Yesterday, Amex and Chase unveiled details about the new branding and other changes soon to come to their Marriott and SPG credit cards. I covered the details here: Marriott Bonvoy credit card changes announced. As changes often do, these changes create opportunities which I’ll discuss below. But first, here’s a summary of the changes:

| Current Card | New Name, New Features |

|---|---|

| SPG (Starwood Preferred Guest) | Marriott Bonvoy™ American Express® Card (as of Feb 13 2019)

|

| SPG Business (Starwood Preferred Guest Business Credit Card) |

Update: This offer has expired as of 4/24/19. Marriott Bonvoy Business™ American Express® Card (as of Feb 13 2019)

|

| SPG Lux (Starwood Preferred Guest Luxury Card from American Express) |

Update: This offer has expired as of 4/24/19. Marriott Bonvoy Brilliant™ American Express® Card (as of Feb 13 2019)

|

| Chase Marriott Rewards Premier Plus | Marriott Bonvoy Boundless™ Credit Card (as of Feb 28 2019)

|

| Chase Marriott Rewards Premier Business Plus | Marriott Bonvoy Premier Plus Business (as of Feb 28 2019)

|

| Chase Ritz Carlton Rewards Visa Infinite | The Ritz-Carlton Card

|

| Chase Marriott Rewards Premier | New name has not yet been announced |

Opportunities

The announced changes present opportunities that may appeal to some:

- Last chance to sign up for the Amex SPG card by Feb 12th. The card’s annual free night certificate for a room costing up to 35K points is arguably worth far more than the card’s $95 annual fee. Even if you can’t qualify for the current 75K welcome bonus with this card (because you’ve had it before, for example), it may be worth getting for the annual free night.

- UPDATE: I have since learned that even after Feb 12, it should be possible to product change from the high-end Brilliant card (né SPG Lux) to the regular Bonvoy Amex (né SPG). This means that it will still be possible to get the $95 Bonvoy card well into the future by first signing up for the Brilliant card and then downgrading a year later.

- Last chance to sign up for the Chase Marriott Business Plus card by Feb 12th. Same argument as above: the card’s annual free night certificate for a room costing up to 35K points is arguably worth far more than the card’s $99 annual fee. Even if you can’t qualify for the current 75K welcome bonus with this card (because you’ve received a welcome bonus for the SPG business or luxury card within 24 months, for example), it may be worth getting for the annual free night alone.

- Wait until Feb 13th to sign up for the Amex Bonvoy Business card or the Amex Bonvoy Brilliant card in order to secure a 100K offer rather than the current 75K offers.

- Wait until Feb 28th to sign up for the Chase Bonvoy Boundless card in order to secure a 100K offer rather than the current 75K offer.

Are you eligible for a Marriott card?

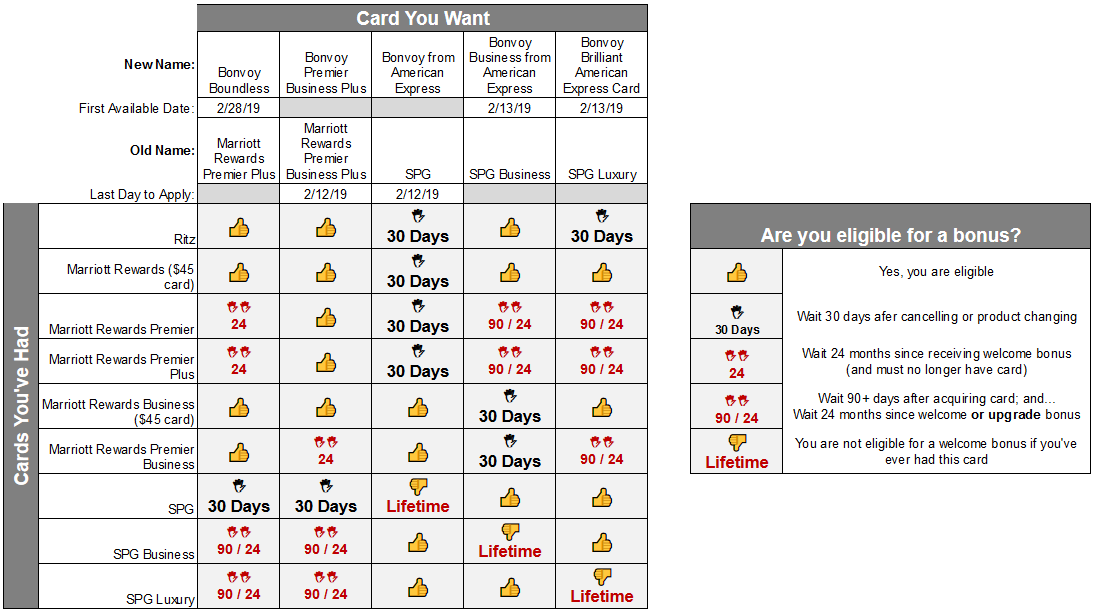

Unfortunately, Amex, Chase, and Marriott have conspired to make it very difficult to get a bonus on a Marriott card if you’ve had any sort of Marriott, SPG, or Ritz card in the past (or now). The following chart shows the eligibility rules for earning a welcome bonus. While I don’t know this for sure, I’m confident that the current rules will still apply after the new card names are introduced.

For those who prefer rules in writing, here’s the relevant text from each application:

Marriott Rewards Premier Plus / Bonvoy Boundless

Eligibility for this product: The product is not available to either:

- current cardmembers of the Marriott Rewards® Premier or Marriott Rewards® Premier Plus credit card, or

- previous cardmembers of the Marriott Rewards Premier or Marriott Rewards Premier Plus credit card who received a new cardmember bonus within the last 24 months.

If you are an existing Marriott Rewards Premier customer and would like this product, please call the number on the back of your card to see if you are eligible for an upgrade bonus.

Eligibility for the new cardmember bonus: The bonus is not available to you if you:

- are a current cardmember, or were a previous cardmember within the last 30 days, of The Starwood Preferred Guest® Credit Card from American Express;

- are a current or previous cardmember of either The Starwood Preferred Guest® Business Credit Card from American Express or the Starwood Preferred Guest® American Express Luxury Card, and received a new cardmember bonus or upgrade bonus in the last 24 months; or

- applied and were approved for The Starwood Preferred Guest® Business Credit Card from American Express or the Starwood Preferred Guest®American Express Luxury Card within the last 90 days.

Marriott Rewards Premier Business Plus / Bonvoy Premier Business Plus

Eligibility for the new cardmember bonus: The bonus is not available to you if you:

- are a current cardmember of this business credit card;

- were a previous cardmember of this business credit card who received a new cardmember bonus for this business credit card within the last 24 months;

- are a current cardmember, or were a previous cardmember within the last 30 days, of The Starwood Preferred Guest® Credit Card from American Express;

- are a current or previous cardmember of either The Starwood Preferred Guest® Business Credit Card from American Express or the Starwood Preferred Guest® American Express Luxury Card, and received a new cardmember bonus or upgrade bonus in the last 24 months; or

- applied and were approved for The Starwood Preferred Guest® Business Credit Card from American Express or the Starwood Preferred Guest® American Express Luxury Card within the last 90 days.

SPG / Bonvoy from American Express

Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Welcome offer not available to applicants who have or have had The Marriott Rewards® Premier Credit Card from Chase, The Marriott Rewards® Premier Plus Credit Card from Chase, The Marriott Rewards Credit Card from Chase, or The Ritz-Carlton Rewards® Credit Card from JP Morgan in the last 30 days.

SPG Business / Bonvoy Business from American Express

Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express® Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Welcome offer not available to applicants who (i) have or have had the Marriott Rewards® Premier Plus Business Credit Card from Chase or Marriott Rewards Business Credit Card from Chase in the last 30 days, (ii) have acquired the Marriott Rewards® Premier Plus Credit Card from Chase or the Marriott Rewards® Premier Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus offer in the last 24 months on the Marriott Rewards® Premier Plus Credit Card from Chase or the Marriott Rewards® Premier Credit Card from Chase.

SPG Luxury / Bonvoy Brilliant from American Express

Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Welcome offer not available to applicants who (i) have or have had The Ritz-Carlton Rewards® Credit Card from JP Morgan in the last 30 days, (ii) have acquired The Marriott Rewards® Premier Plus Credit Card from Chase, The Marriott Rewards® Premier Credit Card from Chase, or The Marriott Rewards® Premier Plus Business Credit Card from Chase in the last 90 days, or (iii) received a welcome or upgrade offer for The Marriott Rewards® Premier Plus Credit Card from Chase, The Marriott Rewards® Premier Credit Card from Chase, or The Marriott Rewards® Premier Plus Business Credit Card from Chase in the last 24 months.

What will I do?

I currently have quite a few Marriott cards:

- SPG

- SPG Business

- Marriott Rewards Premier

- Marriott Rewards Premier Business Plus

- Ritz

The only card missing from my collection is the SPG Luxury (soon to be Bonvoy Brilliant) card. And, even though it has been over 24 months since I received bonuses for the Chase Marriott cards, I still can’t get the Lux/Brilliant card since I have the Ritz card. Technically I could close the Ritz card and wait 30 days before applying for the Brilliant card, but no — I don’t want to do that. The Ritz card has the same annual fee, but better benefits than the Brilliant card. Plus, both my wife and son have the Lux card, so I’m good.

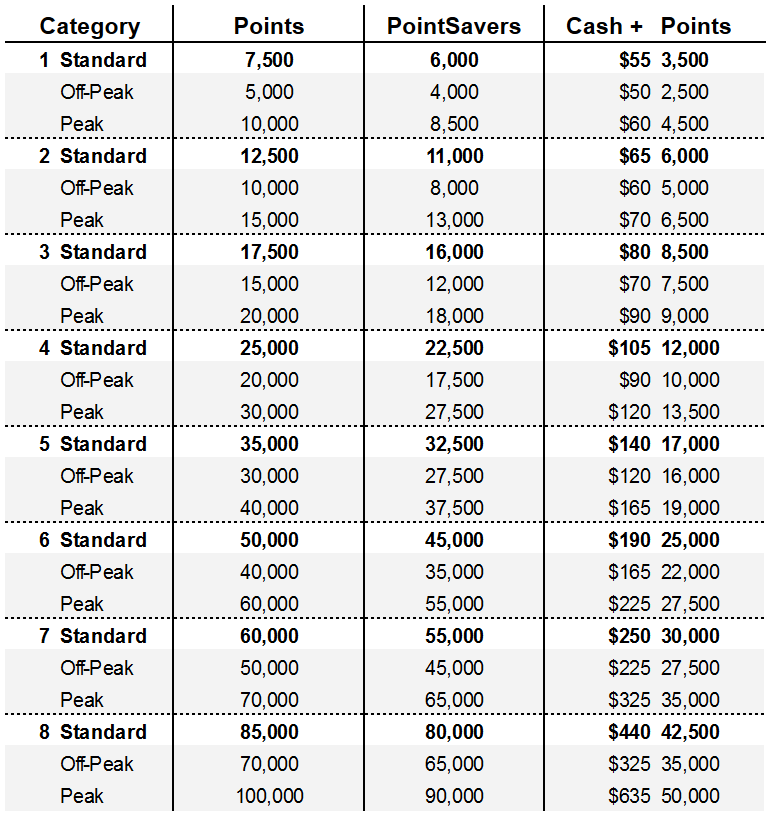

My tentative plan is to keep all five of these cards because I value the annual free night certificates considerably more than the annual fees (except for the $450 Ritz card where I value the combination of the 50K certificate, $300 airline fee reimbursement, and other benefits higher than the annual fee). There are many excellent properties that currently charge 35K per night, so I’ll happily use the 35K certificates each year at those properties. But… Marriott will soon introduce Peak award pricing which will mean that those same properties will cost 40K points per night during peak season. If hotels like the Inn at Bay Harbor (pictured above) are frequently “peak” during times I’d like to go, then the certificates will become much less valuable than they are today.

If I find that Peak pricing or other changes cause the value of the free night certificates to plummet, then I’ll reduce the number of cards in my portfolio. If that happens I’ll probably keep the Ritz, SPG consumer, and Marriott Business cards since they’ll no longer be available to new applicants. I wouldn’t want to give up those cards only to risk regretting it later.

[…] announced.” And, that led to more thoughts and questions, so I followed that up with “Bonvoy Opportunities,” and “Downgrade from Lux/Brilliant to SPG/Bonvoy? Yes, it will be an option.” […]

I got an email offer to upgrade my AMEX Bonvoy card to the Brilliant card with 100k point offer/$5k spend. I also have a Chase Marriott Premier Card with the bonus 4 months ago. I don’t see anything in the upgrade offer email in the T&C about not being able to get the 100k bonus. Do you know if this is true? there is conflicting info on the Flyer talk thread. thanks!

As long as the upgrade offer doesn’t have any terms that say you’re not eligible if you have had this or that card, then you should be fine.

I am looking to start my points journey after realizing my southwest rewards card hasn’t done me any favors the last 5 years. I am trying to decide if i should apply for the SPG Business card now for the 75K bonus or wait a few weeks for the Marriott Bonvoy Business card and the 100K bonus. I have no bonus point restrictions at this point. It seems the only real benefit to the SPG card is the two year delay in $125 annual fee. Any thoughts?

I’d actually recommend the Chase Ink Business cards first. But if you are sure you want hotel cards, I’d do the Chase Business card now and separately decide whether to also do the SPG business card now or later. Personally, I’d get it now with the first year fee waived and the second year at $95

[…] here is another post titled Bonvoy Opportunities with pretty good credit card advice […]

I just got new info from Amex about the SPG business card annual fee (and added it to this post):

Card Members who apply before 3/28/19 will receive the first year free, then pay an annual fee of $95 at the following Card anniversary date, and then pay the new annual fee of $125 at their next Card anniversary date and on all Card anniversary dates thereafter.

For current Card Members, the fee increase will take effect on the Card Member’s next Card anniversary date on or after 3/28/2019

What will the welcome bonus be on the Marriott Bonvoy Premier Plus Business? Is it better to apply for the Chase Marriott Rewards Premier Business Plus card now? Thanks

Chase will no longer accept new applications for this card beginning February 13th. So bonus = 0 unless you apply now

[…] Bonvoy Opportunities […]

Just got the SPG consumer in October of ’18. Have a question about the 35K certificate. Is it possible they might make it a 40K certificate? Just as you pointed out, I’m sure most hotels would make themselves “peak” practically all year long (especially where I’m at, NYC). It would essentially turn into a cert good for categories 1-4 in all practicality.

I’ve started making point advance reservations speculatively, just in the hopes of locking in a 35K price that I can then add my certificate to.

I don’t think it’s likely that they’ll bump it up to 40K. speculative booking is a good idea.

What do you recommend if we still have the old Chase Marriott Rewards card $85 (non premiere)?

Unless you use the feature that lets you earn elite nights through spend, I’d recommend upgrading to the Plus to get the 35K certificate

Any thoughts if this card is going away, or if there are going to be any upgrade offers? I do like earning the extra elite nights, but not sure how long the card will last.

Some people have been receiving upgrade offers via email, so yes that’s possible. My guess is that the card will stick around for a while since they could have discontinued it when they introduced the Plus (as they did with the business Plus card), but they didn’t.

I definitely agree that the Ritz card is a keeper. The $300 credit is pretty flexible which lowers the cost down to $150 or maybe slightly more if you can’t use it up (primary use for me is in-air wi fi and baggage on airlines where I have no privileges, and I can always buy a United pass or two at the end of the year in the rare event that I have money left over), and the free night more than covers the rest. However, I’m not aware of any other card that will let you add authorized users for free and each authorized user gets his or her own Priority Pass. This means I can give the best kind of Priority Pass (unlimited usage with unlimited guesting privileges) to my wife and our three kids when they are travelling without me at absolutely no additional cost. If there is another card that will allow this, please let me know!

As far as I know, only the Ritz card does that.

How old is your son? My children are young so I assumed I couldn’t get an SPG Lux for them.

He’s 19. They have to be 18 or older to apply.

Do u need to co-sign the card ? CHEERs

Not if they’re 18 or older, no

Greg, so you would keep the SPG Business card, even though its annual fee rises to $125? More specifically, at what AF rate, in your estimation, does the holding of the card for the 35k free night become inadvisable?

In reply to another comment above, I wrote “It will be a while before existing cardholders get the new fee. According to TPG, current cardholders will get charged the old fee in 2019 (even after Feb). If so, I’ll certainly go another year. After that, it will depend on my luck in using the certs at desirable properties. So far I’ve been using them at places that otherwise cost well over $300 per night at the time I’ve booked, but that might change with Peak pricing”.

I’m not sure it’s worth speculating what fee would be a deal breaker at this point. The key question is whether you can get substantially more value every year than whatever the current annual fee is. Without Peak pricing, I have no doubt that it’s worth it. With Peak pricing, it will depend on how often properties are Peak. It will also be a problem if/when Marriott moves desirable properties up from cat 5 to 6.

I had the Premiere, waited until my free night posted, and upgraded to Premiere Plus, made one purchase and got the 50K bonus.

I got the SPG Amex when it had the 35K Starpoints bonus (105K points)

I got the RC card late July when many blogs said upon merger completion we would get Platinum until 2020 (very dodgy advice) and got 2 60K nights.

I got the SPG Lux card before Aug 26 (no “other” card bonus restriction) and got the 100K bonus.

Ok, so that’s 4 cards. two 35K and two 50K nights.

The problem is that Marriott is devaluing everything. I can see some properties being peak almost all the time. I will see how the different Marriott properties shake out. This can ONLY be bad for the future. They helped themselves on the card front by offering free nights on the premium cards. They would otherwise be complete garbage.

I still would like to get this confirmation about Platinum until 2020. REAL confirmation.

Real confirmation will come March 1 when you find out whether your status remains or not. I expect it will.

Great article – thanks! But shouldn’t 5/24 restrictions be included in your chart for the Chase cards?

Good idea. I’ll do that when I update the chart in my Bonvoy complete guide

@Greg- Don’t you think Capitol One Spark Miles card is better earning than these cards? I am going to keep the Ritz Card since I still have it for $395 AF to earn Platinum by spending $75K and cancel the SPG Business Card and create an open Amex spot and possibly go for the Hilton Aspire card. I just can’t see these are spending cards but like you others may value the Free Nights. Besides the Free Nights, is there any other value? Thanks!

Yes, there are many cards with better value for spend. I don’t use my cards for spend. I just sock drawer them and use the free nights.