UPDATE: This post is out of date. Please click here for up-to-date coverage of paying taxes by credit card, debit card, or gift card.

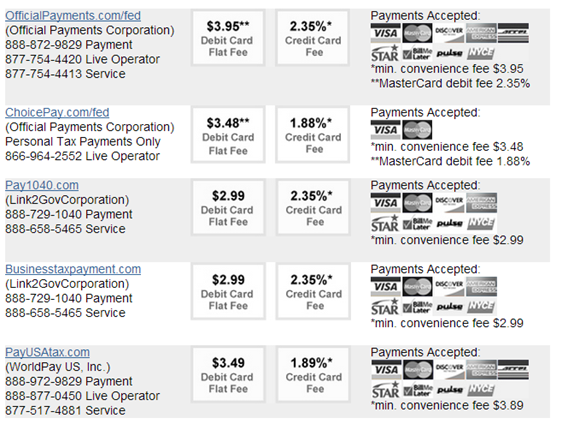

If you have large estimated or year-end tax payments you’ve probably wondered if you could profit by paying your taxes with a rewards-earning credit or debit card. The answer is unequivocally “yes”. The trick is to make sure that the benefits you get from your card outweigh the tax payment fees. Here is a chart (provided by the IRS) that shows the fees associated with paying taxes via credit or debit card. The fees shown below are subject to change, so please see this web page for the latest rates.

As you can see above, debit card fees are as low as $2.99 per payment (regardless of the size of the payment), so debit cards are often the best deal. Visa and MasterCard payment fees are as low as 1.88% at ChoicePay.com, whereas American Express and Discover fees are only slightly more expensive at 1.89% via PayUSAtax.com.

Debit cards

As long as your tax payment is $160 or more, you’ll pay less in fees by paying with a debit card instead of a credit card. The larger your tax payment, the smaller the debit card fee is as a percent of the total. Unfortunately, very few debit cards today offer rewards for debit transactions, but there are a few. Here are the debit cards that currently offer airline mile rewards:

- Suntrust Delta Debit Card: Offers 1 mile per dollar spent. $75 annual fee plus monthly fees unless you maintain a balance of $3K or more. Million Mile Secrets provides more information about this card here. You can also read about my frustrating experience with the card here.

- UFB Direct Airline Miles Debit Card: Offers 1 American Airlines mile per every 2 dollars spent. There is no annual fee, but there is a $1500 transaction limit. Million Mile Secrets provides more information about this card here.

Until recently, Bank of America offered an Alaska Airlines debit card, but, unfortunately, they have stopped issuing the card.

Cost Per Mile

Let’s assume you have four quarterly estimated tax payments of $1,000 each. We can then calculate your cost per mile with each card. Annually, you would pay $2.99 x 4 = $11.96 in tax processing fees, plus you would pay debit card annual fees (if any). Here is the cost to buy miles with each card:

Suntrust Delta Debit Card (assuming you maintain a $3K balance):

- Fees: $75 annual fee + $11.96 tax payment fees = $86.96

- Miles earned: 4,000

- Cost per mile: 2.2 cents

UFB Direct American Airlines Debit Card:

- Fees: $11.96 tax payment fees

- Miles earned: 2,000

- Cost per mile: .6 cents

For relatively small tax payments like these, the Suntrust card offers poor value (unless you use the card for many other debit transactions as well). The UFB card offers good value, but very few miles. Let’s look at what happens when tax payments increase:

|

Quarterly Payments |

Suntrust Fees |

UFB Fees |

Suntrust total |

UFB total |

| $1000 | $86.96 | $11.96 | 4000 miles @ 2.2 cents each | 2000 miles @ .6 cents each |

| $2000 | $86.96 | $11.96 | 8000 miles @ 1.1 cents each | 4000 miles @ .3 cents each |

| $2500 | $86.96 | $23.92* | 10,000 miles @ .87 cents each | 5000 miles @ .48 cents each |

| $5000 | $86.96 | $51.96 ** | 20,000 miles @ .43 cents each | 10,000 miles @ .52 cents each |

| $10,000 | $86.96 | N/A | 40,000 miles @ .22 cents each | N/A |

* Due to UFB’s $1,500 transaction limit, for a $2500 tax payment, it would be necessary to make two payments per quarter instead of just one. This would double the required fees.

** Due to UFB’s $1,500 transaction limit, for a $5000 tax payment, it would be necessary to make four payments per quarter. Since each service only allows two payments per quarter, it would be necessary to use two separate services: Pay1040.com at $2.99 per transaction and ChoicePay.com at $3.48 per transaction.

Analysis

The math for the Suntrust card is pretty simple. The more you use the card, the less the per mile cost becomes. So, for very large tax spenders, the Suntrust card is clearly a great deal. The UFB card is more complicated. From a cost per mile point of view, it looks like a great option regardless of the size of your tax payments. However, unless you have very large tax payments (and/or many other qualifying debit charges), the number of miles earned is small. But, as your tax payments get larger, the process becomes more complicated because you would need to split your payments in order to fit under UFB’s $1500 transaction limit.

Conclusion

With no annual fee, the UFB card is pretty good, but its $1500 transaction limit really limits its value. If your sole purpose for getting the card is to make tax payments, then it hardly seems worth it. If you have small tax payments, then you’ll earn so few miles that its hardly worth the trouble of signing up for a new account. If you have large tax payments, then you would do better with the Suntrust card.

What if earning Delta miles isn’t your thing? Stay tuned for analyses of opportunities to buy miles from the IRS using credit cards and/or prepaid debit cards.

[…] Buying miles and points from the IRS: debit cards […]

[…] Buying miles and points from the IRS: debit cards […]

[…] Buying miles and points from the IRS: debit cards […]

[…] cards? Credit cards can help you build or restore your credit score helps you get what you want, or your automobile insurance companies and landlords. What this means that you agree to the credit cards, or cards that offer rewards and […]

I’d like to confirm Matt from Saverocity’s observation. For the past 3 months (and as recent a posting as 2 days ago) I have been getting miles from UFB for debit card PIN transactions to load my Bluebird.

Mr. Who, your experience with not getting points might be related to purchase of GCs not accruing miles for UFB (I believe I saw something to that effect, but can’t be sure) rather than to PIN v/s signature. Just a possibility…

Silvia P: If you use 5 $500 debit cards, yes you will have to pay the ~$3 fee for each debit card.

If you pay your taxes with debit cards, do the above merchants charge you the fee per debit card. Fro example, if I use 5-$500 debit cards to pay $2,500 of taxes, is the charge $2.99-3.98 per debit card used? I realize that I must call them to use multiple debit cards.

Don’t you guys hate keeping money in a checking account though? If you consider a 7% annual return from investing your cash, thats another $210 of opportunity cost in addition to these debit card’s fees. I’m not tryiing to nit-pick as I know you guys know this but I’d rather keep a Charles Schwab High Yield Investor Checking account open with minimal capital tied up and no fees.

You should not consider a 7% annual return from investing cash that is needed to pay bills within a finite period. The concept of a 7% return is over an extended period of time with dollar cost averaging.

In other words – if you have a $10,000 tax liability and you put it in the market, the market crashes and your 10K is now worth 5K how do you pay the bill?

But the debit cards would have spending limit. Most of them are $2000. If your tax payment due is more than this, then you could not really use the debit card to pay for your tax anyway.

Also, I think some of the debit cards are no longer allowing for mileage accural if you use it to pay for the tax to the government agencies such as the Bank of America Alaska airline debit card.

Is it fair to attribute the yearly $75 fee to one charge? If that were the case, you could append that charge on the smallest charge and make that purchase the most inefficient points earning purchase on the debit card.

Clifford: This analysis assumes that you are getting a debit card just for the purpose of earning miles while paying taxes. Certainly if you use it for other things, the weight of the $75 charge gets spread out and becomes less meaningful.

Another note of interest to very few people: If you have a large tax bill that exceeds your credit card limit, Citi will allow you to send them a cashiers check to establish a credit balance on your account. You can then use Payusatax at 1.9% and get miles for your entire balance due in one swipe. You have to know what you’re using your miles for though because this is rather expensive.

PointsObsession: Thanks for the info!

The transaction limit on the Suntrust card is $35,000. FYI

Hey Mr Who

“UFB Direct: Your SOURCE is 1 year old. PIN works fine doesn’t mean you get points.

I had a PIN transaction @ OM when they had $10 deal on $200 GCs. I didn’t get the points.”

My source is my AA account where my miles posted last month (technically they posted on 5/31) for my Pin transaction… which just happened to be 3 money orders 🙂

Thought I would contribute a data point here: I made an additional (and unnecessary) extension payment for both fed and state returns 4/13 using the ST DL debit, and filed each 4/19. In each case the govs took 2 months to process the returns before transmitting my refund. Interest was applied to the refunds, which more than covered any associated costs. Points posted to my DL account by the end of the month.

Kilroy: That’s great!

Matt from Saverocity: Thanks for that recent data point!

Please verify what your claim on your own instead of getting an idea from another blog and treating it like a truth.

Also, your MMS source, if you read comments, they concluded that only signature transactions get points at least the conversation was heading that way.

MrWho: The comments in the MMS post you are referring to say that using the card to load Bluebird at Walmart is not resulting in points earned, so it may be that UFB has found a way to block certain debit charges from earning rewards, but in general they still advertise that the card earns rewards for debit transactions (see https://www.ufbdirect.com/personal-banking/checking/airline-rewards-checking). I agree with you that it would be very helpful to get recent experience from someone regarding getting rewards for paying taxes.