Yesterday, I accidentally applied for the SPG card. A reader had asked about the new feature where Amex will warn you if you’ve had a card before and are not eligible for the bonus. I had never seen the warning myself except as posted on other blogs, so I picked a card that I’ve had before (the SPG consumer card) and applied.

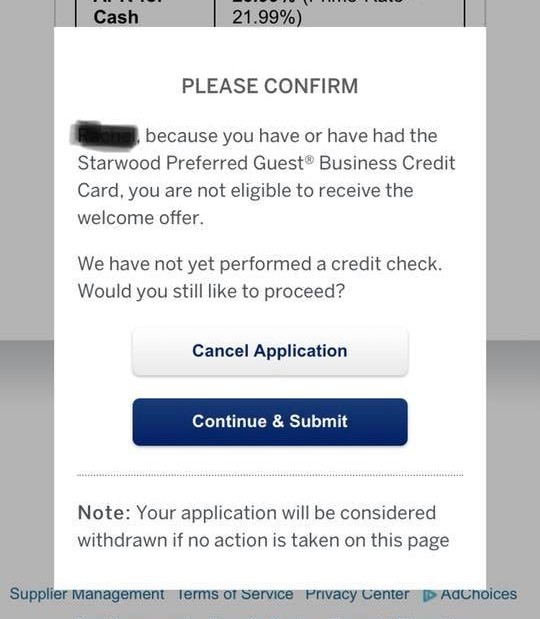

I expected to see something like this:

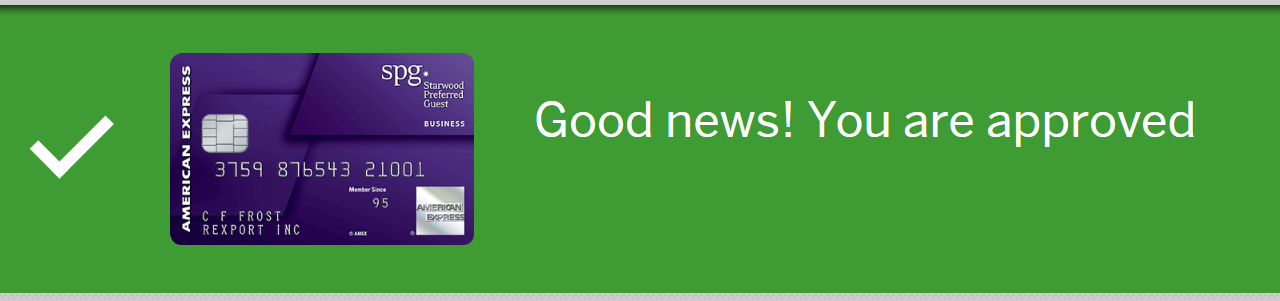

Instead, my application was instantly approved.

I don’t know why the application itself didn’t warn me that I’m not eligible for the bonus. I thought at first that maybe Amex is considering the SPG card new since it now earns the equivalent of Marriott points instead of Starpoints. But others have received the warning for this card with the new earning structure, so that’s not it. Maybe Amex somehow forgot that I had this card. I had cancelled it in May 2015 which is nowhere near the 7 year timeframe that seems to be their forget threshold. Most likely, the warning simply failed to trigger. I think it is very unlikely that I’ll get the bonus for this card.

The more surprising part of all of this is that I got approved despite having 5 credit cards already open. In the past, my applications have been denied when I tried to open a new credit card that would put me over the Amex credit card limit. Note that the limit used to be 4 credit cards, but had moved up to 5. Note also that charge cards, such as Amex Gold cards and Platinum cards, have never been part of this limit.

So, now I had 6 credit cards open. Maybe Amex has changed the limit to 6? I decided to push forward to find out…

I next opened the application for the SPG Business Card. I had cancelled that one as recently as June 2017. Surely the application would warn me that I’m not eligible for the bonus, right? Nope. I was instantly approved.

I now have 7 Amex credit cards.

I’m feeling fairly confident now that the hard limit on credit cards is gone. Or, maybe they have a limit, but it varies by person.

What’s up with the Amex bonus validator?

The validator seems to be completely broken for me. Or maybe it doesn’t work with Chrome? But it’s not broken for everyone. Quite a few Facebook group members reported that they received the same “PLEASE CONFIRM” message as shown above.

Reader Input

We need more data points to fully understand what’s going on. There are two primary questions:

- Is there any limit to Amex credit cards anymore?

- Is there a way to trust the bonus validator if it shows the warning sometimes but not other-times?

And, of course, there’s a third question: Do I have any hope at all of getting the welcome bonus for either card? I’m pretty sure that the answer is no.

What has your experience been with these topics? Please comment below.

By the way, when counting your Amex credit cards, don’t count charge cards, and don’t count authorized user cards. Thanks!

Does anyone know if being an authorized user on a personal card counts toward the 5 card limit?

It does not.

so… did you get the bonuses?

following

Yep. It seems to have been a system glitch

Is getting 4 biz cards in 6 months too much?

Aug, Oct, Jan. Considering the Biz Plat now given that I have a big expense coming up. Unsure if this will trigger some kind of review by Amex.

Thanks

I’m not aware of any issue in doing so.

did you end up getting your bonus and did you confirm that this was indeed your 6th amex credit card?

Yes, I got the bonuses on both cards and yes they were 6th and 7th credit cards. That said, most people report that the 5 card limit is still firmly in place so I believe that it was an error on Amex’s part that my apps worked.

From my understanding having spoken to amex earlier this year, if you haven’t had a particular card for 6 months, when you sign up again, you’re eligible for the sign up bonus.

Whoever you spoke with was misinformed. Most Amex cards have lifetime rules. e.g. once you’ve had the card you’re not supposed to be able to get the bonus again.

The limit is still in force for some people then.

I just applied for the Amex Blue Business Plus. Application was put on hold.

2 days later, got a call from Amex, explaining that I needed to close 1 of my accounts (I have 5 credit, 1 charge)

After I closed one of the accounts, the application was approved

[…] few weeks ago, I accidentally signed up for the consumer SPG card. I was expecting to see a popup warning me that I wasn’t eligible for the card, but received an […]

Applied for the new SPG LUX yesterday and got a call from them that I have too many cards (5 including one from Hilton Citi xfer) and would have to cancel one. So it must be YMMV.

[…] I’m also waiting to see what happens with my recently (and somewhat accidentally) acquired SPG and SPG Biz cards. I’ve finished the minimum spend on each, but haven’t received new SPG membership yet for those cards (see this post for details about this craziness). […]

[…] I am pretty sure they are taking notes in that department over at Amex. I am referring to the Amex 5 card limit… […]

[…] Is the Amex 5 Credit Card Limit Gone? by Frequentmiler. Greg was able to get a 6th and 7th Amex credit card. Limit always used to be 4, then was bumped up to 5 for most people, with sporadic successes of 6. Not sure if I’ve heard of 7 until now. […]

An AMEX chat agent told me late 2017 that co-branded SSN account history pulled from a separate system. Is possible a change was made to that system that impacts only co-branded

Could be!

This limit has been long lifted for me, as I shared with Greg a couple of years ago. Back then I had 5 cards. Now I hold 7 credit cards with AMEX. They are EveryDay (from EveryDay Preferred), Old Blue Cash, SPG, SPG biz, SimplyCash, SimplyCash Plus, and lastly Blue Biz Plus. The last two were approved since 2016. And only one of them was applied and approved using my EIN; others were applied using my SSN. Guess I always had a good ride with them, with heavy spendings thus more cards to approve in my favor maybe? Anyways, with Ritz card approved, I’m thinking to get that Aspire as well; or maybe Marriott or biz version to pool points? Never had any good plan with hotels, but whatever…

Do you have six personal and one business cards? I’ve seen that they can look past the five credit card rule for a combo of both, but they will not give you more than five personal credit cards

I do have a combination of personal and business, but I’ve never seen any case where Amex only counts personal

Come on Greg – You’re the Frequent Miler. You’re famous. You don’t think that AmEx knows who you are. You are in the system. They love you. You have links. They would probably do anything for you.

That’s definitely not true based on past experience with Amex cards.

Question I’ve always wondered. I’m at the supposed AmEx limit (actually over it thanks to the Citi Hilton merger). If I want to apply for another AmEx credit card do I (a) need to cancel down to 4 and then apply or (b) apply while still at 5 or 6 and then cancel during reconsideration call?

I especially ask because I have a fraud alert on my credit file so I am definitely getting a call from AmEx regardless and that could be a good time to cancel down to the needed 4.

Thoughts?

Danny, I was at the 5 limit, applied, got declined by the system, then called recon, and they suggested to me (!!) to close a card, which I did, and then I got approved for the new one I wanted. This happened twice already. Good luck!!

Awesome; thank you!

most welcome