Plastiq is a bill payment service that lets you pay almost any bill with a credit card in exchange for a 2.5% fee. Paying rent, tuition, or other big expenses through Plastiq can be a great way to meet minimum spend requirements for new credit cards. For more details about Plastiq, please see: Complete guide to Plastiq credit card payments.

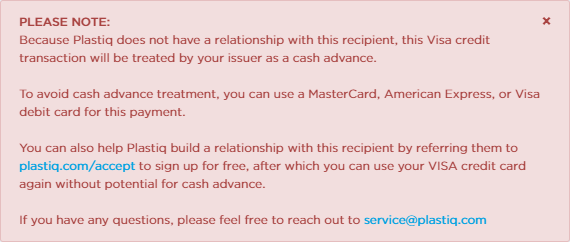

But, if you try to pay a new recipient with a Visa credit card, you may get this warning: “PLEASE NOTE: Because Plastiq does not have a relationship with this recipient, this Visa credit transaction will be treated by your issuer as a cash advance.”

Bummer. You certainly don’t want to go through with that payment as-is since cash advances incur fees, do not earn rewards, and do not help you meet minimum spend requirements. They’re nasty all around.

| Important: If you don’t see a warning like the one above, then you are safe. You will not incur a cash advance fee |

Fortunately, there are two easy workarounds to the cash advance issue…

1. Make your first payment with Amex, Discover, Mastercard, or debit card

Only Visa credit cards run the risk of getting cash advance fees through Plastiq. And this only happens when you make the first ever payment to a recipient. If you make your initial payment with a different type of credit card (2.5% fee), or with a debit card (1% fee), then you can make future payments to the same recipient with your Visa card and you should not get the above warning, nor should you get charged a cash advance fee. Important: You may have to wait until your first payment is deposited before the warning goes away.

2. Ask the recipient to register with Plastiq to accept payments

Obviously this option works best if you personally know the intended recipient. If there’s a business or contractor that you’d like to pay by credit card, you can ask them to register with Plastiq to accept credit cards. There is absolutely no fee to register.

Send them here: www.plastiq.com/accept

Don’t forget: Plastiq no longer accepts Amex or Visa cards for most mortgage payments

The above steps work to avoid cash advance fees when paying rent or other miscellaneous bills, but it will not get you around the mortgage ban. Most mortgage companies (but not all) can no longer be paid through Plastiq with Visa or Amex cards. The best way to test whether your mortgage can be paid with Visa or Amex is to try it. If Plastiq.com allows the payment to go through, then you should be fine.

You can also, of course, continue to pay mortgage with Mastercard or Discover.

See also:

- Plastiq no longer allows Amex mortgage payments

- Plastiq no longer accepts Visa for mortgage payments

[…] doing so, future Visa payments will go through without a hitch. Read more on How to Dodge Plastiq Cash Advance Fees for more details if you plan on applying for a Visa rewards […]

Yup, you definitely will incur a cash advance fee with a Visa Credit Card because it happened to me, but what’s a good rewards Mastercard? Anyone has suggestions?

Can i pay tution fee at some flying school with my hilton aspire card to hit the minimum spend? First they dont accept Amex. second, they charge 3% on visa & MC.

Yes, as long as it is a valid education expense it should work

Hey, I am going to use my personal Chase Visa card to pay for my tuition. The total credit limit for that card is 4k. By the way, I used my plastiq account before to avoid cash advance, so, it means I only can use this card to pay $200 once a time, right? Plus, it won’t affect me to complete the signup bonus, right?

thank you so much

Yes, you can use Plastiq to pay your tuition and it will count towards your signup bonus min spend. I’m not sure what you mean about $200?

[…] ** You can avoid cash advance warnings by making an initial payment to this recipient with a different type of credit card. Future Visa payments will then be OK. For more details see: How to dodge Plastiq cash advance fees. […]

Hi, Greg,

Can I use VISA debit card to first payment?

And, I choose “one-time payment”, is it OK?

Yes

What if you have incurred the cash advance fee? Is there a way to cancel the transaction and pay with another card? If not, will future payment be okay now if I swallow whatever the cash advance fee incurred?

I don’t think there’s a way to cancel the transacation, but you could contact Plastiq support to ask. I assume that future payments would be OK, but you should know by whether or not you get a warning when trying to make the payment.

[…] How to dodge Plastiq cash advance fees […]

One more recent data point – consistent with Greg’s instructions in the post and with Chris’ experience last month:

This payment was to my HOA for my annual dues.

12/11 – Initial payment processed, made via MCard

12/21 – Email from Plastiq; initial payment deposited by HOA

12/22 – Successful payment of remaining balance via Visa, no cash advance fee

I checked Plastiq on approx 12/18 and again on 12/21, and the cash advance notification still showed for Visa payments. 12/22 was the earliest day that I could make the payment without it showing as a cash advance.

Thanks, Greg, for the good post on this process!

Thanks Craig!

I made a mistake trying to get around the cash advance fee.

I tried to pay via my LMCU visa debit card first. I spend a week trying to get them to reduce the fee from 2.5% to 1%. They didn’t budge even after sending in a screenshot of some debit card transactions. They said the BIN was not being reported as a debit card. I ended up sending the payment anyway with the higher fee.

After a couple weeks of waiting for the cash advance warning to be removed, I realized my mistake. I still did not make a payment with a debit card (from Plastiq’s point of view). Doh!

It shouldn’t matter how you paid before. Once the biller is in their system as having been successfully paid (with any card), the cash advance fee should be gone. Contact Plastiq support if that’s not the case.

Ah, you’re right. It just took a while for the system to update. Here’s my timeline:

11/11: Payment processed

11/13: Payment sent

11/21: My post above

11/23: Payment deposited

I can now make payments without the cash advance notice. Thanks, Greg!

Good to hear and thanks for the data!

After about 3 days, the Visa cash advance warning is gone, and now I can pay the bill with Visa cards. Thanks for the great info here, Greg!

[…] ** You can avoid cash advance warnings by making an initial payment to this recipient with a different type of credit card. Future Visa payments will then be OK. For more details see: How to dodge Plastiq cash advance fees. […]

Hmm..I sent a payment via an Amex first. After that completed successfully, I tried to pay via Visa and I still got the cash advance warning message. Same recipient.

That’s strange. I’d be curious to hear whether that’s still the case now that’s it’s a couple of weeks later? Maybe it takes Plastiq a while to update their database?

I encountered the same situation… Hmmm

JR, did it change after a while?

physixfan, how long has it been since your initial payment?

[…] How to dodge Plastiq cash advance fees […]

[…] How to dodge Plastiq cash advance fees by Frequent Miler. Nice quick tip here, didn’t realize you could pay with another issuer first and then switch to Visa to avoid this. […]