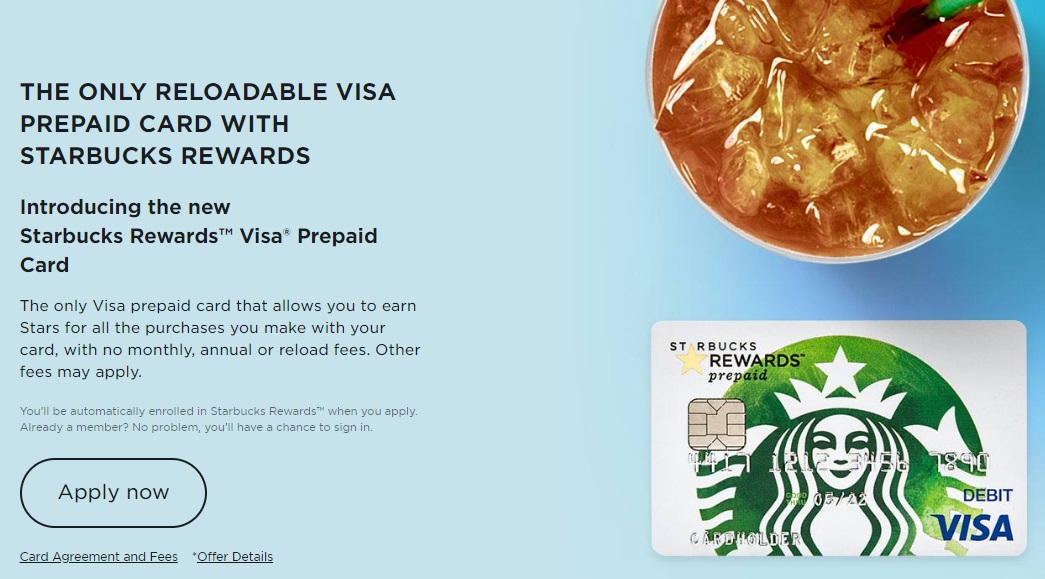

Chase has launched a new Starbucks prepaid card which is reloadable and has no fees. It’s not a particularly compelling product but could be useful for some, especially anyone unable to be approved for credit cards.

Signup Bonus

- Earn 125 Bonus Stars the first time you use your Starbucks Rewards Visa Prepaid Card to load $10 or more to your registered Starbucks Card.

- Direct link.

Earning Details

- Earn 1 star for every $10 of spend.

Key Card Details

- Automatic gold status

- Opening fee – $0

- Monthly fee – $0

- Purchase fee – $0

- Inactivity fee – $0

- Customer service fee – $0

- Reload fee – $0

- Exchange rate adjustment – $3

- Card replacement – rush request – $5

- Legal processing fee ( Processing of any garnishment, tax levy, or other court order or administrative order against a Starbucks Rewards Visa Prepaid Card, whether or not the funds are actually paid) – $75

- Maximum one card per customer

- No cash or credit card reloading

Quick Thoughts

This Starbucks prepaid Visa card won’t be worth getting for most people, but might make sense for anyone who’s unable to get approved for credit cards but still wants to earn some kind of rewards.

On the positive side, it comes with Gold status and offers a signup bonus of 125 stars – enough for a free item – when reloading with $10 for the first time.

Other than that, it doesn’t offer much. You can’t reload with cash or credit cards and only earns one star for every $10 spent. That means you’d have to spend $1,250 on the card to earn a free item.

A better option might be a Discover Cashback Checking account which earns 1% on debit card purchases. Spending $1,250 on that card would earn $12.50 and has the added benefit of you being able to spend it anywhere, rather than being restricted to items from Starbucks.

I got a free month of coffee (4500 stars) after spending 500 in the first 90 days I like this card but the no loading with a credit card is kinda pain. So you can only reload with a Starbucks reward card that’s kinda annoying but there are $49 in annual fees after the first year

Anyone try to buy a money order with this yet? Just wondering why everyone is falling all over themselves over this being a SERVE alternative. (edit) Oh darn, no credit card loading. Can this “debit” card only be used at starbucks?

Am I correct that because this is a debit card it would not affect my Chase 5/24 status in anyway?

Seeing as it’s a prepaid card, it shouldn’t show on your credit report.

Those with credit problems (such that they can’t get approved for a credit card) probably shouldn’t be buying $4 a pop lattes.