This deal is good through 8/31/2013. Rebate ID=13-75033. Hat Tip Trevor.

Staples has a new Free After Easy Rebate software download. These are usually a great way to make progress toward meeting credit card minimum spend thresholds or to earn points and cash back for buying software regardless of whether you actually want the software. This time, the total spend is pretty small ($60), but its better than nothing…

The idea is to go through an online portal to Staples.com and buy software for which you’ll eventually get all of your money back. The best current portal options offer 5% cash back. Once at Staples.com, buy three copies of this product for a total cost of $60. If you use your Chase Ink card you will earn 5 points per dollar since this is an office supply purchase. In other words, you could earn about 300 points for free, plus $3 cash back, plus $3 in Staples Rewards.

Staples has an amazingly easy “Easy Rebate” system. Once you purchase the software, they send you a rebate link via email. You click the link, fill out a little bit of info and you’re done. Note that you will have to wait a while, though. It takes 4 to 6 weeks to receive your check.

If you have questions, please see the Q&A section at the bottom of this post.

Here are the steps to follow:

Step 1: Choose a shopping portal:

You can get additional points or cash back by starting with a shopping portal. Some good choices are uPromise 5%, ShopDiscover 5%, and the Ultimate Rewards Mall 3 points per dollar.

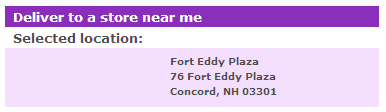

Step 2: Add three copies of “Kaspersky Anti-Virus 2013 for Windows (1 User) [Download]” to your cart:

TIP: Search for item 982926

The rebate’s terms & conditions say:

Limit 3 rebates per name / address / household.

Step 3: Check out

TIP 1: If you have Staples’ rewards money, use it! If you have a Chase Ink card that gives 5X for office supplies, use it!

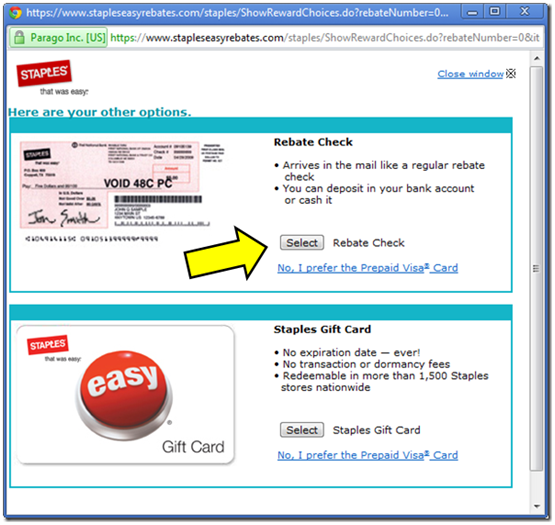

TIP 2: Your state may charge sales tax. If you know someone in a state that doesn’t charge sales tax for downloadable internet orders (CA, NH, etc.), then set their address as the delivery address and no tax will be charged. This is a download only purchase anyway, so nothing will really be delivered. I picked “deliver to store” and picked a store in New Hampshire. Of course, there won’t really be anything to pick up.

TIP 3: Checkout the latest Staples’ coupons here. The $10 off $100 coupon might be of interest to you if you have additional Staples’ purchases to make.

Step 4: Submit Easy Rebates

You will receive an email from Staples with a link in it for submitting the rebates . It’s easy! Even though you ordered 3 items, you’ll only have to fill out the rebate once.

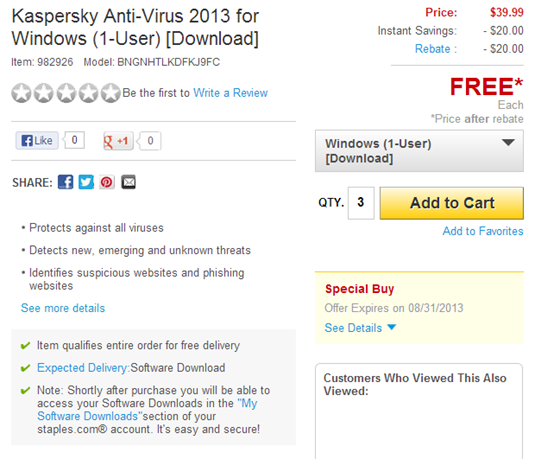

TIP: The software rebate can be changed from a Visa gift card to a check! About 4 screens into the rebate process, you’ll see something like this (screenshot is from a previous rebate, not the current ones):

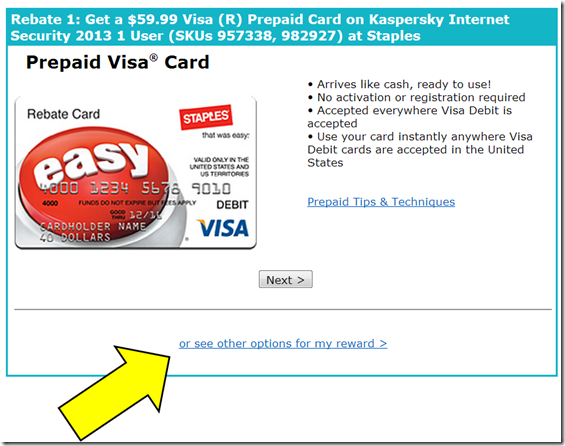

Click on “or see other options for my reward” and you’ll see this:

Q&A:

Same Item

-

Q: In the past I’ve bought the exact same item for the rebate. Can I do this again?

-

A: Yes. As long as the rebate number is different from your past purchases, you should qualify for a new rebate. This rebate is different from any I’ve posted about in the past.

Per Household Limit

-

Q: Can I buy a copy for every friend I know?

-

A: I don’t recommend it. I know at least one person who tried to do something similar, but Staples did not approve the second set of rebates. I don’t know how they figured it out.

Status = Researching

-

Q: The status of my order says “researching”. What’s up with that?

-

A: Staples needs to verify your order. Sometimes this happens if you have the wrong email address or phone number on file. Simply give them a call or do an online chat with them to verify the information they need. Once that is done, they’ll confirm the order.

Ultimate Rewards Mall T&C

-

Q: The Staples’ Terms and Conditions in the Ultimate Rewards Mall says “Not eligible on promotional items, technology, software, and electronics”. Shouldn’t this deal be ineligible since this is software? And, aren’t these free after rebate items “promotional”?

-

A: In all past FAR deals, points have posted despite these terms & conditions, but there is always a risk that portal points won’t post.

Do I have to use a Chase credit card?

-

Q: If I go through the Ultimate Rewards Mall to Staples, do I have to pay with a Chase credit card in order to get bonus points from the mall?

-

A: No, you can use any credit card, but you may have better luck with a Chase card. For details and information about risks involved please see Ultimate Question.

Rebate Time

-

Q: How long will it take for my rebate to arrive?

-

A: The Staples web site says to expect 4 to 6 weeks. In my experience, that estimate is fairly accurate.

Download

-

Q: Do I have to download this software so that I can qualify for the rebate?

-

A: No! I didn’t download any of the software I’ve bought in the past, but all rebates processed successfully.

Double Dip

-

Q: Can I double dip by buying a Staples gift card through a portal and then go through the portal again to use the gift card?

-

A: No. Staples gift cards are for in-store use only. They do not work online.

Do Good

-

Q: I don’t need this software. Is there someone I can send the license keys to that could make good use of this stuff?

-

A: Check with your local schools or libraries. If someone can make good use of this software, then great!

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

| Chase 5/24 semantics ("Subject to" vs. "Count towards"): Most Chase cards are subject to the 5/24 rule. That means the rule is enforced in making approval decisions. In other words, you probably won't get approved if your credit report shows that you opened 5 or more cards in the past 24 months. Meanwhile, most business cards (such as those from Chase, Amex, Barclaycard, BOA, Citi, US Bank, and Wells Fargo) are not reported on your personal credit report. These cards do not count towards 5/24. Example: Chase Ink Business Preferred is subject to 5/24, so you likely won't get approved if over 5/24. If you do get approved, it won't count towards 5/24 since it won't appear as an account on your credit report. |

| Amex credit and charge card limits: If you apply for a new Amex credit card, you may get turned down if you already have 5 or more Amex credit cards; or 10 or more Pay Over Time (AKA charge) cards. Both personal and business cards are counted together towards these limits. Authorized user cards are not counted. See also: Which Amex Cards are Charge Cards vs. Credit Cards? |

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

| Manufacturing Spend Caution: Many, many things can go wrong when manufacturing spend. If you suddenly increase credit card spend, your accounts may get shut down. If you cycle your balance often (e.g. spend to your limit, pay the bill, repeat) within a billing cycle, your accounts may get shut down. If you repeatedly pay your credit card bill from an anonymous bill payment source, your accounts may get shut down. If you buy lots of gift cards you may lose money due to gift card fraud, theft, loss, or simply mishandling those gift cards (e.g. maybe you thought you already used a gift card and tossed it into your “used” bin). If you rely on only one method to liquidate gift cards, you may be stuck unable to pay your credit card bill when that method gets shut down. In other words, don’t try this at home unless you know what you’re doing, and you understand and accept the risks.. |

| Chase Ultimate Rewards points are super valuable and super flexible. At the most basic level, points can be redeemed for cash or merchandise, but you'll only get one cent per point value that way. A better option is to use points for travel. When points are used to book travel through the Ultimate Rewards portal, points are worth 1.25 cents each with premium cards (Sapphire Preferred or Ink Business Preferred, for example) or 1.5 cents each with the ultra-premium Sapphire Reserve card. Another great option is to transfer points from a premium or ultra-premium card to an airline or hotel program when high value awards are available (see this post for details). If your points are tied to a no-fee "cash back" Ultimate Rewards card, then first move those points to a premium or ultra-premium card before redeeming them in order to get better value. |

| Amex Membership Rewards points can be incredibly valuable if you know how to use them. In general, if you use Membership Rewards points to pay for merchandise or travel, you won't get good value from your points. One exception is with the Business Platinum card where you'll get a 35% point rebate when using points to book certain flights. This gives you approximately 1.5 cents per point value, which is pretty good. Another exception is with the Business Gold Card where you'll get a 25% point rebate when using points to book certain flights. This gives you approximately 1.33 cents per point value. If you don't have either card, then your best bet is to transfer points to airline miles in order to book high value awards. More details can be found here: Amex Membership Rewards Complete Guide. |

| Marriott points can be redeemed for free night awards, travel packages, airline miles, or experiences. 5th Night Free Awards: When redeeming points for free nights, the 5th night within a single reservation is free. Airline miles: Points can be converted to airline miles at a rate of 3 points to 1 mile. With many programs, a bonus is added on when you transfer 60,000 points at a time, such that 60,000 points transfers to 25,000 miles. Also, you'll get a 10% bonus when transferring points to United Airlines. Everything you need to know about Marriott's rewards program, Bonvoy, can be found here: Marriott Bonvoy Complete Guide |

| Editor’s Note: This guest post was written by the same guy who showed you how to fly round trip to Africa (DC to Senegal) for 50,000 points, how to book business class to Europe for 80,000 miles roundtrip, and more. You can find John’s website and award booking service here: theflyingmustache.com/awardbooking. -Greg The Frequent Miler |

Amex Application Tips

Check application status here. |

Chase Application Tips

Call (888) 338-2586 to check your application status |

Citi Application Tips

Check application status here. |

Bank of America Application Tips

Click here to check your application status |

Barclays Application Tips

Consumer: Click here to check your application status |

Capital One Application Tips

To check application status, call (800) 903-9177 or (877) 277-5901 |

Discover Application Tips

Click here to check your application status |

TD Bank Application Tips

Call (888) 561-8861 to check your application status |

US Bank Application Tips

Call (800) 947-1444 to check your application status. |

Wells Fargo Application Tips

Check application status here. |

Under certain circumstances consumer Visa cards don't work with Plastiq. The following payments are fine:

|

In order to meet minimum spend requirements, people often look for options to increase spend in ways that result in getting their money back. These techniques are referred to as "manufacturing spend". American Express has terms in their welcome offers that exclude some manufactured spend techniques from counting towards the minimum spend requirements for the welcome bonus offer. For example, most new cardmember bonuses have terms like this:

Eligible purchases to meet the Threshold Amount do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of other cash equivalents.That said, many techniques for meeting minimum spend are perfectly fine. Here are some techniques that are safe for meeting Amex minimum spend requirements (click each link for more information): |

|

| We have added this to our running list of Black Friday deals, which will be constantly updated through Cyber Monday with a mix of gift card deals, merchandise deals, and travel deals. Check back often. |

[…] Using Staples “Free After Easy” Rebate to Generate Spend […]

Love me some Staples rebates!

Check your spam folder If you’re still waiting for the download link to arrive. That’s where mine was.

Read the rebate terms & conditions. It says “Limit 3 rebates per name/address/household.”

Thanks FM! I also see the $20 rebate but I’ll trust that you know what you’re saying.

Staples is one of the best places to make a weekly trip to be able to meet minimum spend. This week, Staples is paying me to take 3 of the Kaspersky (you could actually make $6/copy by using last week’s 30% off. Staples coupons are good 2 days paste the expiration), 4 reams of white copy paper, 4 reams of pastel, 4 packages of photo paper.

In the end, I spent $400 on eGift cards. That got me $480 worth of eGift cards thanks to the promotion they are running right now. I spent $120 of that, so I still have about $360 worth of eGift cards left (used the $80 in promo ones first since they expire in Sept). Total profit ($80 promotion eGift + $125 rebates – $120 spent) = $85 plus the paper and software. Yes, I still have to find a way to spend $360 at Staples, but with their weekly FAR offers, that will be gone soon.

I chose to use a card I needed to meet minimum spend on as the eGift cards wouldn’t have given me 5% on my Ink because they are not issued by Staples directly.

While I appreciate Frequent Miler letting us know about this offer, I agree with Levandar. I just don’t think its worth all that effort for the money and miles involved. Some time ago there was an offer where you could buy 10 software packages for the more expensive 3 user product. That was certainly worth the time, miles and wait for the refund.

I did an easy rebate with Staples last week and they had the option to get paid via PayPal. I haven’t check this on yet so I’m not sure if this is for all items or specific ones. Mine was a rebate for a ream of paper.

When will I received the keys? I place order in the morning.

Seriousoy you guys, is 9 bucks profit worth keeping watch for six weeks to make sure you get a $60 dollar reimbursement check?

Wow, what is this?? A MMS guest post? Sheesh.

Did you guys buy 1 user or 1-3 user download copies?

1-3 user for me shows 59.99..

kris: Sorry, that was a mistake in my post (fixed). Yes, it is the 1 user one that works. Search for: 982926

@Point Travelers

I saw the same thing, my best guess is that it’s a $20 rebate per item, so in Staple’s system, we’ll each get 3 $20 rebates. I hope.

[…] Thanks to Frequent Miler for pointing out the software deal you can do for some free points and a few extra dollars. You can combine that deal with the deal […]

Although I bought 3 copies, I am only seeing a $20 rebate. Anyone else having this issue?

Point Travelers: That always happens. You’ll still get a single $60 check or gift card (depending upon which option you chose).