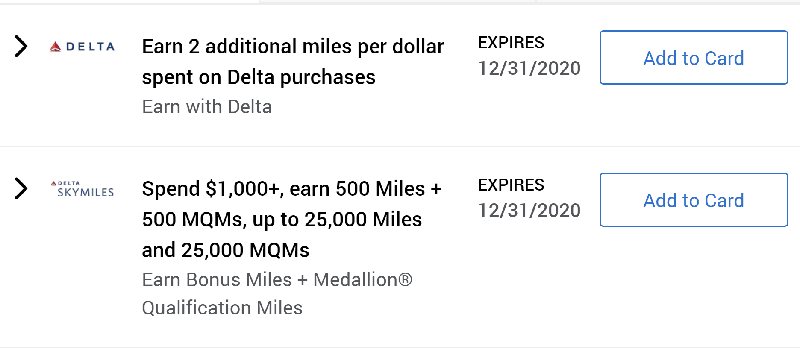

If you have a Delta Platinum or Delta Reserve card that you acquired before July 1st 2020, then you should have offers in your Amex account to earn extra miles per dollar for Delta purchases, and bonus miles and MQMs for each $1,000 of spend (click here for details). This post is about the second offer. Is it worth running up spend in order to earn Delta elite status?

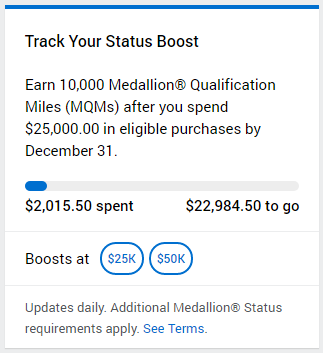

Delta Platinum and Reserve cards already make it possible to earn elite status without flying. Each offers MQMs (medallion elite qualifying miles) with high spend. For details, see: Manufacturing Delta elite status in 2020 and beyond. Now, with the Amex Offer giving us 500 MQMs with each $1,000 spend (up to $50K spend), it’s now possible to earn status easier.

Triple MQM earnings (sort of)

One cool thing about earning MQMs toward elite status this year is the fact that Delta has promised to roll these over to next year. They always roll over any MQMs that are above and beyond those used to reach your current level of status, but thanks to COVID they have stated that all MQMs earned in 2020 will roll over to 2021. This makes it possible to double up MQM earnings between this year and next. And with this promo, you can effectively triple your MQM earnings from credit card spend.

Double MQM Earnings thanks to Rollover

Example: 10K in 2020 + 10K in 2021

Here’s an example of doubling your MQM earnings. A standard perk of the Delta Platinum cards is the ability to spend $25K within a calendar year in order to earn 10K MQMs. That’s not enough for elite status on its own (you need 25K MQMs for Silver status, 50K for Gold status, and 75K for Platinum status). Thanks to this year’s MQM rollover, though, a cardholder who spend $25K in 2020 should start 2021 with 10K MQMs. If the cardholder then spends $25K again, they’ll have a total of 20K MQMs. That’s still not enough for Silver status, but it’s very close. With a modest amount of flying in 2021, the cardholder will easily achieve Silver status.

Triple MQM Earnings thanks to Offer

Example: 10K in 2020 + 12.5K (Offer) + 10K in 2021

Now let’s look at the same example, but with the new offer. Suppose a cardholder hasn’t put any spend yet on their Platinum card, but now spends $25K between now and the end of the year (but only after loading the offer to their account). In that case, the cardholder will get the standard 10K MQMs from that spend plus 12.5K MQMs thanks to the Amex offer. This cardholder, then, will start 2021 with 22.5K MQMs. Once they spend $25K on their card in 2021, they’ll get another 10K MQMs and easily reach Silver status.

UPDATE: Reader DSK points out that the Platinum cardholder can do even better by spending at least $30K this year while the Amex offer is in place. By spending $30K, the cardholder would earn 10K MQMs at $25K spend (the standard MQM boost) plus 15K MQMs from $30K spend (thanks to the Amex offer). This would result in 25K MQMs and Silver status. In 2021, all 25K MQMs should roll over. The cardholder will still have to spend $25K in 2021 for a MQD waiver, but that will also give them 10K MQMs towards either Gold status or so that 10K MQMs will roll over into 2022.

Delta Elite Status Background

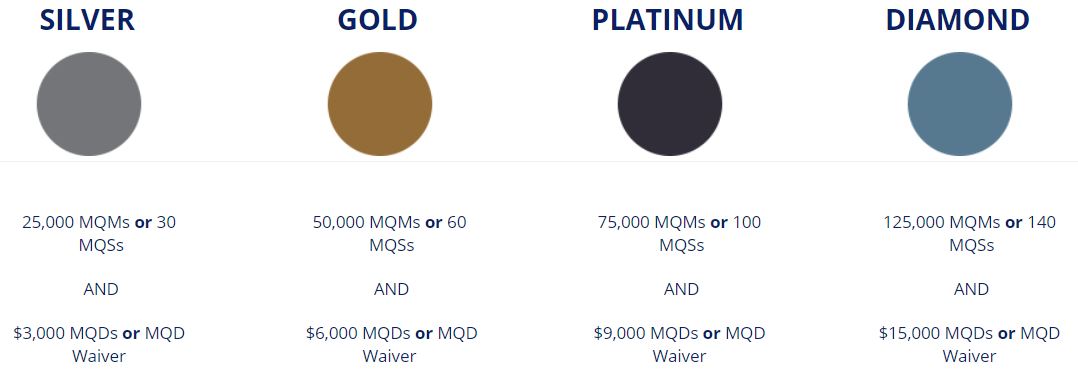

The image above shows the requirements for reaching each level of Delta elite status. Every level of status offers basic perks like free domestic upgrades (when available), premium seat selection, a free checked bag, etc. Higher levels of status make upgrades more and more likely. Also note the following details:

- $25,000 spend on any Delta Platinum or Delta Reserve cards within a calendar year will get you a MQD waiver which means that you don’t need to earn Medallion Qualifying Dollars (spend on Delta flights) to reach elite status up to Platinum status.

- Diamond Status requires $250,000 spend across one or more Delta cards in order to get a MQD Waiver. Due to that very high requirement, the rest of this post focuses on earning lower levels of status.

Delta’s chart of elite benefits can be found here. Here’s a summarized chart I created:

The elite benefits I’ve personally found to be most valuable are:

- Unlimited complimentary upgrades (when available, upgrade from coach to first class on domestic flights). Higher status leads to better chance of upgrades.

- Waived same-day confirmed fees and waived same-day standby fees (switch to different flight on same day as ticketed flight). Requires Gold or higher.

- Complementary Comfort+ seats (more leg room, free drinks, better snacks).

- Free award changes and cancellations. This is huge because it lets me book awards when I see availability even if I’m not sure I’ll take that particular flight. Requires Platinum or higher.

- Regional upgrade certificates. Puts you to the front of the line for regional upgrades. This is great to use for flights where upgrades are most important to you. For example, I use these for flights of about 4 hours or longer. This is a choice benefit for Platinum and Diamond status.

- Global upgrade certificates. Use these to upgrade from coach to business class on any international flight when upgrade space is available. In many cases the upgrade space won’t be available at the time of booking, but you can then waitlist for the upgrade. My wife and I have had nearly 100% success in upgrading this way, but we’ve been very lucky: most of our upgraded flights have been between the US and Europe where upgrades are much easier to score than with longer distance flights (such as to Asia, South Africa, or Australia). This is a choice benefit for Diamond status only.

Is it worth pursuing this offer?

This offer is best if it lines up with the spend required for standard MQM boosts. As a reminder, the Delta Platinum and Reserve cards earn MQMs with spend as follows:

- Delta Platinum: Earn 10K MQMs with $25K spend, and again at $50K spend

- Delta Reserve: Earn 15K MQMs with $30K, $60K, $90K, and $120K spend

If you haven’t spent any money on your card or if you stopped spend exactly after reaching an MQM boost, but before maxing out the boosts altogether, then you can double up with the Amex Offer as follows:

- Delta Platinum: Spend $25K and earn 10K MQMs (standard boost) + 12.5K MQMs (offer) = 22.5K MQMs

- Delta Reserve: Spend $30K and earn 15K MQMs (standard boost) + 15K MQMs (offer) = 30K MQMs

As you can see above, this is a one time opportunity to earn one MQM per dollar spent with the Reserve card and very close to one per dollar with the Platinum card. Either way, you’ll also earn bonus redeemable miles with your spend.

For anyone pursuing Delta elite status, I don’t think there’s any doubt that this is an excellent offer. The question is whether it’s worth spending big on Delta credit cards right now.

Amex Big Spend

One problem with trying to spend big on these Delta cards is the fact that Amex regularly cracks down on gift card spending. Already, they don’t offer points (or MQM status boosts) for gift card purchases made at Simon Malls. And they often withhold bonus points for gift card spend (see, for example: Amex Going Clawback-Happy For Grocery Store Spend). So, you can’t count on gift card purchases as a way of increasing spend.

One thing you can do that won’t upset Amex, assuming you can float the money, is give the IRS a loan. You can pay (or overpay) estimated taxes for a 1.87% fee. If you overpay, you’ll get back your money when you file for end of year taxes next April. For details, see: Pay taxes via credit card.

Here’s an example of how you can reach $25K or $30K spend by overpaying taxes:

- $25K: Pay $24,542 in taxes + $459 (fees)

- $30K: Pay $29,450 in taxes + $557 (fees)

In addition to earning MQMs, you will earn redeemable miles for this spend too, as follows:

- Consumer Platinum ($25K spend): 25K miles (standard) + 12.5K miles (offer) = 37,500 miles

- Business Platinum ($25K spend): 37K miles (1.5 miles per dollar for purchases over $5K) + 12.5K miles (offer) = 49,500 miles

- Reserve ($30K spend): 30K miles (standard) + 15K miles (offer) = 45K miles

Is it worth the 1.87% in fees for the miles alone?

- Consumer Delta Platinum: Spend $459 in fees, get 37,500 miles = 1.2 cents per mile

- Business Delta Platinum: Spend $459 in fees, get 49,500 miles = 0.93 cents per mile

- Delta Reserve: Spend $557 in fees, get 45,000 miles = 1.2 cents per mile

As you can see above, using the “overpay taxes” trick to meet spend with the consumer Delta Platinum card or the Delta Reserve card (consumer or business) is like buying miles for 1.2 cents each. That’s ignoring the cost of having money tied up with the IRS, but it also ignores the value of the MQMs you’ll earn. 1.2 cents per mile is a good price for the miles if you need them, but not a price I’d pay without an immediate use for them. So, with those cards, the decision of whether to do this boils down to how much you value those MQMs. In my opinion, if you value Delta elite status at all, it’s probably worth pursuing.

Things look much better with the Delta Platinum Business card. This card offers 1.5 miles per dollar for purchases of $5,000 or more (up to 50K extra miles per year). So, the tax payment, but not the fee payment, will earn 1.5 miles per dollar. The end result is that this is like buying miles for less than a penny each. That’s a great deal. If you have this card and you were on the fence about whether or not to put the spend on your card this year, I think that this deal should tip your hand. If you can easily float the money, then it makes sense to go for it.

Conclusion

Under the right circumstances, in my opinion this is a great time to spend your way to Delta elite status. The combination of Delta’s MQM rollover policy this year plus the latest Amex spend offer make it possible to earn status through spend easier than ever before. What are the right circumstances? Here they are:

- You have a Delta Platinum or Delta Reserve card.

- Your card has the Amex Offer shown above (Spend $1,000+, earn 500 Miles + 500 MQMs…).

- You have the ability to put lots of spend on your Delta Platinum or Reserve card.

- You have the desire to spend your way to Delta elite status for travel in 2021 and 2022.

And things get even better if:

- You have close to $25,000 left to spend to reach the next status boost. This helps because then your spend helps you max out the Amex offer and reach the next standard MQM boost.

- You have the Delta Platinum Business card which offers 1.5 miles per dollar for purchases of $5,000 or more (up to 50K extra miles per year). This is obviously only helpful if your spend will include purchases of $5K or more.

Often times these bonus offers show up on new cards; any indication that is the case on this one?

The fine print of the marketing materials suggest that it won’t show up on new cards, but who knows? Maybe they were wrong. I’d love to hear from someone who had signed up for one of these cards in August.

Is it too late to apply for new cards now? Anyone applied after 7/1? No offers?

My understanding is that it’s too late to get in on this, yes.

The maximum extra benefit is 25k MQM and RDMs per signed up card;

so for 49k spend in taxes on both personal and business Platinum cards

You get 99.5k miles + 75k miles = 174k miles – worth hopefully at least 1c = 1740$

You also get 10+10+25+10+10+25k MQM = 90k MQM

Cost 99k x1.87 = $1850 + 250$ each for 2 cards = about $2350

Real cost of 90k MQM = about 610$ max

Remember that you have to do another 25k spend next yr = 450$ cost = 1060 total

for 100k MQM = plat from now on and again from Jan 2021 till Jan 23 followed by a yr of at least Silver again

Of course, if you are aiming for DM next year you have 90k this year and 100k spend in Jan 2021 gets you DM for 2 yrs 90k + 40k MQM

One could go on and on, but what is the real value of DL PM or DM now that planes are not flying?

1

Upgrades – may have to sit closer than in economy with middle blocked till Jan 21

2

Future upgrades if you really believe in DL being around – more likely than AA and UA

3

Too much money too little sense on what to do with it?

Hello — have there been any data points suggesting that AmEx has been cracking down on giving rewards on Kiva payments?

My personal data point is that Kiva repayments were exceptionally slow in May and June but seemed to get back to normal-ish last month.

Thanks everyone for your help.

No, I haven’t seen any issues with paying Kiva. I’d be VERY surprised if there was ever a problem there.

Thanks Greg

I opened the Delta Plat consumer card back in January and earned 5000 MQM as part of the signup bonus. So it would give me 27.5K MQM with the additional25K in spend putting me at Silver. Thats great

so if I earn (for example) 75k MQMs through spend and reach platinum status this year, will i then have platinum status for this year (2020 through to jan 2022) AND still have my 75k MQMs at the start of next year?

Yep! In 2021 you’ll want to spend at least $25K on Delta credit cards to get another MQD waiver so that your rolled over 75K MQMs will give you Platinum status through jan 2023

Wow I didnt realize it was this good, definitely going to spend to status for this year then

Starting from scratch, wouldn’t you actually want to spend $30k on the Platinum card after signing up for the offer to get Delta Silver status for 2020 (which means for all of 2021)? Then if you spent $25k on the Platinum card in 2021, wouldn’t that let you keep Silver status in 2022?

Ha! Great point! I’ll add that to the post. Thanks!