Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

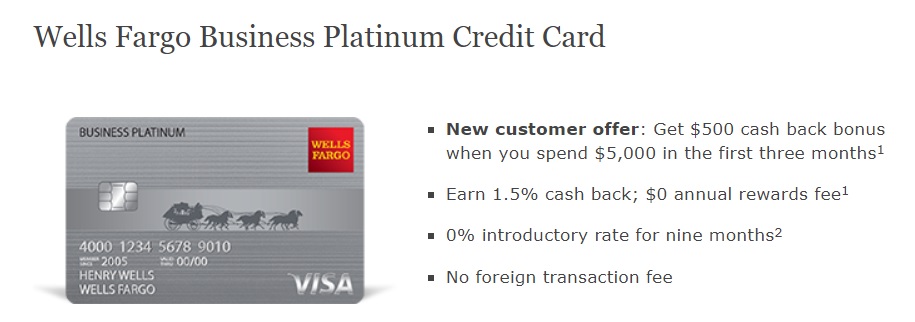

There is a new $500 cash back signup bonus available on the Wells Fargo Business Platinum — though that bonus is only available if you choose the cash back rewards structure. This is a nice signup bonus if you’re looking for cash back — or this card may alternatively be interesting if you have a large balance of Wells Fargo rewards points. Read on for some brief analysis.

The Offer

- Get $500 cash back bonus when you spend $5,000 in the first 3 months if you choose the cash back option at account opening (note there is no signup bonus if you choose to earn points instead)

- Find a direct link to this offer on our Best Offers page.

Key Card Details

These details depend on whether you choose to earn cash back or earn points. The signup bonus only applies if you choose cash back.

Cash back rewards:

- Earn 1.5% cash back everywhere

- No annual fee

- No foreign transaction fees

- Signup bonus is not available if you already have a Wells Fargo business credit card or have opened or closes a Wells Fargo business credit card in the past 12 months

- Signup bonus is valid on sign-ups through 3/31/18 (though could be pulled early at any time)

Points rewards:

- Earn 1 point per dollar everywhere

- Earn 1,000 bonus points if you spend $1,000 or more in a statement period

- Points can be redeemed for merchandise, gift cards, airline tickets and more

- Earn a 10% bonus when you redeem points online

Quick Thoughts

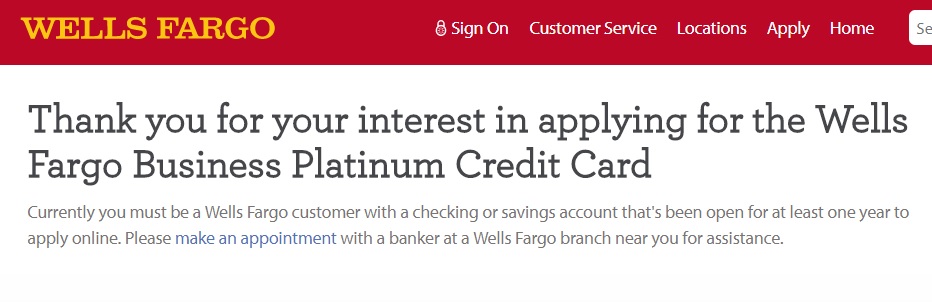

This card appears built to be confusing: there is one card with two different rewards programs at play here. The rewards system you choose will depend upon whether you’re after the signup bonus or increased value from an existing stash of Wells Fargo Rewards points. Note that either way, you must have a Wells Fargo checking or savings account that has been open for at least 12 months in order to apply online.

The $500 signup bonus only applies if you choose cash back rewards at account opening. If you do, this card will be a nice one for the signup bonus ($500 that can be redeemed as a statement credit or deposited directly into your Wells Fargo checking or savings account), but at 1.5% cash back it’ll be weak for everyday spending.

On the other hand, if you choose points, your value on everyday spending may be better than 1.5%. Points don’t have a fixed value; according to a screen grab provided to Doctor of Credit, points can be worth up to about 1.6 cents each toward airfare (though this is based on finding a domestic coach ticket within the 48 contiguous states that costs exactly $400). Additionally, you earn an extra 1,000 points if you spend $1,000 or more in a billing period — increasing your everyday earnings to 2x if you spend exactly $1,000 in a billing period. Additionally, according to this page, it looks like it is possible to combine points from Wells Fargo personal cards with points earned on this card, increasing your redemption rate if you’re able to book near the sweet spots on their chart. That fact might sway some to forgo the signup bonus if they have accumulated a large number of Wells Fargo rewards points.

At the end of the day, the value of the signup bonus will probably be greater for most people. After meeting the minimum spend, you should have $575 total ($500 bonus + 1.5% cash back), which is a nice return on the spend. For everyday business spend, there are more rewarding cards on the market. However, since this is a business card, it isn’t reported on your personal credit report — meaning that this is a relatively easy $575 that won’t affect your Chase 5/24 count if you’re trying to get or stay under that threshold.

H/T: Doctor of Credit

[…] $500 signup bonus on the Wells Fargo Business Platinum (Expires 3/31/18) […]

[…] $500 signup bonus on the Wells Fargo Business Platinum (Expires 3/31/18) […]

I’d do this but I do not have a checking account of any kind at WF. Anyone know of a way around the 12 month having of an account angle?

Is this a thing I should do now? Have minor checking accounts at various banks IN CSE of offers like this?

This is not a kind of thing I see addressed in blogs like this. Maybe a column about pre-positioning, which is what I might call this.

I see you mentioned 5/24 in the post, but are there definitive data points that WF business cards aren’t reported on personal credit reports?

DoC reports that:

https://www.doctorofcredit.com/which-business-credit-cards-report/#Wells_Fargo

And he points to Nerdwallet:

https://www.nerdwallet.com/blog/credit-cards/qa-business-credit-cards-affect-personal-credit-score/

If you give it a Google, a number of other sites say the same. Here’s a DP from MyFico. Message #3 is someone asking if it will report — but the user asking the question says they opened a Wells Fargo business card in May 2015 and as of their comment in October 2015, it hadn’t reported to the personal bureaus.

http://ficoforums.myfico.com/t5/Business-Credit/Wells-Fargo-business-credit-card/td-p/4005346

Furthermore, the absence of any contrary reports in the comments on any of those resources is a fairly solid indication that WF business cards aren’t reported on personal credit reports. I don’t have a personal data point for you, but I felt plenty confident in the information I found to say that they aren’t reported to the personal bureaus. Of course, if your account becomes delinquent, there is always a chance that it’ll get reported.

These are yes/no questions from the Wells Fargo Business card application:

Cash activity:

Please select yes if your business provides any of the following services:

– Sell or buy foreign currency or foreign currency denominated instruments; OR issues or sells money orders or traveler’s checks; OR provides cash or money back from checks, money orders or traveler’s checks in excess of $1000 to any one person on any one day.

– Sell, load or reload prepaid debit cards or other types of open loop prepaid access;

– Sell, load or reload any closed loop cards (restaurant, store, gas cards) and/or open loop prepaid access in excess of $10,000 to any one person on any one day;

– Set up prepaid debit card programs for other companies or other types of prepaid access;

– Perform money transmission for customers to another person or location

—————

Any thoughts on this and how many of us will meet the minimum $5k spend?

The answer to all of those is no (unless you own Walmart, Moneygram, or Family Dollar). They’re basically asking if you’re a money transmitter or operate a money services business.

I was once asked on the phone something like “do you cash checks.” I said, well yeah of course. Turns out he meant do I cash checks for others lol.

Targeted?

You do not need to be targeted.

No — there is a link on our Best Offers page (though, as noted, you need to have had a checking/savings account open with WF for 12 months to apply online).