| Card Details and Application Link |

|---|

Chase Sapphire Reserve® Card 65K Points ⓘ Affiliate 65K after $4K spend in 3 months$550 Annual Fee Click here to learn how to apply This is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Alternate Offer: 70K after $4K spend showing on some accounts when logged-in to Chase Recent better offer: Expired 12/1/22: 80K after $4K spend FM Mini Review: Excellent all-around card for frequent traveler. Best when paired with no-fee Chase Freedom Flex, no-fee Freedom Unlimited & no-fee Chase Ink Cash Click here for our complete card review Earning rate: 10X hotels & car rentals booked through Chase Travel℠ ✦ 10X Chase Dining ✦ 5X flights booked through Chase ✦ 3X Travel and Dining ✦ 10X Lyft (through March 2025) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: $300 Annual Travel Credit ✦ Points worth 1.5 cents each towards travel when booked through the Chase Travel(SM) Portal✦ Transfer points to airline & hotel partners ✦ Primary auto rental collision damage waiver ✦ Priority Pass Select lounge access ✦ Up to $100 Global Entry fee credit ✦ $5 monthly DoorDash in-app credit through December 2024 ✦ Free DashPass through 2025 ✦ Earn 10X on Lyft spend✦ Free Lyft Pink All Access Memberhsip through December 2024 ✦ $15 monthly Instacart credit ✦ 12 months free Instacart+ See also: Chase Ultimate Rewards Complete Guide |

The $550 Chase Sapphire Reserve card is my pick for the best all around travel rewards card. It has decent perks, best-in-class travel protections, and excellent rewards for spend. This card earns valuable Chase Ultimate Rewards points. With the Sapphire Reserve card, points are worth 1.5 cents each when redeemed for travel through the Chase Travel(SM) portal.

Application Tips

Chase Application Tips

Call (888) 338-2586 to check your application status |

Should you apply?

If you spend a lot on travel and/or dining, then I highly recommend this card. That said, you might do better signing up for a different card… The Chase Sapphire Preferred. The Sapphire Preferred often has a better signup bonus than the Sapphire Reserve and so it can make sense to sign up for the Sapphire Preferred and later upgrade to the Sapphire Reserve.

For reference, here are the current signup bonuses for both cards:

| Card Offer |

|---|

65K Points ⓘ Affiliate 65K after $4K spend in 3 months$550 Annual Fee Alternate Offer: 70K after $4K spend showing on some accounts when logged-in to Chase Recent better offer: Expired 12/1/22: 80K after $4K spend |

60K points ⓘ Affiliate 60K after $4K spend in 3 months$95 Annual Fee Alternate Offer: There may be elevated offers available by applying in-branch A similar offer with the first year annual fee waived may be found in-branch. YMMV. |

Are you eligible?

To get this card you must be under 5/24, you must not be a current Sapphire Preferred or Sapphire Reserve cardholder, and at least 48 months must have passed since you last received a new cardmember bonus for the Sapphire Preferred or Sapphire Reserve card.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

How to apply

You can find the best current signup offer and application link here: Chase Sapphire Reserve.

Application status

After you apply, call (888) 338-2586 to check your application status.

Reconsideration

If your application is denied, I recommend calling for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Perks

$300 Travel Credit

Ultra-Premium Ultimate Rewards

Since this is an ultra-premium Ultimate Rewards card, the following rewards are available:- Redeem Points for 50% More Value: Points are worth 1.5 cents each when used to book travel through the Chase Travel(SM) portal.

- Erase statement charges for 25% more value: Points are worth 1.25 cents each when used to erase select categories of charges via Pay Yourself Back.

- Transfer Points to Partners: Points can be transferred one to one to a number of airline and hotel loyalty programs.

Travel Benefits

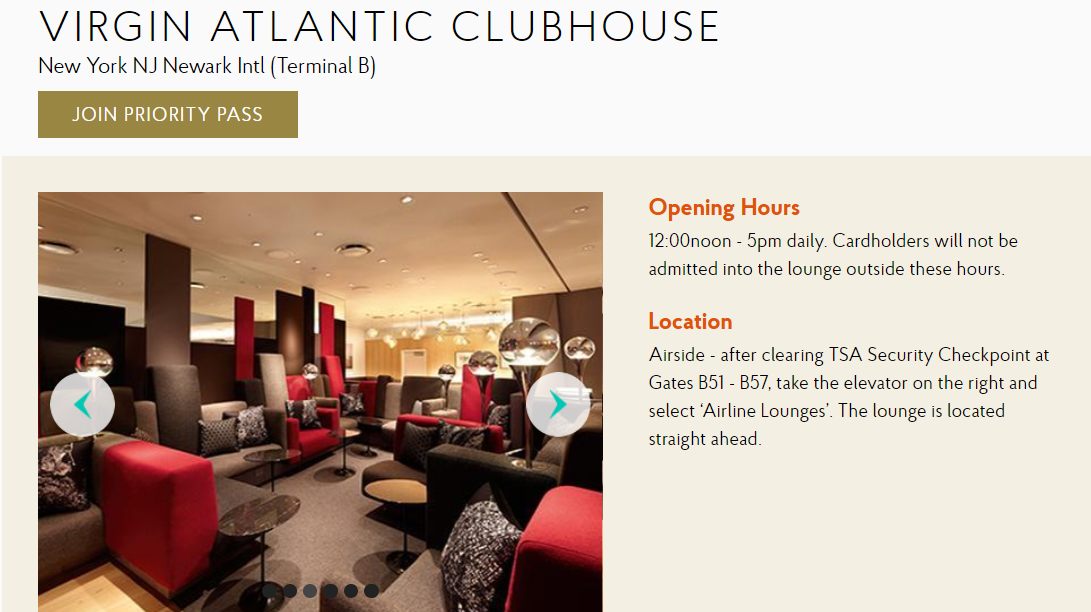

- Priority Pass Select Lounge Membership: Membership includes free access to lounges for yourself and up to two guests. Unlike Priority Pass memberships issued by American Express, this version includes Priority Pass restaurants.

- Global Entry or TSA Pre✔® Fee Credit: Receive a statement credit of up to $100 every 4 years as reimbursement for the Global Entry or TSA Pre Check application fee charged to your card.

- Car rental privileges: National Car Rental Executive status is quite valuable. Also includes discounts with Avis and Silvercar.

- The Luxury Hotel & Resort Collection: Book selected hotels and receive perks such as room upgrades, free breakfast, early check-in and late check-out, discounts and credits, and more.

- Elite Hotel Benefits at Relais & Châteaux: Receive "a VIP welcome" and complimentary breakfast daily at select properties.

- 4th night free at select sbe hotels: At select sbe hotels, get the 4th night free, free breakfast, $30 hotel credit and more. Read our in-dept coverage of this perk here.

- Visa Infinite Concierge Service: "Access to Visa Infinite Concierge who can help you with requests, like dinner reservations, or Broadway, music and sporting event tickets. Call 1-877-660-0905 to reach the Visa Infinite Concierge.1 Traveling outside the U.S.? Call us collect at 1-312-800-4290."

- No foreign transaction fees

Travel Protections

In my opinion, the Sapphire Reserve has the best automatic travel protections of any card on the market today. Most of the following protections kick in even if you pay with points or pay only in part with your card. More details and a comparison to other ultra-premium cards can be found here: Ultra-Premium Credit Card Travel Insurance.- Auto Rental Coverage: Chase offers primary auto rental CDW (collision damage waiver). Here's the description directly from Chase: "Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad."

- Roadside Assistance: "If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year."

- Trip Cancellation / Interruption Insurance: "If your trip is cancelled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels."

- Trip Delay Reimbursement: "If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket."

- Lost Luggage Reimbursement: If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger."

- Baggage Delay Insurance: "Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days."

- Travel Accident Insurance: "When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $1,000,000."

- Emergency Evacuation & Transportation: "If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000."

- Emergency Medical and Dental Benefit: "If you’re 100 miles or more from home on a trip, you can be reimbursed up to $2,500 for medical expenses if you or your immediate family member become sick or injured."

Purchase Protection

- Extended Warranty: "Extends the time period of the U.S. manufacturer's warranty by an additional year, on eligible warranties of three years or less."

- Damage and Theft Protection: "Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year."

- Return Protection: "You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $500 per item, $1,000 per year."

Dining & Food Delivery Benefits

- 10x Chase Dining: Earn 10 points per dollar for prepaid dining booked through Chase Dining.

- Reserved by Sapphire: Starting late 2021, cardmembers will have access to “Reserved by Sapphire” which will purportedly offer “exclusive” chances to book reservations at high-demand restaurants.

- 12 months free Instacart+ - Gives access to free delivery on orders over $35, a 5% credit back on all eligible pickup orders and reduced service fees.

- $15 monthly Instacart credit - Chase Sapphire Reserve cardholders get $15 in statement credits on Instacart purchases each month.

- $10 Monthly GoPuff credit - GoPuff is a delivery service that can be used for groceries, home essentials and other products. Sapphire Reserve cardholders get $10 in statement credits on Gopuff purchases each month.

Lyft Rideshare Benefits

- 10X Rewards: Use your Sapphire Reserve card with Lyft in order to earn 10 points per dollar through March 2025.

- Free Lyft Pink Access (through 2024) - Lyft Pink members complimentary upgrades to Priority Pickup on Standard rides, savings on Lyft Lux, XL, and Preferred rides and relaxed ride cancellations.

Earn Points

Signup Bonus

This card earns super-valuable Ultimate Rewards points. Here’s the current signup offer:

| Card Offer |

|---|

65K Points ⓘ Affiliate 65K after $4K spend in 3 months$550 Annual Fee Alternate Offer: 70K after $4K spend showing on some accounts when logged-in to Chase Recent better offer: Expired 12/1/22: 80K after $4K spend |

Refer Friends

Bonus Spend

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 10X hotels & car rentals booked through Chase Travel℠ ✦ 10X Chase Dining ✦ 5X flights booked through Chase ✦ 3X Travel and Dining ✦ 10X Lyft (through March 2025) |

Redeem Points

Cash Back

Cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer.

Travel

Redeem points for travel: 1.5 cents per point

This card offers 1.5 cents per point value towards travel booked through Chase. Log into Chase under this account, and go to the Chase Travel(SM) portal to book your travel. A $600 flight would cost 60,000 points if you used a no-fee Ultimate Rewards card, but with this ultra-premium card it would cost only 40,000 points.

Details about booking travel through Chase

You can use the Chase portal to book airfare, hotels, cruises, activities, and car rentals. Airfare purchased through the portal still earns airline miles and elite qualifying miles. Hotels booked this way do not earn hotel rewards. Worse, hotels booked through the portal often won't offer you elite benefits even if you have status.Travel protections apply

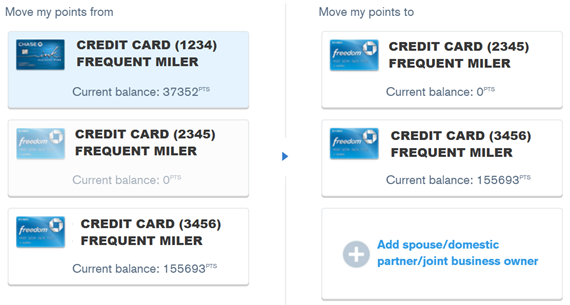

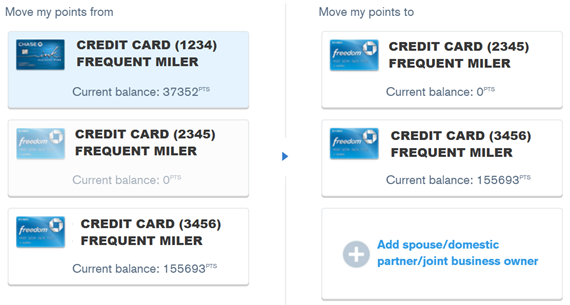

When you pay with points for travel, Chase's automatic travel protections do apply. So, you can be covered for things like car rentals, trip delays, trip cancellation & interruption, lost luggage, etc. The coverage you receive will be based on which card's rewards were used to book the trip. For example, if you have both a Chase Sapphire Preferred and a Sapphire Reserve, you would want to move your points from the Preferred to the Reserve and then use the Reserve points to book your trip. You will get both better value (1.5 cents per point) and better travel protections. See: Sapphire Reserve Travel Insurance.Transfer points

Move points to premium or ultra-premium card first

You cannot transfer points directly from a no-annual-fee Chase card to airline or hotel partners, but you can move points first to a premium card (Sapphire Preferred or Ink Business Preferred, for example) or ultra-premium card (Sapphire Reserve) and then transfer the points to airline or hotel partners. Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. Points can also be transferred to the loyalty account of a joint business owner, but they do need to be an authorized user on the associated business account.Transfer Partners

| Rewards Program | Best Uses |

|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus (Avios.com) rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. See: Emirates Sweet Spot Awards - First class from 30K miles round trip. |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth at least 2 cents each, but they’re sometimes worth far more. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary due to certain taxes not being charged on awards, but tend to average around 1.5 cents per point. |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. Good uses of miles include United's Excursionist Perk awards and (sometimes) dynamically priced United economy awards. |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few great sweet spot awards including US to Europe on Delta One business class for 50K points one-way. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Other ways to redeem points

You can also use points to pay some merchants directly (Amazon.com, for example or via Chase Pay). Don't do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your points - causing you a headache in getting your points reinstated).

Manage Points

Combine Points Across Cards

If you intend to cancel a card that earns Chase points, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account (See: My 90,000 Points mistake). A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Share Points Across Cardholders

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

How to Keep Points Alive

Authorized Users

- Annual fee: $75 per authorized user

- $300 travel credit? Authorized users do not get their own travel credits. Travel purchases made on authorized user cards do get reimbursed but the reimbursement comes out of the same $300 per year bucket as the primary card.

- Airport Lounge Access? Authorized users get Priority Pass Select membership like the primary user.

- Primary car rental collision damage waiver? Yes

- Global Entry or TSA Pre Fee Credit? Authorized users do not get their own Global Entry or TSA Pre reimbursements. Enrollment fees charged to authorized user cards do get reimbursed but it comes out of the same single reimbursement every 4 years as the primary card.

- Why consider paying for authorized user cards? Many will find that it is not worth adding authorized users. However, it can be worth it to earn 3X for travel & dining for authorized user spend, and to give Priority Pass to your authorized users. See also: The Sapphire Reserve Couple Conundrum.

Card Lifecycle

How to meet minimum spend requirements

Keep, cancel, or product change?

The decision of whether to keep this card year after year can be complex. On the one hand, if you spend a lot in its bonus categories, then it’s a no-brainer to keep this card instead of the Sapphire Preferred. On the other hand, if you spend that much on travel and dining, you might do even better with cards like the Amex Gold Card or Citi Prestige. These posts may help you make a decision:

If you do decide to get rid of the card, I recommend downgrading to a fee free card rather than cancelling outright. That way, you’ll be sure to keep your points alive and you’ll most likely have the option to upgrade back to the Sapphire Reserve if you ever need to.

Related Cards

Ultimate Rewards Consumer Cards

| Card Offer and Details |

Ultimate Rewards Business Cards

| Card Offer and Details |

Is there any way to stack up the monthly $15 Instacart and combine across multiple cards? I’m trying to buy GCs to load, but they have a $25 minimum. Not sure if it’s worth paying $20/mo to stack $50/mo in Instacart credit or not. Accounting hassle… Any way to get around the cash out of pocket to stack them?

I’m not aware of any way to stack them. Additionally, I don’t think buying gift cards will trigger the $15 credit. When you go to buy them, the checkout screen is on a different URL: instacart.launchgiftcards.com. When that happens, the charges probably don’t appear to come from Instacart.

What all is included under “3X Travel and Dining”? Under the Travel category, does it include OTAs, hotels, and airlines? The details on exactly what is included is pretty key, IMO, and I’m having trouble finding it.

Chase provides more details here https://www.chase.com/personal/credit-cards/rewards-category-faq

Great link, thanks! Here’s how Chase defines the “Travel” category: “Merchants in this category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages. Some merchants that provide transportation and travel-related services are not included in this category; for example, real estate agents, educational merchants arranging travel, in-flight goods and services, on-board cruise line goods and services, sightseeing activities, excursions, tourist attractions, RV and boat rentals, merchants within hotels and airports, public campgrounds and merchants that rent vehicles for the purpose of hauling. Purchases from gift card merchants or merchants that sell points or miles will not qualify in the travel category.”

If you use a referral link you get 80,000 points instead

I just product changed my Preferred (opened 09/20) to a Flex. Can I still get the Reserve?

[…] While free is better, getting more than 5,000 Ultimate Rewards points for $9.75 is still a big win considering that that points could get you a Category 1 Hyatt stay or could be used to pay yourself back for a grocery, home improvement, or dining purchase of $75.73 if you have the Chase Sapphire Reserve card. […]

Welcome bonus is 50k. Needs a correction 🙂

[…] that allow point transfers include: Chase Sapphire Reserve, Sapphire Preferred, and Ink Business […]

[…] “Must have” Chase cards), then you may want to skip this one. Also if you love the Sapphire Reserve card’s features and don’t want to go without that card for a year (you have to wait a […]

[…] are transferable to a number of airline and hotel programs. If you decide later that you prefer the Sapphire Reserve card, it still makes sense to start with the Sapphire Preferred card (since it has a higher intro bonus) […]

[…] Sapphire Reserve: Redeem points for 1.5 cents each to pay back the following charges: grocery, restaurant, food delivery & takeout, home improvement store purchases, and select charitable contributions (American Red Cross, Equal Justice Initiative, Feeding America, Habitat for Humanity, International Medical Corporation, Leadership Education Fund, NAACP Legal Defense and Education Fund, National Urban League, Thurgood Marshall College Fund, United Negro College Fund, United Way, World Central Kitchen). […]

[…] the Chase Sapphire Reserve card debuted 4 years ago, it made a huge splash with its 100,000 point welcome offer. Combined with […]

[…] drugstores – I speculate that we’ll also see some type of enhancements on the Chase Sapphire Reserve and Chase Sapphire Preferred in the coming weeks to keep those cards relevant. That old Freedom […]

[…] Altitude Reserve Card is US Bank’s challenge to the Chase Sapphire Reserve. The card is targeted at “people who live life on the go and want to be rewarded generously […]

[…] keep her most expensive cards, and in this post I’ll argue that she should add the $550 Chase Sapphire Reserve card to her […]

[…] credit cards offer extra points for spend within certain categories. Examples include the Chase Sapphire Reserve which offers 3X for travel & dining; Amex Gold which offers 4X for US restaurants and 4X for US […]