Most Chase cards long ago lost price protection benefits. However, the IHG credit cards maintained price protection even after the benefit was pulled from most other Chase cards. I recently noted in a Friday night chat with Greg that I used my IHG credit card to buy my new Chromebook specifically for price protection through November holiday sales. While you’ll still be able to make claims for items purchased before November 17, 2019, you will no longer be covered for purchases on or after that date. As a consolation prize, the IHG cards will be adding cell phone protection when you use your IHG card to pay your cell phone bill (with the benefit differing slightly depending on which card you have), but you would be doing that at such high opportunity cost that it’s not much of a consolation at all.

Price protection out, cell phone protection in

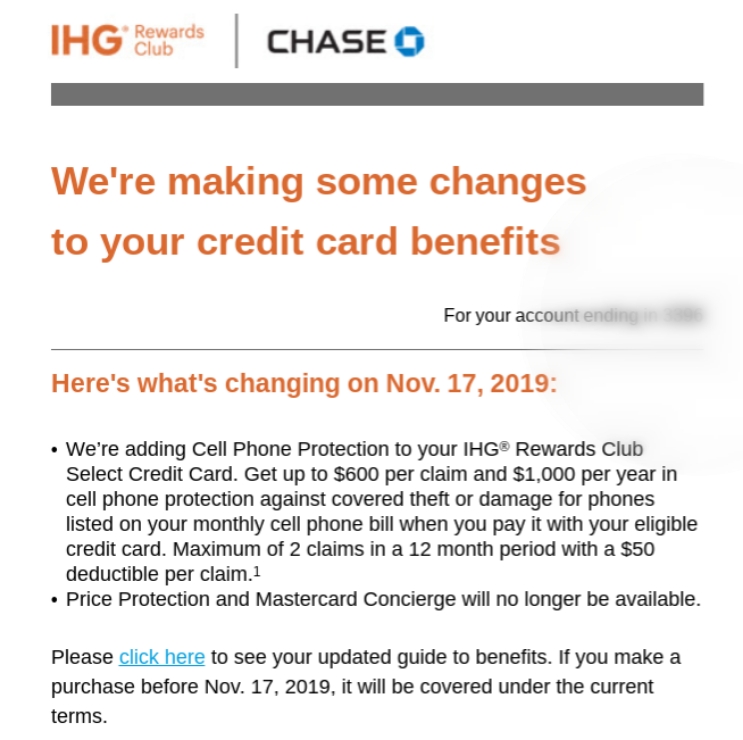

Chase has sent out the following email to at least IHG Rewards Club Select Credit Card holders (this is the old $49-fee version of the IHG card that is no longer available for new applicants). Note there is a difference in the cell phone protection between this card and the newer IHG Rewards Club Premier card.

The second bullet point is the one that stood out to me as the price protection benefit will no longer be available for purchases made with either IHG credit card on or after November 17, 2019.

Cell phone protection is being added. The IHG Rewards Club select card, as shown above, will be offering protection up to $600 per claim and $1,000 per year against theft or damage for phones listed on your monthly cell phone bill when you pay it with your card, with a $50 deductible.

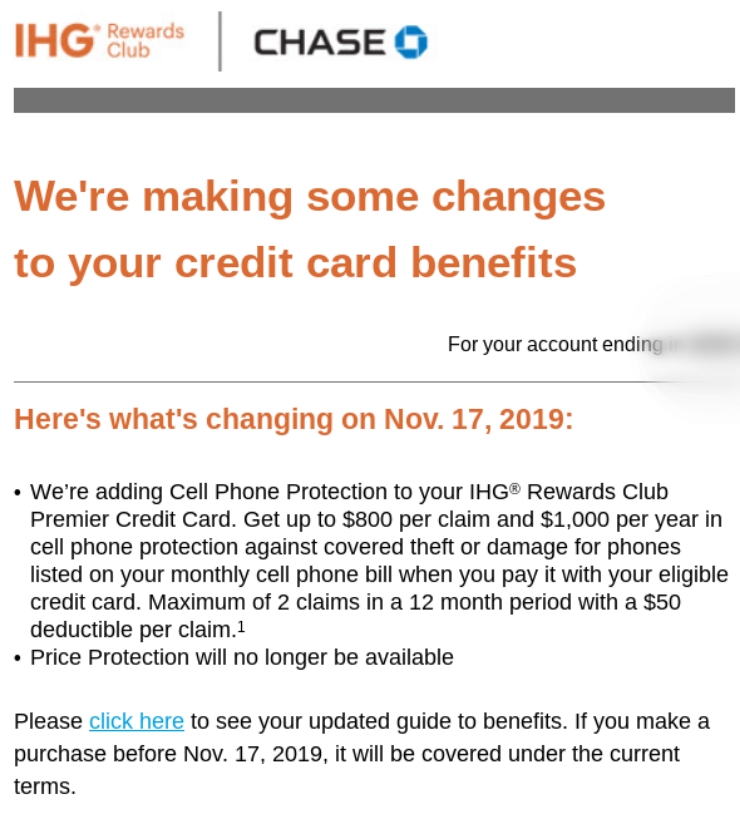

The IHG Rewards Club Premier is adding a slightly higher level of protection since that card will give you up to $800 per claim.

That said, neither card offers a reasonable return on cell phone payments as you’d only earn 1 IHG point per dollar spent. Since you can often buy IHG points for half a cent each (and sometimes less than 4 tenths of a cent), you’d be sacrificing by using this card over a card like the Uber Visa (which only offers 1% back but also has a lower $25 deductible and no annual fee) or the Chase Ink Business Preferred (which offers 3x on US wireless carrier payments and also has cell phone protection). I don’t see this as being a big value add, but YMMV.

[…] No more price protection on most cards as of June 1, 2018. Since cutting price protection on the IHG cards in November 2019, just a few of the Mileage Plus cards still carry price protection (as shown […]

Only got notice on IHG select….Premier too?

Is there still any card with price protection?

Considering the IHG cards have lower deductibles and annual fees than the Ink, how are they not better? Are you really making that much more on the Ink getting URs to cover those costs from your cell phone bill?

The $600 vs $800 coverage limit is not based on Premier or Select card, but if its a world elite or world mastercard. I have a Select World Elite card and got an email and benefits stating the 800 limit and not 600.