FM Intro: While I’m on vacation, I will be lazily reposting old classic Frequent Miler posts. Today’s post, originally published February 2nd 2013, recounts one of several adventures I enjoyed on my first class trip to Bangkok last year…

Join me as I travel in style to Bangkok and back.

You know that moment when you first realize that something has gone very, very wrong, and it feels as if your heart has dropped into your stomach? Well, that happened to me in a big way on my descent into Bangkok…

Last night I flew Thai First Class from Frankfurt to Bangkok on a 777. First Class had two rows in a 1-2-1 configuration and was completely full. Each seat is designed to be like an almost private room in that you can slide closed the doors to your seat/room and, if you’re in the middle (as I was), you can raise a partition between you and the passenger next to you. Here’s a grainy, wobbly photo to give you an idea of what it was like:

I intended to take better photos in the morning with more light, but it turned out that I was preoccupied. More on that in a moment.

Food and service were excellent. The inflight entertainment system had a gigantic screen and a very good selection of movies. Unfortunately there seemed to be something wrong with my screen: in dark scenes, I couldn’t see anything, even with the brightness turned all the way up. Luckily I was able to find a bright enough movie to overcome most of that effect.

When I was ready for bed, I changed into my new Thai Airways pajamas, and the flight attendant prepared my bed. It was awesome. It was by far the most comfortable in-air bed I’ve experienced to-date. Of course, so far, I’ve only tried one other first class lie-flat product, and that was with Lufthansa’s old-style seats, but still this was great. One big quibble: the partition between my seat and my neighbor’s was broken so I never did experience the fully private “room”. In the end I was still very happy with the amazing first class experience, but I would have liked to have tried it out as intended.

Upon descent, we were handed arrival cards to fill out for Customs. When I got to the part asking for my passport number, I reached into the bin next to my seat where I had stored all of the stuff from my pockets the night before. I took out everything one by one, but my passport wasn’t there. Oh crap. That was when the sinking feeling hit me. Crap, crap, crap. I thought that maybe I had shoved it into my backpack, so I rifled through it, but it wasn’t there. Then, I completely emptied my backpack just to be sure. I searched through the seat cushions and in every nook and cranny I could find. It was gone.

Everyone got in on the search. Two flight attendants and my seat neighbors to either side all helped search for my passport, but to no avail. We lowered the seat to flat position to see if that would uncover it. No dice. I resigned myself to the fact that I’d probably spend the rest of the day or longer at the airport with Customs officials. I did have a photo of my passport on my phone so I hoped that would help expedite things.

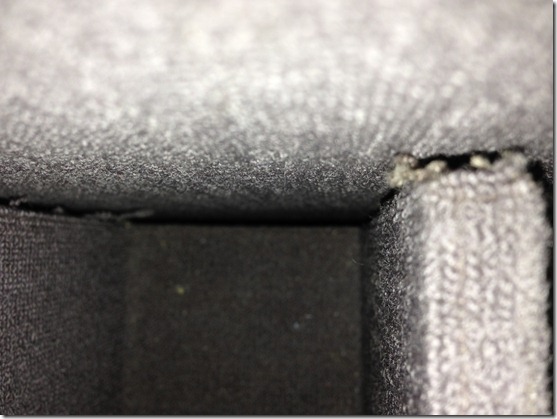

Then, I remembered a trick that my wife had taught me. Even in a well lit room, it can help to use a flashlight to find things. It really does help. So, I asked for a flashlight and looked into the side bin where I had thought I had left my passport. I then noticed something interesting. There was a gap between the wall of the bin and the floor of the bin. This photo is a view looking down and into the bin. See the gap?

When I shined (shone?) the flashlight into the gap, I saw something. I had no way to know if that something was my passport, but I was hopeful. Unfortunately, there was no way for me to get to it.

The lead flight attendant took care of things. He called ahead to the ground maintenance crew so that they were ready when we landed. After the other passengers left, the maintenance crew practically disassembled the entire seat. And sure enough, the thing I was able to see through the crack was my passport, and they retrieved it! Disaster averted! Now onto Bangkok…

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

| Chase 5/24 semantics ("Subject to" vs. "Count towards"): Most Chase cards are subject to the 5/24 rule. That means the rule is enforced in making approval decisions. In other words, you probably won't get approved if your credit report shows that you opened 5 or more cards in the past 24 months. Meanwhile, most business cards (such as those from Chase, Amex, Barclaycard, BOA, Citi, US Bank, and Wells Fargo) are not reported on your personal credit report. These cards do not count towards 5/24. Example: Chase Ink Business Preferred is subject to 5/24, so you likely won't get approved if over 5/24. If you do get approved, it won't count towards 5/24 since it won't appear as an account on your credit report. |

| Amex credit and charge card limits: If you apply for a new Amex credit card, you may get turned down if you already have 5 or more Amex credit cards; or 10 or more Pay Over Time (AKA charge) cards. Both personal and business cards are counted together towards these limits. Authorized user cards are not counted. See also: Which Amex Cards are Charge Cards vs. Credit Cards? |

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

| Manufacturing Spend Caution: Many, many things can go wrong when manufacturing spend. If you suddenly increase credit card spend, your accounts may get shut down. If you cycle your balance often (e.g. spend to your limit, pay the bill, repeat) within a billing cycle, your accounts may get shut down. If you repeatedly pay your credit card bill from an anonymous bill payment source, your accounts may get shut down. If you buy lots of gift cards you may lose money due to gift card fraud, theft, loss, or simply mishandling those gift cards (e.g. maybe you thought you already used a gift card and tossed it into your “used” bin). If you rely on only one method to liquidate gift cards, you may be stuck unable to pay your credit card bill when that method gets shut down. In other words, don’t try this at home unless you know what you’re doing, and you understand and accept the risks.. |

| Chase Ultimate Rewards points are super valuable and super flexible. At the most basic level, points can be redeemed for cash or merchandise, but you'll only get one cent per point value that way. A better option is to use points for travel. When points are used to book travel through the Ultimate Rewards portal, points are worth 1.25 cents each with premium cards (Sapphire Preferred or Ink Business Preferred, for example) or 1.5 cents each with the ultra-premium Sapphire Reserve card. Another great option is to transfer points from a premium or ultra-premium card to an airline or hotel program when high value awards are available (see this post for details). If your points are tied to a no-fee "cash back" Ultimate Rewards card, then first move those points to a premium or ultra-premium card before redeeming them in order to get better value. |

| Amex Membership Rewards points can be incredibly valuable if you know how to use them. In general, if you use Membership Rewards points to pay for merchandise or travel, you won't get good value from your points. One exception is with the Business Platinum card where you'll get a 35% point rebate when using points to book certain flights. This gives you approximately 1.5 cents per point value, which is pretty good. Another exception is with the Business Gold Card where you'll get a 25% point rebate when using points to book certain flights. This gives you approximately 1.33 cents per point value. If you don't have either card, then your best bet is to transfer points to airline miles in order to book high value awards. More details can be found here: Amex Membership Rewards Complete Guide. |

| Marriott points can be redeemed for free night awards, travel packages, airline miles, or experiences. 5th Night Free Awards: When redeeming points for free nights, the 5th night within a single reservation is free. Airline miles: Points can be converted to airline miles at a rate of 3 points to 1 mile. With many programs, a bonus is added on when you transfer 60,000 points at a time, such that 60,000 points transfers to 25,000 miles. Also, you'll get a 10% bonus when transferring points to United Airlines. Everything you need to know about Marriott's rewards program, Bonvoy, can be found here: Marriott Bonvoy Complete Guide |

| Editor’s Note: This guest post was written by the same guy who showed you how to fly round trip to Africa (DC to Senegal) for 50,000 points, how to book business class to Europe for 80,000 miles roundtrip, and more. You can find John’s website and award booking service here: theflyingmustache.com/awardbooking. -Greg The Frequent Miler |

Amex Application Tips

Check application status here. |

Chase Application Tips

Call (888) 338-2586 to check your application status |

Citi Application Tips

Check application status here. |

Bank of America Application Tips

Click here to check your application status |

Barclays Application Tips

Consumer: Click here to check your application status |

Capital One Application Tips

To check application status, call (800) 903-9177 or (877) 277-5901 |

Discover Application Tips

Click here to check your application status |

TD Bank Application Tips

Call (888) 561-8861 to check your application status |

US Bank Application Tips

Call (800) 947-1444 to check your application status. |

Wells Fargo Application Tips

Check application status here. |

Under certain circumstances consumer Visa cards don't work with Plastiq. The following payments are fine:

|

In order to meet minimum spend requirements, people often look for options to increase spend in ways that result in getting their money back. These techniques are referred to as "manufacturing spend". American Express has terms in their welcome offers that exclude some manufactured spend techniques from counting towards the minimum spend requirements for the welcome bonus offer. For example, most new cardmember bonuses have terms like this:

Eligible purchases to meet the Threshold Amount do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of other cash equivalents.That said, many techniques for meeting minimum spend are perfectly fine. Here are some techniques that are safe for meeting Amex minimum spend requirements (click each link for more information): |

|

| We have added this to our running list of Black Friday deals, which will be constantly updated through Cyber Monday with a mix of gift card deals, merchandise deals, and travel deals. Check back often. |

[…] Bangkok Bound: Thai 1st class, and my uh-oh moment […]

I lost my glassed in Biz on KLM once. They were the in foot rest when folded up…..Still thank that Purser to this day who found them….

WOW – that was a lucky break! I can’t imagine what a nightmare that would have been otherwise being stuck there without a passport. Good thing you were in First Class and they were so helpful

So true!