On last week’s Frequent Miler on the Air, our reader question of the week was really made up of comments from two readers that essentially asked, “Should you be worried about a gift card company (seller or bank) that goes out of business because of the current [or some future] financial crisis?”. Thanks to a reader comment and some further reading I now know that yes, Visa Gift Cards (and presumably Mastercard and American Express gift cards) are (in at least some cases) FDIC-insured — but you have to register them online to get insurance.

In response to the announcement last week that Simon Mall is now selling $1,000 Visa Gift cards online up to a max of $25K per day (registration / approval is required), one reader expressed concerned that perhaps Simon is on the verge of bankruptcy and making a desperate play for revenue. In response to that sentiment, reader Marco Polo responded with this gem:

I am at least a little embarrassed to admit that I had never considered whether or not the funds on Visa Gift Cards would be FDIC-insured in the event that the bank backing them failed (though my embarrassment is at least slightly tempered by the fact that it sounds like Greg hadn’t considered it either). I guess I’d never envisioned a world where that would be much of a concern.

But given today’s economic environment and the large quantity of gift cards that one might have on hand at any given time, finding out whether or not Marco was right and funds can indeed be FDIC-insured — and whether or not online registration is required in order to trigger that — seemed awfully pertinent for me personally and I imagine for at least some readers. I bought some gift cards at the end of February as part of my regular manufactured spending and then bought some more online from Simon and am now sitting on a chunk of them that I’m not liquidating at the moment since I’m not taking any unnecessary trips to the store. If that money could be insured, I wanted to know what I needed to do. (Note: Keep in mind that FDIC insurance applies to bank failure; it won’t cover you if cards are lost or stolen).

It certainly appears that Marco was not wrong. An initial Google stumbled me upon an article from the FDIC website titled, “FDIC Consumer News: Is the Money on My Prepaid Card FDIC-Insured?“. That article is worth a read, but the key point for most of our readers is what it says about prepaid cards like Visa Gift Cards FDIC insurance:

“Does the FDIC also insure the funds on my prepaid card?” The answer could be, “Yes,” but there are some important initial issues to understand.

If the FDIC-insured bank that issued the card was to fail, the funds available on your prepaid card may be insurable as long as:

- your prepaid card is eligible for FDIC deposit insurance coverage,

- you properly register the card, and

- specific deposit insurance requirements are met (listed below).

It goes on to further outline those specific deposit insurance requirements, noting that either the bank or in some cases the issuer of the card acting as an agent middle-man between the consumer and the bank (like BlackHawk or InComm) must have your name on the account:

The bank’s records for FDIC insurable prepaid cards must meet the following requirements:

- The account must be appropriately titled (names the owner or owners of the account) in the bank’s records and indicate that the prepaid account provider is going to be acting as the cardholder’s agent, which could include duties such as transferring funds on your behalf when you make a purchase and keeping track of the balance on your prepaid card as you add or withdraw funds.

- If the bank fails, the card issuer as your agent will need to provide the FDIC a list identifying each cardholder and the balance on each card at the time the bank fails.

- The contractual agreement among the financial institution, the prepaid card issuer and the cardholders must indicate that the individual cardholders are the owners of the funds.

Assuming you properly register your prepaid card, if the FDIC-insured bank that issued the card was to fail, you as the consumer would be insurable for up to $250,000, subject to aggregation with other similarly owned deposits you may have in the failed bank (for more information visit FDIC deposit insurance).

The FDIC is not vague on this issue: cards that are eligible for FDIC insurance need to be registered to the account holder. This makes some sense as they would need to know who “owns” the account in order to know who to pay. Greg had speculated in our chat this past weekend that perhaps it would just take longer to get your money back if you didn’t have the account registered, but as I read the FDIC’s terms, I think you would need to have registered your card before the bank fails.

That theory matches the language found on the cardholder agreement that was packaged with my Simon Mall online-ordered Visa Gift Cards. From that agreement (bold is mine for emphasis, capitalization of the word “card” is all them):

1. ABOUT YOUR CARD

The Card is a prepaid Card loaded with a specific amount of funds, redeemable to buy goods and services anywhere Visa debit Cards are accepted in the United States. No additional funds may be added to this Card. The Card is NOT a credit Card. The Card is not a checking account or connected in any way to any account other than a stored value account where your funds are held. If you have registered your Card, the funds will be insured by the Federal Deposit Insurance Corporation (“FDIC”), subject to applicable limitations and restrictions of such insurance. You may register your Card by visiting the Website (www.simon.com/giftcards) or calling 1 (866)325-6238.

I then dug up a cardholder agreement from cards I purchased at a physical mall location to compare. The paragraph on that agreement was almost word-for-word the same as above. The mall-purchased card agreement also included a sentence saying that you will not receive any interest on the funds in the account and it suggested registering at www.simongiftcard.com or calling the customer service number. But the key point — that the funds are FDIC-insured if you have registered your card — was worded exactly as above.

That led me to dig up other agreements. A recent $300 Visa Gift Card I purchased at Staples.com (also issued by MetaBank, like the Simon cards), had the same sentence as the Simon agreements. On the other hand, a $200 Visa from Office Max, issued by Sunrise Banks, was much less clear. While the agreement notes that the card is issued by Sunrise Banks, Member FDIC and it notes that the term “Card Account” means “the records we maintain to account for the value of claims associated with the Card”, it never specifically says it is an FDIC-insured account. It also notes in several places that it is a prepaid card. One could make the jump to guess that it is FDIC-insured and that the “claims associated with the Card” would be insurance claims in the event that the bank failed — but in this case it was far from clear. The wording was almost the same (and equally as vague) on the cardholder agreement from an old $500 Vanilla Visa.

Interestingly, when I went online to register my $200 card from Office Max, I found GiftCardMall links to several different cardmember agreements for Visa Gift Cards. Some of them expressly mentioned that the funds were FDIC insured if the card was registered. Others had wording similar to the previous paragraph.

The moral of the story is this: I don’t know if every Visa/Mastercard/American Express gift card is eligible for FDIC insurance, but I know that some of them are and that it appears to require registration of your personal information to have the insurance. I think the risk of any of these banks failing is likely really small, but the relatively short amount of time it took me to register my cards was worth the peace of mind.

Card Registration

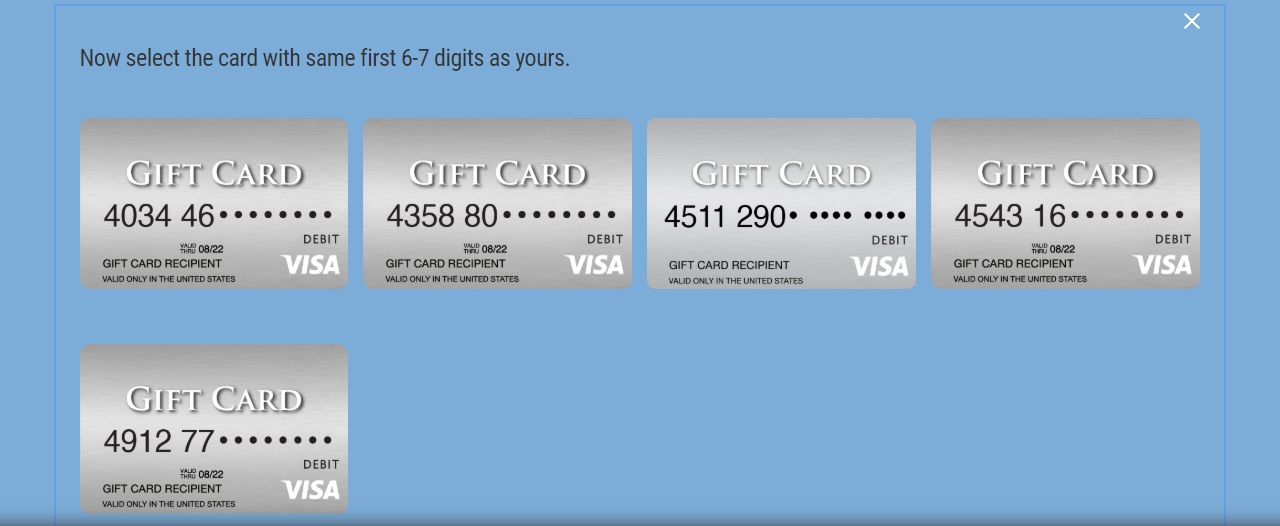

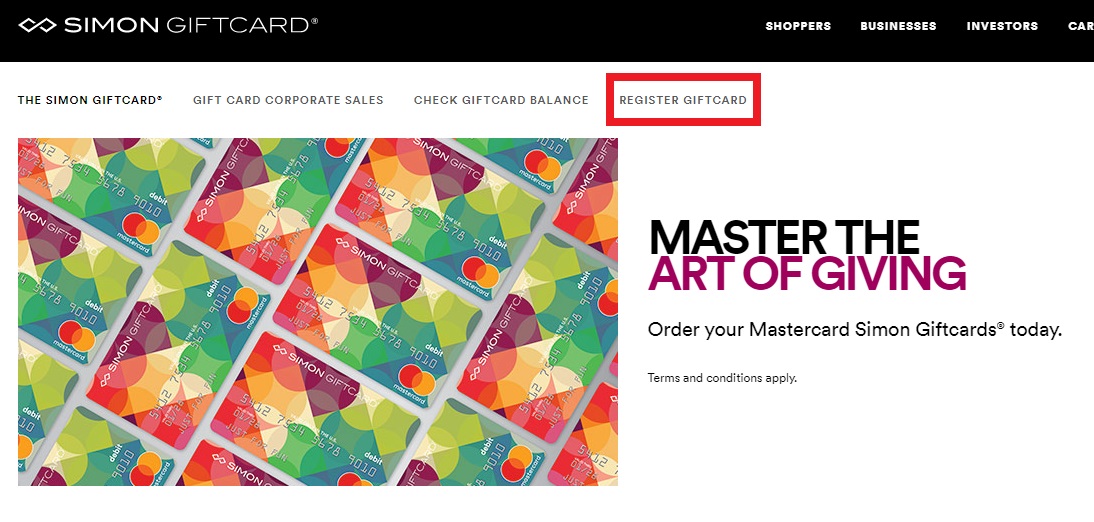

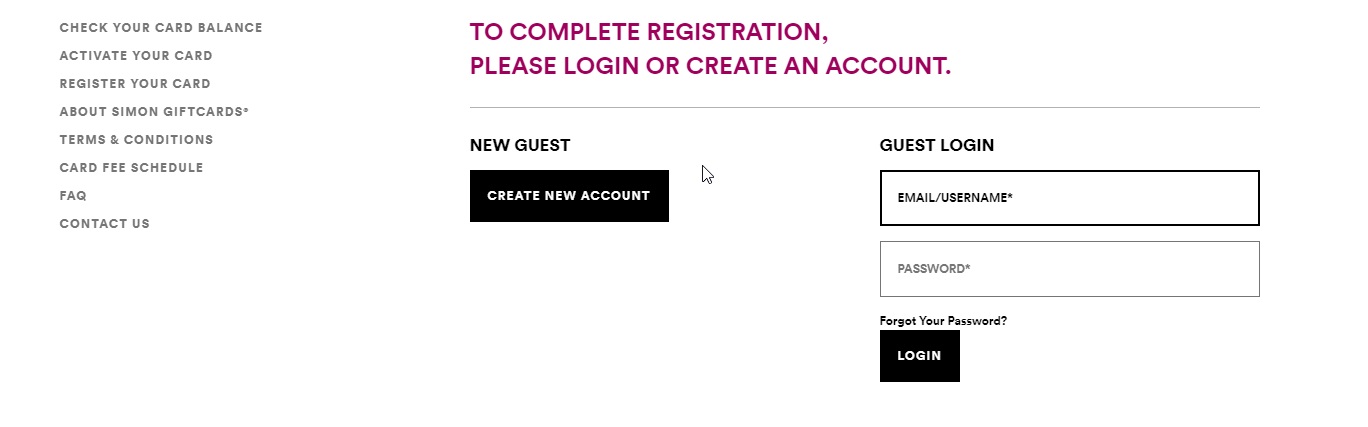

For my Simon Visa Gift Cards, registration was pretty easy. I went to simon.com/giftcards and clicked the button near the top that says “Register Giftcard”. I was then prompted to log in or create an account.

Note that while I obviously have an account for bulk ordering (which is how I bought the card I was registering), this site did not take my same login credentials. I had to create a new account to register my cards. To be clear, the only purpose of this account was to register my cards with my name / address / contact info.

Note that while I obviously have an account for bulk ordering (which is how I bought the card I was registering), this site did not take my same login credentials. I had to create a new account to register my cards. To be clear, the only purpose of this account was to register my cards with my name / address / contact info.

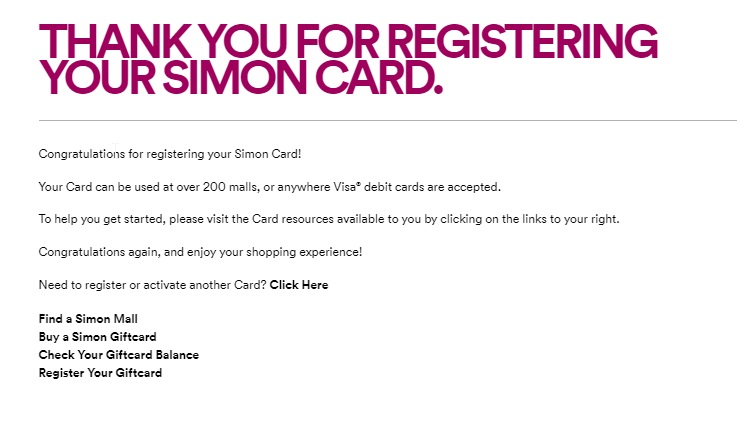

From there the process was intuitive. I entered my card information (number / date / CVV code) and was then prompted to provide my name, address, phone number, and email address. Once I provided that information and hit submit, I received a message thanking me for registering. Conveniently, there is a line that says, “Need to register or activate another Card? Click here”. Clicking there brings you back to the screen to enter the next card number and then it saves your contact info to make registering subsequent cards quick & easy.

From there the process was intuitive. I entered my card information (number / date / CVV code) and was then prompted to provide my name, address, phone number, and email address. Once I provided that information and hit submit, I received a message thanking me for registering. Conveniently, there is a line that says, “Need to register or activate another Card? Click here”. Clicking there brings you back to the screen to enter the next card number and then it saves your contact info to make registering subsequent cards quick & easy.

I don’t know if the registration of a card can later be changed. I didn’t want to mess with my $1K cards by adding a name and address change.

I don’t know if the registration of a card can later be changed. I didn’t want to mess with my $1K cards by adding a name and address change.

Overall, the registration process was easy and only took a few minutes.

The process was even easier with the $200 Sunrise gift card I bought from Office Max given that I didn’t need to create a login to do so. I just had to go to GiftCardMall.com/mygift and enter the card info, then my contact info.

Again, the entire process took maybe a couple of minutes per card if I was being extra careful. I’m not sure whether or not the $200 cards will be insured, but I think my chances are at least better now that they are.

Bottom line

For someone who has bought a lot of gift cards and has at times had a decent chunk of change tied up into them at once, I’m surprised that I hadn’t previously considered whether or not gift cards were FDIC-insured. I guess one of the reasons I’ve never thought about it is because I have felt confident that the backing bank probably won’t fail. I still feel pretty confident about that, but I don’t have any insight into prepaid card issuer finances to know that is true. While I am not at all actively worried about MetaBank or Sunrise failing and losing the money I have on my gift cards, it was well worth a few minutes of my time last night registering my cards to make sure that the FDIC can indeed find me if the banks should go under. I certainly hope that the current economic crisis we face is temporary and I don’t expect banks to fail, but at the same time we’ve seen a small bank fail recently and it just makes sense to take advantage of the insurance that comes with the account. That is especially true for those of us who have bought up more than we can chew if the bank went belly up.

When trying to register a VGC at giftcardmall.com/mygift I keep getting error messages.

[…] Are Visa Gift Cards FDIC insured? […]

Holding the funds in segregated accounts wouldn’t solve the problem as the original comment suggests. The Patriot Act requires banks to identify all account holders – without the registration details even the segregated “account” does not meet the regulatory definition of ‘Account Holder’ and therefore there is no FDIC insurance. Once the individual owner is identified FDIC insurance in in force. no way around that under current US regulations.

In the event of BK if you didn’t register you’d be an unsecured creditor. If they were properly segregating accounts then the GC funds should still be “whole.” You’d not receive FDIC funds (“quick” reimbursement) but after a potentially lengthy legal process you’d likely be made whole. Not segregating properly (illegal) would mean an “unsecured GC creditor” wouldn’t be made whole even through BK process.

Not segregating accounts properly is an MF Global reference for those sufficiently well versed or unlucky enough to appreciate or have experienced first hand.

Unsecured gift card holder think American Airlines gift cards circa 2011.

I got refund from cancelled Metropolitan opera on Visa gift card that I used to buy tickets long time ago. I don’t have this card anymore. I got rid of it after liquidating funds. Do you have any recommendation how to get access to refund money?

Thank you

If you still have the receipt from the purchase of the gift card, it may have the pertinent information to get the card replaced by the issuer. It’s always best practice to keep your receipts. I keep the receipts both for the purchase of the cards and the purchases of the money orders just in case something goes wrong.

In the worst case scenario of the issuing bank failing before you are able to register the card, would initiating a chargeback work to get your money back? After all, if Simon Mall sells you a $1000 gift card, and the next day the card is worthless, that sounds like solid grounds to dispute the purchase with your credit card company.

I really don’t know given the nature of gift cards. Hopefully it won’t come to that.

BTW, Metabank is headquartered in Sioux Falls, SD. So, THEsocalledfan is not the only awesome thing in this town!

Flip a card for award points because that’s real money disappearing not award points .

CHEERs