UPDATE: Please find updated information here: Pay student loans or 529 plans with a credit card!

The New York Times recently published an article about Gift of College rolling out gift cards to stores (initially only in California). They wrote: Want to Help Pay for a Child’s College? Grab a Gift Card. Fees for these gift cards are reported to range from “$3.95 to $5.95 depending upon the card’s value”. The highest value gift card purchasable will be $500, so we can calculate the expected fee as a percentage: $5.95 / $500 = 1.19%.

Many credit cards automatically earn rewards worth more than 1.19%, so the ability to buy these gift cards will clearly be a boon to those who fund college savings programs anyway. Of course it will be even more exciting if the gift cards are found in stores where large category bonuses are possible. For example, if they are sold at grocery stores, we can pay with credit cards that earn great grocery store bonuses. Or, if they are sold at stores such as OfficeMax or Staples, we can pay with credit cards that earn 5X rewards for office supplies, such as Chase Ink or Amex Simply Cash Plus.

Update 10/31/2016

In the previous version of this post I wrote about the options for using a credit card to fund college savings online for as low as 1.19%. Unfortunately, Gift of College has now capped online gift card purchases at $300 each. With a $5.95 fee for each gift card that amounts to a 1.98% fee. Direct credit card contributions are now capped at $500 (previously $1000) and have a $15 fee (3%).

If you have a credit card that earns better than 2% rewards for all spend, or one that offers a bonus for charitable donations (such as the US Bank Flexperks Visa), then it is worth buying the gift cards online. Otherwise, my advice now is to look for the gift cards in-store. On November 7th, these gift cards are expected to be available nationwide at Toys R Us and Babies R Us stores. Most of these stores should allow you to pay with a credit card.

Update 10/26/2016

In the previous version of this post I wrote about the options for using a credit card to fund college savings online for as low as 1.19%. Unfortunately, Gift of College has now capped online gift card purchases at $100 each. With a $5.95 fee for each gift card that amounts to an outrageous 6% fee! Direct credit card contributions are now capped at $500 (previously $1000) and have a $15 fee (3%).

My advice now is to look for the gift cards in-store. On November 7th, these gift cards are expected to be available nationwide at Toys R Us and Babies R Us stores. Most of these stores should allow you to pay with a credit card.

Here’s the old post… (listed percentages are no longer relevant)

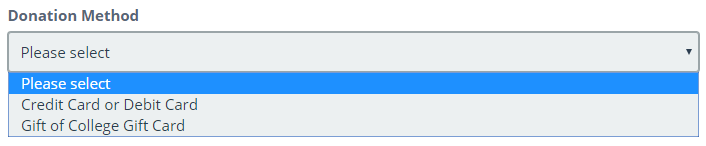

Fortunately, those of us who live outside of California do not have to wait. Gift of College already provides two options online for contributing to college savings programs with credit cards. One option is to fund directly with a credit card (or debit card). Another option is to purchase a gift card online which can then be redeemed into a college savings account.

Direct Credit Card Funding: As low as 1.5%

Currently, the most you can fund at once directly with a credit card is $1,000. If you try to do more, you’ll receive a warning like this:

Currently, there’s a $15 fee to gift $1,000 this way. That amounts to a reasonable 1.5% fee.

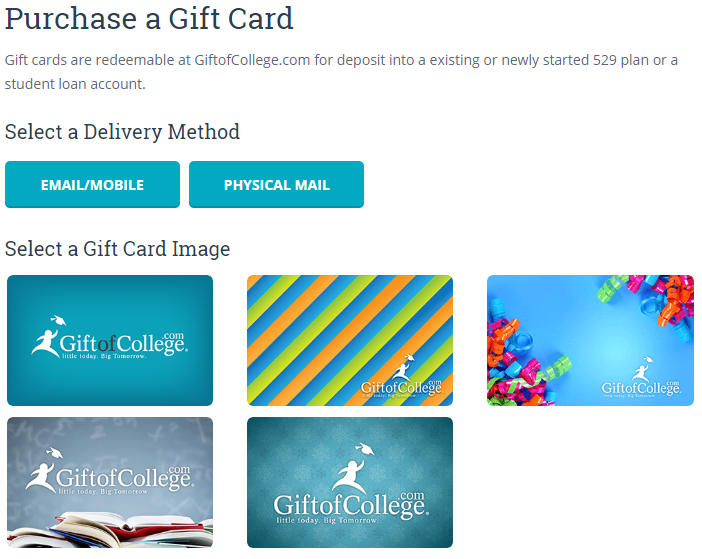

Gift Card Funding: As low as 1.19%

To fund via gift card, go to Gift of College’s Purchase a Gift Card page. Here you can purchase e-gift cards or physical by-mail gift cards. I selected e-gift cards and found that I was charged $5.95 for each $500 card. This is the same as the reported in-store price. This amounts to a fee of only 1.19%.

Limits?

I’m not sure what limits exist, if any, in how much can be contributed to college savings plans via credit card or gift cards. The NY Times article I linked to above mentions that Gift of College has implemented “anti-money laundering and other fraud protections.” I’m just guessing here, but this may mean that they’ll ask for additional information if you fund very high amounts, or if you switch credit cards often. While that may be a pain for a few customers, I think it is great if they can effectively prevent fraud.

Accepted Credit Cards

Gift of College currently accepts Amex, Discover, MasterCard, and Visa.

Cash Advance?

One risk when using a credit card to fund things that sound like cash equivalents is that the purchase may code as a cash advance. In those cases, you won’t earn credit card rewards, but you will incur additional fees.

I tested contributing directly with a credit card using a Citibank card, and I bought a few e-gift cards with my US Bank FlexPerks business Visa. In both cases the transaction coded as a regular purchase with the merchant code 08398 (Charitable Organizations).

I can’t promise that all credit cards will code these transactions as regular purchases, but it seems likely. If you’re concerned, one way to protect yourself is to call your card issuer and ask to lower your cash advance limit to the smallest allowed amount, and then make Gift of College purchases in larger amounts. That way, if the transaction codes as a cash advance, the purchase should be denied at the outset.

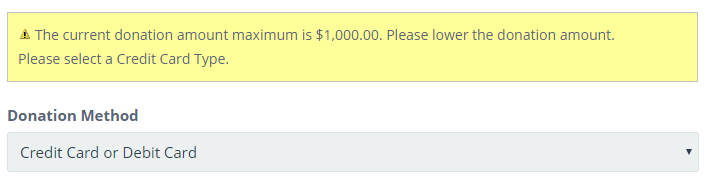

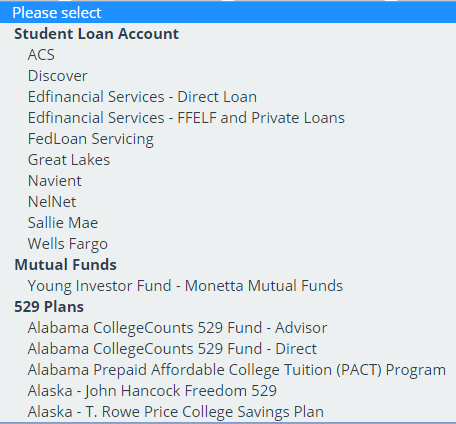

Which College Savings Plans are Eligible?

The NY Times article mentioned that “At least one [529 Plan] has stopped accepting 529 gifts.” So, how can you find out if your plan is eligible? When you register for Gift of College, you are prompted to register a plan for your child / beneficiary. Here you can select from a long list of 529 Plans and a smaller list of student loan accounts.

Theoretically, as long as the fund in question appears in this list, you should be able to fund it through gift cards or direct credit card donations.

How long does it take?

I don’t yet have a lot of experience with this, but in my initial tests, direct credit card funding took 10 days from funding to appear in my son’s 529 account. Gift card funding took 7 days once I redeemed the gift card, but I had ordered the gift card on a Friday and received it on Monday, so in total, the gift card route took the same 10 days to complete. It remains to be seen whether subsequent funding will be quicker.

Wrap Up

Since I have a son headed to college next year, I’m thrilled to have found a way to contribute to his college fund via credit card! I used to contribute monthly through an automated process. Now, the gift card route takes a bit more work. Each month I’ll have to log in to buy gift cards. Then, when received via email, I’ll log in again to redeem them. Is it worth the minor hassle? At only 1.19% in fees, I have no doubt. I expect that many people will find that this is a great way to meet credit card minimum spend requirements for earning huge signup bonuses, or to increase spend in order to earn big spend bonuses.

UPDATE: Please find updated information here: Pay student loans or 529 plans with a credit card!

Went to buy gift of college gift cards online from their website today, max you can buy online now is $500 and it’s charging a $15 fee, yikes!

Is there any new updates for gifts card at Toys R US?

Yes, they’re there and they work. Details here: https://frequentmiler.com/2016/11/08/pay-student-loans-529-plans-credit-card/

Worked Great. Not only have I managed to meet my spending requirements, I’ve also managed to contribute to my son’s college fund. Win win!

There are two donation types.. gift card and fund with credit card.

When logged into my own account, I choose the credit card option (I am aware of the 3% fee) I am funding my own account correct?

Yes, it will fund whichever account you setup within your log-in to giftofcollege.com

went to toysrus today, but cannot find the gift card

they are brand new. i ask the manager to look in the back for new shipments, and sure enough..they were there

Good tip. Thanks

Vindu, it looks like direct contributions are capped at $500 so I’m not sure what they told you is true.

Also, I did make $1000 in gift card purchases the day Greg first posted this, but the money has not made it to my child’s 529 yet. It’s been 10 days. I emailed customer service and they said it could take up to 14, but I have no idea why it takes that long. Could this become another Incomm bust?

It now looks like they have removed the direct contribution option from the web site. So it’s just gift cards.

For direct contributions to a 529 through GiftofCollege.com, the fee is 5 percent, but capped at $15, according to an email that I received from Customer Service.

So for a $500 contribution, that’s 3 percent, but for a $1,000 contribution, it’s 1.5 percent, which is more reasonable. (Or for a $2,000 contribution, that’s 0.75 percent.)

So do contributions half as often but at double your intended the amount to save on the fees.

Update: Gift card limit is now $300 which equals ~ 2% fee

It seems like you can only unload the entire gift card amount to one child account. Can anyone confirm? Thanks.

Yes, I believe that’s true

[…] didn’t last long. Yesterday I posted “How to fund college savings with a credit card.” In that post I detailed how to use a rewards credit card to fund a child’s college […]

Gift card max value has been lowered to $100 … 1.19% fee option is dead.

Sh*^%t. They also killed the direct contribution approach by capping it at $500.

@ Ace – you can’t remove “only the contribution” as distributions from 529 are comprised of both principal and interest. If 529 funds are used for expenses that don’t fall within the IRS’s rules, then you’ll pay the tax on earnings as well as a 10% penalty on earnings.

Also, it sounds like @ Larry was referring to potential *gift taxes* to the *donor* (aka parent, grandparent etc), which is another thing to beware of if contributing big $$ to the tune of $14k + in a calendar year.

If you’re looking to go big with this for big spend bonuses, be aware that donations are not without potential tax consequences. No tax advice advice here, but make sure you understand the gift tax consequences for contributions.

529 plans can be liquidated at any time with no tax consequence EXCEPT on earnings and/or tax advantaged contributions.

In a nutshell, if you contribute after tax income and withdraw only the contribution, not the earnings, no tax.

I’m not talking about liability on the earnings. I’m talking about contributions in excess of the gift tax yearly maximum.

While the funding of a 529 plan is nice, I think the BIGGER potential here is paying down your own student loans.

I do have those!

It seems to be possible based on the website. Have not yet tried it, though.

No tax complications there, and essentially a way for me to be able to pay my monthly bill that I’m paying anyway with a credit card. That’s big!

Why would anyone do a direct credit card transaction when the fee is lower to buy an e-gift card?

So I figure if you use a Chase Freedom Unlimited where you get 1.5X UR to buy the e-gift cards, I am essentially paying $0.00783 per mile. It’s not bad but not as good as other methods….

Beginning November 7th, the giftofcollege gift cards will be available in Toys R Us and Babies R Us stores in increments of $25 to $500.