A few weeks ago, I accidentally signed up for the consumer SPG card. I was expecting to see a popup warning me that I wasn’t eligible for the card, but received an instant approval instead. That became my sixth Amex credit card (I have other charge cards too, but that’s irrelevant here). This was surprising because it seemed to blow out of the water the “max 5 Amex credit cards” rule. So, to really put the limit to the test, I also applied for the SPG business credit card and was instantly approved for that too. Now I have 7 Amex credit cards.

The 5 Credit Card Limit Stands (for most)

Since asking the question: “Is the Amex 5 Credit Card Limit Gone?” the answer has become clear. Many people, including my wife, have since encountered the 5 credit card limit. This is enforced only when applying for a new credit card (charge cards aren’t counted and aren’t effected). For those with 5 or more Amex credit cards, the new application typically won’t be approved unless you first cancel a card to get under 5 total credit cards.

The reason I was approved for these cards seems to be a fluke. Even though I signed into my Amex account when applying, Amex seems to have thought I was a new customer. This was evident in the instant approval message for the consumer card which stated “Member Since: Today!” (thanks to JayP for pointing this out)

What about my welcome bonuses?

The consumer SPG card appeared in my mailbox within a couple of days. The business card took longer to arrive. In both cases I met the welcome bonus minimum spend requirements immediately in order to see if I would get the bonus on either card.

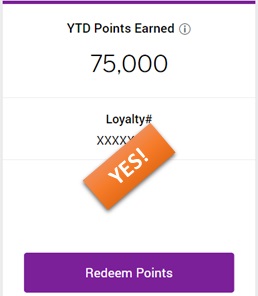

Technically, I shouldn’t get either bonus since I’ve had both cards before. I cancelled my previous SPG consumer card 3 years ago, and cancelled a SPG business card just over 1 year ago. And both card welcome bonuses are usually subject to the lifetime rule (you are not eligible for the bonus if you’ve had this card before). However, yesterday I logged into my Amex account and found a pretty sight under my SPG consumer card account: 75,000 points earned!

The last four digits of the loyalty number (hidden under my “YES!”) don’t match any numbers I know of, so I think that they created a new SPG account for me. Once I figure out how to access that account, I should be able to merge it into my regular account.

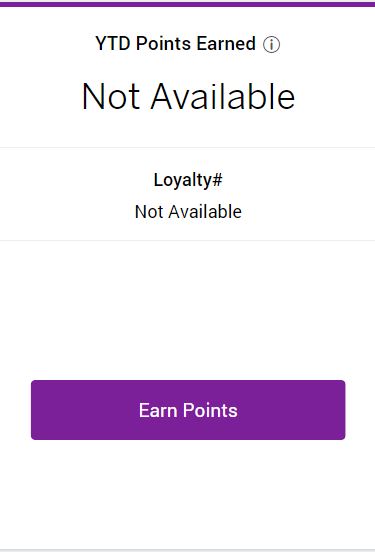

My SPG Business account, meanwhile, has yet to show the 100K bonus. This is what I’ve seen since opening the card:

I’ll publish a quick update if that bonus ever posts.

[…] American Express has done just about as much as they can to make their charge cards similar to credit cards without actually turning them into credit cards outright. For those of us interested in collecting points, we like these cards because you can earn a sign-up bonus for each flavor of American Express card and these cards don’t count against the number of credit cards AMEX allows you to have with them (which I believe is still capped at five cards). […]

Boom! My SPG Business card now shows 100K points earned!

What account did each post to? The same “new” account? 2 different new accounts? Wondering if this is replicable without the extra Starriott accounts… Shouldn’t the bonus restriction (whether lifetime or 24 months or whatever) be based on your Amex (SSN/TIN) history rather than your SPG/Marriott numbers?

Basically, the question is whether behind the scenes Amex made the new SPG cards new products, and that’s why you can get another bonus. Or did we already have data points disproving that?

Surprisingly (to me) they posted to the same new account. I don’t think you can generalize from my experience since it seems to be an error on their part that they don’t see my customer history. Others have received pop-up warnings saying that they’re not eligible for the bonus since they’ve had the card before. That gives some evidence that the SPG cards aren’t considered new products. On the other hand, I have very little faith in those popups being correct all the time. Long story short: I have no idea.

Did any of this ever get clawed back?

Nope

Currently have the SPG personal card and have $110K in spend which was all corporate related. Was hoping to see a bonus for upgrading to the Lux but no bonus offered. Really want to upgrade as I would immediately qualify for Platinum this year being over the 75K threshold, but don’t want to waive ever getting the sign up bonus by upgrading now.

I assume it’s not possible apply for a new SPG Lux and then upgrade my SPG Personal to another SPG lux…which would result in two Lux cards. Of course I’d just cancel the upgraded one after my Platinum status were to hit.

Actually I think that you can do that (sign up for the Lux and upgrade to the Lux). It’s worth a shot anyway.

I also think this is possible. In the past, i applied for a Business Platinum and a Business Gold (met spending on each and earned the welcome bonuses). Within the first year, I got an offer to upgrade the Business Gold to Business Platinum. I took the upgrade offer and had 2 Business Platinum cards for a while. Got the upgrade bonus and kept both Business Platinums for a while (chose different airlines). I would expect Lux would probably be the same situation.

I got approved for another spg card Friday. I got 2 e-mails about combining my starwood and spg accounts and the spg email has a number I have never seen and I can keep it or combine with MR (whose version of the e-mail doesn’t mention an account number)…personally I would wait until the new number shows the bonus points and Marriott has time to get functional again, then transfer to Marriott. it seems they are giving you the choice of keeping your points under the SPG banner, which makes no sense. So now we have SPG, MR and RC?!? sharing points but keeping their corporate identity? Ritz and family sounds better to me, after Marriotts merger shenanigans I don’t want to say the name of their pathetic chain….with one bonus per lifetime or 5-7 years…and lower earnings, the SPG cards are one time sock drawer cards.

This is exactly what happened to me. I applied for the SPG Luxury card on Friday thinking I’d be turned down for already having 5 credit cards with Amex. I was logged into my Amex account and did the application with an iPad. Instant approval, but I had to create a separate login for the card which was odd. I received the card today (Tuesday) and shows member since 2018 but the new login shows 2000 which is what it should be. Also the credit limit went up by 5k since the instant approval. I have the same “Not Available” for my loyalty number even though I entered my Marriott number on the application.

Hopefully you’ll get the bonus too

i had 8 Amex cards, but recently cancelled one….which leaves me at 7.

Yep. My application was pending due to 6 cards (5 credit). Called this morning and was told that I was at the limit of 5 credit cards. After cancelling a redundant Hilton card my Lux card was approved. The only problem with the delay is that I can’t get my new number immediately to use for my current Marriott stay that ends tomorrow.

Don’t bother calling Marriott to help you merge those accounts. The wait time on the West Coast was an hour before I hung up During business hours. And they aren’t answering their help emails when your accounts won’t merge online. Can’t wait for Hyatt Small Luxury hotels to join the ranks. Marriott is so yesterday for luxury travelers.

How come only bloggers always have these happy accidents?

Lol I have 8 credit cards cards now.

9 here

Yeah, many people have more than 5 credit cards. Most recently that happened because of the switch over from Citi Hilton to Amex Hilton, but there have been other reasons in the past. The trick isn’t having more than 5, the trick is getting approved for a new credit card if you already have 5 or more.

I have 7 credit cards and 2 charge

I also had 5 credit cards (plus 3 charge cards) and applied for the two SPG cards after reading Greg’s story and got instant approval too.

BTW: Greg, how many days did it take for the points to show up in your AMEX account after the charge posted?

Isn’t creating another Starriot account against Starriott terms? Would they shut you down for this?

I didn’t create another account, Amex did.

Ah, but look what Amex rat teams started doing today — literally billing folks who took advantage of the same Amex offer twice (on different cards). Ok, Amex defenders will say, it’s in the fine print. But common sense will say, but they not only permitted us to load it on different products, but then we received the expected reward when spending met…..

So in your case Greg, the Amex Rat team logic will be, it doesn’t matter that we made the mistake, it was still “illegal” — and therefore, we can be as nasty, as Presidential as we wanna be. 🙁

ps, looking forward to your take on the Amex claw back moves today…. (will this be isolated? applying just to the Amex biz offers last month, or is the disease going to spread to other popular recent offers, like the ongoing one with best buy)

Thank you Sir, we ‘ll get it fixed right away!