With most Chase credit cards, Chase will not approve a new card application if you have opened 5 or more cards, with any bank,...

I'm a huge nerd when it comes to credit cards. I collect them the way that others collect baseball cards or sneakers. To me,...

UPDATE 2/18: A couple of readers who originally let us know that the Wyndham Business Earner Card was showing up on their personal credit report...

Separately I published a first year credit card plan for a single person with no ability or willingness to apply for business cards: Beginner...

Signing up for credit cards is, by far, the fastest and easiest way to amass a fortune in points and miles. Chase, in particular,...

Recently I published two first year credit card plans for a single person: one with and one without business cards:

Beginner credit card plan...

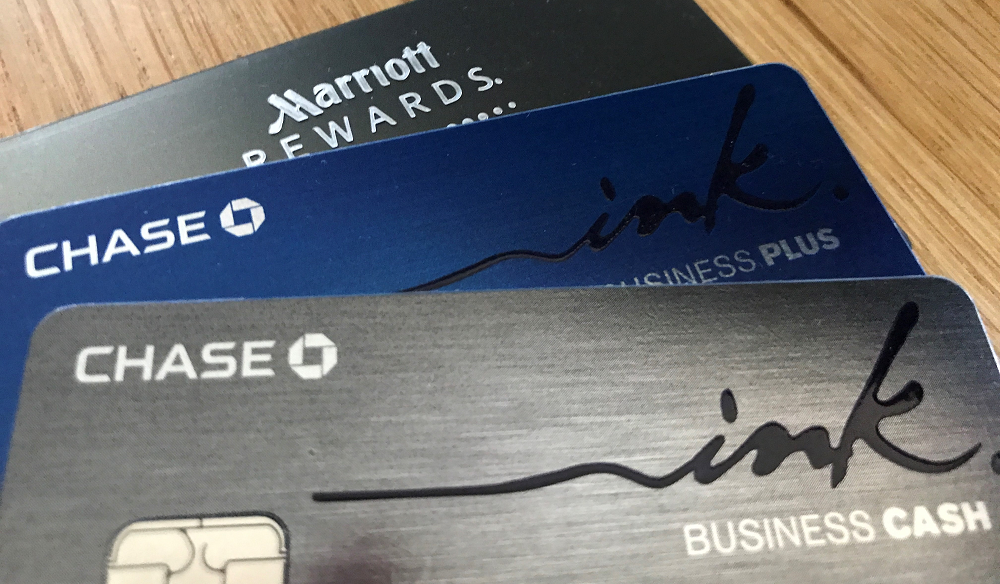

In my opinion, Chase offers many of the best credit cards and the best signup offers. They have a fantastic lineup of cards that...

Nick previously published "What’s the best Chase card that’s not subject to 5/24?" As much as I enjoyed his post, I thought this was...

Over the weekend, I had the opportunity to speak at Frequent Traveler University Seattle. I enjoyed speaking about credit card benefits beyond the signup...

This morning, Greg posted about his latest attempt to bypass 5/24. In that post, he details the process of applying through a BRM (Business...

In April, Doctor of Credit posted a "New Way To Bypass Chase 5/24." I was intrigued. I wanted to get Chase's new Ink card:...

Most Chase credit cards fall under their dreaded "5/24 Rule". That is, Chase will deny your application if you have opened 5 or more...

The Chase Ink Business Preferred card rolled out in the fall of last year with a mighty 80,000 point signup bonus. I've been eager...

Recent developments have made me think more about Chase's 5/24 Rule (where they deny applicants who have opened 5 or more cards in the...