There was a time, not long ago at all, when I maximized my wallet with just two cards: Chase Sapphire Reserve and Chase Freedom Unlimited. I got 3X for travel and dining with the Sapphire Reserve, and I got 1.5X everywhere else with the Freedom Unlimited. Now, that approach has shattered.

The above paragraph isn’t true. In reality my wallet was much more complicated than that, but it is true that those were my everyday go-to cards. In fact, the above was exactly true for my wife’s wallet where I labelled each card. Here’s an example of her Freedom Unlimited card:

The title of this post is also not true, but once I thought up the title I liked it too much to ditch it. In truth, Amex and Citi have captured quite a bit of my spend, but not all. Far from it.

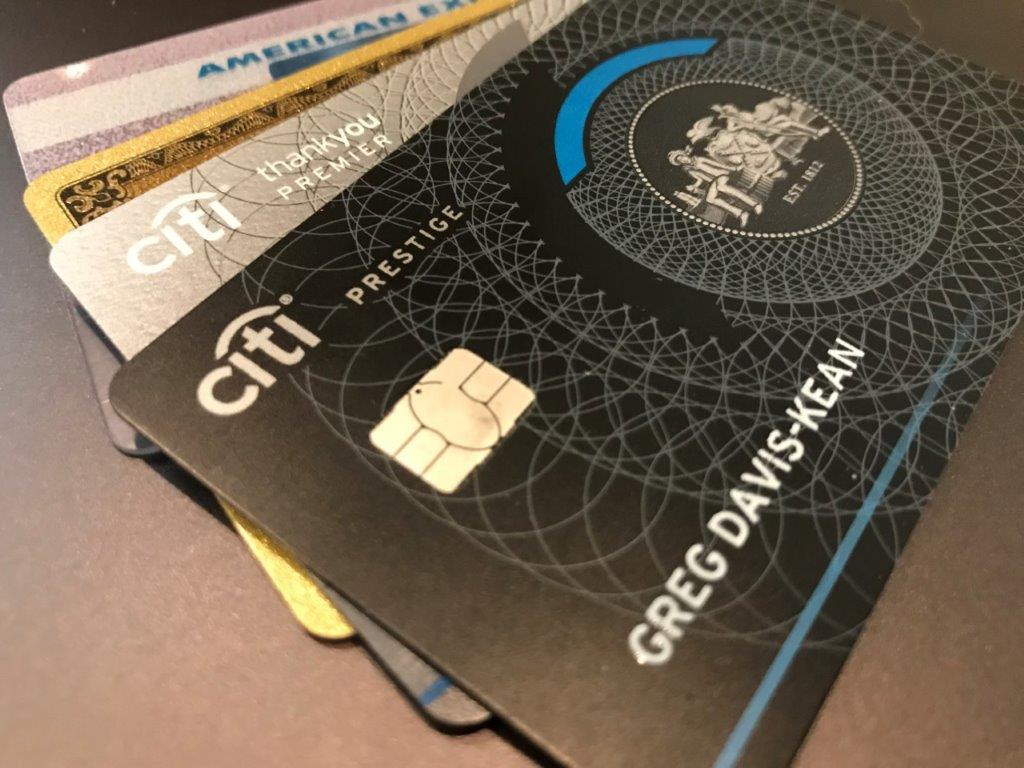

Starting January 2019, when Citi Prestige bonus category changes go into effect, I expect my wallet to contain the following cards (along with the bonus categories I expect to use each card for):

- Citi Prestige: 5X dining and flights (maybe flights… more on this in a future post)

- Citi Premier: 3X gas and travel, 2X entertainment

- Amex Gold: 4X US grocery (max $25K per year, then 1X)

- Amex Blue Business Plus: 2X everywhere else (max $50K per year, then 1X)

Notice anything missing? There’s not a single Chase card in the mix (in reality, I would probably also throw in my Chase Ink Business Cash to get 5X at office supply stores, but that complicates the story).

Above are the cards I expect to be in my physical wallet. There’s more to my spend than that. I’ll keep the following cards available through Apple Pay (or Samsung Pay if I get the Samsung watch and sync it to my new Android phone):

- US Bank Altitude Reserve: 3X for all mobile wallet payments

- Chase Freedom (I have lots of these): 5X in rotating categories

For online purchases, my credit cards can stay at home in the sock drawer. These are the cards I expect to use online or on auto-pay:

- Citi AT&T Access More: 3X for online retail purchases

- Chase Ink Business Cash: 5X for cell phone, cable, internet, and Staples.com

- Chase Ink Business Preferred: 3X for online advertising (for my blog business)

The list of cards above doesn’t include all of the cards that I have. I keep many other cards either because they are fee free or because they have perks that outweigh the annual fee. Just one of many examples is my IHG card which offers a free night each year. I hardly ever use this card for spend, but the annual fee is worth it for the annual free night.

Why pay all those fees?

The list of cards that I use for spend includes a number of no-fee cards, but also several that I spend quite a bit on. Here’s the list that I pay for:

- US Bank Altitude Reserve: $400

- Citi Prestige: $350 (grandfathered into that price from when I previously had Citi Gold checking)

- Amex Gold: $250

- Citi Premier: $95

- Citi AT&T Access More: $95

- Chase Ink Business Preferred: $95

Each of the above cards offer perks that more than offset the annual fees (shown are just some of the perks):

- US Bank Altitude Reserve ($400): $325 travel reimbursement. 3X mobile wallet pay. 1.5 cent award redemption. 12 free Gogo Wifi passes.

- Citi Prestige ($350): $250 travel reimbursement. 4th Night Free. 5X dining & select travel.

- Amex Gold ($250): 4X US grocery bonus alone makes up for the annual fee. $100 airline fee rebate. $10/month restaurant credit is a great addition for me since I’ll easily use it every month.

- Citi Premier ($95): 1.25 cents redemption value towards travel. 3X gas & travel.

- Citi AT&T Access More ($95): 10K annual point bonus with $10K spend. 3X online retail.

- Chase Ink Business Preferred ($95): 3X online advertising; cell phone protection against theft or damage

Back to my wallet

So there you go. Amex and Citi have taken over my wallet… my physical wallet with awesome category bonuses. As described above, there is still a place for Chase spend (especially at 5X with the Freedom and Ink Cash cards) and with miscellaneous other cards for other specific purposes. But for day to day transactions, Amex & Citi now have the upper hand.

What’s in your wallet? Your phone? Your sock drawer?

Is US Bank still really aggressive shutting people down for MS on the altitude?

I’d guess so, but I haven’t heard of anyone testing it in quite a while

[…] Amex and Citi capture my wallet but not my spend […]

What also needs to be taken into account are the transfer partners for each currency. Chase has taken a few shots to the face with the loss of Korean Air and with the Hyatt devaluation upcoming. I would hope Chase can bring in an additional transfer partner to offset the loss of Korean Air.

The transfer bonuses offered by Citi or Amex are nice for those who can use them. I don’t think Citi has the quality transfer partners for my use. Amex has the transfer partners but the card is still not globally accepted.

Gas for me is the SPG business (4X Marriott points), with a 10% discount on Mobil gas stations (amex offers). I triple deep, attaching the card to the spent app for an extra 1% discount. I guess one can also sign up for the Mobil rewards, that would be the next step.

It’s a business card, so don’t forget to sign up for visa savings edge at chevron/Texaco for another 2% when the Amex offer runs out

Its an AMEX card, so no visa savings edge. On the other hand, the Marriott business Visa would be elegible for this, and also give you the extra 2%.

How do you have lots of chase freedom cards?

Product change I assume.

Greg remember the ink preferred is a 3x travel card too. Have you considered converting either the premier or the CIP to a no fee? The premier has 3x in gas, but you can get 3x with your altitude by using a dummy card at the pump with samsung pay. But you are probably not paying an annual fee on the premier, and I seem to remember that you’re an apple guy.

i thought i was the only on who put spend labels on their cards 😉

In my wallet:

Chase Ink Cash for 2x Restaurant and 2x Gas

Chase Ink Preferred for 3x Public Transportation, Parking, Travel

Amex Everyday Preferred for 3x-4.5x Grocery

Amex Blue Business Plus for 2x Everything Else

In my Samsung Pay:

CSR (dining), my wife carries physical card, will be replaced by Citi Prestige in January

Citi Premier (7-11 for GCs, gas abroad), will also use for gas, after I’ll get Amex Gold, and cancel EDP

Altitude Reserve – for non-category spend, and everything abroad, which is not covered by CSR, Prestige and Premier.

Amex EDP (groceries)

Multiple Freedoms

US Bank Cash+

Maximum 10 cards at a time.

In Google Pay:

Whatever I added there to backup Samsung Pay (it has 5 cards maximum limit for Amex cards), the rest is unlimited in my experience. Total of 30 cards.

In my physical wallet:

3 Ink Cash (cause they are not supported by mobile wallets)

Citi AT&T Access More (online)

Amex BBP (in case I can’t use Altitude Reserve from Samsung Pay, or online, where AT&T doesn’t pay 3x)

Barclays Priceline 2x (in case Amex BBP, Altitude Reserve or AT&T AM fail)

Amex EDP (gas), will be replaced by Citi Premier, after I switch to Amex Gold for groceries)

Nice collection.

It never occurred to me that you could use both Samsung Pay and Google Pay. That’s great.

Why keep Access More in your wallet when you only need it online?

More than that, if you have Samsung phone and Samsung watch, you can have 2 different Samsung Pays – one for the watch and one for the phone, and it will give you a limit of 20 cards that you can add to Samsung Pay. The phone app is much more feature rich than the watch app. You have access to cashback portal, the store, where you can buy gift cards, many with discount, and there is also promotions section, where you can earn additional Samsung Pay points. Google Pay is also a different app, which doesn’t conflict with Samsung Pay.

In my wallet:

BoA Premium Rewards and Cash Rewards as back-up for Samsung Pay — Cash at gas and Costco

Paypal Debit – don’t take Amex and not working on sign-up bonus or bonus category

Chase Ink Cash — office stores

Hilton Business (Working on Sign-up bonus)

Will add back Citi Prestige in January for dining/flights

Amex OBC — back-up for Samsung Pay

Amex BBP — back-up for Samsung Pay

Samsung Pay:

BoA cards above

Citi AT&T Access More

Freedom Cards — Rotating

Discover — Rotating

Amex OBC — groceries, gas go on BoA Cash Rewards

Amex BBP — Interchangeable with Paypal debit

Citi Dividend — Rotating, esp. Best Buy

The idea of using Google Pay is brilliant, but I really prefer the points I get with Samsung Pay. Also, it’s much easier to use. I may consider US Bank AR in the future, but I just finished spend on CNB Crystal Visa Infinite. I’m almost under 5/24 now too. I also have many other cards I don’t carry with me, like Amex Platinum.

I love the Amex Blue B’ness Plus too, but you’re actually better off with one of the Chase Unlimited cards for everyday spend. 2.25 points combined with your CSR. At least.

For me, anything not food/travel/gas/internet/phone/grocery related, i.e. everything otherwise everyday spend, is going on either the Chase unlimited card or Blue B’ness Plus. They really are about the same depending on whether you prefer MR or UR.

Of course if you can MS at office stores and grocery stores…..go with that too….but juggling fifty gift cards with fifty different retailers can be a logistical headache.

Personally, I’ll take 2X membership rewards over 1.5X Ultimate Rewards any day, but I totally understand the opposite view

I am with you on this one, Greg

I wonder what you would actually forego by limiting yourself to just 3 cards. To me, your system of having 10 or more cards and having to think about what you are buying and what category it is in…is more trouble than it’s worth. (Although, because your business, i.e., this blog, is all about this stuff, I understand your motivation for writing about it.)

My system is far simpler: my primary card is always whatever sign-on spend bonus I am working on, unless it is travel (in which case, I use a combination of Prestige and Ritz). If it another type of large purchase item, I may give it some more thought (e.g., Prestige for added warranty). I might do some MS at an office store with my Ink from time to time.

Everything else is just “noise” and isn’t worth thinking about. I’d be glad to shown that your multi-card system is the way to go, though.

@ bluecat — I absolutely agree that your primary card should always be one where you are working on an opening bonus. That makes the 2xs and 3xs noise.

Your system makes perfect sense. Mine is exactly opposite. With new signup bonuses, I rarely take the card out of the house at all. I look for ways to meet min spend with one or two big charges (Kiva, bill pay, tax payments, etc.) and then put the card away. I find that much simpler.

What would be useful, then, is a discussion of which method is better. Is the “pain” of targeting different spend categories with (and having to keep track and carry around ) different cards worth it? I suspect that the answer will be “it depends” but I’ve always found your blog—above and distinct from all of the others–to be far more analytical. For example, you created a very useful spreadsheet to help your readers understand which premium credit cards had worthwhile benefits. I would have thought you would do the same on this topic. (Maybe you have and I missed it!)

My gut is telling me that–outside of big ticket items like travel–your approach is not worth the bother. But I’ve always wondered about this…

Agreed, almost always working on minimum spend, and that one gets it, generally a larger purchase if possible, to make it easy. Otherwise, and to keep things simple for P2, it goes on BOA Premium Rewards w/ Platinum Honors, for 3.5x on travel/dining and 2.62x on everything else. Will generally keep an Amex Platinum in the wallet for lounge access, roadside assistance, etc, but that’s about it.

You are right, this is what I do too. By far the best card if you keep 100k at BOfA MERRILL. I throw in a no fee chase INK which I have autopay setup for comcast/att bill for 5 percent on those. There really is no such thing as MS anymore. So on total spend I average better than percent blended. Simplifies life.

What are you using for dining until January? Amex Gold? CSR?

Gold in the US, CSR otherwise

My local supermarkets all take Apple Pay, and that’s where my Amex Gold goes.

I have the AMEX gold.Could you please explain how that interacts with Apple Pay at supermarkets

You should earn the same rewards as if you had used the card directly. It’s just easier to use Apple Pay since you don’t have to carry around the card and can just hold your phone near the swipe terminal to pay.

>” I would probably also throw in my Chase Ink Business Cash to get 5X at office supply stores…”

I should hope. That’s the last card (well, I have 2 similar ones) they are going to drag from my cold dead hands. Of course, I can buy gift cards to my grocery there.