Doctor of Credit and Miles to Memories have both reported on a very unfortunate development: Amex is clawing back statement credits on people who used the Staples offer for 10% back on multiple cards and received more than a cumulative $100 back. That could really be painful for folks who synced that offer to multiple cards and used it many times. Amex is saying that they will now charge your account(s) for however much you received in excess of the $100 allowed per card member. That’s really bad news for a lot of reasons and could be particularly expensive for those who used to offer on a large number of card accounts.

The Offer being clawed back

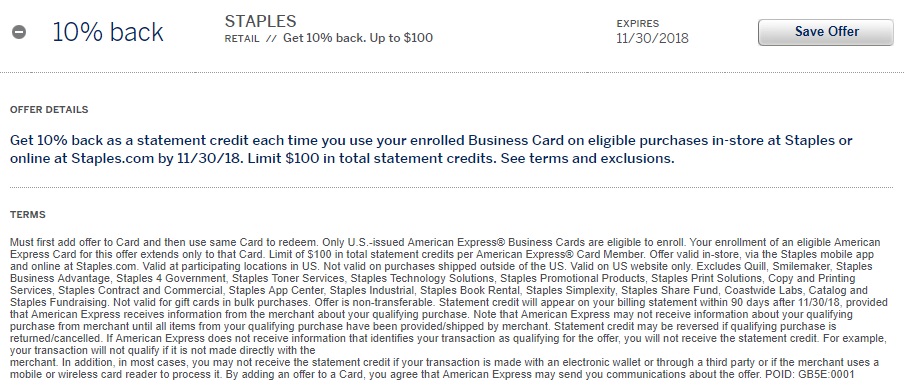

The only offer being clawed back (so far) is the offer to get 10% back at Staples that appeared on Amex business cards. There have been several offers for 10% back at different places, presumably making up for the loss of the Amex OPEN Savings program. This was the offer in question:

We published this offer on June 1st (See: New 10% Amex Offers: Staples, Lowe’s, Exxon Mobil & Dell (Business Cards Only)). At that time, the multi-tab method for adding Amex offers to multiple cards was working with all offers. At the beginning of August, Amex ended the ability to sync most offers to multiple cards (See: A new era for Amex Offers). However, offers that had already been synced to multiple cards still show up as synced.

The Staples offer (and others like it at Lowe’s Exxon Mobil, and Dell) was so good that I’m sure many readers immediately synced it to all of their business cards.

Unfortunately, multiple reports indicate that Amex has sent an email with the following text:

Hello [Name]:

We’ve charged your account for $XXX.XX and we’d like to explain why.

You already received a credit of $100 for eligible purchases at Staples.

We offered you 10% back as a statement credit each time you used your enrolled Business Card on eligible purchases at Staples by 11/30/18, for up to $100 in total statement credits per American Express Card Member. However, we discovered that you received more than the $100 maximum credit across your Card(s).

To correct this error, we will debit your account for any amount credited to you above the $100 that you were eligible for. If you used multiple Card accounts, we may debit across each of your accounts to offset credits you received.

You will see this adjustment on an upcoming statement.

Thank you for your Card Membership.

American Express Customer Care

For those who used this offer across multiple cards, this news is absolutely horrible. I’m sure that some people stand to be out a lot of money on this clawback.

Amex points to the fact that the terms of the offer state:

Limit $100 in total statement credits per American Express Card Member

Essentially, Amex is saying that you knew the rules of the game and they are now clawing it back.

Is this fair?

In my mind, this question is multi-faceted. Two main things to consider:

- Is it fair to have clawed these back considering the long history of Amex paying out these offers over multiple cards?

- Is the $100 limit a fair interpretation of the terms?

My opinion is just my own, but here are my thoughts:

Full disclosure: I have not received the email and I did not yet exceed the $100 in Staples statement credits, so I do not stand to personally lose here.

On Question #1: I think it doesn’t feel fair for Amex to claw these back in this manner. While some will make the argument that people who are abusing the system deserve no sympathy, I’d posit that Amex created a system that allowed for offers to be added to multiple cards and then allowed that system to stand for years. A customer who accidentally happened upon the multi-tab method by having their account open in two windows at once and as a result has been using multiple offers for years might have the reasonable assumption that Amex defines a card member as a Platinum card member and a Gold card member and an SPG card member separately rather than as an Amex card member. After allowing for multiple syncs (and paying them out), I think it’s pretty poor form to decide to stop honoring them a couple of months after people used them. I think it is especially unfair to have paid them out and then charge accounts months later. What happens to accounts people have closed in the interim? Or to someone who misses the email and doesn’t know their card has been charged? This just doesn’t seem like the right way to handle the situation in my opinion.

Someone in the comments over at Miles to Memories proposed that even if we are to accept that Amex only intended for these offers to be used once, their choice to not enforce the terms for years and then suddenly retroactively do so would kind of be like your local city government saying that they have suddenly decided to enforce jaywalking laws and now they are sending you a ticket for $50 for each time you jaywalked over the past few months. That analogy is far from perfect — in this case, the jaywalking was actually costing Amex dollars and cents that they are choosing to now recoup — but I think that the spirit of the analogy is that it doesn’t feel fair to retroactively enforce terms that they chose not to enforce for so long, even if we accept that those were the terms and Amex is right in their enforcement.

On Question #2: I think that this is at least open to debate. On the one side, Amex will argue that the $100 limit per Amex card member was laid out in the terms in black and white. And some will say that this is completely fair and that those who were playing with fire were bound to get burnt one day. That’s a pretty logical argument.

On the other hand, I don’t feel like the definition of “American Express Card Member” is particularly clear. Amex is now making a clear statement that an American Express Card Member is an individual person who holds any combination of Amex cards. They are defining the limit to one offer per person. But given Amex’s long history of allowing offers to be synced over multiple cards and then paying out offers once per account, I think one could have understood the language to mean that someone is a Business Platinum card member or a Business Gold card member, or an SPG Business card member etc and that they could conceivably be more than one of those things simultaneously. It certainly isn’t unheard of for companies to offer multiple kinds of membership to one individual. For example, one person can be both an IHG Rewards member and an IHG Business Rewards member. In fact, in the Amex app, there is a section called “membership” where you can see information on your rewards. Since my Business Platinum card earns Membership Rewards and my SPG Business account now essentially earns Marriott points, those sections are different for each account. I think it’s not unreasonable to think that these are separate memberships. When you further add the fact that Amex has been paying out on these offers over multiple cards for years, I think it becomes even more reasonable to have thought Amex defined a card membership as being by the card rather than person.

That’s not to say that I’m totally shocked that Amex has chosen to enforce the terms this way. I think we’ve all long been aware that this could be the interpretation intended (for one thing, the “Member Since” date on your card would show the date you first became an American Express cardholder — which gives credence to the notion of a card member being defined by the individual rather than individual account), and since the offers had to be synced to multiple cards via things like the multi-tab method, I’m personally not surprised that Amex would contend that this was their intention all along. I think what surprises me is that they would claw it back retroactively instead of enforcing the terms as they so choose proactively. That’s really the major problem here — had someone attempted to use the offer on a second card and not gotten the credit, they would reasonably interpret that Amex didn’t intend them to get the credit more than once and likely wouldn’t have continued to make purchases expecting these statement credits. Amex could have instituted this kind of solution by simply refusing to credit it more than once and I think question #2 would have had a clear answer and a fair warning.

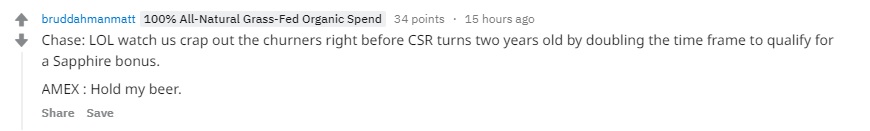

Though if you subscribe to the theory that those using multiple offers were cheating the system and they knew it, you may not have sympathy for that position and I know there are some who will cheer the hit to the pocketbooks of those they perceive to have been cheating the system. I personally tend to think that if this was a major money-losing issue, Amex would have taken steps to stop it eons ago. Further, if the goal was to stop this from happening, they could have sent out a mass email explaining that going forward, offers would only work once per account and then actually enforced it. Instead, this seems like a calculated attack meant to harm those who used a lot of offers. Amex isn’t alone in sending a message, though this was clearly a more aggressive way to do so. This comment from reddit kind of sums that up.

Bottom line

Whether you cheer it or jeer it, there is no denying that Amex is making a statement in their announcement of clawbacks on the Staples Amex Offer for those who used for more than $100 in statement credits. At this point, that is the only offer about which we’ve seen emails. Is it possible that Amex will expand this retroactive enforcement to more offers and/or further back in time? It’s hard to say, but I’m sure many people could stand to be hurt pretty significantly if Amex were to go back and claw back years worth of 1800Flowers offers, eBags offers, Lowe’s offers, Office Depot offers, etc. Syncing to multiple cards and getting the credits has become so commonplace that I imagine many people wouldn’t even know how much that could amount to if Amex were to dig deep on clawbacks. I hope that this effort is a singular calculated warning shot looking to get the word out that they intend to crack down on multi-card use and not an indication of a further effort planned to claw back offers more widely. Time will tell…

[…] make a mistake in how it was targeted? Was it a lazy copy and paste of the terms? Will they later claw it back if synced to non-business cards? Your guess is as good as mine. These are very good offers, but […]

[…] some business cards for 10% back at Staples (assuming you haven’t already overdone it and gotten offers clawed back — go easy). Even without those offers, this can be a good deal if you’re using a card that […]

[…] Staples purchases across all of your cards as Amex is clawing back statement credits (See: Ouch: Amex clawing back Amex Offers credits). I know that many readers have likely already felt the pain on that, but thought it was worth […]

It’s a load of crap. Those of us who had separate logins were never using the “multi-tab trick”. In fact, there was no trick at all. We just logged into our accounts and selected the offer. To suddenly, and retroactively, claw back the credits is nothing less than fraud as far as I’m concerned. I’ll hope a Class Action suit is filed.

I just got the email for my SPG and Business Plus accounts. Ugh

I closed my SO’s account, hopefully they don’t go after closed account.

I think this action has Staples written all over it. Staples probably got mad at Amex for not restricting the offer enough and refused to pay. Staples is clearly regretting doing this offer. They are cancelling online orders for gift cards, and they’ve specifically told me it was because of the Amex 10% offer. Oh, and what Amex offer was it that was the first to restrict people to one per person? The Staples $5 of 25. Coincidence? Hmm…. So, no, this is not Amex trying to send a warning or a message. This is Amex willing to do Staples’ dirty work for them.

And also, IMHO of course, just like any other company, Amex can’t just put charges on your credit card merely because they have access to it. If you didn’t authorize it, it’s a “billing error” under the FCBA. If Amex/Staples decide that they are going to re-interpret the terms from 2 months ago and that you owe them money, they have to ask you for it. If you don’t pay, they can sue. But charging your credit card just because they can is not allowed.

So yes, round 1 goes to Amex. But it’s not the last one.

It isn’t a new charge. It is a withdrawn credit.

It would’ve been simpler if AU cards had the same number as primary card just like Ch4se and C1ti does. If the same card number were used by any of the 99 AUs, it won’t trigger another discount if such card has already been used once for the AO. UNLESS, they really meant it to be confusing…

I know at one point, the company even encouraged to add up to 99(!) AUs via email. I wished I kept that email. For now, I have not, and hopefully will not, receive the clawback email.

btw, I’ve read plans to pre-emptively close their accounts before they receive the email. This doesn’t sound like a good idea to me because they can always bring those to collection and bring more destruction. I’d rather know if they sent me one and deal with it rather than give me the false impression that I’m safe just because the account has been closed.

It won’t help. They have charged closed accounts too.

How do you play the Exxon 10%. My local Exxon, there are so few of them and so far apart where I live, has said they won’t get gift cards. Not VGC and bot even Exxon gift cards. Don’t see the value in this annex offer.

AMEX was dangling a carrot and seeing if we take the bait. This whole situation seems the same as entrapment to me. I wonder if the members that had their credits clawed back will also end up in a AMEX database of undesirable customers.

Amex has, more than any other issuer, declared war on churners. They don’t want them as customers, whether for transaction fees, annual fees, referrals or anything else. They want “normal” customers who spend on their cards “normally” and don’t maximize (or even use) rewards.

This act is aggressive on purpose — it’s specifically intended to burn out a class of customers. They’re 100% sure that anyone who used a sync method is a customer they don’t want, and they have meted out both warning and punishment. I doubt they’ll take it further with past sync offers, but who knows.

I’m not taking their side — I think it’s incredibly obnoxious — but the statement they’re making is the one they want to be making.

It seems they are running a playbook from the IRS which can clawback with audits up IIRC 7 years.

It must have been a really large dollar loss for them to clawback the money, or they are willing to write off ‘credit card sharks’ and take a Q3 lowered card swipe income.

That said while it seems like a lot of this hit on the business card side (which your PG has much higher risk exposure and far fewer protections and recourse).

But it still goes back to the golden rule he who has the gold makes the rules. When card issuers ran into a liquidity crisis during the great recession, some pulled some pretty underhand moves (well within the law and their prerogative, but it screwed a lot of card holders pretty royally and compounded the credit crisis).

That said this leaves a bad taste in my mouth, even tho I didn’t exploit this loophole.

Can you share some:

” When card issuers ran into a liquidity crisis during the great recession, some pulled some pretty underhand moves (well within the law and their prerogative, but it screwed a lot of card holders pretty royally and compounded the credit crisis).”

A lot of amex cards were closed because they didn’t want the liability.

SO, I have an Amex Blue from back then. They whacked it down to a $500 limit and to this day I cannot move credit limit into it!

And of course Chase whacked all my CLs with 0 APR BTs down to the amount of the debt AND instituted a 5 percent min payment! I got a settlement for that one years later….

I would remove the part in your post about multi-tab trick, it makes it sound like people “HAD” to circumvent the website to add these offers to their cards, which is not true.

Many of us have our AUs under separate logins. There was nothing unique done to add these offers to the cards. These offers never disappeared when adding to other cards on other logins. It is “reasonable” to assume if you see an offer on your card, you add it, and you redeem it, that all is well…

Also, adding AUs under your own name has never been against T&C of Amex, half the chats and calls I have with Amex, they ask me unprompted if I want to add more AUs in my name and will happily register them for me under separate logins.

It personally blows my mind Amex would retroactively do something like this. Their canned response in chat says they will continue clawing back (in batches) in October and December, however, these offers are still on my cards. Why doesn’t Amex remove these offers if they can not be used? This is false and misleading advertising defined by the FTC.

Obviously, we win some and we lose some. I plan to move forward and not look back, but in the end, it’s a jacked up move by Amex to their customers to go about it the way they did. Something tells me this is “Staples” doing, they didn’t want to pay out to Amex for Amex faulty IT to run the promotion how it was intended to be ran. Amex realized they were at a loss and came after their customers. Bad move…

The playing with fire thing isn’t fair.

Transactions take place between consenting parties. When you tell the other party how you will act. “You used your offer” in an email instantly and 2 days later “-$100 staples” appears in your activity – this shows your agreement with what took place. Months of throwing out the bait and then switching. It’s wrong.

Amex doesn’t finance the majority of these offers, if any of it at all.

What likely happened, staples who is always on the brink of going under, told amex they are refusing to pay their bill. The commissions they make on selling a gift card are very small. Staples called out Amex on the ToC and their inability to enforce it. Instead of Amex taking one, they decided to put it on Amex cardholders.

[…] Amex 破天荒的打算討回已經送出的 Amex Offer credit。前陣子 Amex 的 OPEN Savings program 結束之後,出現了一系列的 business 用的 Amex […]