The Chase Ink Business Unlimited has gone live for new applications, with an intro signup bonus of 50,000 Ultimate Rewards points after spending $3,000 in the first 3 months. That’s a fantastic signup bonus for a card with no annual fee and 1.5x earning structure everywhere (which becomes more valuable than the advertised 1.5% back when paired with another premium Chase card). We have added a direct link to our Best Offers page.

The Offer

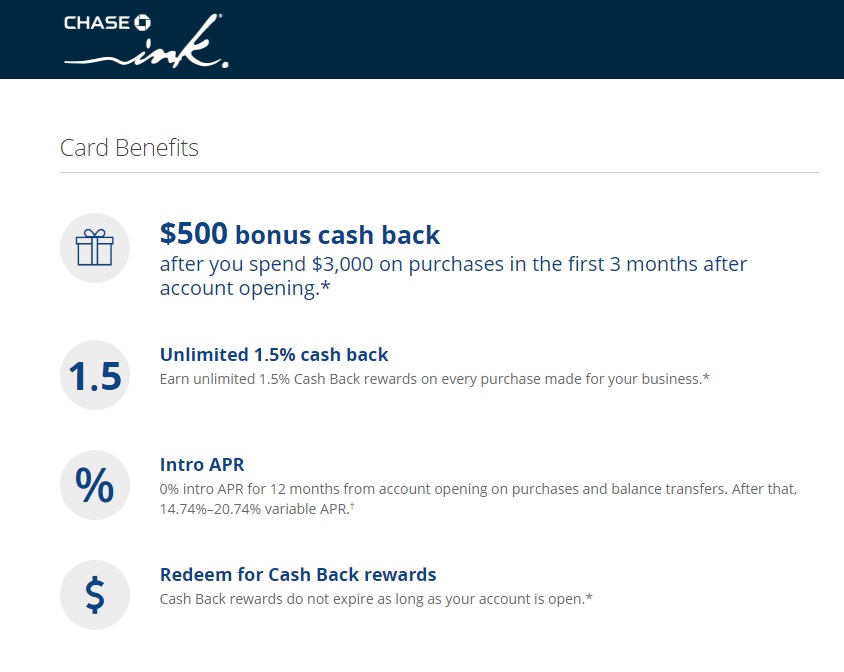

- Get 50,000 Ultimate Rewards points (“$500 cash back”) after $3,000 in purchases in the first 3 months

- Direct link on our Best Offers page

Key Card Details

- Earn 1.5x everywhere (1.5% back)

- No annual fee

Quick Thoughts

This is an awesome offer for a card with no annual fee and matches the current opening offer on the Chase Ink Cash. While some people had speculated that the Chase Ink Cash would be discontinued upon the release of this card, Greg argued that Chase is releasing this card in order for its personal and business portfolios to more closely mirror each other (See: Chase’s new 50K offer and their evolving Ultimate Rewards lineup).

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

While we do not yet have a large number of data points, it is certainly expected that this card will be subject to 5/24 — meaning that if you have opened 5 or more new accounts in the past 24 months, you are not likely to be approved.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Those under 5/24 would have to consider the signup offer here against those available on the Chase Ink Cash and Chase Ink Business Preferred. In addition to comparing earning structures, those under 5/24 might also consider whether it makes more sense to open a Chase Ink Business Preferred for its larger signup bonus and later product change it if you find that the earning structure of the Ink Cash or Ink Business Unlimited better suits you. On the other hand, if you already hold the Ink Business Preferred, this new Ink Business Unlimited might be just the offer you need to add some life to your Ultimate Rewards portfolio.

H/T: Miles to Memories

My business has several ink cards (one for each of our locations). Since Chase involuntarily product changed my Ink Bold into a second Ink Plus, I was wondering if you know whether the my old Ink Plus can be product changed to the new Ink Unlimited? (Yeah, I could call Chase directly but I have to get my business partner on the phone to ask the question and that’s easier said than done…would prefer to not waste time if necessary)

You should be able to product change to anything that earns UR points.

I see this (in conjunction with the Ink Preferred) as Chase’s attempt to phase out “5x office stores” all together. As such, I’m considering it better to just hold onto my Ink cards for MS long term rather than give them up for a quick one time bonus.

Soooooo…..I’ve got the Ink B’ness Preferred. I know that the Ink Cash is a diifferent product and can be held alongside the IBP. Can we do the trifecta? I.e. IBP, Ink Cash, and Ink Unlimited? Or is it too early to say?

Hey Nick, Zack here. Loyal reader, but first time commenter. I am fledgling point collector, having gotten into the game a couple years ago. I currently hold a Sapphire Preferred and Ink Business Preferred, having been attracted to large sign up bonuses and no foreign transaction fees (I spend 95% of my time living outside the US). I am heading back to the States soon and thought it would be a good opportunity to add a another card to the wallet, especially since I’ll be spending enough money for a sign-up bonus. I’ve been waiting in anticipation for the Ink Business Unlimited launch as one of your or Greg’s previous blogs mentioned that it would offer 1.5 UR redemption. Since I use all my UR points for travel, I was hoping to up the 1.25 redemption I receive on the Sapphire Preferred (side note: I’ve looked into the Sapphire Reserve and decided my travel patterns don’t align with making full use of the $300 travel credit, thus costing me a huge annual fee). Since I didn’t see the Business Unlimited UR redemption rate mentioned in this blog, I was hoping you or others might have more insight? Also be curious to know if you had better suggestions beyond the new Unlimited card for someone in my situation (Business Cash for example)? I’m keen to remain in the Chase orbit for simplicity sake and average $30-50k spending annually (~25% of that in USD). Thanks in advance and keep up the great blogging.

Hi Zach, I think you may be thinking of my post where I speculated that Chase may introduce a new card: Ink Business Reserve to parallel the Sapphire Reserve. The Ink Business Unlimited and Ink Business Cash cards offer only 1 cent per point redemption unless you move the points to another card first. Also, both of these do have foreign transaction fees so they’re probably not a good match for you, except for the sign-up bonuses and for spend when you’re in the US.

Thanks Greg, you and Nick send out soo much helpful information, its hard to keep track. With a Ink Business Reserve not yet on the horizon what would you recommend as my next card?

Separately, I’ve been sitting on a question forever that I can’t seem to answer from your site: What happens to already accrued UR points post card closure/product change? I built up a sizable amount of points on my Ink Business Preferred and transferred them to the Sapphire UR account where they currently sit. If I close/change the Ink Business card will I lose those points or since they are now part of my Sapphire holding will they be OK?

Hey want to give you a data point about chase business cards. Applied for Marriott business card, chase put my application on hold until they could verify my business. I called and told them I was a sole proprietorship, but 3 different people at chase said they now require documentation such as an EIN. Let me know if you want a copy of the letter.

Hi Jacob. That’s interesting — I know at least one person who recently applied and was approved for the Marriott Business card without an EIN (although he did have to describe his business to get approval). Yes, we’d be interested in seeing the letter! mail to: greg at frequentmiler.net. Thanks!

I was asked basically for the same information, but somehow, upon calling reconsideration, they allowed me to just answer a bunch of questions. I don’t know if it was because I have 2 existing businesses (both with INK cards) with them and somehow I convinced the recon agent to just match the info from that while providing updated income info or what. But I agree, it’s certainly becoming harder to get an INK card. They seem to be “clamping down” and making you provide full documentation as compared to before