When applying for credit cards, it is common to not get an instant decision. At that point, you have a decision to make: Do you call the bank’s reconsideration line to force a quick decision, or do you wait?

Usually, I recommend waiting. When you apply for a card, you have a number of chances to get approved:

- Instant approval upon applying

- Automatic delayed approval

- Automatically triggered analyst review

- Call reconsideration if denied

If you call the reconsideration line when your application is not instantly approved, you are voluntarily giving up the chance of getting approved in steps 2 or 3, above. So, my usual recommendation is to wait.

Three reasons to call

Despite the above advice, there are times where it makes sense to call…

1. You need the card right away

Maybe you have a large purchase to make and you want to use the new card. Or maybe you need to earn the signup bonus points in time to plan an upcoming vacation. Either way, calling can be an effective way of speeding up the process.

2. You’re confident you’ll be approved, and you’re impatient

If you have good reason to believe that the card will be approved and you can’t stand waiting, then there is little harm in calling.

3. You want to control account trade-offs

If you have existing credit card accounts with the same bank that you applied to, they may move credit from another card to the new one, or even close a dormant account in order to approve your new card. By calling, they’ll usually let you choose exactly how you want to free up credit for the new card.

Do you remember how my wife and I recently signed up for the Fairmont card just before it was no longer possible to do so? My wife’s application went pending, and so we waited. Eventually her application was approved along with the following message:

To open your new account and provide the highest possible credit limit, we’ve adjusted the credit line(s) on your other credit card(s) based on your use of these accounts. Here’s a summary of the adjustments:

- Account ending in XXXX

- Action Taken: CLOSURE

- Account ending in YYYY

- Action Taken: DECREASE

They had outright closed one card, and drastically decreased the credit line in another. I’m sure we could have called to change this result, but we were OK with it.

Which of my wife’s cards was closed? Do you remember how I recently signed up for the IHG card in order to align my account with my wife’s so that we would get the annual free night certificates around the same time? Yep, they closed her IHG card. Ironic, isn’t it? So, next year, around the same time, she’ll apply for the card again. We can always use another 80K points…

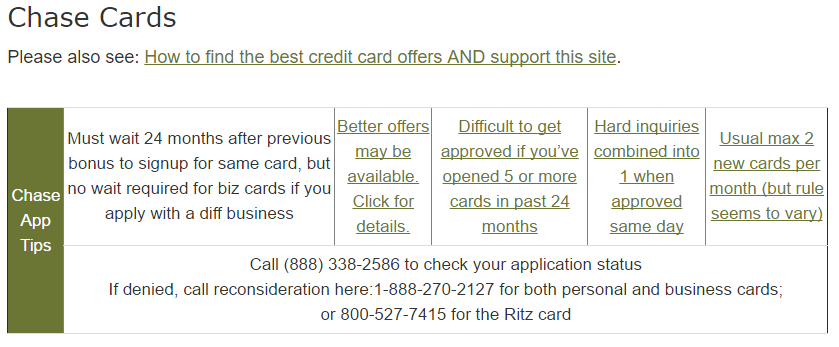

Calling Reconsideration

Our Best Offers page has an “App Tips” section for each credit card issuer. There you will find reconsideration phone numbers, along with other helpful tips.

I’ve built my credit up over the last two years from low 500s to now having scores about 780… have about 10 new cards from within last two years… first apps since my score has been this high though were this week, applied for 6 cards, 2 instant approvals and 4 pending (one of which has already been denied.). I also have high income of 100k… does this make sense that i shouldn’t be getting more instant approvals? Of the six apps, the approvals were boa Alaska and Amex hilton… rejection was boa merril +…. still pending are total rewards (after getting an email that i was preapproved before applying), jetblue biz card (i already have 3 personal cards from barclay), and capitalone spark biz…. seems kinda odd to me that I’m not getting instant approvals.. any thoughts or advice Greg or anyone else?

I think that’s pretty normal. Once you start signing up for cards for the signup bonuses, instant approvals become more and more rare. That doesn’t mean you won’t get approved though. As for Merrill+, they do seem to be much more restrictive with that card than most.

Thanks for taking the time to respond… since i posted my comment 2 of the 3 remaining pendings have been denied and i also got an instant rejection… so for apps this week, 2 approvals, 4 rejections and 1 pending…. seems kinda rough for 784 and 100k income….

Have you tried calling recon for those that were denied? It’s often possible to change denials into approvals simply by answering questions and/or offering to move credit from other cards. Our Best Offers page has the recon phone numbers at the beginning of each bank’s section.

In the process now and off to a good start… the Merrill + rep I spoke to said she’s recommending approval and I’ll hear back in 72 hours.. Jetblue biz approved on reconsideration… fnbo travelite opened a file through consideration and said I’ll hear back Monday… calling cap one tomorrow… I also have to call total rewards visa back tomorrow because i was denied because my address on the app didn’t match the address on my pre approval???

[…] Should you call when your application goes pending? […]

Do you get extra hits on your credit score with repeat reconsiderations?

I applied for Chase Reserve and was denied. Called reconsideration line. It was a miserable call with the agent being very arrogant, asking me how many cards I had, etc.

We then went into the bank and Branch Manager initiated the call. DH approved for SR but I had 7 cards falling into 5/24. Chase Private Client didn’t help. Did my application/denial mess with my credit score and will it cause an issue if I try applying for Business SPG?

No, usually they won’t do a second hard pull, so it shouldn’t hurt your score in any way to call reconsideration even multiple times.

Your application almost certainly did initiate a hard inquiry that could have a tiny negative impact on your score, but that impact goes away with time. Unless you have MANY recent hard inquiries, it shouldn’t hurt your chance of getting the SPG business card at all.

[…] Should you call when your application goes pending? – I usually call 2 days after applying. Except for Chase’s new procedures with 5/24, I’ve had about a 90% approval history doing it this way. […]

Specific question – would an exception be if you are going for 2 Chase cards same day (say Southwest personal plus and premier) and the first app is auto approved? Would calling on the 2nd before they can “see” the first be better?

Great question. It takes a while for an approved application to show up as a new account on your credit report, so it shouldn’t really matter whether you call immediately or wait. That said, we don’t have full knowledge of how Chase handles these things, so there may be some risk to waiting that I’m not aware of.

Another reason for calling and a datapoint – I dropped to 4/24 so applied on 2/1 for the CSR in-branch. The banker told me they needed more info so I had him call, they told him they were backed up and needed some time. Later that day, I called Chase on another matter and had just been approved with a 10k line. I immediately transferred all but 2k of my CSP to the new card. On 2/6 I received a letter dated 2/1 stating they had approved me by pulling 10k from my Sapphire Preferred…but since I already lowered it to 2k before they had a chance to pull it, they left it alone, and my CL with the CSR is intact! Maybe they’ll eventually catch up, but If you’re applying with Chase and up against their max credit limit, you may want to call, get approved and transfer credit to preclude them from arbitrarily shifting your lines.

And thanks for the idea about the two-step product change on my 7-month-old Sapphire Preferred to the Freedom Unlimited.

I called ASAP for both my 2 BofA Apps (Merrill + Alaska) because they only combine hard pulls if it’s decisioned the same day.

Approved for the Merrill but declined for Alaska due to too many inquiries. I got the more important one though. Maui here I come!

Enjoy your trip!

FYI: the inquiries combine with BOA even if it is not decisioned the same day

So, you’re confident that your wife (YOUR WIFE!) will be under 5/24 next year to get another IHG? I’m disappointed in you/her FM, SMH. 🙂 Just kidding, hope it goes well for you. But definitely surprised she’d be under 5/24…unless you’re sticking her with all the biz applications.

The IHG card is not subject to 5/24. I’m hoping it will stay that way.

I usually call 2 days after applying. Except for Chase’s new procedures with 5/24, I’ve had about a 90% approval history doing it this way.

Shocked that they would cancel a card without at least having a conversation with your wife. I would be rather ticked if they did that to me.

Its fairly common for banks to close down cards that have no activity. Her last annual fee payment to the card was last February. I’m sure if she had more recently paid the annual fee they wouldn’t have closed the card.

I was pissed at first but when I realized that it just “forces” us to get another 80K + $50 signup bonus, I was totally fine with it.

How long do you have to wait before applying again? 2 years? When applying for our cards, we weren’t yet savvy enough to think about coordinating anniversary dates. I wouldn’t mind cancelling one of ours and applying again later.

You don’t have to wait after cancelling, but you do need to wait 24 months after you last received a signup bonus for the same card.

*impatient*. Inpatient is when your insurance decides that it’s ok to admit you because you are dying.

LOL. Fixed. Depending upon your prognosis as an inpatient, calling might be in order…

I tried applying for 3 cards from bank of america the other day. I got approved for 2 and 1 pending. Only 1 new card showed on my account and it seems as if the other approved application and pending application have vanished. Unable to track status, even after calling. Weird. Should I reapply for the 2nd card I was approved for?

Good question. I’d be interested in info from other readers about this. I’ve had that happen a number of times with BOA business cards: whether they were instantly approved or pending, the application appears to have vanished. In all cases, though, I eventually received the card in the mail. So, my bet is that you will get the cards if you simply wait it out.