| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

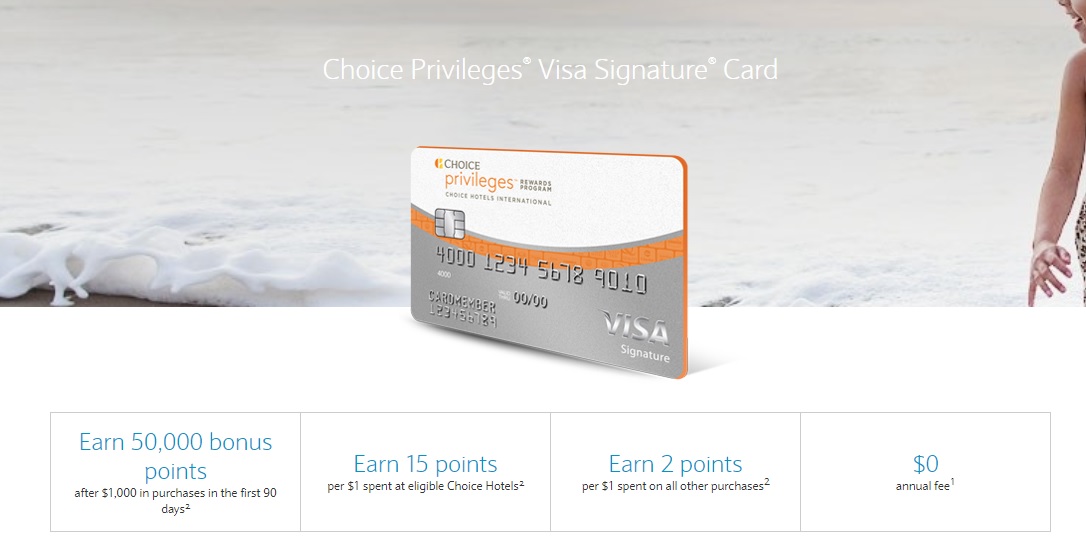

Barclays has increased the offer on the Choice Privileges Visa Signature Card. Choice Privileges points can be very useful in some markets, particularly in Scandinavia. While this offer won’t appeal to everyone, it can certainly be quite valuable to those taking advantage of Choice sweet spots.

The Offer

| Card Offer |

|---|

40K Points ⓘ Non-Affiliate 40K after $1K spend in first 3 monthsNo Annual Fee |

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Decent bonus for a no-annual fee card, but not a great keeper unless you value the Choice Gold Status No Annual Fee Earning rate: 5X at Choice Hotels ✦ 3X at gas stations, grocery stores, home improvement stores, and phone plans ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Gold status ✦ Cell phone Protection ($25 deductible, $800 max per claim) |

Quick Thoughts

We have previously highlighted the value of Nordic Choice properties in our sweet spot spotlight series. See the following post for more info on how to use points to terrific value in Scandinavia:

Outside of Scandinavia, there are also niche opportunities for good value from Choice. For example, Greg found a pretty cool Cambria suites a couple of years ago. In some European cities, there are quite nice Ascend collection properties.

On the other hand, this offer isn’t particularly useful in many places where Choice properties are quite cheap — often points prices do not correlate favorably to cash rates in the US.

While this offer probably isn’t the best fit for most readers, it is quite a bit better than the standard offer of 32K (though not quite as good as last year’s 64K offer, which required more spend). It’ll make sense in the right circumstances, but it’s a niche offer for sure.

Find more information about this card and an application link on our dedicated card page by clicking the card name under “The Offer” or “Key Card Details” above.

H/T: Doctor of Credit

[…] Choice Privileges 50K offer […]