UPDATE 4/10/2019: Bank of America has updated the terms of the Business Advantage Relationship Rewards program. Now, like with personal cards, the relationship bonus will be applied the the card’s entire earnings. For example, if you earn 3% cash back and have Platinum Honors, you’ll get 3% x 1.75 = 5.25% back. For existing Cash Rewards for Business customers, this new approach starts with purchases made as of May 1 2019. For new cardholders, this new approach is already in effect. Hat Tip: Doctor of Credit.

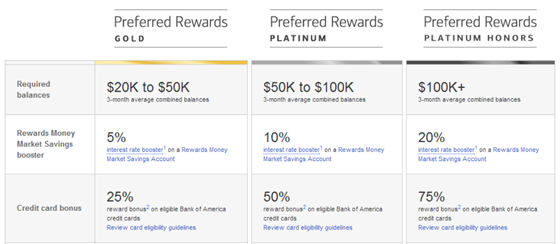

Bank of America offers a loyalty program of sorts where the amount of money you have on deposit with BOA and Merrill determines your elite level. To achieve top tier Platinum Honors with either the consumer loyalty program (Preferred Rewards) or the business loyalty program (Relationship Rewards) you need to have $100K on deposit.

We’ve covered these programs before:

The most interesting benefit of top tier status in these programs is the ability to earn 75% more rewards via certain BOA credit cards. With either the consumer Travel Rewards card or the Business Travel Rewards card, this means that you can earn 2.63% back (towards travel) on all spend:

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The Affinity Cash Rewards Visa Signature card could be really interesting for its rotating categories since the fine print indicates that it stacks on top of ordinary earnings. No Annual Fee Earning rate: 5% back at all bookstores, including Amazon (note: this is capped at $1000 in purchases per month) ✦ 2% back at restaurants, gas stations, supermarkets, Netflix, Spotify, Uber and Lyft. Base: 1% Dine: 2% Gas: 2% Grocery: 2% Other: 5% Card Info: Visa Signature issued by AFCU. This card has no foreign currency conversion fees. Noteworthy perks: No foreign transaction fees; cell phone protection |

FM Mini Review: Good cash back card for everyday spend as long as you do not spend more than $20K per billing cycle (at which point a 2% card would be better). Lack of foreign transaction fees is a positive. No Annual Fee Earning rate: Tier One Rewards (which now requires $1,000 in an Alliant high-yield checking account and 2 electronic transactions per month) offers 2.5% cash back everywhere on up to $10K per billing cycle, then unlimited 1.5% cash back beyond $10K in purchases in a billing cycle. (Note that some purchases, like those from GiftCards.com, are not eligible for cash back) Base: 2.5% Card Info: Visa Signature issued by Alliant. This card has no foreign currency conversion fees. Noteworthy perks: No foreign transaction fees |

FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate $350 Annual Fee Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 1.5X on transit, eligible U.S. shipping, and purchases of $5K or more (up to $100K per year) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Terms and Limitations Apply. (Rates & Fees) |

FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate $350 Annual Fee Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X restaurants ✦ 2X US Supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $150 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Cell phone protection ✦ Terms and Limitations Apply. (Rates & Fees) |

FM Mini Review: Excellent choice for frequent Delta flyers who can make use of SkyClub access and companion certificate. Also a good choice for big spenders seeking Delta elite status. $650 Annual Fee Earning rate: 3X Delta ✦ 1.5X on eligible transit, U.S. shipping & office supply store purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Domestic, Caribbean, or Central American economy or first class companion certificate (subject to taxes & fees) after card renewal ✦ SkyClub access (starting 2/1/25, 15 visits per year (after 15 visits have been used, additional visits can be purchased for $50 each) or earn unlimited visits after spending $75K/calendar year on the card ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when you book your Delta flight with your Reserve card ✦ Earn up to $250 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades ✦ $100 Global Entry fee credit every 4 years (or 4.5 years for TSA Precheck) ✦ Priority boarding ✦ First checked bag free on Delta flights. ✦ Hertz President's Circle Status ✦ Terms and limitations apply. (Rates & Fees) See also: Delta Reserve complete guide |

FM Mini Review: Excellent choice for frequent Delta flyers who can make use of SkyClub access and companion certificate. Also a good choice for big spenders seeking Delta elite status. $650 Annual Fee Earning rate: 3X Delta Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy or first class companion certificate (subject to taxes & fees) after card renewal ✦ SkyClub access (starting 2/1/25, 15 visits per year (after 15 visits have been used, additional visits can be purchased for $50 each) or to earn an unlimited number of visits each year starting on 2/1/25, spend $75K or more on eligible purchases between 1/1/24 and 12/31/24, and each calendar year thereafter. ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when flying Delta ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades ✦ One statement credit every 4 years for the $100 Global Entry application fee or one statement credit every 4.5 years for the $85 TSA Precheck application fee ✦ Priority boarding ✦ First checked bag free on Delta flights. ✦ Hertz President's Circle Status ✦ Terms and limitations apply. (Rates & Fees) See also: Delta Reserve complete guide |

FM Mini Review: Priority boarding and first checked bag free make this a reasonably good option for Delta flyers who do not have elite status. However, those who can make use of an annual companion certificate would do better with the Delta Platinum card. $0 introductory annual fee for the first year, then $150 Earning rate: 2X Delta ✦ 2X U.S. purchases for advertising in select media and U.S. shipping purchases (capped at $50k per year starting 1/1/24) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $200 Delta flight credit after $10K in purchases in a calendar year Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Get up to $150 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays ✦ Priority boarding, and first checked bag free on Delta flights. Terms and limitations apply. (Rates & Fees) |

FM Mini Review: Priority boarding, and free checked bag make this a reasonably good option for Delta flyers who do not have elite status. However, those who can make use of an annual companion certificate would do better with the Delta Platinum card. $0 introductory annual fee for the first year, then $150 Earning rate: 2X Delta ✦ 2x restaurants worldwide ✦ 2x US supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $200 Delta flight credit after $10K in purchases in a calendar year Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Get up to $100 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays ✦ Priority boarding and first checked bag free on Delta flights. Terms and limitations apply. (Rates & Fees) |

FM Mini Review: This card offers an OK welcome offer for a no-fee card, but many/most other cards offer better return for spend. No Annual Fee Earning rate: 2X restaurants worldwide ✦ 2X Delta ✦ 1X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: 20% statement credit on in-flight purchases of food, beverages, and headsets Terms and limitations apply. (Rates & Fees) |

FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Click here for our complete card review $695 Annual Fee Earning rate: 5X flights and prepaid hotels at AmexTravel.com ✦ 1.5X points per dollar on eligible purchases of $5000 or more (on up to $2 million of those purchases per year) ✦ 1.5x on US construction/hardware stores, US electronic goods, and US shipping ✦ 1X elsewhere ✦ Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Select one qualifying airline and receive up to $200 in statement credits per calendar year for qualifying charges ✦ Up to $400 a year in statement credits for Dell purchases ($200, twice-yearly) ✦ Up to $120 in wireless services credits per year ($10 per month) ✦ $100 Global Entry fee reimbursement.✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Gold status. ✦ $189 CLEAR fee reimbursement annually ✦ 35% Airline Bonus: Get 35% points back after you Pay With Points for flights with your selected airline (or premium cabin with any airline). Enrollment required for select benefits See also: Amex Platinum Guide |

FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. $695 Annual Fee Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ $200 prepaid hotel credit per calendar year valid on Fine Hotels & Resorts and The Hotel Collection bookings ✦ Up to $20 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, SiriusXM, and/or The Wall Street Journal ✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ $189 CLEAR fee reimbursement per calendar year ✦ $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card ✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status Enrollement required for some benefits. Terms Apply. (Rates & Fees) See also: Amex Platinum Guide |

FM Mini Review: This card offers an awesome return on US supermarket and worldwide dining spend, putting it at or near the top-of-class in both categories. Dining credits and Uber / Uber Eats credits go a long way towards reducing the sting of this card's annual fee. $250 Annual Fee Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide ✦ 1X points on other purchases. Terms apply. (Rates & Fees) Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $10 in statement credits monthly with participating dining partners (Goldbelly, Wine.com, Milk Bar, Shake Shack, Seamless/Grubhub, Cheesecake Factory) ✦ $10 monthly Uber or Uber Eats credit (use it or lose it each month) ✦ $100 hotel credit on qualifying charges on stays of 2 nights or longer, plus a room upgrade upon arrival, if available with The Hotel Collection at americanexpress.com/hc ✦ Enrollment required for select benefits. |

FM Mini Review: This card is worth considering as your go-to travel card, but only if you value its CLEAR and Lounge Buddy credits. Also note that Amex cards continue to have limited acceptance in many international destinations. Click here for our complete card review $150 Annual Fee Earning rate: ✦ 3X on travel & transit (including flights, hotels, taxis, and rideshares) ✦ 3X dining ✦ 1X points on other purchases. Terms apply. See Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: $189 CLEAR credit annually ✦ $100 LoungeBuddy credit annually Terms Apply. |

$95 Annual Fee Earning rate: ✦ 2X at AmexTravel.com ✦ 1X points on other purchases. Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: None |

FM Mini Review: This card may be a keeper for those who use the monthly credits, but keep only if you also make good use of one or two 4X categories. Click here for our complete card review $375 Annual Fee Earning rate: Earn 4X in combined eligible purchases in the two categories where your business spends the most each billing cycle (capped at $150K spend per calendar year, then 1x): Electronic goods retailers or software and cloud system providers in the U.S. ✦U.S. purchases at restaurants ✦Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S. ✦ U.S. purchases for advertising in select media ✦ U.S. purchases at gas stations ✦ Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways. ✦ 3x on eligible purchases through AmexTravel.com ✦ 1x on all other purchases. Terms apply. Base: 1X (1.55%) Travel: 3X (4.65%) Dine: 4X (6.2%) Gas: 4X (6.2%) Shop: 4X (6.2%) Phone: 4X (6.2%) Biz: 4X (6.2%) Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Earn up to $20 in statement credits each month for eligible purchases at FedEx, Grubhub, and office supply stores. Enrollment required. ✦ Monthly Walmart+ Membership credit when you use the card to pay for monthly Walmart+ membership ✦ Terms Apply. (Rates & Fees) |

FM Mini Review: This card is pricey for one with few perks. Keep only if you make good use of a 3X category. $0 introductory annual fee for the first year, then $175 Earning rate: Earn 3X on one of your choice, 2X on rest. [3X choices: ✦ Airfare purchased directly from airlines ✦ U.S. purchases for advertising in select media ✦ U.S. purchases at gas stations ✦ U.S. purchases for shipping ✦ U.S. computer hardware, software, and cloud computing purchases made directly from select providers. 3X and 2X apply to first $100,000 in purchases in each of the 5 categories per year, 1X point per dollar thereafter. Card Info: Amex Charge Card issued by Amex. This card imposes foreign transaction fees. |

$250 Annual Fee Earning rate: Unlimited 1.5% cash back on eligible charges when you pay within 10 days of your statement closing date. Pay your Minimum Payment Due by your Payment Due Date and the discount is applied to your next statement Base: 1.5% Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Terms and limitations apply. (Rates & Fees) |

FM Mini Review: Great choice for keeping Membership Rewards points alive if you choose to cancel other Membership Rewards earning cards. Click here for our complete card review No Annual Fee Earning rate: ✦ 2x points at US supermarkets, on up to $6,000 per year in purchases (then 1x) ✦ 1x on other purchases Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: ✦ Make 20 or more purchases in a billing period and get 20% more points, less returns and credits ✦ Points transferrable to many airline programs (unusual feature for no-fee card) ✦ Low intro APR: 0% for 15 months on purchases and balance transfers, then a variable rate, currently 13.24% to 24.24% ✦ $0 balance transfer fee. Balance transfers must be requested within 60 days from account opening. Terms apply. See Rates & Fees |

No Annual Fee Earning rate: Make 20 or more purchases in a billing period and get 20% more points, less returns and credits ✦ With 20% more points, earn: 2.4X points at US supermarkets, on up to $6,000 per year in purchases (then 1.2x) ✦ 1.2X on other purchases Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

FM Mini Review: Thanks to the 50% bonus on points earned, this is, in my opinion, one of the strongest mile-earning cards available. Click here for our complete card review $95 Annual Fee Earning rate: ✦ 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x) ✦ 2x points at US gas stations ✦ 1x points on other purchases. Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Earn 50% more points: Use your Card 30 or more times on purchases in a billing period and get 50% more points on those purchases less returns and credits. Terms apply. See Rates & Fees |

$95 Annual Fee Earning rate: Earn 50% more points: Use your Card 30 or more times on purchases in a billing period and get 50% more points on those purchases less returns and credits. With 30 or more purchases, earn: 4.5x points at US supermarkets on up to $6,000 per year in purchases (then 1.5x) ✦ 3x points at US gas stations ✦ 1.5x points on other purchases. Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

FM Mini Review: In my opinion, this is the best of the consumer Amex Platinum cards when you need two cards thanks to Morgan Stanley offering one free authorized user. Unfortunately you do need to have a Morgan Stanley account to apply. $695 Annual Fee Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X prepaid hotels booked with American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $500 after $100K cardmember year spend Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ 1 Free Authorized User ✦ Redeem points for 1 cent each into your Morgage Stanley account ✦ $695 Annual Engagement Bonus for Platinum CashPlus accounts See also: Amex Platinum Guide |

FM Mini Review: Decent no-fee card thanks to its 2X category bonuses, but you do need to have a Morgan Stanley account to apply. No Annual Fee Earning rate: ✦ 2X U.S. Restaurants ✦ 2X select U.S. Department Stores ✦ 2X Car Rentals Purchased Directly from Select Car Rental Companies ✦ 2X Airfare Purchased Directly from Airlines Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Big spend bonus: $100 after $25K card membership year spend Noteworthy perks: Invest with rewards (1 point = 1 cent) |

FM Mini Review: Solid cash back option, especially for those who spend a lot at US Supermarkets and US gas stations $95 Annual Fee Earning rate: ✦ 6% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 6% Cash Back as a statement credit on select U.S. streaming subscriptions. ✦ 3% Cash Back as a statement credit on transit (includes taxis/rideshare, parking, tolls, trains, buses and more). 3% cash back US gas stations ✦ 1% cash back on other purchases ✦ Terms apply. Base: 1% Travel: 3% Gas: 3% Grocery: 6% Shop: 3% Other: 6% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Big spend bonus: $100 after $15K card membership year spend Noteworthy perks: Terms Apply. (Rates & Fees) |

$695 Annual Fee Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ Use Membership Rewards® points for deposits by Schwab to your eligible brokerage account. (For example, 10,000 points = $110) ✦ $100 credit with Schwab holdings of $250,000+ or $200 credit with holdings of $1,000,000+ on approval & each year. See also: Amex Platinum Guide |

No Annual Fee Base: 1.3X (2.02%) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: 30% annual relationship bonus. Terms apply. See Rates & Fees Points earned with this card are not transferable to airline miles unless you also have a premium Membership Rewards card. |

FM Mini Review: 2X rewards for all spend (up to $50K per year) with no annual fee makes this card a winner. Click here for our complete card review No Annual Fee Earning rate: 2X Membership Rewards points on all purchases, up to $50K spend per calendar year (then 1X thereafter). Terms apply. (Rates & Fees) Base: 2X (3.1%) Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

No Annual Fee Earning rate: 2% cash back as a statement credit on all purchases, up to $50K spend per calendar year (then 1% thereafter). Terms apply. Base: 2% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

FM Mini Review: Solid cash back option (cash back given in the form of a statement credit), especially for those who spend a lot at US Supermarkets and US gas stations $0 introductory annual fee for the first year, then $95 Earning rate: ✦ 6% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 6% Cash Back as a statement credit on select U.S. streaming subscriptions. ✦ 3% Cash Back as a statement credit on transit (includes taxis/rideshare, parking, tolls, trains, buses and more). 3% cash back as a statement credit US gas stations ✦ 1% cash back as a statement credit on other purchases ✦ $7 monthly statement credit on Disney Bundle subcription of $12.99 or more. Enrollment required. ✦ Terms apply. Base: 1% Travel: 3% Gas: 3% Grocery: 6% Shop: 3% Other: 6% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Terms Apply. (Rates & Fees) |

No Annual Fee Earning rate: ✦ 3% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 3% cash back as a statement credit at US gas stations on up to $6,000 per year, then 1%. ✦ 3% cash back as a statement credit on U.S. online retail purchases on up to $6,000 per year, then 1% ✦ 1% cash back as a statement credit on other purchases ✦ Terms apply. Base: 1% Gas: 3% Grocery: 3% Shop: 3% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Get $7 back each month after using your Blue Cash Every Day card to spend $12.99 or more each month on an eligible subscription to The Disney Bundle. Terms Apply. (Rates & Fees) |

FM Mini Review: Good choice for those who spend A LOT at US Supermarkets. No Annual Fee Earning rate: ✦ Up to 5% Cash Back as a statement credit at U.S. supermarkets, U.S. gas stations & select U.S. drugstores (Everyday Purchases) ✦ Up to 1% Cash Back as a statement credit on other purchases. ✦ For your first $6,500 in purchases in a reward year, you will earn 1% on Everyday Purchases (5% thereafter), and 0.5% on other purchases (then 1%) ✦ Terms Apply. Base: 1% Grocery: 5% Other: 5% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

FM Mini Review: For Amazon Prime members, this is a great card for Amazon, AWS, and Whole Foods purchases. Note though that Chase and Synchrony offer similar consumer cards. No Annual Fee Earning rate: Prime Members: 5% in Amazon rewards on US purchases at Amazon Business, AWS, Amazon.com, Whole Foods on up to $120K in purchases per calendar year, then 1% ✦ 2% Back in Amazon rewards at US restaurants, US gas stations, and on US wireless telephone services ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Grocery: 5% Shop: 5% Phone: 2% Brand: 5% Other: 2% Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. |

FM Mini Review: Solid cash back card for those who spend a lot within the 5% and 3% categories. Cash back comes in the form of astatement credit. No Annual Fee Earning rate: ✦ 5% US office supply stores and US wireless phone services ✦ 3% your choice from list of categories (e.g. airfare, hotels, car rentals, gas stations, restaurants, select media buys, shipping,computer) ✦ 1% other purchases. 3% and 5% rebates are capped at $50,000 per rebate year and then earn 1% thereafter. Terms Apply. Base: 1% Travel: 3% Gas: 3% Phone: 5% Office: 5% Biz: 3% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

FM Mini Review: This card is loaded with valuable perks that are more than worth the card's annual fee if you stay in Hilton resorts at least twice per year. $550 Annual Fee Earning rate: ✦ 14X Hilton spend ✦ 7X US restaurants, flights booked directly with airlines or amextravel.com, select car rental companies ✦ 3X on all other eligible purchases ✦ Terms & Limitations Apply. Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Additional free night awards after $30K and $60K spend in calendar year Noteworthy perks: ✦Annual Free Night Reward every year upon renewal ✦ Free Diamond Status ✦ Up to $400 Hilton Resort Credit per membership year ($200 semi-annually) ✦ $200 Flight Credit ($50 per quarter for purchases directly with airlines or via Amex Travel) ✦ $100 on-property credit w/ Aspire Card package ✦ Terms Apply. See Rates & Fees See also: Amex Hilton Aspire In-Depth Review |

FM Mini Review: Easy way to secure Hilton Gold status (which offers free breakfast among other perks). Those who want Diamond status may be better off with the Aspire card. $150 Annual Fee Earning rate: ✦ 12X Hilton spend ✦ 6X U.S. restaurants, US Supermarkets, and US gas stations ✦ 4X U.S. Online Retail Purchases ✦ 3X on all other eligible purchases Base: 3X (1.44%) Dine: 6X (2.88%) Gas: 6X (2.88%) Grocery: 6X (2.88%) Shop: 4X (1.92%) Brand: 12X (5.76%) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: ✦ Free night award after $15K spend in calendar year ✦ Diamond elite status with $40K calendar year spend ✦ Terms apply Noteworthy perks: Free Gold status. Diamond status w/ $40K spend. ✦ Up to $200 in Hilton credits ($50 per quarter) ✦ Terms Apply. (Rates & Fees) |

FM Mini Review: Easy way to secure Hilton Gold status (which offers free breakfast among other perks). Amex business cards do not count towards 5/24 status so will not hurt chances of applying for Chase cards. $195 Annual Fee Earning rate: ✦ 12X Hilton spend ✦ 5X on other eligible purchases (on the first $100K in purchases per calendar year, 3X thereafter). ✦ For eligible purchases made from March 28, 2024 through June 30, 2024: 6X on Select Business & Travel Purchases (flights booked directly with airlines or Amex Travel; car rentals booked directly from select car rental companies; US restaurants; US gas stations; wireless telephone services purchased directly from US service provider; US shipping purchases) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Eligible purchases made through June 30, 2024 will count toward a Free Night Award after $15K spend within a calendar year and another Free Night Award after $60K spend. This benefit will no longer be available after June 30, 2024. Diamond elite status with $40K calendar year spend Noteworthy perks: ✦ Free Gold status. Diamond status w/ $40K spend. ✦ Terms Apply. (Rates & Fees) |

FM Mini Review: This card isn't particularly rewarding, but it's good to keep primarily for targeted Amex upgrade offers to the Surpass card. No Annual Fee Earning rate: ✦ 7X Hilton spend ✦ 5X US restaurants, US Supermarkets, and US gas stations ✦ 3X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Gold elite status with $20K calendar year spend Noteworthy perks: ✦ Free Silver status; Gold status with $20K spend. ✦ Terms Apply. (Rates & Fees) |

$0 introductory annual fee for the first year, then $95 Earning rate: 6X Marriott ✦ 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Marriott Gold Elite with $30K annual spend (note this threshold will increase to $35K on January 1, 2019) Noteworthy perks: 1 Free Night Award every year after your Card account anniversary up to 35K points (subject to resort fees) ✦ Receive free premium internet at Marriott properties. See also: Marriott Bonvoy Complete Guide |

FM Mini Review: Decent ultra-premium option for Marriott fans, especially those aiming for lifetime status tiers $650 Annual Fee Earning rate: 3X airfare -on flights booked directly with airlines; 3X restaurants worldwide, 6X Marriott; 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Annual Choice Award with $60K calendar year spend Noteworthy perks: ✦ 85K Free Night Award each year upon renewal ✦ $300 dining credit per membership year ($25/mo) ✦ Platinum Elite status ✦ 25 elite nights credit ✦ Priority Pass membership (Lounges only) with 2 guests ✦ Global Entry fee credit ✦ Free premium internet at Marriott properties Note: Enrollment required for some benefits. See also: Marriott Bonvoy Complete Guide |

$125 Annual Fee Earning rate: 6x at Marriott Bonvoy properties ✦ 4x at restaurants worldwide, U.S. gas stations, wireless telephone services purchased from U.S. suppliers and on U.S. purchases for shipping ✦ 2x on all other eligible purchases. Terms Apply. (Rates & Fees) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn an additional 35k free night certificate (can be topped-up with up to 15k additional points, subject to resort fees) after you spend $60K on purchases in a calendar year Noteworthy perks: Complimentary Marriott Gold elite status ✦ 15 Elite Night Credits each calendar year ✦ 35k Free Night Award every year after card renewal (subject to resort fees) ✦ Complimentary premium Internet access at Marriott properties ✦ Terms Apply (Rates & Fees) See also: Marriott Bonvoy Complete Guide |

$250 Annual Fee Earning rate: 6X Marriott.✦ 4X restaurants & U.S. Supermarkets on up to $15K spend per year ✦ 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: One 50K Free Night Award after $15K calendar year spend. Noteworthy perks: 15 night credit towards elite status every year upon account anniversary ✦ 1,000 bonus points with each qualifying stay ✦ Gold elite status See also: Marriott Bonvoy Complete Guide |

FM Mini Review: The Schwab Investor card offers a decent return via the intro offer, but it isn't very rewarding for ongoing spend. No Annual Fee Earning rate: 1.5% on all eligible purchases Base: 1.5% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Cash back is automatically deposited into your eligible Schwab account. |

No Annual Fee Earning rate: 1.5% on all eligible purchases Base: 1.5% Card Info: Amex issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: See rates & fees. |

$89 Annual Fee Earning rate: 5X at FlyFrontier.com ✦ 3X restaurants Card Info: Mastercard World issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: $100 discount voucher after $2,500 in annual spend. Noteworthy perks: ✦ Keep miles from expiring with one purchase every six months. ✦ Earn 1 elite qualifying mile per dollar spent ✦ No award redemption fee when taxes/fees are paid for with the card. |

$99 Annual Fee Earning rate: 3X Hawaiian Airlines ✦ 2x gas, dining, and office supply stores ✦ 1x everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 40,000 annual bonus miles — 20k miles with $50-$99k annual spend or 40k miles with $100k or more annual spend; Noteworthy perks: One-time 50% off a companion discount on roundtrip coach travel between Hawaii and North America on Hawaiian Airlines |

$99 Annual Fee Earning rate: 3X Hawaiian Airlines ✦ 2x gas, dining, and grocery stores ✦ 1x everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: Two free checked bags when flight is booked through Hawaiian Airlines ✦ One time 50% off companion ticket ✦ $100 off a companion ticket for roundtrip coach travel between Hawaii and North America on Hawaiian Airlines at each account anniversary |

FM Mini Review: $25 per day of in-flight food & beverage credits is pretty interesting. If you fly AA enough to make good use of this, this card is well worthwhile. $195 Annual Fee Earning rate: ✦ 3X AA ✦ 2X hotel and car rentals ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate for up to 2 companions with $20K membership year spend. ✦ Earn up to 15,000 bonus Loyalty Points per status qualification period: Earn 5K bonus points at $20K spend, $40K spend, and $50K spend Noteworthy perks: $25 per day in-flight food & beverage credit ✦ First checked bag free ✦ Priority Boarding ✦ $100 Global Entry application fee credit ✦ 25% off in-flight purchases ✦ $50 wifi credit per membership year ✦ Round up purchases to earn more miles |

$99 Annual Fee Earning rate: 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate with $20K membership year spend. Noteworthy perks: First checked bag free ✦ Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation ✦ 25% off in-flight purchases ✦ $25 wifi credit per membership year ✦ Flight cents: round up purchases to earn more miles |

$95 Annual Fee Earning rate: ✦ 2X AA, office supply, telecommunications services, and at car rental agencies ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: $99 companion certificate with $30K account year spend Noteworthy perks: ✦ First checked bag free ✦ Preferred boarding ✦ 5% bonus on miles earned the previous year after AF is paid ✦ 25% statement credit on in-flight purchases |

FM Mini Review: Frequent JetBlue travelers should seriously consider this card for its terrific perks. The combination of the 10% rebate on awards and the annual 5,000 point bonus make this card a keeper. $99 Annual Fee Earning rate: 2X restaurants and grocery ✦ 6X JetBlue ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 tile for every $1,000 in purchases. Noteworthy perks: ✦ Free checked bag ✦ 5000 bonus points every anniversary ✦ 10% point rebate on awards ✦ $100 statement credit w/ purchase of travel package ✦ 50% savings on in-flight purchases |

FM Mini Review: This card is almost identical to the JetBlue Plus card except that this one offers Group A boarding and earns 2X at office supply stores rather than grocery stores. Both cards are great choices for JetBlue flyers. $99 Annual Fee Earning rate: ✦ 2X restaurants and office supply stores ✦ 6X JetBlue ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 tile for every $1,000 in purchases. Noteworthy perks: ✦ Free checked bag ✦ Group A boarding ✦ 5000 bonus points every anniversary ✦ 10% point rebate on awards ✦ $100 statement credit w/ purchase of travel package ✦ 50% savings on in-flight purchases |

FM Mini Review: Not bad for a fee-free airline card. No Annual Fee Earning rate: ✦ 2X restaurants and grocery ✦ 3X JetBlue ✦ 1X everywhere else✦ Card Info: Mastercard World issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 tile for every $1,000 in purchases. Noteworthy perks: 50% savings on eligible inflight purchases including cocktails, food and movies. |

$89 Annual Fee Earning rate: 2X Miles & More Card Info: Mastercard World issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: Cardmembers receive a companion ticket and two complimentary Lufthansa Business Lounge vouchers after first purchase and each year after paying the annual fee |

$99 Annual Fee Earning rate: 3X Emirates ✦ 2X airfare, hotel, and car rentals ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Maintain Emirates Skywards Silver status with $20K spend per membership year (Silver status offers cardmember lounge access to Emirates Business Class lounges in Dubai only) Noteworthy perks: 25% discount when buying miles ✦ No foreign transaction fees |

$499 Annual Fee Earning rate: 3X Emirates ✦ 2X airfare, hotel, and car rentals ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: 10K bonus miles with $30K spend per membership year ✦ Maintain Emirates Skywards Gold status with $40K spend per membership year (Gold status offers cardmember and guest lounge access to Emirates Business Class lounges worldwide) Noteworthy perks: Priority Pass Select ✦ Global Entry Fee Credit ✦ 25% discount when buying miles ✦ No foreign transaction fees |

$0 introductory annual fee for the first year, then $89 Earning rate: 2X Miles on all purchases Base: 2X (2%) Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: Get 5% Miles back when redeeming for travel ✦ Chip wth PIN capability ✦ No foreign transaction fees ✦ Redeem miles for travel statement credits at 1 cent per point ✦ See Rates & Fees |

FM Mini Review: This card is best for earning JAL miles, which can be very valuable. If you spend exactly $15K or $25K per year, you can earn an effective 1.76 Japan Airlines miles per dollar or 2.14 miles per dollar with other transfer partners. Points can alternatively be redeemed for 1 cent each towards travel. $150 Annual Fee Earning rate: 2X Miles on all purchases Base: 2X (2%) Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: 15K bonus miles after $15K spend; 10K additional bonus miles after additional $10K spend Noteworthy perks: ✦ Chip wth PIN capability ✦ $100 Global Entry credit once every 5 years ✦ Lounge Key access (pay $27 per lounge visit) ✦ Transfer to most airline partners 1.4 Arrival to 1 airline mile (or 1.7 Arrival to 1 Japan Airlines or Air Canada Aeroplan mile). |

No Annual Fee Earning rate: ✦ 2X Miles for travel and dining ✦ 1X everywhere else Card Info: Mastercard World issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Get 5% Miles back when redeeming for travel ✦ Free FICO scores ✦ Chip wth PIN capability |

FM Mini Review: This card is great for its signup bonus (when the 45K bonus is available). For some, the card is worth keeping for its 6,000 bonus points per year + status w/ Wyndham & Caesar's. $75 Annual Fee Earning rate: ✦ 5X Wyndham ✦ 2X gas, utility, & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: 6,000 bonus points every account anniversary ✦ Platinum status (matches to Caesar's Total Rewards Platinum) |

No Annual Fee Earning rate: ✦ 3X Wyndham ✦ 2X gas, utility & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: Gold status |

FM Mini Review: Sign up for the bonus. Keep for the 10% award discount. No Annual Fee Earning rate: ✦ 5X Wyndham & gas ✦ 2X restaurants & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: 7,500 points each anniversary year after $15K spend Noteworthy perks: Gold status ✦ 10% discount on free night awards ✦ Cardmember discount on paid stays ✦ No foreign transaction fees |

FM Mini Review: Not bad, but the business version is better. $75 Annual Fee Earning rate: 6X Wyndham & gas ✦ 4X restaurants & grocery ✦ 1X everywhere else Card Info: Visa Signature or Platinum issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: 7,500 points each anniversary year ✦ Platinum status ✦ 10% discount on free night awards ✦ Cardmember discount on paid stays ✦ No foreign transaction fees |

FM Mini Review: Excellent earning rate at gas stations and Wyndham hotels. Diamond status plus 15K annual bonus makes this card a keeper. $95 Annual Fee Earning rate: 8X Wyndham & gas ✦ 5X marketing, advertising, and utilities (telecommunications, cable, satellite, electric, gas, heating oil and water) ✦ 1X everywhere else Card Info: Visa Signature issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: 15,000 points each anniversary year ✦ Diamond status ✦ 10% discount on free night awards ✦ Cardmember discount on paid stays ✦ No foreign transaction fees |

FM Mini Review: This card could be decent for an easy cash back bonus, but there are much more rewarding options for ongoing everyday spend. No Annual Fee Earning rate: Earn 1.529% back on your purchases when your Upromise Program account is linked to an eligible College Savings Plan or 1.25% if it is not ✦ Up to $250 cashback rewards per calendar year on gift card purchases at MyGiftCardsPlus Base: 1.25% Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: When your Upromise Program account is directly linked to an eligible 529 College Savings plan, you'll receive a 1.529% cash back (otherwise, you get 1.25% back) |

No Annual Fee Earning rate: Earn 5x on eligible Priceline.com purchases. Earn 2x on gas and restaurants. Base: 1% Dine: 2% Gas: 2% Brand: 5% Card Info: Visa issued by Barclays. This card has no foreign currency conversion fees. |

FM Mini Review: Points are worth $0.01 each toward paid travel. This card might be worth it for the bonus if you know you'll make good use of BreezePoints. Long term, it only makes sense if you frequently fly Breeze Airways -- and even then, there are other cards that might be as good or better for airfare purchases depending on how you value transferable points vs airline-specific penny points. $89 Annual Fee Earning rate: 5X on Breeze Airways Nicer and Nicest Bundles & Trip Add-ons ✦ 2X on Breeze Airlines Nice Bundles ✦ 2X grocery ✦ 2X restaurants ✦ 1X everywhere else (including Breeze flights) Base: 1% Dine: 2% Grocery: 2% Card Info: Visa issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: One-way bundle upgrade with every $15K in purchases Noteworthy perks: 7,500 BreezePoints after every account anniversary with $10K in cardmember year purchases ✦ Priority Boarding ✦ Complimentary Inflight WiFi |

No Annual Fee Earning rate: 1.5% everywhere Base: 1.5% Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: When you redeem, earn 5% back towards next redemption. e.g. Redeem $100 cash back, earn $5 bonus towards next redemption. Note that redemptions start at $50 ✦ Enjoy a 0% introductory APR for 15 months on Balance Transfers made within 45 days of account opening. After that, a variable APR will apply |

No Annual Fee Earning rate: 3% drugstores and gas stations ✦ 2% medical expenses ✦ 1% everywhere else Base: 1% Gas: 3% Other: 3% Card Info: Mastercard issued by Barclays. This card imposes foreign transaction fees. |

No Annual Fee Earning rate: 3% airfare, hotel stays, and car rentals ✦ 2% restaurants ✦ 1% everywhere else Base: 1% Travel: 3% Dine: 2% Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. |

FM Mini Review: While the initial bonus is not very generous, the uncapped 3x earnings in a category of your choice (from ten options) each quarter could make this card interesting. No Annual Fee Earning rate: Choose one of ten categories for 3x and one for 2x each quarter, then 1x everywhere else. Must choose 3x and 2x categories before each quarter starts or all purchases will default to 1x. You may select your categories as early as the first day of the preceeding quarter. Bonus categories are not capped. Base: 1X (1%) Card Info: Visa issued by BBVA. This card imposes foreign transaction fees. |

FM Mini Review: This card offers a decent cash back bonus and nice ongoing perks for a card with no annual fee. While the 1.5% earnings rate is not special, the card may be appealing in situations where you anticipate price protection or travel protections being useful. No Annual Fee Earning rate: 1.5% everywhere Base: 1.5% Card Info: Visa issued by BECU. This card has no foreign currency conversion fees. Noteworthy perks: Price protection (up to $500 per claim / $2500 per year) ✦ Lost and delayed baggage protection ✦ Trip cancellation / interruption protection |

FM Mini Review: Alaska miles are quite valuable so this offer is better than it appears $95 Annual Fee Earning rate: 3X Alaska Airlines ✦ 2x gas, EV charging, local transit, rideshare, cable, and select streaming services purchases ✦ 1X elsewhere Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: $121 companion pass every year after $6K spend. Noteworthy perks: ✦ Free first checked bag for you and up to six other passengers on your reservation ✦ Priority Boarding ✦ 10% bonus on earned miles with eligible BOA account ✦ During 2024, earn 4K EQMs/$10K spend, up to a maximum of 20K EQMs. |

FM Mini Review: Alaska miles are quite valuable so this offer is better than it appears $95 Annual Fee Earning rate: 3X Alaska Airlines ✦ 2x gas, EV charging, shipping and local transit ✦ 1X elsewhere Card Info: Visa issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: $121 companion pass every year after $6K spend. Noteworthy perks: ✦ Free first checked bag for you and up to six other passengers on your reservation ✦ 10% bonus on earned miles with eligible BOA business account ✦ During 2024, earn 4K EQMs/$10K spend, up to a maximum of 20K EQMs. |

$90 Annual Fee Earning rate: 3X Virgin Atlantic ✦ 1.5X everywhere else Card Info: Mastercard World Elite issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: Companion award ticket with $25K annual spend ✦ 7,500 bonus points with $15K cardmember year spend + an additional 7,500 points with $25K cardmember year spend ✦ 25 tier points towards elite status per $2,500 spend (max 50 tier points per month). |

FM Mini Review: Valuable primarily only for the welcome offer, then it should go off to the sock drawer unless you're interested in Flying Blue elite status. Click here for our complete card review $89 Annual Fee Earning rate: 3X on Air France, KLM, and SkyTeam purchases ✦ 1.5X everywhere else Card Info: Mastercard World Elite issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: 5K after anniversary when you spend $50 or more the previous year ✦ 40XP points towards status after anniversary when you spend $15K or more the previous year Noteworthy perks: 20 Experience Points every year; Miles don't expire as long as you make a purchase once every 2 years. |

$49 Annual Fee Earning rate: ✦ 3X Virgin Atlantic ✦ 1X elsewhere Card Info: Mastercard World Elite issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: 2,500 bonus points with $5K cardmember year spend + an additional 5,000 points with $15K cardmember year spend; |

$99 Annual Fee Earning rate: ✦ 2X gas and grocery ✦ 3X Asiana. Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: ✦ 10,000 points awarded annually ✦ $100 annual rebate on Asiana ticket purchases ✦ 2 lounge invitations every year on card anniversary |

$80 Annual Fee Earning rate: 2X Asiana Card Info: Visa issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: 2 X $100 credits annually on U.S. departure Asiana operated flights. |

FM Mini Review: Best for those who stay often at Sonesta hotels $0 introductory annual fee for the first year, then $75 Earning rate: 2X airfare, car rental and dining ✦ 3X Sonesta Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: 30K bonus points with $7.5K cardmember year spend Noteworthy perks: Instant upgrade to Sonesta Travel Pass Elite (free club access or continental breakfast plus other perks) |

No Annual Fee Earning rate: 1.5X everywhere; 3X for travel booked through BOA's travel center Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: Up to 75% bonus for Preferred Rewards banking customers |

No Annual Fee Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, this card earns: 2.625X points for all spend (and 5.25X for travel purchased through BOA's travel center) Base: 2.625X (2.63%) Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. |

No Annual Fee Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status Base: 1.5X (1.5%) Card Info: Visa Signature issued by BOA. This card imposes foreign transaction fees. Noteworthy perks: Up to 75% bonus for Preferred Rewards banking customers |

No Annual Fee Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status. Note that you'll need Preferred Rewards on the business side ("Preferred Rewards for Business") to earn a greater return. Base: 1.5X (1.5%) Card Info: Mastercard issued by BOA. This card imposes foreign transaction fees. Noteworthy perks: Up to 75% bonus for Preferred Rewards for Business banking customers |

No Annual Fee Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status Base: 2.625X (2.63%) Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. |

No Annual Fee Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status Base: 2.625X (2.63%) Card Info: Mastercard issued by BOA. This card has no foreign currency conversion fees. |

No Annual Fee Base: 1X (1%) Card Info: Visa issued by BOA. This card has no foreign currency conversion fees. |

FM Mini Review: This card has best-in-class earnings for those with $100K+ invested with BOA. With that level of investment, you would earn 3.5X travel & dining and 2.62X everywhere else. $95 Annual Fee Earning rate: ✦ 2X travel and dining ✦ 1.5X everywhere else Base: 1.5% Travel: 2% Dine: 2% Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: ✦ $100 annual airline incidentals fee reimbursement ✦ $100 Airport Security Statement Credit towards TSA Pre✓ ® or Global Entry Application fee, every four years ✦ Up to 75% bonus for Preferred Rewards banking customers |

$95 Annual Fee Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, earn: 3.5X travel and dining ✦ 2.625X everywhere else Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. |

FM Mini Review: With $100K+ invested with BOA / Merrill Edge or Merrill Lynch, you would earn 3.5X travel & dining and 2.62X everywhere else. With the 20% discount on flights booked via the BOA Travel Center, this card effectively earns 4.375% on travel & dining and 3.28% back everywhere else when used toward flights for those with Platinum Honors status. $550 Annual Fee Earning rate: ✦ 2X travel and dining ✦ 1.5X everywhere else Base: 1.5% Travel: 2% Dine: 2% Card Info: Visa Infinite issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual airline incidentals fee reimbursement ✦ $150 lifestyle conveniences reimbursement (streaming services, food delivery, fitness subscriptions and rideshare services) ✦ $100 Airport Security Statement Credit towards TSA Pre✓ ® or Global Entry Application fee, every four years ✦ Up to four Priority Pass Select accounts ✦ Up to 75% bonus for Preferred Rewards banking customers ✦ 20% discount when redeeming points for domestic or international airfare in any cabin class through Bank of America Travel Center or concierge |

No Annual Fee Earning rate: 3% back on your choice of the following: gas and EV chargng, online shopping, cable, streaming, internet & phone plans, dining, travel, drugstores, home improvement & furnishings (can choose a new category monthly). ✦ 2% back at grocery stores & wholesale clubs ✦ 1% back everywhere else. 2% and 3% rewards are capped at $2500 in combined purchases per quarter Base: 1% Travel: 3% Dine: 3% Gas: 3% Grocery: 2% Shop: 3% Phone: 3% Other: 3% Card Info: Visa Signature issued by BOA. This card imposes foreign transaction fees. Noteworthy perks: Up to 75% bonus for Preferred Rewards banking customers |

No Annual Fee Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, earn: 3.5% at grocery stores and wholesale clubs and 5.25% on gas up to the first $2,500 in combined purchases each quarter Base: 1.75% Travel: 5.25% Dine: 5.25% Gas: 5.25% Grocery: 3.5% Shop: 5.25% Other: 5.25% Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. |

No Annual Fee Earning rate: 2% at grocery stores and wholesale clubs and 3% on one category of your choice between gas, online shopping, dining, travel, drug stores, or home improvement/furnishings (can choose a new category monthly) up to the first $2,500 in combined 2% and 3% category purchases each quarter, then 1%. Base: 1% Travel: 3% Dine: 3% Gas: 3% Grocery: 2% Shop: 3% Other: 3% Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: Up to 75% bonus for Preferred Rewards banking customers |

No Annual Fee Earning rate: 2% on dining plus 3% on 1 choice from: gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services (for the first $50,000 in combined choice/dining purchases each calendar year, 1% thereafter) and 1% everywhere else. Base: 1% Travel: 3% Dine: 2% Gas: 3% Phone: 3% Office: 3% Biz: 3% Card Info: Mastercard issued by BOA. This card imposes foreign transaction fees. Noteworthy perks: When you're a Business Advantage Relationship Rewards client, you can get up to 75% rewards bonus on every purchase you make. This means that you can earn up to 5.25% with this card! Your rewards bonus is based on your enrolled tier – Gold 25%; Platinum 50%; or Platinum Honors 75%. |

No Annual Fee Earning rate: With Platinum Honors status with Bank of America's Business Advantage Relationship Rewards program, this card earns: 3.5% on dining plus 5.25% on 1 choice from: gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services (for the first $50,000 in combined choice/dining purchases each calendar year, 1.75% thereafter) and 1.75% everywhere else. Base: 1.75% Travel: 5.25% Dine: 3.5% Gas: 5.25% Phone: 5.25% Office: 5.25% Biz: 5.25% Card Info: Mastercard issued by BOA. This card has no foreign currency conversion fees. |

FM Mini Review: No rewards on everyday purchases, but a nice sign-up bonus for a no annual fee card. No Annual Fee Base: 0% Card Info: Mastercard Platinum issued by BOA. This card imposes foreign transaction fees. |

No Annual Fee Earning rate: 1.5X everywhere; 3X for travel booked through BOA's travel center Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: When you're a Business Advantage Relationship Rewards client, you can get up to 75% rewards bonus on every purchase you make. Your rewards bonus is based on your enrolled tier – Gold 25%; Platinum 50%; or Platinum Honors 75% |

No Annual Fee Earning rate: With Platinum Honors status with Bank of America's Business Advantage Relationship Rewards program, this card earns: 2.625X points for all spend (and 5.25X for travel purchased through BOA's travel center) Base: 2.625X (2.63%) Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. |

No Annual Fee Earning rate: 2X Spirit Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: ✦ 5K bonus miles each anniversary when you spend $10K within prior year Noteworthy perks: Points Pooling ✦ 25% in-flight food & beverage rebate ✦ No points expiration ✦ No foreign transaction fees ✦ Zone 2 priority boarding |

$0 introductory annual fee for the first year, then $79 Earning rate: 3X Spirit ✦ 2X dining & grocery ✦ 1X everywhere else Card Info: Mastercard World Elite issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: ✦ $100 Companion Flight Voucher EACH anniversary after making at least $5,000 in purchases within the prior year Earn ✦ 1 SQP (towards elite status) for each $10 of spend Noteworthy perks: Waived redemption fees ✦ Points Pooling ✦ 25% in-flight food & beverage rebate ✦ No points expiration ✦ No foreign transaction fees ✦ Zone 2 priority boarding |

FM Mini Review: Spirit awards start as low as 2500 miles one-way off peak, but miles expire with 3 months of inactivity. $59 Annual Fee Earning rate: 2X everywhere Base: 2X (2.4%) Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. Big spend bonus: ✦ 5K bonus miles when you spend $10K annually and pay your annual fee Noteworthy perks: Zone 2 priority boarding |

FM Mini Review: Points are worth $0.01 each toward onboard credit or cruise purchase with Norwegian. Note that points expire 5 years after they are earned regardless of activity. This card offers very poor value for ongoing spend after meeting the welcome bonus requirements. Interestingly, it appears to be eligible for Bank of America Preferred Rewards, which would increase the bonus categories by as much as 75% for those with Bank of America's top-tier Platinum Honors. No Annual Fee Earning rate: 3x Norwegian cruise line purchases ✦ 2x air and hotel Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. |

FM Mini Review: Points are worth $0.01 each toward onboard credit or cruise purchase with Royal Caribbean. You can earn a max of 540,000 points per year. Points expire 5 years after the month in which they are earned regardless of acivity. This card offers very poor value for ongoing spend and you may earn a more valuable welcome bonus with less required spend with other cards. No Annual Fee Earning rate: 2x Royal Caribbean, Celebrity Cruises, and Azamara Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. |

FM Mini Review: Points are worth $0.01 each toward onboard credit or cruise purchase with Celebrity. You can earn a max of 540,000 points per year. Points expire 5 years after the month in which they are earned regardless of acivity. This card offers very poor value for ongoing spend and you may earn a more valuable welcome bonus with less required spend with other cards. No Annual Fee Earning rate: 2x Royal Caribbean, Celebrity Cruises, and Azamara Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. |

FM Mini Review: Points are worth $0.01 each toward airfare and do not expire unless you cancel the card. If you cancel the card, you forfeit all points. Between that policy and the annual fee, this card probably isn't worth it in most scenarios. $59 Annual Fee Earning rate: 3x Allegiant ✦ 2x dining Card Info: Mastercard World issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: Priority Boarding and one free beverage every time you fly Allegiant and show your card. ✦ BOGO airfare when you use your card to buy a vacation package with at least a 4-night hotel stay or 7-day car rental on a single itinerary |

No Annual Fee Earning rate: 3% travel & AAA ✦ 2% gas, grocery store, wholesale club and drugstore purchases ✦ 1% back everywhere else Base: 1% Travel: 3% Gas: 2% Grocery: 2% Shop: 2% Brand: 3% Other: 2% Card Info: Visa Signature issued by BOA. This card has no foreign currency conversion fees. Noteworthy perks: No foreign transaction fees |

FM Mini Review: This card earns 2 "miles" per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review $95 Annual Fee Earning rate: 2X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees |

FM Mini Review: This card offers annual rebates that easily mitigate the fee for those who travel often. Authorized users are free and also get access to perks like Priority Pass, Capital One Lounges, Plaza Premium lounges, and more. The card earns 2 "miles" per dollar on most purchases just like the Capital One Venture Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One huge advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review $395 Annual Fee Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5x miles on flights booked via Capital One travel. ✦ 2X miles everywhere else. Card Info: Visa Infinite issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual credit for bookings made through Capital One Travel ✦ 10,000 bonus miles each year starting at first anniversary ✦ Up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Capital One Lounge access ✦ Priority Pass membership w/ unlimited guests (lounges only) ✦ Plaza Premium lounge access ✦ Cell phone insurance ✦ Trip insurance ✦ Primary CDW coverage ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

FM Mini Review: Similar to the Venture X consumer card, the business version offers annual rebates that easily mitigate the fee for those who travel often and could be worth it for the lounge access and travel protections given the cost/benefit ratio. Unlike the Venture X, free authorized users do not get Priority Pass access. The card earns 2 "miles" per dollar on most purchases just like the Capital One Venture X Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review $395 Annual Fee Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5x on flights booked via Capital One travel. ✦ 2X everywhere else. Card Info: Visa issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual credit for bookings made through Capital One Travel ✦ 10,000 bonus miles starting at first anniversary ✦ Up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Capital One Lounge Access ✦ Priority Pass w/ unlimited guests (includes restaurants) ✦ Plaza Premium lounge access ✦ Cell phone insurance ✦ Trip insurance ✦ Primary CDW coverage ✦ Redeem miles for travel at 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

FM Mini Review: Decent welcome bonus for a card with no annual fee, but other cards offer better rewards for ongoing spend. Click here for our complete card review No Annual Fee Earning rate: 1.25X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

FM Mini Review: While you can do better with a 2% cash back card that has no annual fee, the Quicksilver card often offers excellent discounts with popular services such as Uber or Spotify. No Annual Fee Earning rate: 1.5% everywhere ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 1.5% Other: 5% Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: No foreign transaction fees ✦ Up to 6 months of complimentary Uber One membership statement credits through 11/14/2024 |

No Annual Fee Earning rate: 3% on dining, entertainment, select streaming services, and purchases at grocery stores (excluding superstores like Walmart® and Target®) ✦ 8% cash back on Capital One Entertainment purchases ✦ 5% on hotels and rental cars booked via Capital One Travel (terms apply) ✦ 1% everywhere else Base: 1% Dine: 3% Grocery: 3% Other: 3% Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Complimentary Uber One membership statement credits through 11/14/2024 ✦ No foreign transaction fees |

FM Mini Review: Excellent cash back card for dining and entertainment spend. $0 introductory annual fee for the first year, then $95 Earning rate: 4% cash back on dining, entertainment, and popular streaming services ✦ 3% at grocery stores ✦ 1% everywhere else ✦ 8% cash back on Capital One Entertainment purchases ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 1% Dine: 4% Grocery: 3% Other: 4% Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: No foreign transaction fees |

FM Mini Review: This card is similar to the Spark Cash Plus card, but it has the advantage that "miles" earned with this card can be transferred to a large number of airline & hotel programs. $0 introductory annual fee for the first year, then $95 Earning rate: 2X Miles everywhere ✦ Earn 5X miles on hotel and rental car bookings through Capital One Travel Base: 2X (2.9%) Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees ✦ Up to $100 fee credit for TSA Pre✓® application fee or Global Entry application fee |

FM Mini Review: This card is similar to the Spark Cash Select for Business, but rewards are intended to be used to offset travel purchases. This is a good option for business owners who prefer simple rewards with no annual fee, and who value free travel over cash back. If you spend more than $19K per year, though, go for the 2X Spark Miles card. No Annual Fee Earning rate: 1.5X miles everywhere ✦ Earn 5X miles on hotel and rental car bookings through Capital One Travel Base: 1.5X (2.18%) Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees |

FM Mini Review: Many cards offer unlimited 2% cash back, but this is the only business card I know of that does so. This is a good option for business owners who prefer simple cash back rewards. $0 introductory annual fee for the first year, then $95 Earning rate: 2% everywhere Base: 2% Card Info: Visa Signature issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: No foreign transaction fees |

FM Mini Review: This may be a good option for business owners who prefer simple cash back rewards. Note that this is a pay-in-full card, so your balance is due in full every month. $150 Annual Fee Earning rate: 2% everywhere ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 2% Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Big spend bonus: Get $150 annual fee refunded every year you spend at least $150,000 Noteworthy perks: No foreign transaction fees ✦ No preset spending limit |

FM Mini Review: This is a good option for business owners looking for simple cash back rewards with no annual fee. If you spend $30,000 or more per year, though, you would be better off with the 2% Spark Cash Plus card. No Annual Fee Earning rate: 1.5% everywhere ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 1.5% Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: No foreign transaction fees |

FM Mini Review: By means of "Rocket Points" this is really a 1.25%-5% cashback card. Could be useful to build some cash towards a down payment, lackluster otherwise. $95 Annual Fee Earning rate: 5x Rocket Points everywhere Base: 1.25% Card Info: Visa Signature issued by Celtic. This card has no foreign currency conversion fees. Noteworthy perks: Points can be redeemed towards down payment or closing costs at 5% cash back value ($8,000 max per loan), towards Rocket Mortgage principal at 2% cash back value or towards statement credits at 1.25% cash back value |

FM Mini Review: For Amazon Prime members, this is a great card for Amazon, AWS, and Whole Foods purchases. No Annual Fee Earning rate: Prime Members: 5% in Amazon rewards on US purchases at Amazon.com and Amazon physical stores ✦ 5% back at Whole Foods ✦ 5% back on Chase Travel purchases ✦ 2% Back in Amazon rewards at US restaurants, local transit and commuting (including rideshare), US gas stations, and drugstores ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Grocery: 5% Shop: 5% Brand: 5% Other: 2% Card Info: Visa Credit Card issued by Chase. This card has no foreign currency conversion fees. |

FM Mini Review: Not as compelling as the Prime Visa Card and, if you buy enough Amazon items to be interested in it, you should probably be a Prime member anyway. No Annual Fee Earning rate: 3% in Amazon rewards on US purchases at Amazon.com and Amazon physical stores ✦ 3% back at Whole Foods ✦ 3% back on Chase Travel purchases ✦ 2% Back in Amazon rewards at US restaurants, local transit and commuting (including rideshare), US gas stations, and drugstores ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Grocery: 3% Shop: 3% Brand: 3% Other: 2% Card Info: Visa Credit Card issued by Chase. This card has no foreign currency conversion fees. |

FM Mini Review: This card only earns 1% back in the form of "Disney Dream Dollars" and the meet & greet is also available on the Disney debit card. However, the current signup bonus makes it worth a look. No Annual Fee Earning rate: This card only earns 1% back in the form of "Disney Dream Dollars" on most purchases (and 2% in bonus categories) and the meet & greet is also available on the Disney debit card. However, the current signup bonus makes it worth a look. Base: 1% Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Character meet & greet at a private cardmember area ✦ 10% off select merchandise purchases of $50 or more at Disney Store and DisneyStore.com |

FM Mini Review: This card only earns 1% back in the form of "Disney Dream Dollars" and the meet & greet is also available on the Disney debit card. However, the current signup bonus makes it worth a look. $49 Annual Fee Earning rate: 2X grocery stores, restaurants, gas stations, and most Disney locations ✦ 1X everywhere else Base: 1% Dine: 2% Gas: 2% Grocery: 2% Brand: 2% Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: ✦ Redeem rewards dollars toward a statement credit for air travel (book any airline / any destination and redeem rewards dollars at a minimum of $50 in rewards dollars) ✦ Character meet & greet at a private cardmember area ✦ 10% off select merchandise purchases of $50 or more at Disney Store and DisneyStore.com ✦ |

FM Mini Review: Good choice for a nice intro bonus. Award rebate makes the card a keeper if you frequently book awards from the US to Europe. $95 Annual Fee Earning rate: 3X British Airways. Iberia, Aer Lingus, and LEVEL ✦ 2X hotel accommodations booked directly with the hotel ✦ 1X elsewhere Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Every calendar year you make $30,000 in purchases on your British Airways Visa card, you’ll earn a Travel Together companion Ticket good for two years. Noteworthy perks: Up to $600 per year in award fee rebates ✦ 10% off BA flights originating in the US. ✦ No foreign transaction fees |

FM Mini Review: Good choice for a nice intro bonus. Unless you fly Iberia often or intend to go for the big spend bonus, though, I don't see it as a compelling card to keep past the first year. $95 Annual Fee Earning rate: 3X British Airways. Iberia, Aer Lingus, and LEVEL ✦ 2X hotel accommodations booked directly with the hotel ✦ 1X elsewhere Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Every calendar year you make $30,000 in purchases on your Iberia Visa card, you’ll earn a discount voucher good for $1,000 to use toward two tickets on the same flight Noteworthy perks: 10% off on Iberia flights when you use your Iberia Visa to purchase at iberia.com/Chase10 ✦ No foreign transaction fees |

FM Mini Review: Good choice for a nice intro bonus. Unless you intend to go for the big spend bonus, though, I don't see it as a compelling card to keep past the first year. $95 Annual Fee Earning rate: 3X British Airways. Iberia, Aer Lingus, and LEVEL ✦ 2X hotel accommodations booked directly with the hotel ✦ 1X elsewhere Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Every calendar year you make $30,000 in purchases on your Aer Lingus Visa card, you’ll earn an economy class companion ticket good for 1 year. Noteworthy perks: Priority Boarding on Aer Lingus flights departing from and returning to the US from Ireland ✦ No foreign transaction fees. |