It has long been the case that Bluebird’s Member Agreement has stated that MoneyPass Network ATMs are free for Bluebird cards receiving direct deposit. Specifically, the Member Agreement says, “To qualify, at least one Direct Deposit payment must have been received in the thirty (30) days before the ATM transaction.”

Until recently, though, the direct deposit requirement was not enforced. Previously, as long as you used a MoneyPass Network ATM your withdrawals were free. I described this in my April 2013 post: “Bluebird: Are direct deposits necessary for free ATM use?“

Yesterday, though, I received a Tweet from Jose A:

@FrequentMiler I had not made a direct dep to my BB in months and was not charged an atm fee until 2 weeks ago. Just an fyi.

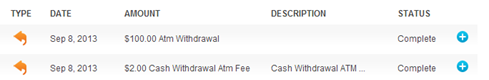

So, I ran out to my nearest MoneyPass ATM and tried it out myself. Sure enough, Jose A was right. After withdrawing cash I logged into my Bluebird account and found the $2 fee:

Set up Direct Deposit

To avoid ATM fees, you need to setup direct deposit to your Bluebird account. To do so, simply log into your Bluebird account, then go to “my account… funding sources”. There you’ll see your Routing Number and Account Number to be used for direct deposit. While American Express would like you to setup automatic direct deposit from your paycheck, there are many other options you can use. For example, you can use the routing number and account number to push money to your Bluebird account from services like Amazon Payments and Google Wallet. I’ve also had success with a transfer of cash back from TopCashBack to my Bluebird account. With any of these methods, the trick is remembering to push money to your Bluebird account monthly (or at least several days before you plan to withdraw cash).

Other Tidbits

- You can find MoneyPass Network ATMs here. Note that you can also find Walmart kiosks with this web page by typing “Walmart” into the top textbox.

- Bluebird has extended the option to order free paper checks through January 1, 2014.

- The ability to transfer funds from Bluebird to a bank account for free is not gone, it’s just hidden. Readers showed me how to find it as I described here: Where did Bluebird’s Transfer Money button go?

- Wondering why we care about Bluebird? See “Bluebird takes flight and changes the game.” Also see “Vanilla Reloadables” and “Gift card PINs.”

I am deciding between BB And GoBank. Honestly if BB did not charge for in network atm I would go with BB. But since I can not get direct deposit thus will be charged….GoBank it is…

Bill H: thanks

FM – I thought I’d mention that I just saw that Consumer Reports have done a comparison of stored value cards and have selected Bluebird as the number one choice.

Roger: No, Amazon Payments won’t accept gift cards. Simply use a credit card with Amazon Payments to send someone else up to $1K per month and they can withdraw the money to their bank account.

.

dave d: VanillaOne cards should work at Walmart for reloading Bluebird as long as you select debit. You do need to wait at least an hour after buying the cards, though. If it doesn’t work, you could try using them at the Walmart money center to pay bills instead.

Please help!

I went and bought two one vanilla prepaid visa cards and put $500 on each and planned to deposit the $ to my bluebird acct at walmart to apply towards my mortgage and atalmart. Checkout it would not deposit into bluebird and tried debit and credit but neither worked.

What did I do wrong and what can I do?

Thank you so much.

Is it possible to use a gift card with Amazon Payments and send to Bluebird? Or, do I have to add funds to Amazon Payments via my bank?

If doing a direct deposit, would it still be possible to load $5,000 per month using other means, such as from Vanilla Reloads, debit cards, or Visa gift cards? The direct deposit requirement would be reasonable enough if it doesn’t count toward the $5,000 per month load limit.

Brandon: Yes, the direct deposit limit is counted separately from other deposits

Matthew: I don’t know this for sure, but I’d bet that the sub accounts would also get the ATM fee waived

Does anybody know how subaccounts get handled? Say I have direct deposit on the main account, does that mean the subaccounts also get the ATM fee waived? Also from what, I can see a subaccount can not set up direct deposit so not sure how to make sure the ATM fees are waived for the subaccount. Any thoughts?

I concur that the amount of the direct deposit into the Bluebird account is not a consideration point to determine eligibility to avoid ATM withdrawal charges. Simply having one each month seems to be enough to successfully qualify.

How about a regular transfer from my other checking accounts like Wellsfargo or Citibank. Will that be OK

You don’t specify, but I’m guessing there’s no minimum required for DD? For example, if I direct deposit xxx of my paycheck to my Chase account and then leave a remainder of about $16 to Bluebird two times a month, that should be fine?

I was scared when I logged in and didn’t see the transfer button! A quick google search solved the problem.

I;ve tried to add BB account as a bank for Amazon payments,by using the routing & acct# on BB checks on AP’s Add a Bank page. According to AP the routing # is a Wellsfargo? But that small deposits from AP never came thru to be verified.

DJ: That’s strange! Anyone else have that problem?

.

Jennifer: I’ve done as little as two cents in the past.

.

caveman: Yes, ACH transfers from other checking accounts will probably work too.

I believe that money must be pushed to Bluebird from a request originating at another financial institution. I tried pulling money to Bluebird from a Bluebird originating request. It was labelled transfer rather than direct deposit and I was charged 2.00 when I made an Moneypass ATM withdrawal.I called about it and I was not able to get the fee waived.

Chuck: That’s right. For a transfer to count as a direct deposit, it has to be initiated from outside of bluebird. The process of logging into Bluebird that I described above was just for the purpose of retrieving your routing number and account number. Once you have those, log into a different site that allows money to be moved to your bank (e.g. Amazon Payments, Google Wallet, Paypal, etc.) and withdraw money from that site into your Bluebird account.