Discover Bank has increased the bonus on their free Cashback Checking account to $300. The offer is currently only open to Discover customers. Let’s look at the details.

The Offer

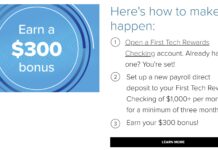

Receive a $300 bonus when you open a Discover Cashback Checking account by 11/15/15 and receive two direct deposits of $250+ each within 90 days.

Note: You won’t see the bonus details on the main screen. Once you click to open the account and sign-in to your current Discover account, you will see the bonus details confirmed.

Key Terms

- Open to Discover credit/deposit customers, excluding current/previous Cashback Checking customers.

- Subject to approval.

- To get $300: Open account between 9/15/15-11/15/15 with code Bonus4915 and receive 2 Direct Deposits (payroll, Social Security, pension) of $250 or more within 90 days of funding.

- Bonus issued as credit to the open account within 30 days of completing requirements.

- Limit 1 per customer/account.

- Bonus will be reported as interest on IRS Form 1099-INT. Offer may be modified/withdrawn.

For more information and a detailed analysis, see this Doctor of Credit post.

Never miss a Quick Deal, Subscribe here.

![(EXPIRED) [Targeted?] TD Bank: $400 checking bonus, up to $600 savings bonus (up to $1K total) a hand holding a fan of money](https://frequentmiler.com/wp-content/uploads/2020/08/hand-full-of-money-refund-cash-218x150.jpg)

When I go to sign up, it says, “IMPORTANT OFFER UPDATE: THIS OFFER IS REDEEMABLE ONLY BY THE INDIVIDUAL WHO … RECEIVED AND WAS THE ADDRESSEE ON OUR DIRECT MAIL OFFER.” It doesn’t appear that you can get the bonus just by using the code unless you received the offer by mail.

It seems this is new language they have added. At this point I wouldn’t apply since they appear to be cracking down on people who weren’t targeted.

Yes indeed they cracked down on me and my wife. I opened checking accounts for both of us on 11/9/15. I called Discover on 1/28/16 and they said Yes I had met the requirements and would receive the $300 bonus by 2/24/16. I called on 2/24/16 and they said No we did an investigation and you were not targeted for this offer and it only applies to targeted customers. The rep said it “went viral” and the code was “all over the Internet” so they limited it to targeted only. So no $300 for me. Or my wife. Win some, lose most (at least lately it seems).

[…] Discover Increases Checking Bonus to $300 […]

My Capital one 360 push DIDN’T count as DD, according to the discover rep I spoke to.

Did you call or chat?

Called in to inquire about general info on how the double cash works for the checking account, and I happened to mention that the accounts were new. Rep then asked if I had signed up using any promo code; and of course, I said yes. Then she informed me that I might not qualify for the bonus associated with the offer because some promo codes were distributed “on blogs,” and that the bank has decided that the bonus would not be honored for those who did not specifically receive the “offer letter.” Supposedly there is a form that can be checked. She tried to check on my account, but said the system would not let her, so she said she was transferring me to someone else who could check it for me. Before transferring me, I reiterated my original request for info on the cash back program for the checking account, but she did not seem to know the details about the “double” offer, so she said the supervisor she was transferring me to would know better than her. Then, the call dropped. Hmm…am not calling back about this mysterious “form,” but letting you know…YMMV

Same thing happened to a friend. The rep had told him that ppl who signed up before Nov 4th are safe.

[…] Discover Increases Checking Bonus to $300 […]

Anyone have datapoints on DD trigger? With Serve/Rb/BB having the new bank rule implemented a few days ago I’m not willing to unplug my Serve -> Santander w/d option yet if I can’t have it re-linked.

Discover also doesn’t have an option for DD alerts so it’s really a shot in the dark until data points roll out.

I’m having a problem when I attempt to open an account and log in with my credit card credentials, the address that’s populated for me is my address from two houses ago. I’m not sure where they’re pulling this address from, as my credit card has the most up to date information and I haven’t lived at the address they’re populating for many years. The boxes are greyed out and unable to be modified. Not sure if I should call them at this point.

@Ken, why not sign up for the IT card then open the checking account? It would be like a $300 + $50 (+$50 after year one) signup bonus for the IT card. Plus you’d get the 2%/10% cashback the first year.

Because I’d rather use hard pulls on cards that provide more value than $50. If this were January and I had an entire year to take advantage of the It car’s year bonus I’d probably do it how you’ve suggested.

You seem to assume that Discover does a hard pull here. Doesn’t Discover do a soft pull when you open a checking account or savings account?

Did you read the post I was replying to? The hard pull is for the credit card they suggested.

I thought you got an entire year, not calendar year to get the double cashback, so it wouldn’t matter if it was January or December. After the 12 months, then your cashback is doubled then.

Discover IT, discover deals, and double cash back for the next 12 months is worth way, way more than $50 ($100 once its doubled, plus this $300 bonus) if you can utilize it. Also, its 12 months from when you sign up. Why do you want to specifically wait until January?

Double First Year Cash Back: After the first 12 consecutive billing periods that your new account is open, we will double all of the cash back rewards you’ve earned and apply them to your account in the following one or two billing cycles. You’ve earned rewards when they have posted to your account by the end of the 12th consecutive billing period. You will not receive Double Cash Back if your account is closed or no longer in the cash back reward program as of the award date. This promotional offer may not be offered in the future. This exclusive offer is available only to new cardmembers.

If that doesnt pull you, you can open a Discover savings with $100 bonus without the IT card and then open this checking.

Hmm, I was under the impression that the deal was for this calendar year only. But if it’s for 12 months with no AF on the card it might be worth it.

I also like your idea of opening a savings account first and then doing the checking account. That would result in 0 hard pulls and $400 bonus cash.

Does the Savings account require a $10,000 deposit for the $100 bonus? That’s what I was seeing on one site.

10,000 minimum for savings? I’m seeing a $500 minimum for savings at a halfway decent interest rate on discovers website. Post that link where you saw 10G… Maybe it’s one of those “Morgan Stanley” investment account minimums?? 10 grand, unreal!

@HubbaBubba, there’s promo codes for the Savings Account to get $100 bonus, but you have to deposit X amount in the first 30 days. Looks like there’s 2 codes, one that requires a $5000 deposit and one that requires a $10000 deposit. Both of them give you $100 bonus though.

The 1099 is b.s. and needs to be factored in to whether it’s worth the effort.

@Ken, why not sign up for the IT card, then open the checking account? It would be like getting a $300 + $50 signup bonus for the IT card which will give you 2%/10% cashback for the year. If that sounds like a good idea, you can use my referral link: http://bit.ly/1QPssgY (if Shawn/FM don’t mind)

Subscribed in case they open it to new customers.