US Bank has a promotion for new checking accounts that offers a $400 bonus with very easy requirements. This deal is available in most...

A couple of years ago, US Bank announced that they'd be introducing the ability to obtain credit card numbers instantly for new card applications.

There...

Radisson cardholders recently received a letter informing them that the Radisson Rewards Premier Card will automatically be converted into the US Bank Altitude Go...

US Bank is offering increased bonuses on both the Altitude Connect and Business Leverage cards based on Team USA's medal count at the Winter...

The US Bank Altitude Connect card recently launched and I just realized that we hadn't published a post about the card. It features a...

Doctor of Credit reports two very positive permanent changes rumored to be coming to the U.S. Bank Altitude Reserve card: the bank will reportedly...

There is a targeted offer out for some US Bank credit cards offering up to $90 in statement credits, with bonus at gas stations,...

As had previously been rumored, US Bank today launched the Altitude GO credit card. This card earns a great return on dining for a card...

With the current situation putting travel on hold for at least the rest of 2020, many readers are thinking of ways to trim their...

US Bank has long issued three version of the Radisson credit cards: The Radisson Rewards Premier Visa Signature, the Radisson Rewards Visa Signature, and...

US Bank has sent out a targeted spending offer for Radisson Rewards Visa cardholders that looks like a terrific deal: spend $500 each month between May...

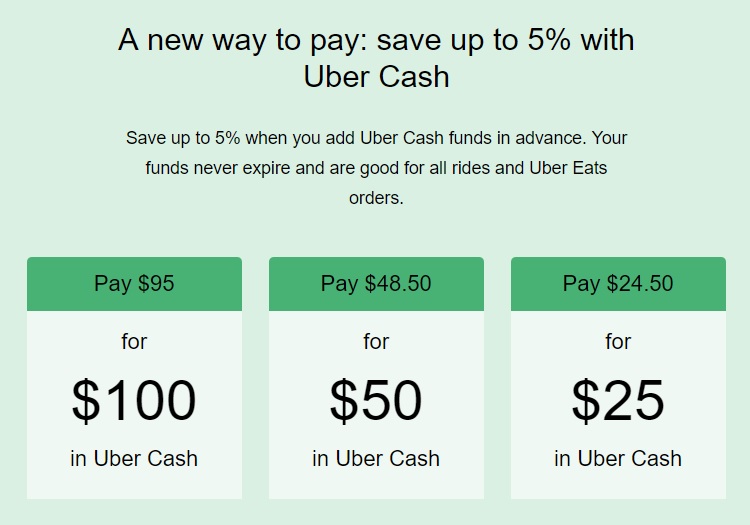

Uber recently came out with a deal to save up to 5% when you pre-load your Uber account with Uber Cash. That's not an amazing deal...

Recently, Club Carlson re-branded as Radisson Rewards. As part of the re-brand, they announced a new benefit on the Radisson Rewards Credit Cards (still known as...

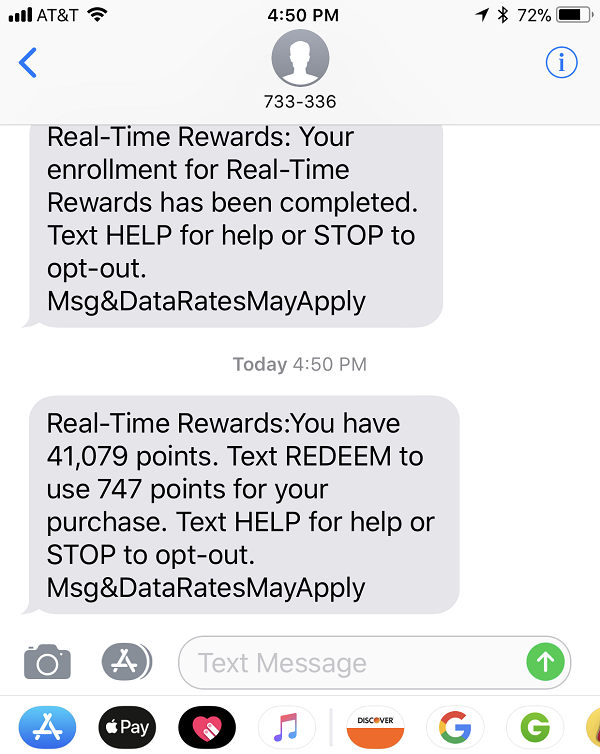

Readers may remember that I was pretty excited about US Bank's Real-Time Mobile Rewards when I learned that they've expanded them to include travel. ...

![[Expired] 20K easy points: Targeted Radisson spending offer a screenshot of a advertisement](https://frequentmiler.com/wp-content/uploads/2019/05/Radisson-Visa-spending-offer-20K-after-500.jpg)