Recently I published two first year credit card plans for a single person: one with and one without business cards:

- Beginner credit card plan — 325,000 points in 12 months (no business cards)

- Beginner with business credit card plan: 460,000 points in 15 months

This post rounds out the series by introducing two player mode: signing up for cards as a couple. Two is definitely better than one when it comes to credit card perks and bonuses. Here I’ve made the assumption that just one of the pair has a business.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Assumptions

Rather than talk about this mythical couple as “person 1” and “person 2”, I figured that it would be easier to give them names:

- Bobby owns a business

- Jordan doesn’t have a business and isn’t willing to sign up for business cards

For this post I’ve made the following assumptions about the couple:

- Both have good credit scores

- Neither has applied for any new credit cards in the past few years.

- Each spends about $1,500 per month via credit cards

- The couple additionally spends $3,000 per month on a mortgage

- Bobby spends $3,000 on quarterly estimated federal tax payments

- Bobby has a business

Given the above, I looked at current credit card signup offers to suggest a plan…

Plan overview

The easiest and quickest way to amass points and miles is through credit card signup bonuses. Contrary to conventional wisdom, this won’t hurt your credit score long term as long as you pay your credit card bills in full each month and avoid charging near your limit (e.g. it’s better to keep your credit utilization low relative to the amount of credit you have available). In fact, many people see their credit score increase a few months after starting to sign up for multiple cards. The general process for earning points this way is described in our Start Here page.

When you get started, if all goes well you’ll earn lots of rewards and your credit score will go up a bit (or remain relatively stable). On the other hand, once you’ve signed up for a bunch of cards, it will be harder to get approved for new cards from certain banks. Chase, in particular, has the dreaded 5/24 Rule. If you have opened 5 or more cards in the past 24 months, from any bank, Chase won’t approve you for any more cards. For that reason, anyone considering signing up for a bunch of credit cards should think seriously about starting with Chase. Chase has quite a few excellent cards and it would be a shame to lose your ability to get those cards due to signing up for cards first from other banks. See: “Must have” Chase cards for more details.

Capital One is also extremely hard on approvals for those who have opened many new accounts. I’m not aware of any hard and fast 5/24 rule, but anecdotally they seem to weigh recent card openings very heavily against the applicant. Personally, I haven’t been approved for any Capital One cards despite having an excellent credit score.

In my opinion, the Capital One® Venture® Rewards Credit Card (or its small-business twin: Capital One® Spark® Miles for Business) is particularly good for those starting out with credit card rewards. This card earns 2X everywhere, and points (Capital One insists on calling them “miles”) are very easy to redeem. Simply charge travel to your card and then you can use points “miles” to “erase” those statement charges at a value of 1 cent each. As you get more advanced, you can alternatively transfer points to airline partners. If you know what you’re doing, this can lead to far more value from your points.

For the above reasons, the plan I’ve put together focuses first on obtaining the Capital One Venture Rewards card and a number of “must-have” Chase cards:

- Capital One® Venture® Rewards Credit Card: Great card overall for solid rewards for all spend, plus the ability to transfer rewards to airline miles. The Capital One® Spark® Miles for Business is virtually identical and so would be a good alternative. Unfortunately, Capital One business cards do not have the same advantages of other banks’ business cards. Specifically, Capital One does report the new accounts and spend activity to the personal credit bureaus and so the Capital One business cards act just like personal cards and do count towards 5/24.

- Sapphire Reserve: Earn 3X Ultimate Rewards points for travel & dining. Points worth 1.5 cents each towards travel. Points are transferable to a number of airline and hotel programs. It may make sense to start with the Sapphire Preferred card (since it has a higher signup bonus) and then upgrade to the Sapphire Reserve later.

- Ink Business Cash: Earn 5X Ultimate Rewards points at office supplies and 5X cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually); and 2X gas and restaurants.

- Ink Business Unlimited: Earn 1.5X Ultimate Rewards points for all other spend.

- United Explorer: I consider this a “must have” Chase card because it can be downgraded after a year to a no-fee United card which preserves this card’s best features: Improved economy saver award availability, and last seat standard economy award availability. The former feature, especially, makes it much easier to book international awards with United miles since it opens up space between airports domestically. The latter feature is great for those ocassions when you are stuck with no good way to get from one place to the other. Read about how I put this feature to great use here.

- World of Hyatt: Keep for the annual free night certificate. Consider spending $15K per year for a second certificate, especially if you pursue Hyatt status since you’ll earn 2 elite qualifying nights with each $5K spend.

Note that Chase offers cards from three hotel chains: Hyatt, IHG, and Marriott. This plan makes it possible to get two of the three. In general I’d favor the IHG card instead of the Marriott card as the 2nd hotel card since you can still get Marriott cards from Amex.

In addition to the above “must have” cards, the following cards are recommended for their signup bonuses before you reach the 5/24 threshold:

- Ink Business Preferred: Earn 3X Ultimate Rewards points for travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year). In general I don’t see this as a “must have” card for the long term unless you highly value this card’s cell phone protection benefit or 3X on advertising. However, it has a great signup bonus that you won’t be able to get once you’re over 5/24 so it’s definitely worth getting before it’s too late.

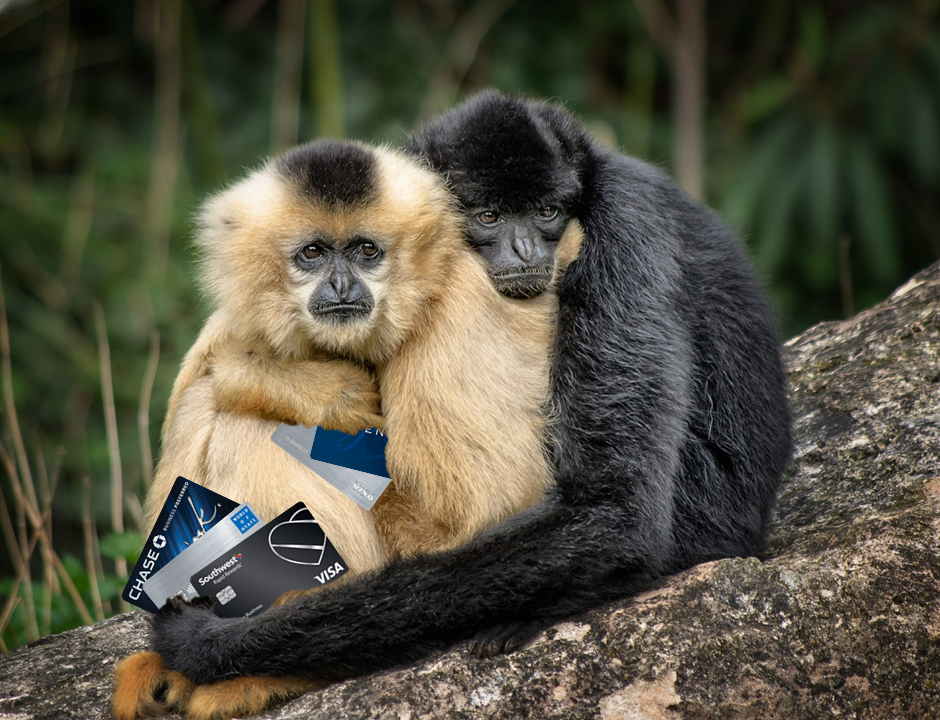

- Southwest Rapid Rewards Performance Business Credit Card and Chase Southwest Airlines Rapid Rewards Premier Business Card: Both tend to have excellent signup bonuses. Even better, Chase doesn’t prohibit applicants from getting both business cards the way they do with Southwest personal cards. As a result, it can be easy to earn the Southwest Companion Pass so that you can add a companion to all of your Southwest flights for free while the pass is active. To get the pass, you must earn 110,000 points in a calendar year. Once you do, the pass will be active for the rest of that calendar year and all of the next! Best bet is to sign up for these cards in December so that points post to your account as early in the next year as possible.

Hotel cards for two

Most hotel credit cards include a certificate for a free night stay which you get each year upon renewal. When a couple is involved, a cool option is to both have the card so that you can use the certificates for a weekend getaway every year for the price of just two annual fees.

It’s ideal for a couple to sign up for these cards at the same time. Usually the certificates are good for only a year. By signing up at the same time, the validity dates will be the same and it will be easier to plan 2-night getaways.

Staying under 5/24

Another advantage of two player mode is that it’s fairly easy for one of the two to stay under 5/24. A person with a business can sign up for 2 personal cards each year plus any number of business cards (at least those that don’t contribute to 5/24) and can stay indefinitely under 5/24. This is handy in case Chase comes out with any new “must have” cards. In the plan I’ve detailed, Bobby the business owner, will stay well under 5/24.

How much spend?

Most credit card offers require meeting spend requirements in order to earn a signup bonus. And, in most cases, 3 months is the magical amount of time you have to meet those requirements. So, let’s look at how much spend our fictional couple can achieve every three months:

Since each spends $1500 per month on credit cards, the couple already spends $9,000 every 3 months. We’ve also assumed that Bobby spends $3,000 per quarter in estimated tax payments. Since federal taxes can be paid by credit card for a low fee (1.89% at the time of this writing), that’s an easy way to add $3,000 in credit card spend every 3 months. See: Complete guide to paying taxes via credit card, debit card, or gift card.

Additionally, Bobby and Jordan could spend another $3,000 per month via credit card by using a bill payment service like Plastiq to pay their mortgage (please see this post for details). Plastiq would charge $75 in fees (2.5%) for each $3,000 bill payment. That fee can be well worth it in order to qualify for signup bonuses. Unfortunately, neither Visa nor Amex allow mortgage payments through Plastiq. And since most of the first year cards I’ve recommended are Visa cards, the Plastiq bill payment trick will have to wait for future use.

Since we’re not going to assume Plastiq bill payments at this time, we’ll go with a total of $12,000 in spend every three months.

Preparation

Before signing up for any new cards, I recommend signing up for Travel Freely. This is a free web-based tool that walks you through the process of signing up for cards to earn big bonuses. The tool keeps track of your cards including your 5/24 status, alerts you when time is running out to complete minimum spend, alerts you when annual fees are nearly due, and much more. I consider it essential for anyone starting out.

Here’s the link to sign up (for free) with Travel Freely. Full disclosure: Frequent Miler and Travel Freely have a business relationship, but only because I believe that this tool is truly useful for anyone into signing up for cards for their bonuses. I use it to manage my signups and those of several family members as well. You can read more of my thoughts about Travel Freely here: Take the stress out of credit card bonus hunting: Travel Freely.

First set of cards

The plan is to sign up for the cards below on the same day.

Jordan: Capital One® Venture® Rewards Credit Card

Let’s start with the card that may be best overall for those new to miles & points: the Capital One® Venture® Rewards Credit Card. At the time of this writing, the signup bonus is 50K “miles” after $3,000 spend in 3 months. This card offers Global Entry / TSA Pre Check credit. That means that you can use it to pay the signup fee for Global Entry ($100) or TSA Pre Check ($85) and you’ll get fully reimbursed. Note that Global Entry includes TSA Pre Check, so you might as well get Global Entry if you have access to an interview center.

Since signup bonuses change over time, the following display shows the current offer at the time you read this on the web:

| Card Offer and Details |

|---|

75K Miles + up to $200 in statement credits ⓘ Non-Affiliate Earn 75,000 bonus miles after $4K spend in 3 months + up to $200 in statement credits when you make an Avelo purchase in your first year + priority boarding on Avelo flights for the first year. (Rates & Fees)$95 Annual Fee Alternate Offer: Airport Kiosk offer of 80K miles after $4K spend in the first 3 months See this post for details. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card earns 2 "miles" per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel Card Info: Visa Signature issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees |

Jordan: Chase Sapphire Preferred

Eagle eyed readers may have noticed that I’m suggesting the Sapphire Preferred card rather than the Sapphire Reserve card which I listed as a “must have” Chase card. The reason for this is that at the time of this writing, the Sapphire Preferred has a better signup bonus (60K points vs 50K points). I also believe that it is easier to get approved for the Sapphire Preferred card than the Sapphire Reserve. After a year, it should be possible to upgrade to the Reserve card with no new credit inquiry. Note too that you can’t get the bonus on both the Preferred and the Reserve so you wouldn’t be giving up anything to get the Preferred.

The following display shows the current Sapphire Preferred offer at the time you read this on the web:

| Card Offer and Details |

|---|

60K points ⓘ Affiliate 60K after $4K spend in 3 months$95 Annual Fee Alternate Offer: There may be elevated offers available by applying in-branch A similar offer with the first year annual fee waived may be found in-branch. YMMV. FM Mini Review: Great signup bonus. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with fee-free Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 5X Lyft (through March 2025) ✦ 10% annual point bonus Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Primary auto rental collision damage waiver ✦ Free DashPass through 2025 ✦ Transfer points to airline & hotel partners ✦ $50 annual credit for hotel stays booked through Chase ✦ $15 quarterly Instacart credit ✦ 6 months free Instacart+ |

Bobby: Chase Ink Business Preferred

In general I don’t see this as a “must have” card for the long term unless you highly value this card’s cell phone protection benefit or 3X on advertising. However, it has a great signup bonus that you won’t be able to get once you’re over 5/24 so it’s definitely worth getting before it’s too late. For most people I’d recommend downgrading this card after a year to the no-fee Ink Business Unlimited (1.5X everywhere) or to a second Ink Cash card (in case the $25K cap on 5X spend is too limiting).

The following display shows the current Ink Business Preferred offer at the time you read this on the web:

| Card Offer and Details |

|---|

100K points ⓘ Affiliate 100K after $8K spend in 3 months$95 Annual Fee Recent better offer: 80K after $5K spend. Many preferred the 80K offer due to the much lower spend requirement FM Mini Review: Great card for welcome bonus and 3X categories. Also consider the annual fee-free Ink Business Cash for its 5X categories, and the fee-free Ink Business Unlimited to earn 1.5X everywhere. Earning rate: 3X travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year) ✦ 5X Lyft through March 2025 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Points worth 25% more when redeemed for travel ✦ Transfer points to airline & hotel partners ✦ Cell phone protection against theft or damage See also: Chase Ultimate Rewards Complete Guide |

Second set of cards

91 days after your first set of applications, the small hit to your credit report caused by those inquiries should have largely dissipated. In fact, it is common to find that your credit score is higher by this point than it was when you began. Apply for both of the following on the same day.

I’ve listed here the Southwest business cards as a great pick for your second set of cards, but really the timing should be determined by the date when you’re ready to apply. The ideal time to apply for both of these cards is early December or January so that you’ll earn all of the bonus points as early in the calendar year as possible. The reason for doing this is so that you’ll have the Southwest Companion Pass for as long as possible. Once you earn 110,000 points within a calendar year, you’ll keep the pass for the rest of that calendar year and all of the next year.

If the timing isn’t right for these cards, move on to the third set and return to these later.

Bobby: Chase Southwest Airlines Rapid Rewards Business Cards

| Card Offer and Details |

|---|

50K points ⓘ Affiliate 50K points after $1K spend in first 3 months $99 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Earning rate: 3X Southwest ✦ 2X Rapid Rewards(R) hotel and car partners ✦ 2X rideshare ✦ 1X on all other purchases. Card Info: Visa issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $10K in purchases Noteworthy perks: 6000 bonus points each year upon card renewal. 2 EarlyBird Check-Ins each year. 10,000 Companion Pass qualifying points each year. |

80K points ⓘ Affiliate 80K after $5K spend in first 3 months$199 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Earning rate: 4X Southwest ✦ 3X Rapid Rewards(R) hotel and car partners ✦ 2X rideshare ✦ 2X social media and search engine advertising, internet, cable, and phone services ✦ 1X on all other purchases. Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $5K in purchases Noteworthy perks: 9000 bonus points each year upon card renewal ✦ 4 Upgraded Boardings per year when available ✦ Global Entry or TSA Pre✔ Fee Credit ✦ Up to 365 Inflight WiFi Credits ✦ 10,000 Companion Pass qualifying points each year. |

Jordan: Chase United Explorer Card

At the time of this writing, this card has a lower than usual signup bonus: only 40K miles. Hopefully, a better offer will be in place by the time you are ready to apply for this card. I consider this a “must have” Chase card because it can be downgraded after a year to a no-fee United card which preserves this card’s best features: Improved economy saver award availability, and last seat standard economy award availability. The former feature, especially, makes it much easier to book international awards with United miles since it opens up space between airports domestically. The latter feature is great for those ocassions when you are stuck with no good way to get from one place to the other. Read about how I put this feature to great use here.

Before you apply for the United card, I highly recommend logging into your United account and going through the steps of buying airfare (you can stop before actually filling out your credit card info if you don’t really have a purchase you want to make). Somewhere in that process, you may get an offer for this card that is better than the public offer.

The following display shows the current public United Explorer card offer at the time you read this on the web (again, hopefully the offer will be better by the time you get to it!):

| Card Offer and Details |

|---|

60K miles ⓘ Friend-Referral 60K miles after $3K spend in 3 months.$0 introductory annual fee for the first year, then $95 This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 8/11/22: 70K after $3K spend FM Mini Review: Decent perks such as enhanced access to United saver level economy awards makes this a keeper for some. Earning rate: 2X United ✦ 2X restaurants ✦ 2X on hotel stays Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 1,000 PQPs per year: 25 PQPs per $500 spend Noteworthy perks: ✦ Improved economy saver award availability ✦ Free first checked bag for primary cardholder and one travel companion when you pay with the card ✦ Unlocks complimentary elite upgrades on award tickets ✦ Priority boarding ✦ No foreign exchange fees ✦ 2 United Club passes per year on you anniversary ✦ One year of complimentary Dash Pass (Must activate by 12/31/24) ✦ Primary auto rental collision damage waiver ✦ Up to $100 Global Entry,TSA Pre-check or Nexus credit ✦ 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card |

70K Miles + 500 PQPs ⓘ Friend-Referral 70K miles and 500 PQPs after $4K spend in the first 3 months $250 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 3X United ✦ 2X restaurants including eligible delivery services ✦ 2X on all other travel ✦ 2X select streaming Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 6,000 PQPs per year: 25 PQPs per $500 spend Noteworthy perks: Up to $125 in statement credits for United purchases each cardmember year - terms apply ✦ Two 5K award flight rebates per cardmember year ✦ First and second checked bag free for cardholder and one companion when you purchase your tickets with the card and include your Mileage Plus number ✦ Up to $100 Global Entry, TSA PreCheck or Nexus reimbursement ✦ 25% back on United inflight or Club Premium drink purchases |

Third set of cards

Apply for these 91 days after the last set of cards. If you’re using Travel Freely, you’ll get an email reminder that you’re ready to apply for new cards.

Bobby: Chase Ink Business Cash

I’m a huge fan of this card for its ability to earn 5X valuable Ultimate Rewards points in several categories of spend. Plus, it has no annual fee. Read our in-depth coverage of this card by clicking through below.

| Card Offer and Details |

|---|

Up to 75K points ⓘ Affiliate 35K after $3K spend in 3 months and an additional 40K points after $6K spend in 6 months. In addition, 10% Business Relationship bonus if you have the Ink Business Cash and a Chase Business Checking account on your first anniversary.No Annual Fee Alternate Offer: If you have a household member with an Ink card, you may prefer the referral offer whereby the referrer can earn 40,000 points and the new account holder can earn 75,000 points after $6,000 in purchases in the first 3 months since it will yield more total points. Recent better offer: 90K after $6K spend in 6 monthd (expired 1/17/24 FM Mini Review: This one should be in everyone's wallet. Incredible welcome bonus for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5X Lyft through March 2025 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. See also: Chase Ultimate Rewards Complete Guide |

Jordan and Bobby: Chase World of Hyatt Credit Card

Both Jordan and Bobby should sign up for the Hyatt card. This way they’ll both get an annual free night certificate and can turn the two annual fees into very nice annual weekend getaways.

The Hyatt card has a different signup bonus structure than the others in this roundup (at least at the time of this writing): Earn 25K after $3K spend in 3 months and then earn another 25K after a total of $6K spend in 6 months. In this case, $3K of Jordan and Bobby’s quarterly $12K budget is committed to the Ink Business Cash card, above, so that leaves $9K for Hyatt card spend. Make sure to spend at least $3K on each card within these three months and then spend as much more as possible. Whatever is left over of the $6k per card requirement will flow over to the next quarter.

The following display shows the current Hyatt offer at the time you read this on the web:

| Card Offer and Details |

|---|

Up to 45K points ⓘ Non-Affiliate Up to 45K: 30K after $3K spend plus 1 extra point per dollar for non-bonused spend, up to $15K spend in 6 months.$95 Annual Fee This card is subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great card for welcome bonus and annual free night. Might be worth using regularly for additional free night and as a path to status. Earning rate: ✦ 2X restaurants / cafes / coffee shops, airlines, local transit, fitness clubs and gym memberships ✦ 4X Hyatt Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: One free Cat 1-4 night certificate after $15K spend in a calendar year. ✦ Get 2 elite qualifying night credits every time you spend $5K in purchases Noteworthy perks: ✦ Free category 1-4 night every year upon renewal ✦ Additional free category 1-4 night after $15K spend in calendar year ✦ Discoverist elite status ✦ 5 elite qualifying nights |

Fourth set of cards

It is likely that $3K of spend still needs to go on the Hyatt cards from before, so we have $9K of spend now to work with…

Bobby: Chase Ink Business Unlimited

The Ink Business Unlimited is yet another excellent card that earns Chase Ultimate Rewards points. It earns 1.5 points per dollar for all spend. Points can be moved to the Sapphire Reserve card to make them much more valuable.

| Card Offer and Details |

|---|

75K points ⓘ Affiliate 75K after $6K spend in 3 monthsNo Annual Fee Alternate Offer: You may be able to get an offer of 120,000 points after $6,000 in purchases via a Business Relationship Manager. Recent better offer: 90K after $6K spend in 6 monthd (expired 1/17/24) FM Mini Review: Great welcome bonus for a fee-free card. Good option for earning 1.5X everywhere. Good companion card to Ink Business Preferred, Sapphire Reserve or Sapphire Preferred. Click here for our complete card review Earning rate: 1.5X on all purchases ✦ 5X Lyft through through March 2025 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. See also: Chase Ultimate Rewards Complete Guide |

Jordan and Bobby: Chase IHG Rewards Club Premier Credit Card

Both Jordan and Bobby should sign up for the IHG card. As with the Hyatt card, they’ll both get an annual free night certificate and can turn the two annual fees into weekend getaways. Note, though, that it might be more difficult to find desirable IHG properties that can be booked with the IHG certificate. On the other hand, the IHG card has other excellent perks: Platinum status (great for status matching to other hotel chains!), fourth night free on award stays, and a 20% discount on points purchases.

| Card Offer and Details |

|---|

140K Points ⓘ Affiliate 140K points after $3K spend in 3 months$99 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 175K after $3K in spend (expired 4/6/23) Earning rate: 10X IHG ✦ 5X travel, dining, and gas stations ✦ 3X on all other purchases Card Info: Mastercard World Elite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: 10K bonus points + $100 statement credit after you spend $20K in a calendar year + make one additional purchase ✦ Diamond status after $40K in purchases + one additional purchase in a calendar year Noteworthy perks: Anniversary free night e-certificate good at IHG properties up to 40K points per night ✦ Ability to add an unlimited number of points to a free night certificate to book a higher-level hotel ✦ Fourth night free on award stays ✦ 20% discount on points purchases ✦ Platinum elite status ✦ Up to $50 in United TravelBank cash per year (must register your card with your United account) |

Add it all up

Assuming success at getting approved for all of the above cards and in meeting the spend requirements, Jordan and Bobby should have earned the following numbers of signup bonus points (not counting points additionally earned from spend):

- Chase Ink Business Preferred Card: 80,000

- Chase Sapphire Preferred Card: 60,000

- Capital One Venture Rewards (or Spark Miles): 50,000

- Chase World of Hyatt Credit Card: 50,000

- Southwest Rapid Rewards Performance Business Credit Card: 80,000

- Southwest Airlines Rapid Rewards® Premier Business Card: 60,000

- Chase United Explorer Card: 40,000

- Chase Ink Business Cash Credit Card: 50,000

- Chase World of Hyatt Credit Card: 50,000 x 2 = 100,000

- Chase Ink Business Unlimited: 50,000

- Chase IHG Rewards Club Premier Credit Card: 125,000 x 2 = 250,000

In total, we’re looking at 820,000 points & miles in 15 months based on the bonuses available at the time of this writing. It’s actually possible to do far better than this, but this plan offers a solid start and ensures that Bobby and Jordan have some of the key cards in their portfolio for ongoing success in earning points and traveling for free.

In addition to the 820,000 points, Jordan and Bobby will now get free night certificates each year from their Hyatt and IHG credit cards. They can use these free night certificates to book weekend getaways each year. When booking two consecutive nights from separate accounts I recommend contacting the hotel ahead of time to let them know that you’re together. This way they’ll do their best to keep you in the same room.

Next steps

At the end of the 15 months described above, Jordan will be at 5/24 (i.e. Jordan will have opened 5 cards in the past 24 months). Jordan can continue to apply for cards from other banks, but won’t get approved for additional cards from Chase unless he/she waits long enough to drop under 5/24.

Bobby, on the other hand, will be at only 2/24 since none of the Chase business cards that Bobby signed up for count towards 5/24. Bobby can continue to sign up for 2 consumer cards per year, and any number of business cards (except for those from certain banks like Capital One) and still stay under 5/24. This is great because Chase may introduce a new “must have” card in the future and this will leave Bobby available to apply for it.

Loved this post–thanks! Just wanted to point out that in the “Add It All Up” section, you have listed the World of Hyatt bonus twice: the first time at “x1” and the second at “x2”.

Hi Guys

A very comprehensive review – it’s just a pity herein Australia we cant get similar offerings.

I just got the Chase ink business unlimited but chase reduced my credit line on ink plus more than I wanted. Is there any risk if I ask if part of the Ink Plus credit line be reinstated, as this might cause eyes to review how I max out the 5x category each year?

There’s always some risk if you use the cards in ways that might trouble Chase. My guess is that the risk would be low, but I don’t really know.

I asked for the CL to be reinstated back to the Ink Plus and it was done right away with no issues.

Can I please get clarification on if the CapOne Venture card counts as 3 against 5/24 or just 1. I know it pull from all 3 credit bureaus, but don’t understand why that actually matters.

It only counts as 1 towards 5/24.

CapOne is known to issue inquiries to all 3 credit bureaus, but that doesn’t have any effect on how many new accounts appear on your credit report once you are approved.

You keep forgetting to mention a Global Entry benefit from IHG Premier card – with this sample spread it would be the only card that provides it besides Venture. Hence the actual evaluation of the card may go higher than $551/1st year.

You’re right, I do keep forgetting that. Thanks for the reminder.

The United Explorer card also has it. And one the Sapphire Preferred is upgraded to the Reserve, that would have it, too

One key element that missing in final evaluation is the $$ of all annual card fees for 15 month period.

I think it applies to your other posts – “Beginners Guides …”

Right. I probably should add the first year fees. Thanks. I expect to revisit this series every few months as things change and so will tackle that next time.

I stopped reading after:

Bobby spends $3,000 on quarterly estimated federal tax payments

Bobby has a business

Also what is the redemption goal with all this? Just randomly accumulating points/miles?

I have a bunch of cards which are even more spread out in points systems but I never lose sight on what is actually beneficial for me and what works. Sure I have airports where SouthWest flies out but they don’t fly at the times I want to, have layovers and are not cheaper than other flights. So SW cards in the end less worth than Alaska or even Asiana cards to me.

This particular plan is definitely not for everyone. I had to make a number of assumptions in order to make a coherent plan. Sorry that it doesn’t work for you.

The goal was to focus primarily on transferable points that can be used for almost any redemption.

Okay. Then why no Amex card and/or why no Marriott?

You can cash out MR for cash (with the Schwab Plat) if you cannot find a way to redeem/transfer MR.

I think UR and MR are a strong combination and getting some Marriott points if possible is great to top off some miles accounts.

It may not give you the highest number of points, but high amount of points doesn’t equal highest value.

40k Asiana miles are worth more than 170k IHG points, if you can/do fly star alliance and are flexible or can plan ahead.

The answer to why no Amex card is simple: you need to focus on getting the Chase cards you can while still under 5/24. Of course you could pepper in a couple of Amex business cards, the BOA Alaska business card, this and that and the other thing — but this is a road map for how to start. That Asiana card will be available to you when you’ve completed this plan — but the IHG card will not be available to you (and may not ever be available to you again if you don’t intend to stay under 5/24 long term). The idea here is to secure cards that you will want to keep (or downgrade and keep) long term that will not be available to you once you’ve started opening a lot of credit cards.

As to why not Marriott, Greg addresses that in the post. If you prefer Marriott, that card may be a better choice than the IHG card — but on the other hand, since you can always get an Amex Marriott card after you’ve completed this starting plan but you will not be able to get an IHG card in the future (again, assuming you don’t work to get/stay under 5/24), he included the IHG card.

This post isn’t about the signup bonuses for the most part — it is about framing a plan for what to open in year 1 so that you have the cards you want/need long-term and can then get into the Asiana and Lufthansa cards of the world and so on and so forth.

Okay. The title suggests maximize points and not stay under 5/24.

For a long term plan you also need to get the freedom cards (maybe a year or two after it) if you want to keep getting UR. They don’t have much signup bonus compared to other cards but you get UR, and it adds up.

You can have both Chase and Amex Marriott. So if you want to be flexible and first get all Chase cards, You need to get the Chase Marriott card and then a little more than 2 years later the Amex Marriott card.

With that I would rather drop the Southwest and get the Marriott, especially if you really don’t fly (revenue) with Southwest.

Those are reasonable changes. I do expect that everyone will change the plan to meet their needs.

Enrico

I wish I paid that amount u need a game plan which they have . Unless u do MS or spend half a $m a year on the card u FLIP . Chase watches the most I think I already have the $149 SW card so I’m set for SW . Good Post .

Once again is it OK with the weather to go to PPT in 10/20 to 11/5 or is it TOOOO wet.

Thanks

CHEERs

Great set of articles, thank you! Quick question on the United Explorer card…why not do the 100K business version instead? Is it because of the higher spend requirement at $5K for first 50K and $25K in 6 months for next 50K? Or is it maybe missing the two main features of the personal card (special access to extra reward flights, and last seat booking)?

I don’t think the business card has a no-fee downgrade option. It’s still a good card, but I don’t consider it to be “must have” since it doesn’t have a no-fee option for long term benefits. If Bobby has spare spending capacity, then it’s a decent card to go for.

This is a pretty nice writeup. I feel like there’s way too little optimization for 2 players talked about in the churning world. For example, Southwest CP- couples should be making a 4 year plan around this to alternate who’s the companion. So the SW bonuses would anchor their 24 month plan, and work bonuses around that.

Thanks Jason. Chase has made it very difficult for a couple to do that anymore with the Southwest cards unless both members of the couple are willing to sign up for business cards. If they both can, then yes alternating SW signups every 24 months is a great way to go.

You see no risk of shutdown/blacklist in signing up for this slew of cards in such a short time?

That’s a great question. To my knowledge, most Chase shutdowns are caused by spending patterns that make Chase think that the cardholder is a bad risk. Applications do get eyes on the account, so if you’re worried that you are cycling credit limits or spending more than is reasonable given the salary you put in your applications then I would be worried about signing up for more cards. I’m assuming that the couple described here does not manufacture spend or do other things that might make Chase suspicious.