This is a great bonus if you have the cash on hand to make it happen. The checking account and small business credit card would be a simple way to get a thousand dollars in addition to the credit card signup bonus. Whether or not the others make sense will require more personal analysis. At least one commenter at Doctor of Credit reports having opened his account as a sole proprietor with a registered DBA. See that Doctor of Credit post for more info on this valuable bonus.

H/T: Doctor of Credit

[…] Easy(ish) money: Up to $2500 bonus w/ business bank accounts at BOA (Expires 2/28/18) […]

I sent this offer to 2 family members. The first one said “I wouldn’t touch BOA with a 10-foot pole: they screwed up our office accounts Horribly several years ago.”

The second one just called me to report: “Last week I deposited a check for $75,000. BOA recorded it as $75 -and that’s what they took out of the payer’s account too. I also sold my house last week and they overcharged fees on closing my line of credit. Now they won’t stand behind what they told me. And they’ve never heard of this bonus offer.” This was Richmond, VA. YMMV

U get a 1099 for all these bonuses FYI (for the few who do not know this already)

Thank Nick – I’ll probably take advantage of this, especially as I hate Wells Fargo’s nickel-and-diming and there’s no time commitment to keeping the $50,000 in the account. Nothing like an incentive to try someone else!

Do you know how long to keep the deposited to keep the bonus? How long should the checking account remain open?

I did a similar bonus in 2016 and closed the account in 2017. Does anyone know if it’s possible to get it again?

From the fine print:

You must not be an owner or signer on a Bank of America business checking account that is open or that was closed within the last six (6) months.

As long as you closed it more than 6 months ago, you should be good to go.

Ah yes, easy. Because a large portion of America has $50k in cash sitting around in non-tax-advantaged accounts to transfer over…

Yeah, that’s why the title says easy(ish) — you’re right that it won’t apply to everyone. That said, as noted, it may be possible to do with a smaller amount of cash transferred in, withdrawn, and transferred in again as many times as is necessary (YMMV). Those with a small business, or who buy and resell merchandise or third party gift cards (and thus have constant cash flow coming in) will probably find that pretty easy if it works — and I know many readers are involved in those types of activities with constant cash flow. If that doesn’t work, you would need to have the $50K in cash — which obviously doesn’t apply to everyone, but does apply to some — and it’s a pretty easy thousand bucks for those who do.

There are plenty of small business owners that can deposit the required $50,000 for this bonus. Obviously BOA is targeting people that can bring money to their table, and they want high balances parked in their accounts.

If this isn’t you there are plenty of other bank bonus deals you can get in on with much lower requirements.

I did this last year but only went for the $1000 by opening a business checking account and a credit card. I wasn’t sure I could do it because I didn’t have $50k, but I tried it anyways by rotating funds. I can confirm it is doable by rotating funds. Here are some things I did. A bulk were from rotating an initial $10k and I completed the requirement in under 60 days.

– ACH into the BOA account from other external bank accounts

– ACH paycheck from job

– Withdraw the funds from BOA as cash or bill pay, then redepositing them to other external accounts. Then sending it back to BOA in another form, like writing a check this time or cash deposit (different amounts and dates) instead of ACH.

– I also asked family to write me a check in exchange for cash, which I deposited.

– Linked it to PayPal and sent funds down to BoA from eBay sales.

* Note the bonus did not post until 90 days after I completed the requirements. I also kept rotating the funds past $50k through the 90 day period cause I wasn’t sure what qualified for the deposits.