According to several blogs (here, here, and here), in late June Chase quietly began shipping out Chase Ink cards as Visa cards rather than MasterCard cards. Most will regard this as a ho hum event. After all, almost all merchants that accept MasterCards accept Visa cards as well. It occurs to me, though, that there are some potential benefits…

MasterCard small business cards qualify for the MasterCard Easy Savings program. Simply register each business MasterCard and you can earn cash back automatically at various merchants. Visa has a similar program: Visa SavingsEdge. Both programs offer cash back for various business services, hotels, and gas stations.

I’m particularly interested in the gas station savings even though both programs offer only 1% cash back. The reason I’m interested (besides it being a good deal) is that many gas stations sell gift cards. You know where I’m going with this right? If the purchase of a gift card at a gas station qualifies for cash back then one would earn 1% cash back plus 2X Ultimate Rewards points when buying gift cards (since gas stations are a 2X category with Chase Ink cards). And, if one could find a qualifying gas station that sells Visa gift cards loadable up to $500 with a $4.95 fee, then the fee might be completely paid back by the savings program leaving you with 2X earnings fee free!

In July, I explored this theory with the MasterCard Easy Savings program, but I was hampered by two issues: 1) The 1% fuel savings were explicitly capped at $100 in purchases; and 2) I was unable to find a participating gas station in my area that sold gift cards. I did discover, though, that in-store purchases (yep, peanut M&Ms, what else?) did qualify despite wording that said savings were given only when you pay at the pump.

So, how about the Visa SavingsEdge program? This program offers 1% cash back at Texaco and Chevron stations. Like the similar MasterCard benefit, this one is supposedly limited to “qualifying fuel purchases made at the pump,” but I think there is a very good chance that in-store purchases will also count. The great thing here is that, unlike with MasterCard Easy Savings, there is no stated purchase limit for the 1% cash back benefit!

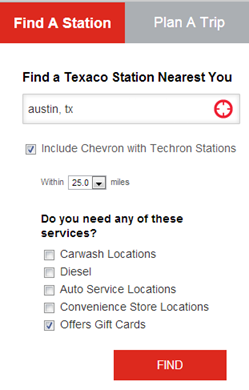

Unfortunately, there are no Texaco or Chevron stations anywhere near me so I’m hoping that some readers will help out with this experiment. Register a Visa business card with Visa SavingsEdge and then visit a Texaco or Chevron that sells gift cards. The Texaco / Chevron online location finder has an option to find stations that sell gift cards: Go to www.texaco.com/find-station.aspx, enter your location, and be sure to check the “Offers Gift Cards” box.

If you already have a Chase Ink MasterCard, but would prefer a Visa card, you have a few options. Let me be clear that I don’t know for sure that any of these options will work, but my best guess is that they will. The most obvious option is to simply ask Chase to replace your card with a Visa variety. A second option is to apply for a new Ink card. Hopefully, this will be considered a new product (since it is a Visa instead of a MasterCard) so that you could earn the sign up bonus again. A third option is to wait. My guess is that Chase will eventually replace all of our MasterCard Inks with Visa cards. Again, I’m not sure that any of these options are real options, but I’m sure we’ll learn from readers’ experiences soon enough.

I’m interested in hearing from readers. What do you think of this switch from MasterCard to Visa? How does it affect you, if at all?

I go the second bonus on the Visa version while still having the MC version open 🙂

Sweet! And, just to confirm: it was the same type of Ink (e.g. Ink Plus or Ink Bold) and the same business and tax ID?

I did too, but it was a different business. Used my SS# for both though as they’re both Sole Props.

[…] As Frequent Miler has pointed out, Chase has switched over its Ink cards from MasterCard to Visa. […]

I mentioned on my blog that Chase may be transitioning current cardholders to Visa as well: http://www.thepointsninja.blogspot.com/2013/09/chase-ink-cards.html

I hope that doesn’t happen, because, as a World Mastercard the Ink has some nice CDW benefits that can come in handy for countries (such as Ireland) that are often excluded from CC CDW waivers. http://www.thepointsninja.blogspot.com/2013/06/chase-ink-cdw-benefits-money-saver-in.html

Andyandy

I think the important thing is we we currently hold an Ink card if we’ll get the bonus again by applying for a Visa Ink card.

@luchex: for Target, I have clicked the Visa discount link and added it to my cart. Then I close that tab and enter again from a cashback or points site. My rewards have always credited and sometimes I even purchase with my AmEx.

Drugstore.com is the only site that I have found (so far) that kills the discount if you use another link. These discounts usually come from their email list so it might be a different case as well.

I often have items in my cart and close out and enter again through a cash back or point site and have never had issues with getting the credit. Most of my online shopping is Target, Banana Republic/Gap, and Home Depot.

@m

I guess it’s too late. Many blogs are discussing the MS savings/VISA savings.

Regarding Alamo and National on the VISA business program, the 4% kicks in only if the rental price is over $100.00 in total. I don’t know if this applies to base rental costs or total including fees, taxes, surcharges, etc.

yes but careful re gc @ stations. i was using this on mc card for awhile. they didn’t have the ‘up to $100’ limit until late last year. then I’m sure they noticed & instituted that limit. if many ppl do this, a visa limit will come fast.

you ll becoming more like a UA commercial “and Here, and Here and Here ” haha

Some other differences between the Visa/MC savings programs:

Visa is 5% hotels (all budget hotels)

MC is 4% hotels (mostly budget hotels, but they list Hyatt Places & Hilton Garden Inns which would be a nice bonus on top of getting hotel points/UR pts….though when I searched a few cities that I know have Hyatt Place/ Hilton GI I did not see any available).

Visa is 4% rental cars (National, Alamo)

MC is 5% rental cars (Avis, Budget, and 1 more).

Also, the Ink cards come with access to Avis First status. This was a great combo along with the 5% rebate at Avis. I wonder if Chase will now enter into an agreement with National to provide additional benefits from National as they did with Avis?

I had the MasterCard before, applied Ink Plus over labor day, got the visa version.

Adnan: I assume you got the signup bonus again? Was it for the same business or a second business? Also, did you sign up for the Ink Plus both times or maybe the Ink Bold the previous time?

FM I have a questio for a long time. When I try to buy from a merchant, I go to evreward, I see let’s say kohls through UR. Besides I see the VISA discount and sometimes other coupons. But they don’t have a coupon code, just a button that opens the kohl website and already has the VISA discount. Because I am interested in the UR points, I get out, delete cookies and reenter to the shopping mall of the program I care. How can I manage to apply the VISA or other type of discount besides the merchant’s and earn the points in one purchase?

luchex: if there really isn’t a coupon code then you probably can’t get both UR mall points and that discount. When I looked at EvReward today, though, I saw that there was a coupon code associated with the Visa promotion. So, you could use that (but I doubt it would stack with other codes such as 20% or 30% off).