| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

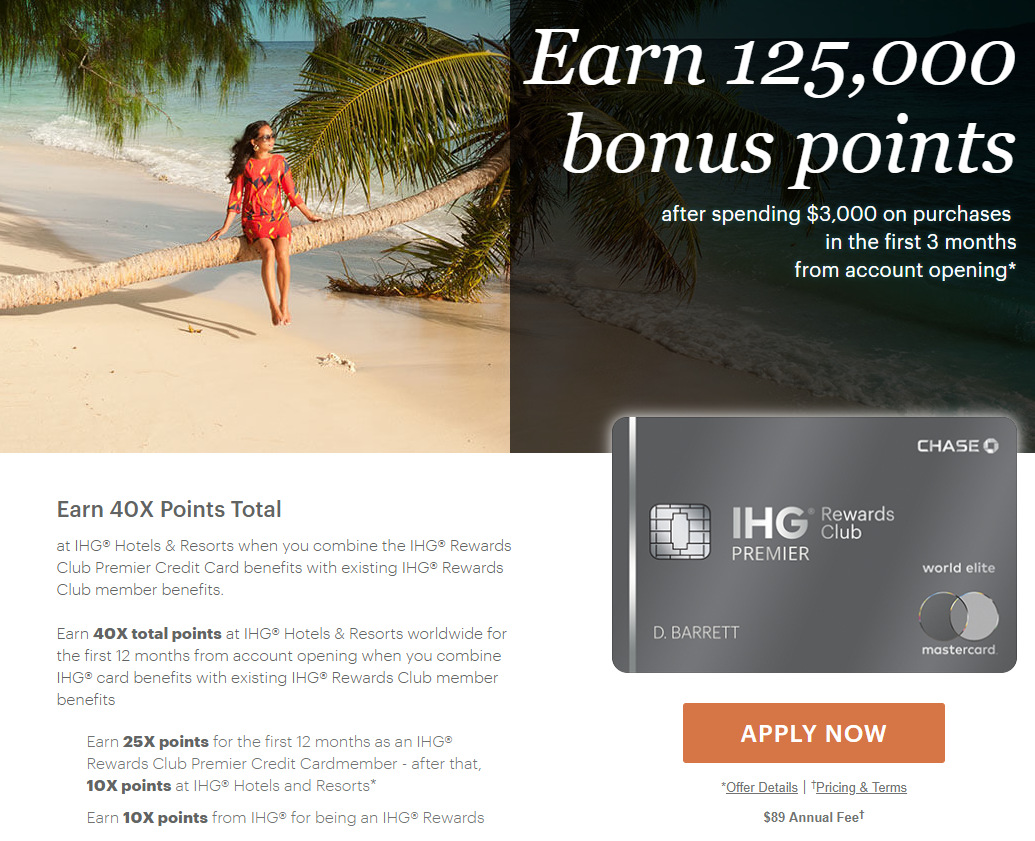

There’s a new (possibly targeted) offer out on the IHG Rewards Club Premier credit card that looks amazing for IHG enthusiasts: in addition to the intro bonus of 125K IHG points after spending $3K on purchases within the first 3 months, get 25x at IHG properties and 4x everywhere else for the first year. While IHG points can often be purchased for around half a cent (and sometimes quite a bit less), earning 25x on paid stays and 4x everywhere else will no doubt be awesome for those who can leverage the points for good value.

The Offer

For more information about this card and to find an application link, see our dedicated card page by clicking the card name below.

| Card Offer |

|---|

140K Points ⓘ Affiliate 140K points after $3K spend in 3 months$99 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 175K after $3K in spend (expired 4/6/23) |

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

$99 Annual Fee Earning rate: 10X IHG ✦ 5X travel, dining, and gas stations ✦ 3X on all other purchases Card Info: Mastercard World Elite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: 10K bonus points + $100 statement credit after you spend $20K in a calendar year + make one additional purchase ✦ Diamond status after $40K in purchases + one additional purchase in a calendar year Noteworthy perks: Anniversary free night e-certificate good at IHG properties up to 40K points per night ✦ Ability to add an unlimited number of points to a free night certificate to book a higher-level hotel ✦ Fourth night free on award stays ✦ 20% discount on points purchases ✦ Platinum elite status ✦ Up to $50 in United TravelBank cash per year (must register your card with your United account) |

Quick Thoughts

Note that if the link on our card page doesn’t work, try logging in to your IHG Rewards Club account to look for this offer (and comment to let us know!).

Stephen noticed this offer this morning when logging in to his IHG account and it looks fantastic for people who spend paid nights at IHG properties. Earning 25x on credit card spend on top of the points earned from staying with IHG (ordinarily 10x base points + 5x bonus for having Platinum status, which comes as a benefit of the card) means you’ll earn a minimum of 40x at IHG hotels for the first year. Spire Elite members will earn 45x (and as IHG recently ran a status match opportunity, hopefully some readers took advantage of that).

Keep in mind that this card is subject to the Chase 5/24 rule. Furthermore, the bonus is not available to you if you currently have this card or have earned a new cardmember bonus on it within the past 24 months.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Ordinarily, I wouldn’t consider using up a 5/24 slot on an IHG credit card since I find other Chase cards generally more valuable. However, for someone who has a lot of paid IHG stays — particularly those reimbursed by an employer — this offer is incredible. A member who spends 50 nights a year at IHG properties at an average cost of $100 per night would earn at least 200,000 IHG points between the credit card and loyalty program. That’s before considering any quarterly Accelerate or other bonus offers, etc. Surely some folks spend more paid nights and pay higher average rates, in which case earnings could quickly increase.

I am less enthused about the prospect of earning 4x “everywhere else” for the first year. That’s actually not a bad rate of return, but if you can get a card that earns more than 2% cash back in the first year (like the Discover IT Miles card or Alliant Cashback card or BOA Premium Rewards card with Platinum Honors), you could earn cash back instead and probably buy more than 4 IHG points per dollar spent. On the other hand, if you know you have a valuable use in mind and you’d rather keep things simple, earning 4x everywhere else sure beats earning 1x.

Keep in mind that IHG has gotten rid of award charts in favor of variable award pricing and recently raised the points rate of some hotels to 100K points per night, which dulls the shine on this offer a bit. I suspect that it will become harder to get outsized value out of your points moving forward. I still think 25x at IHG properties is a good enough return to consider this offer if you have a lot of paid IHG stays, but it may be less attractive a year from now depending on how variable pricing pans out.

Overall, I’d say this is an intriguing offer for those invested in IHG Rewards.

[…] It’s possible for some people to earn up to 85x on their stays, although it’ll likely be a minority of people that find themselves falling into this category. That’s because you’d need to be a Spire Elite member and have applied for the IHG Premier card when it was offering 25x on IHG stays in the first year. […]

[…] new offer recently debuted on the IHG Rewards Club Premier credit card. See this post for full details on that offer, but in a nutshell what makes this offer stand out is its eye-popping bonuses for first year spend: […]

When programs start handing out points like this a major deval is almost certainly to follow. Delta, Hilton, & now United have put out large offers lately because their points are worth less & less every year. Look for top tier IHG redemptions to be an easy 100k+ per night in the coming year….

You think Chase would match this offer to people who applied for the last 120k/$5k deal? Particularly the 25x part? I’m assuming no.

I have been working business cards for a while and have a few 5/24 slots available. Was planning on filling two slots with hotel cards, but was planning on doing the World of Hyatt card and hoping the Marriott Boundless increases their offer at some point. I think I can only do two. Would you recommend skipping the Marriott card for this IHG offer?

@Greg same boat as you, I’ve had this card on my list since the new card came out. Mainly been working the biz cards. We added the AMEX SPG Biz cards last fall – they provided good value will be interesting to see when peak pricing rolls down.

Personally I would get the Marriot AMEX biz over Boundless and keep a 5/24 slot open unless your hoping to PC to Ritz card later.

With regards to Hotel cards – is it for domestic or Int’l stays. Have you seen Drew’s TravelisFree Google Hotel maps with points? I try to app based on planned intl trips over next 12-24 months and see what hotels brands are in those destinations – as well as are they 4th/5th award night free. Then if you have annual award nights from other cards, you can use as well on the trip.

So a big factor in IHG vs Boundless depends on where your headed or plans are at SO after MSR you would have 137K IHG vs 81k Bonvoy pts

IHG 4th Award night free

SPG 5th Night free (award or paid) Marriott

All good points. If we do the math, IHG points are worth about 0.5 cents, so booking at IHG essentially gives 20% back. That’s great value, but it’s also the same we get with the venture card and hotels.com. While I could apply for this card and try to pile on the points by buying stays at IHG hotels, is there really any advantage to doing that over just getting essentially 20% back from the venture and hotels.com combo?

@Greg, DW got through Venture card when they ran 75K SUB last Nov. – it can be hit or miss getting approved with C1 even with FICO’S over 750 ( DW was pre-approval checking C1 I wasn’t PA and TD was 5/24 at the time). They HP all 3 CRB.

Hotels. Com 10X may not be renewed for another year. iHG after SUB – annual night 40k cert should always be worth more than $89 AF. .

But again it depends on how you travel and where

Thanks for this tip! I’ve been waiting for an offer of 120K+ for this IHG card so I can apply (which I did and got approved). I’ve the old card also so now I’ll be able to stack up the 2 free night certificates next year and onwards.

Have the old card and was offered to upgrade to this one. Recommended?

Same situation, but best to reapply the new one with this offer, keep the old one for the free night

I would just apply for the card instead of upgrading. Get 2 free night certificates each year.

Are you suggesting that you can have both IHG cards – keep the old one and add the new one? Surely Chase considers this as a similar card??

Any comment, Nick or Greg?

Yes, it’s possible to have both

Randomly went to IHG to make an award reservation, not logged in and did see this offer! Better than the 120K,spend $5000 one that ended couple mths back!

Hey Nick, do you know when this offer is going to expire?

No, I don’t. I don’t saw an ad for it on the IHG home page this morning, so I imagine it will be around for a bit…but I don’t know how long.

Bummer. Thanks anyways. I’m going to have my spouse sign up for this, but want to time it right.

Thanks for posting this offer!

Wow this is an insane offer.

And I thought the 100K offer we saw before was already very good.

Too bad I already have this card.

If the 25x applies to purchases of points on cash and points bookings then the math gets mildly tempting. It would bring the costs of points from about .57 to .49 cents.