The $550 Chase Sapphire Reserve card is my pick for the best all around travel rewards card. It has decent perks, best-in-class travel protections, and excellent rewards for spend. This card earns valuable Chase Ultimate Rewards points. With the Sapphire Reserve card, points are worth 1.5 cents each when redeemed for travel through the Chase Ultimate Rewards portal and via Chase Pay Yourself Back.

Application Tips

Chase Application Tips

Call (888) 338-2586 to check your application status |

Should you apply?

If you spend a lot on travel and/or dining, then I highly recommend this card. That said, you might do better signing up for a different card… The Chase Sapphire Preferred. The Sapphire Preferred often has a better signup bonus than the Sapphire Reserve and so it can make sense to sign up for the Sapphire Preferred and later upgrade to the Sapphire Reserve.

For reference, here are the current signup bonuses for both cards:

| Card Offer |

|---|

65K Points ⓘ Affiliate 65K after $4K spend in 3 months$550 Annual Fee Alternate Offer: 70K after $4K spend showing on some accounts when logged-in to Chase Recent better offer: Expired 12/1/22: 80K after $4K spend |

60K points ⓘ Affiliate 60K after $4K spend in 3 months$95 Annual Fee Alternate Offer: There may be elevated offers available by applying in-branch A similar offer with the first year annual fee waived may be found in-branch. YMMV. |

Are you eligible?

To get this card you must be under 5/24, you must not be a current Sapphire Preferred or Sapphire Reserve cardholder, and at least 48 months must have passed since you last received a new cardmember bonus for the Sapphire Preferred or Sapphire Reserve card.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

How to apply

You can find the best current signup offer and application link here: Chase Sapphire Reserve.

Application status

After you apply, call (888) 338-2586 to check your application status.

Reconsideration

If your application is denied, I recommend calling for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Perks

$300 Travel Credit

Automatically earn $300 in statement credits each membership year as reimbursement for travel purchases. For those who spend at least that much each year on travel, this effectively lowers the $550 annual fee to approximately $250. Note though that you will not earn rewards on the $300 in spend that is reimbursed.

Automatically earn $300 in statement credits each membership year as reimbursement for travel purchases. For those who spend at least that much each year on travel, this effectively lowers the $550 annual fee to approximately $250. Note though that you will not earn rewards on the $300 in spend that is reimbursed.

Ultra-Premium Ultimate Rewards

Since this is an ultra-premium Ultimate Rewards card, the following rewards are available:- Redeem Points for 50% More Value: Points are worth 1.5 cents each when used to book travel through the Chase Travel(SM) portal.

- Erase statement charges for 25% more value: Points are worth 1.25 cents each when used to erase select categories of charges via Pay Yourself Back.

- Transfer Points to Partners: Points can be transferred one to one to a number of airline and hotel loyalty programs.

Travel Benefits

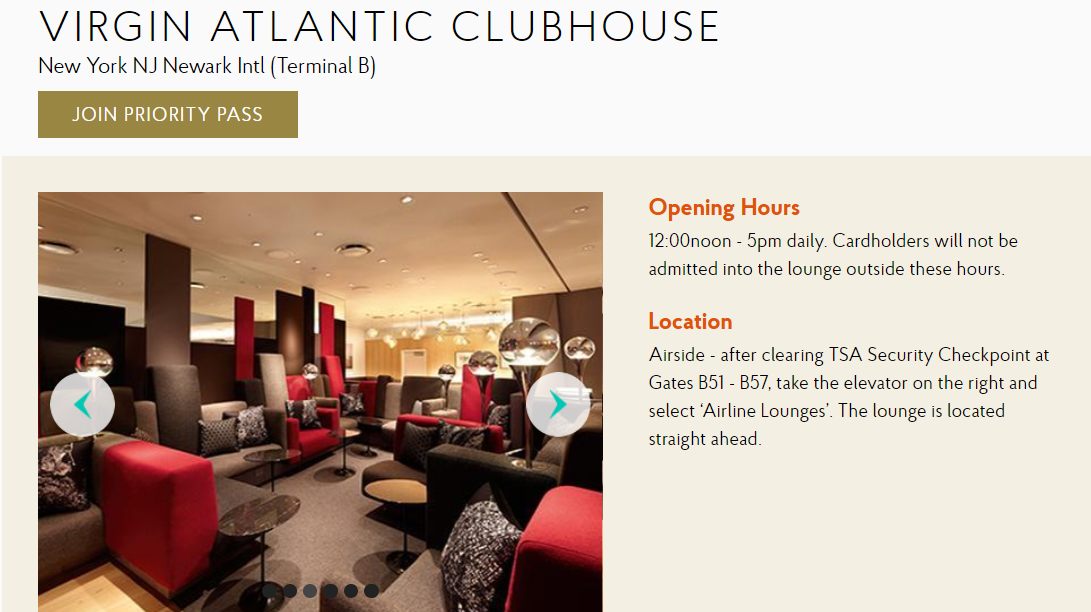

- Priority Pass Select Lounge Membership: Membership includes free access to lounges for yourself and up to two guests. Unlike Priority Pass memberships issued by American Express, this version includes Priority Pass restaurants.

- Global Entry or TSA Pre✔® Fee Credit: Receive a statement credit of up to $100 every 4 years as reimbursement for the Global Entry or TSA Pre Check application fee charged to your card.

- Car rental privileges: National Car Rental Executive status is quite valuable. Also includes discounts with Avis and Silvercar.

- Elite Hotel Benefits at Relais & Châteaux: Receive "a VIP welcome" and complimentary breakfast daily at select properties.

- 4th night free at select sbe hotels: At select sbe hotels, get the 4th night free, free breakfast, $30 hotel credit and more. Read our in-dept coverage of this perk here.

- Visa Infinite Concierge Service: "Access to Visa Infinite Concierge who can help you with requests, like dinner reservations, or Broadway, music and sporting event tickets. Call 1-877-660-0905 to reach the Visa Infinite Concierge.1 Traveling outside the U.S.? Call us collect at 1-312-800-4290."

- No foreign transaction fees

Travel Protections

In my opinion, the Sapphire Reserve has the best automatic travel protections of any card on the market today. Most of the following protections kick in even if you pay with points or pay only in part with your card. More details and a comparison to other ultra-premium cards can be found here: Ultra-Premium Credit Card Travel Insurance.- Auto Rental Coverage: Chase offers primary auto rental CDW (collision damage waiver). Here's the description directly from Chase: "Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad."

- Roadside Assistance: "If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year."

- Trip Cancellation / Interruption Insurance: "If your trip is cancelled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels."

- Trip Delay Reimbursement: "If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket."

- Lost Luggage Reimbursement: If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger."

- Baggage Delay Insurance: "Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days."

- Travel Accident Insurance: "When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $1,000,000."

- Emergency Evacuation & Transportation: "If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000."

- Emergency Medical and Dental Benefit: "If you’re 100 miles or more from home on a trip, you can be reimbursed up to $2,500 for medical expenses if you or your immediate family member become sick or injured."

Purchase Protection

- Extended Warranty: "Extends the time period of the U.S. manufacturer's warranty by an additional year, on eligible warranties of three years or less."

- Damage and Theft Protection: "Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year."

- Return Protection: "You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $500 per item, $1,000 per year."

Dining & Food Delivery Benefits

- 10x Chase Dining: Earn 10 points per dollar for prepaid dining booked through Chase Dining.

- Reserved by Sapphire: Starting late 2021, cardmembers will have access to “Reserved by Sapphire” which will purportedly offer “exclusive” chances to book reservations at high-demand restaurants.

- 12 months free Instacart+ - Gives access to free delivery on orders over $35, a 5% credit back on all eligible pickup orders and reduced service fees.

- $15 monthly Instacart credit - Chase Sapphire Reserve cardholders get $15 in statement credits on Instacart purchases each month.

- $10 Monthly GoPuff credit - GoPuff is a delivery service that can be used for groceries, home essentials and other products. Sapphire Reserve cardholders get $10 in statement credits on Gopuff purchases each month.

Lyft Rideshare Benefits

- 10X Rewards: Use your Sapphire Reserve card with Lyft in order to earn 10 points per dollar through March 2025.

- Free Lyft Pink Access (through 2024) - Lyft Pink members complimentary upgrades to Priority Pickup on Standard rides, savings on Lyft Lux, XL, and Preferred rides and relaxed ride cancellations.

Earn Points

Signup Bonus

This card earns super-valuable Ultimate Rewards points. Here’s the current signup offer:

| Card Offer |

|---|

65K Points ⓘ Affiliate 65K after $4K spend in 3 months$550 Annual Fee Alternate Offer: 70K after $4K spend showing on some accounts when logged-in to Chase Recent better offer: Expired 12/1/22: 80K after $4K spend |

Refer Friends

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Bonus Spend

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 10X hotels & car rentals booked through Chase Travel℠ ✦ 10X Chase Dining ✦ 5X flights booked through Chase ✦ 3X Travel and Dining ✦ 10X Lyft (through March 2025) |

Redeem Points

Cash Back

Cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer.

Travel

Redeem points for travel: 1.5 cents per point

This card offers 1.5 cents per point value towards travel booked through Chase. Log into Chase under this account, and go to the Chase Ultimate Rewards portal to book your travel. A $600 flight would cost 60,000 points if you used a no-fee Ultimate Rewards card, but with this ultra-premium card it would cost only 40,000 points.

Details about booking travel through Chase

You can use the Chase portal to book airfare, hotels, cruises, activities, and car rentals. Airfare purchased through the portal still earns airline miles and elite qualifying miles. Hotels booked this way do not earn hotel rewards. Worse, hotels booked through the portal often won't offer you elite benefits even if you have status.Travel protections apply

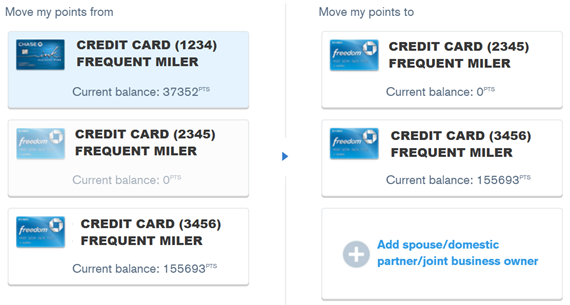

When you pay with points for travel, Chase's automatic travel protections do apply. So, you can be covered for things like car rentals, trip delays, trip cancellation & interruption, lost luggage, etc. The coverage you receive will be based on which card's rewards were used to book the trip. For example, if you have both a Chase Sapphire Preferred and a Sapphire Reserve, you would want to move your points from the Preferred to the Reserve and then use the Reserve points to book your trip. You will get both better value (1.5 cents per point) and better travel protections. See: Sapphire Reserve Travel Insurance.Transfer points

Move points to premium or ultra-premium card first

You cannot transfer points directly from a no-annual-fee Chase card to airline or hotel partners, but you can move points first to a premium card (Sapphire Preferred or Ink Business Preferred, for example) or ultra-premium card (Sapphire Reserve) and then transfer the points to airline or hotel partners. Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. Points can also be transferred to the loyalty account of a joint business owner, but they do need to be an authorized user on the associated business account.Transfer Partners

| Rewards Program | Best Uses |

|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus (Avios.com) rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. See: Emirates Sweet Spot Awards - First class from 30K miles round trip. |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth at least 2 cents each, but they’re sometimes worth far more. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary due to certain taxes not being charged on awards, but tend to average around 1.5 cents per point. |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. Good uses of miles include United's Excursionist Perk awards and (sometimes) dynamically priced United economy awards. |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few great sweet spot awards including US to Europe on Delta One business class for 50K points one-way. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Other ways to redeem points

You can also use points to pay some merchants directly (Amazon.com, for example or via Chase Pay). Don't do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your points - causing you a headache in getting your points reinstated).

Manage Points

Combine Points Across Cards

If you intend to cancel a card that earns Chase points, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account (See: My 90,000 Points mistake). A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Share Points Across Cardholders

Why this is valuable:

Why this is valuable:

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

How to Keep Points Alive

Authorized Users

- Annual fee: $75 per authorized user

- $300 travel credit? Authorized users do not get their own travel credits. Travel purchases made on authorized user cards do get reimbursed but the reimbursement comes out of the same $300 per year bucket as the primary card.

- Airport Lounge Access? Authorized users get Priority Pass Select membership like the primary user.

- Primary car rental collision damage waiver? Yes

- Global Entry or TSA Pre Fee Credit? Authorized users do not get their own Global Entry or TSA Pre reimbursements. Enrollment fees charged to authorized user cards do get reimbursed but it comes out of the same single reimbursement every 4 years as the primary card.

- Why consider paying for authorized user cards? Many will find that it is not worth adding authorized users. However, it can be worth it to earn 3X for travel & dining for authorized user spend, and to give Priority Pass to your authorized users. See also: The Sapphire Reserve Couple Conundrum.

Card Lifecycle

How to meet minimum spend requirements

Keep, cancel, or product change?

The decision of whether to keep this card year after year can be complex. On the one hand, if you spend a lot in its bonus categories, then it’s a no-brainer to keep this card instead of the Sapphire Preferred. On the other hand, if you spend that much on travel and dining, you might do even better with cards like the Amex Gold Card or Citi Prestige. These posts may help you make a decision:

If you do decide to get rid of the card, I recommend downgrading to a fee free card rather than cancelling outright. That way, you’ll be sure to keep your points alive and you’ll most likely have the option to upgrade back to the Sapphire Reserve if you ever need to.

Related Cards

Ultimate Rewards Consumer Cards

| Card Offer and Details |

Ultimate Rewards Business Cards

| Card Offer and Details |

[…] [Download | Source] […]

CSR is indeed a wonderful card. It sames me at least $20,000/yr on trip cancellation insurance alone and I earn at least 400,000 points per year on travel purchases. Why must many of you spend your time trying to scam the system? With the new computer software – you may just lose all of your Chase cards (for life).

Not sure who you had in mind, but I think because we’re not all spending $130,000 a year in travel purchases… I don’t feel upgrading or downgrading when allowed by Chase and reasonable based on one’s travel habits constitutes “trying to scam the system.” The reason for my question was to see if anyone knows if Chase has an issue with strategically timed downgrades.

Is there a clear rule on frequency of upgrade/downgrade that is ok (after year 1)? I.e. if I upgrade to Sapphire Reserve then keep it for 13 mos using travel credit twice, then downgrade for a few months, then need to book a trip and so upgrade again is that going to cause an issue with Chase? Or if I upgrade for 3 mos, then downgrade back and get fee pro-rated?

Hello, is Chase Sapphire Preferred Card and Chase Sapphire Reserve Card considered 2 different products? I have Chase Sapphire Preferred card that I had for 4 year. Planning to “upgrade” it to Chase Sapphire Reserve Card with new card bonus. Planning to cancel my Chase Sapphire Preferred Card and open the Chase Sapphire Reserve Card. If those to card considered two different cards. Do I have to wait 48 month to get the Chase Sapphire Reserve Card?

Chase considers the two together when they say that you can’t get the card if you’ve received a new card bonus in the past 48 months. So, you can cancel or downgrade your Sapphire Preferred, wait until 48 months have past since you received the signup bonus for the Sapphire Preferred and then sign up for either the Sapphire Preferred or Reserve, whichever you prefer.

It’s a fine card, I currently have it, but for most people the optimum strategy is to play the upgrade/downgrade game, or if below 5/24 just get SUB, cancel, and apply again when eligible. Reasons are: 1) many already have cards with PP and GE credits, so incremental value of these benefits is $0. 2) Travel credit earns 0 UR, so opportunity cost is minimum 900UR. 3). Many other cards beat CSR for category spend.

For me the CIP is the real keeper:. $95 AF, 3x travel, 20k referrals, same travel protection benefits, cell phone protection, and a better SUB to boot.

Yes the Ink Biz Preferred is very good, but keep in mind that some of the travel protections stipulate that you have to be traveling on business. It’s unclear if they’ll enforce that but it could be an issue. Also I’m not sure what you mean by it having the same travel protection benefits. They’re not the same as the CSR.

Do you recommend dropping the Sapphire Reserve next summer/fall when most “early adopters’ will hit the 48-month since a sign up bonus for this card family? Assuming I am under 5/24, would I be eligible to sign up for a new Sapphire Preferred card at that time and get the sign up bonus for that card? Other than the loss of the 1.5x transfer ratio, it seems like a good plan. Thanks for all your great information!

You could do that, but it depends on a few factors. Do you get much value from the Reserve? If so, you might want to simply keep it. Also, do you have a business? Personally if I was in that situation I’d rather sign up for the Ink Business Preferred 80K offer or one of the other Ink 50K offers since those offers will give you the same type of points without putting you back over 5/24

I think the travel benefits are often Exaggerated. I never used the travel disruption or cancelation benefit until this month. I had two incidents where 1. Riot happened and I had to cancel my trip. 2. Strike happened and the airline canceled me ticket. In both cases I was not able to claim the additional costs at all. Apparently riots are excluded. And during cancelation you cannot claim the ticket that you had to buy. They will cover only the change fees, not fare difference etc. Their benefit guide is not quite clear on these things but when you call them they keep rejecting your claim based on things that are not on the benefit Guides available online. I have requested the paper description which is more detailed and if you read it carefully the conditiona that would apply re actually very narrow. It would be great if you can look into it and give us guidance instead of simply promoting this card as their travel benefit is ‘great’. I have been using this card for travels because of protection but now I would be very cautious about it. I get the priority pass either way so I m not really sure if 450 or 150 after travel rewards would make my sense… The biggest reason for me to use this card was the travel insurance benefits but after two bd experiences I am thinking of alternative cards

Ken

Some people here got all kinds of money back . I think they look who u are then respond . There is always a loop hole they can use so I buy annual ins now $245 a year AIG (10 yrs) . My house and the house next door got hail damage . I got $6k he got a WHOLE brand new outside of house (Roof Sidling) .. Deals on travel are great but ins could which I hope I never use can save a Zillion $$ .

CHEERs

What do you mean by depends on who you are. Is that a discrimination haha. Anyway the actual causes in the paper explanation excludes many things so it is hard to claim anything except some very obvious ones like weather issue (but airlines provide most stuff in this case) and getting sick before travel. But almost everything else is excluded clearly so I am not sure if chase would override their clauses and give out money to people. I think many people have assumptions that many obvious things like riots etc would be covered and use this card. I was one of them and I would definitely rethink my card choices now given that now I know I can not claim most things under this card

Thousand ways to say no and they look @ have u been good for business ? If that’s discrimination Sue the Bank as in lol .

CHEERs

I’m sorry you had a bad experience! My mom encountered a similar problem where they rejected her claim due to conditions that were not in the guide. She escalated the issue and was paid in full.

For each bad experience story like yours I’ve heard multiple positive experiences. For example, one guy recently told me about how he had to cancel a cruise due to a situation that he didn’t think was covered, but they paid him 100% back.

My belief is that scrutiny into ANY travel insurance program will reveal many upsetting stories where they denied claims. I don’t have any reason to believe that the CSR insurance is worse than others on that front. The only thing I know for sure is that the list of things that are covered is much more complete with the CSR (and Ritz) insurance than with any other credit card.

Hi Greg – any chance you have a copy of the 2019 guide that was in effect when you wrote this article? I can’t locate a copy. I have a 2018 version, but I know there was one between then and Feb 2020…

No, sorry

Thanks for sharing your experience. I agree this makes the Reserve less appealing. And I really hate when credit card companies don’t fully make all the T&C available online, but only on a paper guide. Especially since they may change T&Cs regularly. Feels very bait & switch to me.

Right times that by 14 cards and their counting on that to Boost profits ..

CHEERs