At FTU in DC last weekend, I presented “You can still earn 5X everywhere.” Many of the tips I presented involved reload cards, gift cards, and Bluebird cards, but I also showed how you can earn 5X almost everywhere without gift cards. In this three part series, I’ll show you how.

Three Part Series

- 5X everywhere without gift cards, part 1: Ultimate Rewards

- 5X everywhere without gift cards, part 2: ThankYou Points

(this post) - 5X everywhere without gift cards, part 3: Everything Else

(coming soon)

The cards shown above on the left earn Chase’s Ultimate Rewards points. The cards on the right earn Citibank’s ThankYou points. In this post, I’ll focus on cards that earn ThankYou points, and I’ll finish up with a post about what to do with charges that don’t fit into the above buckets.

ThankYou Points

At first glance, the ThankYou Points program looks pretty weak. For example, if you redeem points for cash, you’ll get only half a penny per point:

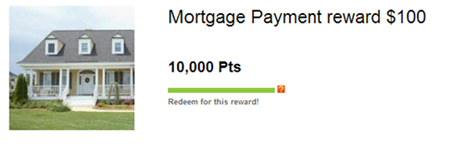

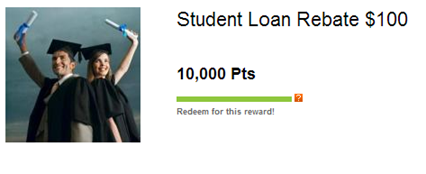

You can do much better, though, by redeeming for a mortgage payment, student loan rebate, or certain gift cards. With these you’ll get 1 penny per point:

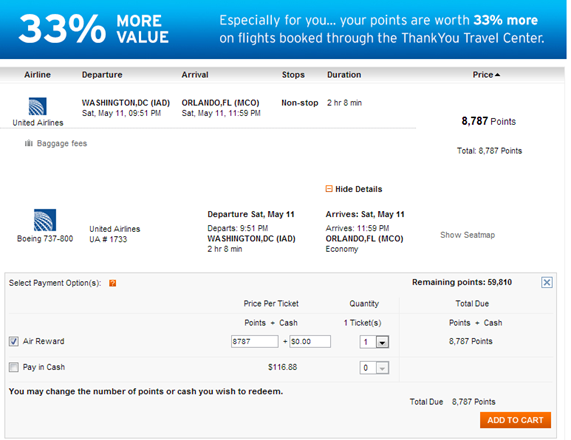

But, you can do even better. If you have a premium ThankYou travel rewards card such as the ThankYou Premier card, you’ll get 1.33 cents per point value towards airline tickets.

The Citi ThankYou Premier card lets you redeem ThankYou points for 1.33 cents per point value.

Here’s an example of a flight search using ThankYou points. I looked up one-way flights from Washington Dulles to Orlando. For the date and time I chose, the best fare Kayak could find was $114 on United. The ThankYou travel booking site found the same flight for $116.88 and priced it at 8,787 points. For some reason the ThankYou booking engine seems to add a few dollars to each leg above the best available fare. This means that you’ll get slightly less than 1.33 cents per point value, but it’s still a great deal. In this example, I would get 1.3 cents per point value as measured against the best available rate ($114).

One great thing about booking flights this way is that you do earn miles from the airline you fly. In contrast, most airlines would have charged 12,500 miles for this one-way trip (those that allow one-way awards, that is), and one would not earn miles for flying on an award ticket.

Combining points

When you have multiple credit cards that earn ThankYou points, all of the points will go into the same account as long as you link those cards to your ThankYou account. To do so, log into ThankYou.com and go to “My Sponser Accounts” and add each card.

If you have the ThankYou Premier card, all of your points will automatically be worth 1.33 cents per point towards flights.

Transferring points

One great feature of the ThankYou program is that you can transfer points to any friend or family member for free. This means that as long as you know (and trust) one person who holds a Citi ThankYou Premier card, you can get up to 1.33 cents value towards flights. Simply transfer the points to your friend and ask them to book your flight. Note that transferred points expire within 90 days if not redeemed. See details in the ThankYou Rewards Terms & Conditions document.

5X almost everywhere

By filling your wallet with the right assortment of cards, you can earn 5 points per dollar almost everywhere you shop day to day. Here are the Citi ThankYou Rewards cards that will help you get there:

Citi ThankYou Preferred 5X for 12 months

UPDATE 5/7/2013: The Citi Preferred 5X link appears to be dead. Sorry everyone.

On Feb 6, Personal Finance Digest reported a working link to an application for the ThankYou Preferred card that offers a year of 5X earnings at gas stations, grocery stores, and drugstores. Sure, the 5X earnings are limited to 1 year, but things change so fast in this hobby that one year is like a lifetime.

Don’t confuse this card with the similarly named ThankYou Premier card. The Premier card is the one you need to get 1.33 cents per point value for flights. That one comes with a $125 annual fee after the first year. The Preferred card, on the other hand, has no annual fee. And, if you use the sign-up link found by Personal Finance Digest, you’ll earn 5X for the first year when shopping within several very popular categories.

Citi Forward (for College Students) 5X

I signed up for this card last year just before they began limiting it to college students. This card earns 5X for purchases made at restaurants, bookstores, movie theaters, video rental stores, and record stores. To me, the restaurant category alone makes this card a keeper.

NOTE 3/20/2014: This offer is no longer available

If you want this card, but you’re not a student, you may be out of luck. I think that the best option is to find a student in your family who would be willing to get the card and sign you up as an authorized user. Of course, all of your charges will be on the student’s account so while it might be a great deal for you, it might not be so great for the student…

Wrap Up

By getting both the special Citi ThankYou Preferred card, and the Citi Forward card you will be able to earn 5X ThankYou points at gas stations, grocery stores, drugstores, restaurants, bookstores (including Amazon.com!), movie theaters, and more. Since getting these two cards, I have found myself using them to get 5X for almost all day to day spend.

Finally, getting the two 5X cards is not enough if you want to enjoy 1.33 cents per point value towards airline tickets. To do that, you will need to have (or a friend will need to have) the Citi ThankYou Premier card (or another premium ThankYou travel card).

More details about the cards shown above,and signup links for each, can be found on the following pages:

- Best Credit Card Offers

- Preparing for Miles

- The old Citi 5% gas/grocery/drugstore link is dead, here’s a new one (Personal Finance Digest)

Caution

The purpose of this series of posts is to show how it may be possible to earn 5 points per dollar almost everywhere, but that does not mean that you should. Not everyone can (or should) get all of the cards I’ve listed. While it is true that I have all of the listed cards, this is not meant to be personalized advice for you. Is this right for you? Only you can decide. And, as always, I do not recommend signing up for rewards credit cards unless you always pay your balance in full every month. Otherwise the cost of the interest payments will far exceed the benefit of points earned.

![image_thumb[4]](https://frequentmiler.com/wp-content/uploads/2013/05/image_thumb4_thumb.png)

1-800-842-6596 Calling this number and you can request physical Amazon giftcard for 1 cent per point. The website has it 1.25 points per cent.

Thanks!

[…] total spend: Frugal Travel Guy suggests limiting spend to half of your credit limit each month. That sounds like a good rule of thumb […]

The Citi Preferred 5X link appears to be dead. Sorry everyone.

Just had my Citi Platinum Select converted to a Forward. Thank you for the info. To goals^n^dreams.. the guy doing the most talking about getting shut down did 160k in 6 weeks..he should be shut down for being..STUPID..!

http://www.flyertalk.com/forum/credit-card-programs/1442041-citi-thankyou-preferred-5x-gas-groceries-drugstore-13.html

Most of people were shut down by Citi. It is so dangerous since my oldest card (10 years history) with citi. Not worth!!!! I dont want to lose my 10 years with citi!!! It is so painful!!!!

Anyone know if Chegg.com is coded as a bookstore for Citi Forward? This is the textbook rental site for college students.

@Azriel, The answer is no. AP is coded differently than Amazon.com.

Just out of curiousity… does anyone know if Amazon Payments is coded as a book store, like Amazon.com?

PW/FM – I have the same question. I actually don’t have the Citi Preferred, but I do have the Citi Premier, thinking about opening the preferred for 5x drugstore (as that seems to be the only one left with multiple x reward for VR purchases). I wanted to make sure Citi does not code VR purchases differently so that they don’t get the 5x rewards. Also, thankyou lets you convert 1000 typ to 1500 hilton points. So if someone still wants to use hilton, $1000 in VR purchases will yeild 7500 hilton points, even better than the Amex Hilton cards.

TY uses Expedia as a search engine and there is no AA or southwest availability. Apparently there is a “make a wish” line where they can book those flights for you for an undefined amount. Any one have any experience w this? Not being able to book AA is very disappointing…..although still not a deal breaker.

“FrequentMiler says:

May 4, 2013 at 9:29 am

Michelle S: The Freedom 10% bonus with checking is supposed to be automatic but it makes sense to contact Chase to make sure you’re enrolled.”

I suggest not to contact them by phone or secure message. When I got the 10/10 deal last year, the local banker assured me, but both phone & secure message CSR told me differently. Thankfully, my local banker was right. It took about 2 months for the 10/10 deal to kick in on the Freedom.

Frequent Miler: Applied 4/10/13 and when I received the welcome packet, there was no mention. Sent a secure message and was told 5x was not on the account. They asked me to fax in both sides of the offer I had received. I eventually got a letter in the mail affirming that I was enrolled in the offer. I agree that phone CSRs often don’t know which end is up, but I was messaging with US CSRs and they added the offer to my card. Just warning others who are applying now that they need to check up on it.

JD: That’s interesting. Yes, it can’t hurt to be sure. BTW, Citi refers to this as “4 bonus points” (e.g. 1 base point plus 4 bonus points)

Can you book plane tickets for other people other than yourself from your own personal Than You account? Also, can you please explain how the “yielding a net return over 20%” works with the Premier card? Thanks!

Preacher: yes, you can book flights for people other than yourself from your ThankYou account. I can’t explain “over 20%” because I don’t think that’s right, but I hope I’m wrong 🙂

Does the Citi Thank You Preferred come with a companion ticket like the Premier card does?

Stephanie: No, the Preferred card doesn’t have a companion ticket. Keep in mind that the Preferred is a no-fee card so it is expected to have fewer benefits.

I’ve read blogs, FT and FW incessantly, and I don’t understand why TY doesn’t get more love. Preferred 5X where it’s easiest to buy VRs and GCs and then with Premier a 1.33 multiplier to boot. Plus, with Premier’s flight points, a JFK-LAX RT for $300, yields 1.33 x $300, plus another 1.33 x 4,875, yielding a net return over 20% (though you do have to match regular spending to free up the flight points). What other than the Ink 5x categories even comes close to those returns? I haven’t jumped in on the Preferred yet because there is some time left on another card with similar spend category, but what am I missing in thinking that this is the best overall combo?

PW: Unless I’m missing something here, I don’t think you calculated the value of flight points correctly. They do not transfer one to one to TY points. My understanding is that, in the end, the best you can do with flight points is double the TY points earned on the Premier card. Since that card earns 1X (on most purchases), it really means 2X (or a little more with the annual dividend and some bonus categories). Maybe I’m wrong and you can apply flightpoints to TY points earned on the Preferred card as well? If so, that would be great!