Have you ever wished for the flexibility to book a flight today but make your final decision and payment closer to departure? Have you longed for the days before everyone by the pool was glued to a digital device? In this Frequent Miler Week in Review Around the Web, we have those topics covered along with some other top reads from around the ‘net. Read on for this weekend’s recap.

Why Recent Changes aren’t Enough to Convince me to Renew my AmEx Gold Card

Leana at Miles for Family makes the case for why she doesn’t think the Gold card is a good choice for the average non-MSer, and I totally disagree with her on this one. Leana makes this point, “Can one potentially turn a profit on Amex Gold, even when factoring the annual fee? Absolutely. Will an average person bother to jump through all the hoops? I doubt it“. Here’s my response to that: What hoops? It’s 4x US Restaurants and 4x US Supermarkets — that’s about as hoop-less as it gets. According to the US Bureau of Labor & Statistics, the average family spends $2,641 per person living in the household on food each year. Assuming that’s on food purchased from restaurant & grocery merchants, that comes out to 42,256 points per year for a family of 4 (assuming 0 MS). Catch a transfer bonus like the current 40% bonus to Avios and it’s more than 59,000 Avios — enough to fly a family of 4 round trip on an AA shorthaul via Iberia Avios. While the maximizer in me loves that Leana buys grocery store gift cards for 6-10% off to save more on food than this card is worth to her, I think that keeping track of those gift cards & balances requires more acrobatics than using the Gold card. What about you? Are you #TeamLeana or #TeamNick?

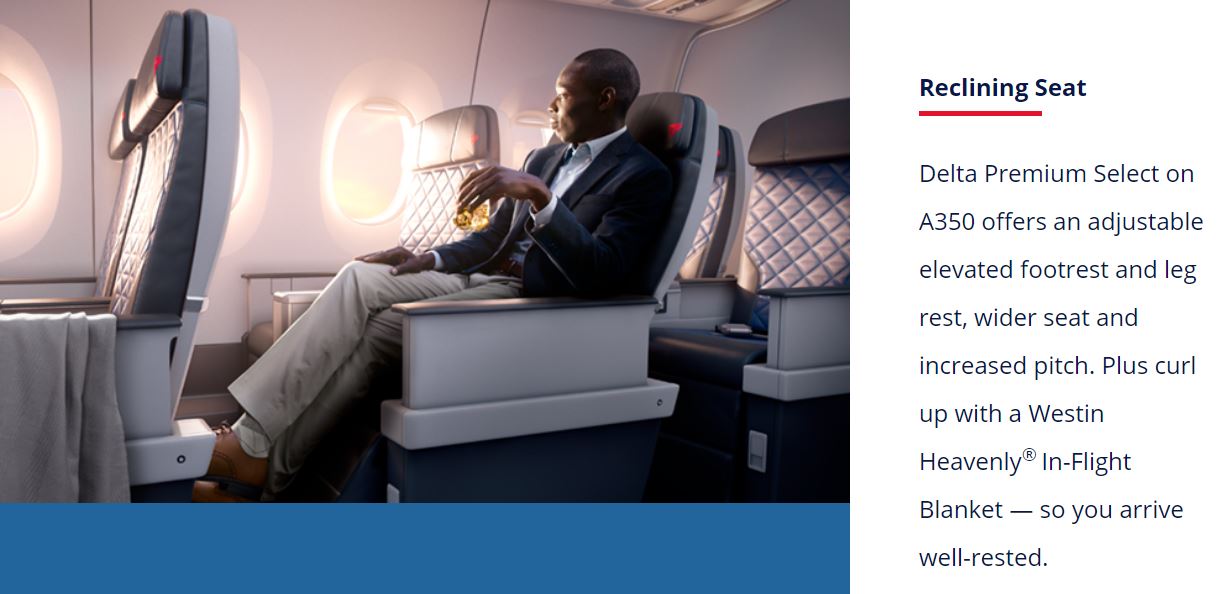

AD Stationed In Hawaii Should Hit Delta Plat and Reserve Hard

The title of this niche post from Derp Report makes it sound even more niche than it really is as this one could theoretically apply to anyone living in Alaska, Hawaii, Puerto Rico, or the US Virgin Islands. It’s likely that only an active duty service member would actually execute this exercise for obvious reasons, but this kind of out-of-the-box thinking makes for a good read to get the wheels spinning as to possibilities you may not have considered in this space. I wouldn’t personally do this even if it were possible for me, but I love reading stuff like this and filing this type of knowledge away for a rainy day.

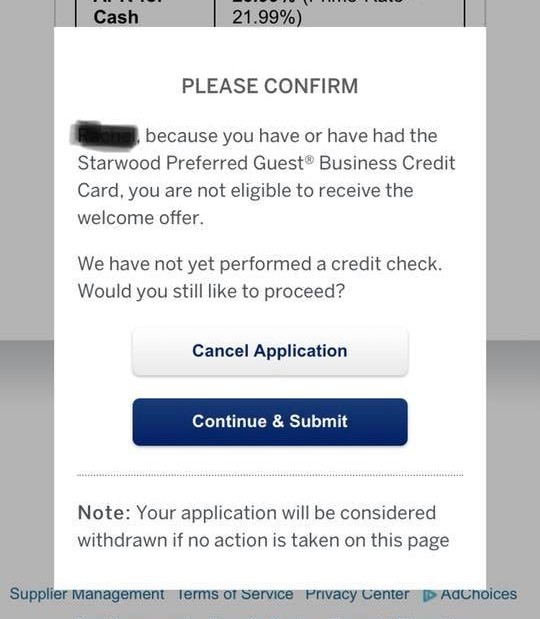

“Poor Patrick Pibb,” or the cruel ambiguity of Amex’s new restrictions on sign-up bonuses

Windbag Miles highlights the case of someone dealing with the type of situation I wondered about when the Amex no-bonus-for-you pop-up window began: someone locked out from earning any bonuses for no clear reason (i.e. not because she has had the card before, but for Amex’s ambiguous other loophole reasons to deny it). Don’t get me wrong, the pop-up is exponentially better than getting approved for the card and doing the spend only to be told you’re not eligible — but this type of situation leads to the type of speculation in the post (and further in the comments) because all one can do is speculate. I’d love to have the Autobahn of rewards in an ideal world, but if there is going to be a speed limit I’d rather know what it is.

Wyndham Grand Creates Tech-Free Family Program at Pools and Restaurants

Do you remember what it was like to wake up on the first morning of vacation, put on your swimsuit, and head directly into the pool — without first instagramming the view from your room, liking your friend’s status update, and checking the latest headlines? Wyndham is trying to bottle up that nostalgia by boxing up your phone. Did you know that the average American looks at their phone screen every 12 minutes during vacation? I’m not going to lie – I do my part to keep that average down so that you can unplug and relax with a cool promo from Wyndham that sounds like it even comes with some extra perks for agreeing to disconnect at select properties through November 12th. Hotel News Resource has the scoop.

How to use BA Holidays to avoid paying for your flight until 5 weeks before departure!

We’ve written before about the fact that you can sometimes get great value by booking airline vacation packages directly with an airline — sometimes paying less with a package than you would pay for the flight alone. BA adds even more, giving you a pretty flexible cancellation policy and more Avios by booking a package. See this post from Head for Points for more on how to do it and why this could be a great deal.

That’s it for this week around the web. Check back soon for this week’s last chance deals.

I’m #TeamLeana! 🙂 First of all, thanks for the link. Looking back at my post, I can see that I didn’t make myself as clear as I should have. You are absolutely right that getting 4 points back on groceries and dining is as simple as it gets. However, there is that pesky $250 fee to consider. When I referred to jumping through hoops, I was talking about buying airline gift cards and making monthly trips to Cheesecake Factory. I think most normal people would be better of with Amex Everyday Preferred.

True, the limit on grocery bonus is $6000 per year, but many folks shop at Walmart too, so it’s sufficient. Plus, you would get 3 points on gas and 1.5 points on everything else. I hate using gift cards on gas, so that’s a very useful category. Also, I’m a little confused as to who Amex is targeting with this card. Frequent business travelers, average families, both? Most normal people I know will never consider a card with a $250 annual fee, regardless of potential perks. Amex Everyday Prefrred, on the other hand, is relatively easy to justify. To me, the new Amex Gold just seems like a “Jack of all trades and master of none” kind of thing. Still, I appreciate your arguments and can definitely see your point.

Depends on the locale and lifestyle. In big cities like NY, ordering lunch/takeout from Grubhub is the norm and can be redeemed at face value. AMEX Gold Card goes after Trader Joe’s/Whole Foods types, not Walmart grocery shoppers. Add to that Amex offers and 3x back on travel and yea, this card can be incredibly lucrative to many. The suburban family to the frequent domestic business traveler to the younger crowd in a big city that commonly dines out and does happy hour.