The new Air France KLM credit card launched the other day, and I wrote that the card isn’t particularly exciting. A few years back, I probably would have thought that an airline credit card offering 1.5 miles per dollar was something special — but these days, every transferable currency has a card that earns an equal or better return (and in the case of Air France, they happen to be transfer partners with everyone). Then another comment on a different post — this time about the newly-revamped Amex Gold card — got me thinking about miles and transferable currencies versus cash back. In turn, that made me wonder: are cash back cards the new airline cards – or should they be in our eyes?

The easiest way to earn miles without flying will always be through welcome bonuses. Opening a new credit card and meeting the minimum spending requirement for a bonus is always the fastest way to earn miles, whether earning directly with a specific loyalty program through one of the top airline card offers, or earning transferable currencies.

However, when the luster of new account bonuses is gone, whether because you’re locked out of the bonuses you may want or you just don’t want to open five or ten or thirty new cards per year, you next have to consider your return on everyday spend. For a lot of people, food makes up a big part of the budget. That’s one of the reasons I was so pumped for the new benefits on the Amex Gold card: US Supermarkets and US Restaurants make up a healthy portion of our personal spending each year. The card created such buzz that Greg had to ask: Did Amex’s new Gold card kill Chase’s Sapphire Reserve?.

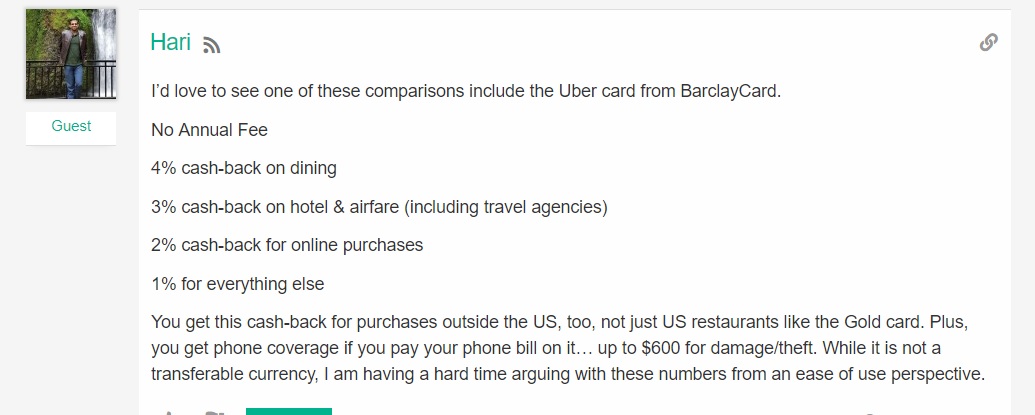

However, not everyone is feeling it on the Amex Gold card. in the comments on that post, reader Hari had this to say:

My first mental reaction was fairly dismissive: Hari’s comparing apples to oranges. I’d take 4 Membership Rewards over 4% any day of the week. Of course, if you value Membership Rewards points at more than 1 cent each, the second half of my statement has to be true for you, too. Right?

Hari’s comment didn’t get me thinking too seriously about the Uber Visa card. Four percent cash back on dining with no annual fee doesn’t sound bad, but I’d rather take 3x on dining with a Sapphire Reserve and get to choose between transferring to partners or redeeming for travel through the Ultimate Rewards portal at 1.5 cents per point (approximating a 4.5% return when used towards travel). I feel like the Uber card’s return on dining certainly isn’t bad, but neither is it category-leading. With no annual fee, it’s definitely not bad for dining.

The other cash back categories on the Uber card excite me less. I’d say that anyone spending enough on airfare and hotels to care about them as a category bonus should probably have a premium credit card for its trip protections (while still probably earning 3x). Two percent for online purchases isn’t notable since you can get a card like the Citi Double Cash that earns an effective 2% back on all purchases with no annual fee.

Further, 2% or 3% back in a limited range of categories doesn’t stand out because there are two options on the market that earn an effective 3% back in the first year with no annual fee (for at least that first year):

The Discover IT Miles card earns 1.5 “miles” (really like “cents”) everywhere, with your year-end total being doubled at the end of the year. Since Discover “miles” are worth about once cent each, you’re earning a 3% return in the first year. The Alliant card earns a flat 3% back for the first year and waives the $59 annual fee the first year (in year 2, it earns 2.5% back and carries the $59 annual fee).

Either of these cards offers the “ease of use” factor that Hari is looking for. Neither offers as good a return on dining. However, either one blows most airline credit cards out of the water.

Our Best Airline Card Offers page ranks airline credit cards based on first year value. That’s taking into account any introductory bonus and the opportunity cost of putting spend on those cards when spending towards the new cardmember bonus. But after the new cardmember bonus, the ongoing earn rate on most airline cards is 1x. A couple of cards earn 1.5x everywhere (such as the Virgin Atlantic credit card, the United Club card, and the new Air France KLM card), but most earn 1x everywhere.

However, in many instances, you can do pretty well with a cash back card and mileage sales. Just within the past few months, we’ve seen the following sales on purchased miles (all of which since expired):

- Avianca LifeMiles from 1.375c each

- American miles from 1.72c each

- United miles from 1.88c each

- Aegean miles from less than 2.1c each

- Alaska miles for ~2.1c each

And those are just a few recent examples. I don’t track opportunities to buy miles closely; I imagine one can find other interesting opportunities with some effort. Normally, I’m not much of a fan of buying miles, at least not speculatively. But what if earning cash back and buying miles is your strategy? If you were earning 3% cash back and then buying miles during sales like those above, your effective earn rate in miles per dollar spent would be:

- Avianca: 2.18x

- American: 1.74x

- United: 1.6x

- Aegean: 1.43x

- Alaska: 1.43x

All of the above rates are much better than you would do with any of the respective airlines’ credit cards except United (it’s only slightly better than the 1.5x everywhere earned with the United Club card). It’s also worth noting that one can earn 2x American miles on purchases at grocery stores with the MileUp card, which beats the cash-back-to-miles strategy if you spend mostly at the grocery store.

In terms of unbonused spend, most of those rates are pretty attractive. The fact is that cash back can be an effective way of “earning miles”. Put another way, earning cash back isn’t just an alternative to earning miles, but it can be part of a miles earning strategy. It probably won’t become anyone’s entire focus as not all airlines sell their miles cheaply. But it certainly can be a way to get great value out of your cash back.

While Alaska and Aegean would each return less than 1.5 miles per dollar spent using this strategy, those miles tend to be more valuable. Surely, many readers transferred SPG points to those airlines in years past at a 1:1.25 ratio, having effectively earned 1.25 miles per dollar spent. Earning at 1.43 is significantly better.

Of course, the above examples are based on perfect scenarios in the sense that you’ll have had to have earned at a rate of 3% cash back (presumably only possible a year at a time) and been able to (and wanted to) buy miles in the quantity necessary to get the best pricing. That’s a lot of assumptions – if you have to buy more miles than you want/need to get those rates, the strategy loses steam. Also important is which type of miles you want. While both Star Alliance and oneworld are represented in the examples above, those won’t be as helpful if you’re looking for Skyteam redemptions (of course, Air France is an Alaska airline partner, so you can use Alaska miles for travel on some Air France routes). However, the examples above are not meant to be comprehensive — you may well be able to find the right opportunities to buy in other programs and make a cash-back-for-miles strategy make sense.

However, in terms of earning cash back at a high enough rate to make the strategy worthwhile, don’t forget that you can boost your earnings every day through a variety of cash back strategies — and this part doesn’t rely on using a cash back card to start. Card-linked offers from apps/programs like Dosh, Spent, Acorns Found Money, Retailmenot, etc can easily add 1% or more to your normal earnings at many retailers – enabling you to stack a greater return whether spending on a transferable currency card or card back card. Here are posts on some of those programs from recent months:

- Dosh App: 6% In-Store Cashback At Walmart – Limit $10 Per Day

- (EXPIRED) Extra cash back at Staples, Home Depot, Walgreen’s, more w/ Retailmenot App

- 3% back on gas w/ Spent from now on

- 60+ retailers where Acorns Found Money offers the highest cashback (note that many of these may have changed since publication)

Doctor of Credit maintains an excellent resource page on these and many more card-linked programs. The fact is that an extra 3% on gas could be an extra 2.18 LifeMiles per dollar spent. Of course, it could also be three pennies per dollar in your pocket — the advantage of cash back is being able to choose when you can leverage it for more value as miles and when to use it to buy yourself something nice. Know when to hold ’em, know when to fold ’em — but it’s hard to win if you’re not playing the game to the best of your ability.

At the very least, these card-linked programs and cash back cards offer return that is worth some attention. If you had a card that earned an extra 2 miles per dollar at the gas station over the other options in your wallet, you would likely use that card. And the fact is, you do. It can be any card in your wallet thanks to the ability to buy miles cheaply — and it doesn’t have to be limited to one airline. It’s not revolutionary to imagine cash back as the ultimate transferable currency, but it’s worth noting that it might be even more valuable when leveraged as purchased miles.

Bottom line

Many miles & points fanatics focus on earning transferable currencies. That’s a strategy I have also followed and one on which I continue to focus most of my spending and earning. However, with the frequency and pricing of mileage sales these days, cash back should also be part of a well-rounded strategy to earning miles without flying.

Kinda surprised to see this piece as I get guff whenever I post about cash over points/miles on these type of forums. My limited travel usually involves driving and hotels that aren’t part of anybody’s programs. I’ll take cash over the alternatives any day. That’s why I love UR over MR or TYP (points are never worth less than a penny and sometimes more). There are no restrictions to using cash. You can stack, buy discount cards to get more cashback and you have something to spend in those little hideaways that take only cash. Just my 2 cents

What if you buy Marriott points and transfer to airlines that way? I’m not fully versed on the new program, but 60k pts generally becomes 25k Miles, right? And they sale points at 1.25c, maybe they have sales as well? At 1.25c that’s 2.5c per mile with lots of transfer partners. Maybe Marriott will have a sale as well.

This is a fascinating article that I had not thought about. My next card will be the schwab amex platinum so I can cash out those amex gold MR points for cash. Nowadays the lack of award space has really turned me off to miles. I’m all about bank rewards now since I can redeem then for flights I want and when for my family. I do end up trying to use miles if it works for the flight I need and then buy the rest with the citi thank you points or UR. I think my plan going forward is to use the UR and citi points for hotels then schwab amex plat for flights.

the good old days are done. If you are single or DINKY, then it doesn’t matter, you can use airline points/sweet spots etc still cuz you can fly Tuesday to Thursday 3 weeks later.

However, if you have a family, even with 8-10 weeks vacation… which most people don’t have, you still will have big problems on the redemption side unless your SO/kids can either miss school or have overnight layovers or driving adventures to distant airports in Canada.

So your post is spot on.

My current strategy is still not to worry about 5/24 or massive numbers of inquiries and to get new cards.. This is getting nearly impossible, between 5/24, citi 2 year, amex lifetime, etc.

I refuse to do anything complicated MS wise, because I wasted so much time on RedBird for silly numbers of points, don’t want to get shut down, and I do not have the energy or modern savvy (I think I need FTU for MS maybe)…

So my strategy right now is Alliant for everything, except AMZN for AMZN/Whole Paycheck Market and any other new cards I can find ( recently did AerLingus and another round of BA).

Avios are nearly worthless to me now because of AA’s married segment logic and my inability to be near an Aer Lingus airport. I ALMOST had an incredible itinerary for the same day booked with Avios on AA metal, would have saved the close in fees and many points, could never get through on US Exec Club phone, tried Netherlands and Germany, they refused to see the AA flights, called S Africa and she was able to get the flights after 10 minutes of checking my ID, explaining married segments, asking her to price it with both flights etc etc, then she wanted me to send her a screen shot to waive the fee because she wanted me to prove an error and then I thought she hung up on me.

However, the problem was I was on Skype, the CC to reload was expired, I ran out of credits BECAUSE CALLING S AFRICA IS LIKE 30 cents per minute, not 0.3 cents per minute!

I just gave up. She was like a unicorn, and the call cost over $5. I ended up not booking on AA out of protest and didn’t really feel like going.

Join the discussion…Hi asdfasd, I basically adhere to the same philosophy as you do. However, how do you utilize Alliant?

I would imagine you could do even better by earning cashback and using that to purchase airfare on sale. Probably similar effort to finding the best way to redeem miles too.

[…] Are cash back cards the new airline cards? (via Frequent Miler) […]

The issue is that most people consider miles/points “found money” for travel. Most people would not be disciplined enough to keep cash back as a separate travel fund for purchasing miles and the cash would inevitably be used towards something else and other things would take priority over travel.

This is the valid point. Who will in right mind spend 4000 $ to buy american miles to achieve that 1.76 c/m rate.

This is an interesting point. One that I tend to agree with. I would probably end up spending my 100,000 AKA $1,000 earned from spending 50K on a 2% cash back card on a mix of different things that *might* include travel

Thanks for the thorough and thoughtful response, Nick! 🙂

You are absolutely right that the CSR is extremely versatile – I’m incredibly frustrated that the AmEx keeps pushing the Gold Card as having no FX fees and then only offering the major points bonuses on spend within the US. It just seems like a contradictory message from a consumer perspective. That’s what started my thoughts regarding the Uber Visa and other cash-back cards (admittedly the Uber visa doesn’t offer as much flexibility as the CSR in a lot of cases… or travel protection, for that matter).

One thing to keep in mind regarding points purchases with the DoubleCash: it *does* charge FX fees. I’m not sure how a points purchase for a foreign airline will come across when it hits Citi, but tacking on an extra 3% isn’t fun. I’ve used it for some attractive sales within the US without issue, and it helps take the sting out of the tax you have to pay for buying miles.

What a fascinating post. I love that you are always thinking outside of the box, Nick. I feel like you are always finding that elusive piece of the puzzle I’ve been working on that makes a whole other edge come together. It’s awesome.:)

Great, thorough post! Aegean miles are actually on sale again (did a post last week) for 50% off now so even better!

Wow, I never thought of it like that. Earn cashback/buy points to achieve greater miles/dollar. Great angle.

I wonder if the opposite would be true with respect to hotel points, since so many of them are with so little individually…