Now that Plastiq no longer accepts American Express cards, it makes sense to look for other ways to pay bills by credit card. Melio is a bill payment service that continues to accept Amex. Like Plastiq, Melio also charges a 2.9% fee when paying by credit card, but unlike Plastiq, Melio can only be used by businesses to pay business expenses. If you’re interested in trying Melio, you’ll find welcome bonus offers below for up to $250.

Melio Overview

Melio is a service intended to simplify paying business bills. Melio has no subscription fees, and it lets you can pay business bills with a credit or debit card for a 2.9% fee, or for free with bank-to-bank ACH transfers. No matter how vendors want to get paid (ACH or check), Melio users can choose how they want to pay (i.e. ACH for free, or credit card 2.9% fee).

It can make sense to pay the 2.9% fee if you want to increase spend in order to earn a large welcome bonus or to earn a big-spend bonus (for example, some credit cards offer free hotel nights or elite status with big spend). Unfortunately, you cannot pay personal bills with Melio.

Why use Melio?

Here are some reasons you may find Melio compelling for paying business bills that can’t usually be paid by credit card:

- No subscription fee

- Earn credit card rewards. This can be especially compelling when you need to increase spend to earn a large welcome bonus or to earn a big-spend bonus (for example, some credit cards offer free hotel nights or elite status with big spend)

- Keep your cash for up to 45 extra days. With a service like Melio, you can pay your vendors immediately, but wait until your credit card statement is due to pay off your credit card bill.

Melio Welcome Bonus: $200

Sign up for Melio with Frequent Miler’s unique link, and then you’ll earn $200 back after your first successful payment of $200 or more.

We have an affiliate relationship with Melio in which we’ll earn a commission after your first payment of $200 or more (as long as you click through our link to sign up). We negotiated a special offer with Melio to increase your welcome bonus (otherwise, your bonus would have been only $100).

How to earn $200:

- Sign up for Melio here: Frequent Miler’s Melio link.

- Upload a bill or an invoice.

- Make a payment of $200 or more via Melio Pay.

That’s it, Melio should then deposit the $200 cashback to the bank account you provided.

Welcome Offer Terms: To be eligible to receive the $200 Cashback, a user must successfully register to Melio using the link above, and successfully complete their first payment on the platform (via MelioPay) of at least $200, and such payment is not charged back or refunded. Eligible users will receive the $200 Cashback by bank deposit to their bank account provided by such users to Melio. Melio reserves the right to end the promotion ahead of time or to make changes or additions to this promotion for any reason at any time. This promotion is available only to new users who have signed up to Melio using the link above. Melio reserves the right to withhold payment of rewards in case of fraud or abuse and subject to its Terms and Conditions.

Melio Welcome Bonus for iPhone users: $250

Those with iPhones can sign up for Melio with Frequent Miler’s unique link, and then earn $250 back after your first successful mobile payment of $200 or more.

How to earn $250:

- Sign up for Melio by following the instructions here: Frequent Miler’s Melio App link.

- Download the Melio App

- Upload a bill or an invoice.

- Make a payment of $200 or more via the Melio Pay app.

That’s it, Melio should then deposit the $250 cashback to the bank account you provided.

Welcome Offer Terms: To be eligible to receive the $250 cashback, a user must successfully register to Melio following the instructions above, and successfully complete their first payment of at least $200 via Melio Pay, and such payment is not charged back or refunded. Eligible users will receive the cashback by bank deposit. Melio reserves the right to end the promotion ahead of time or to make changes or additions to this promotion for any reason at any time. This promotion is available only to new users who have signed up to Melio using the instructions above. Melio reserves the right to withhold payment of rewards in case of fraud or abuse and subject to their Terms and Conditions.

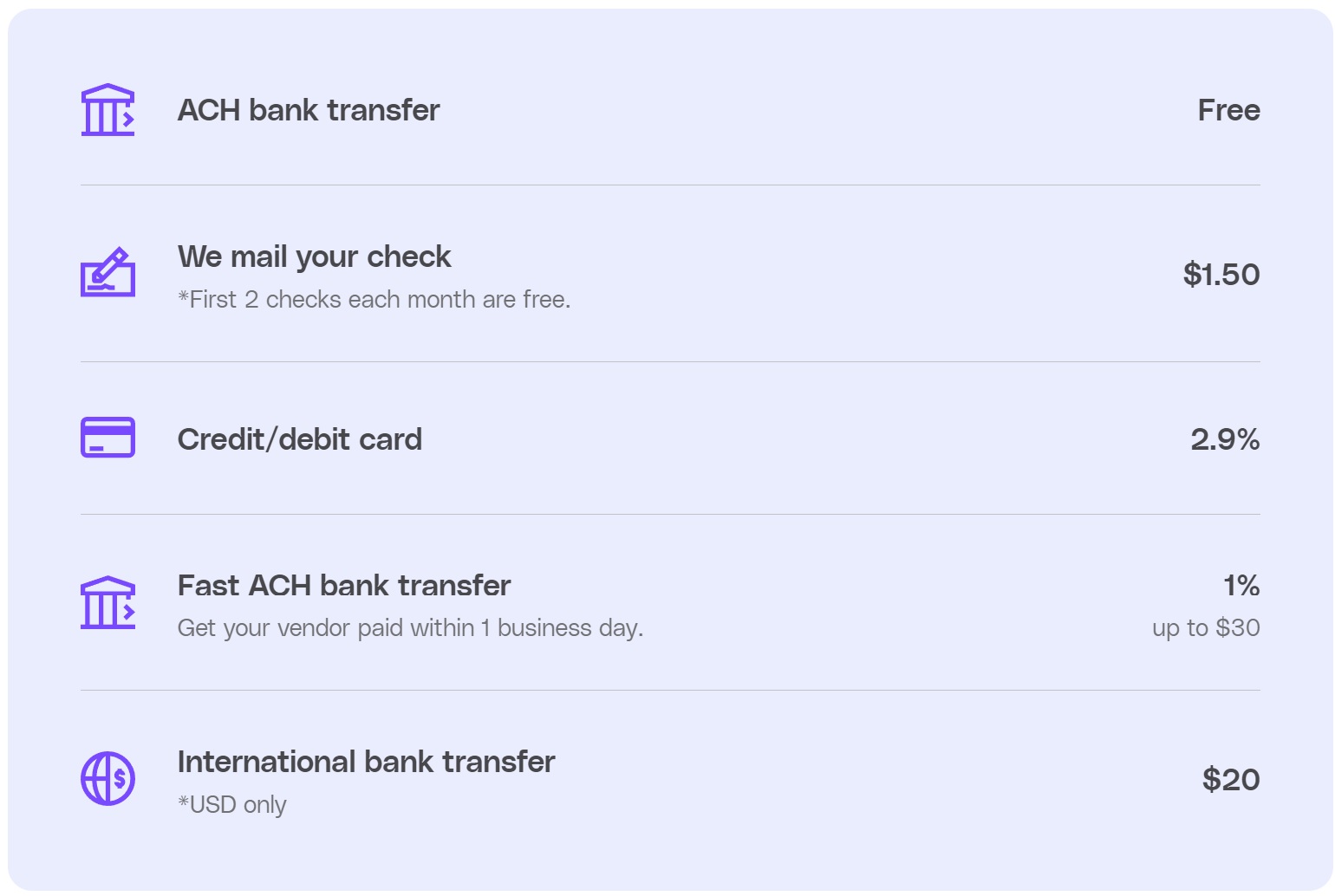

Melio Pricing

Melio charges 2.9% to pay with a credit or debit card. Melio’s pricing is nearly identical to Plastiq’s except that Melio charges $1.50 per check after the first 2 free checks each month.

Frequently Asked Questions

Who can use Melio?

Almost any U.S. based business, including sole proprietor businesses, can use Melio to pay business bills.

Businesses cannot use Melio if they are involved with any of the following:

- Gambling and related activity

- Multi-level marketing firms or any agents that represent them

- Sales of tobacco, marijuana, hemp, pharmaceuticals, supplements, nutraceuticals, or paraphernalia.

- Pornography, obscene materials, or any sexual/adult services

- Weapons, ammunition, gunpowder, fireworks, and any other explosives

- Toxic, flammable, or any radioactive material

- Gold, silver, diamonds

- Other goods and services subject to government regulation.

What types of payments are allowed with Melio?

Melio offers the following examples of payments that are allowed:

-

Rent (when your landlord is a business not an individual)

-

Taxes

-

Utilities

-

SaaS & app-based expenses

-

Franchising and operating expenses

-

Legal expenses

-

Accounting & bookkeeping expenses

-

Freelancers/contractors

-

Inventory, raw materials, and supplies

-

Professional services

-

Maintenance services

-

Donations

-

Employee reimbursements

-

Credit card debt (not with a credit card)

-

Loan payments (not with a credit card)

-

Mortgage payments (not with a credit card)

-

Pre-payments (only with ACH bank transfer)

Which credit cards can I pay with?

- American Express: Limited to certain industries

- Visa business cards

- Mastercard

- Discover

What types of payments are allowed with Amex cards?

The use of American Express cards is only supported in the following industries:

- Education

- Government

- Rent

- Utilities

- Membership Clubs

- Professional Services

- Business Services

- Inventory/Wholesale

- Construction/Logistics

Can I make payments with Visa/Mastercard/Amex gift cards?

No. Melio does not allow payments from prepaid cards.

Can I use Melio to pay a 1099 Contractor?

Yes. And your contractor can select how they want to receive payment: check or ACH.

Note that Melio typically asks for one of the following for verification purposes: Trade License / Business Registration, Doing Business As (DBA) Registration, Previous Schedule C filing, Most recent sales tax filing, Business utility bill under sole proprietor or DBA name, Sole proprietor bank statement.

What types of payments are not allowed with Melio?

Melio prohibits all of the following uses:

- Personal payments (i.e. payments for a non-business entity)

- Card network specific restrictions

- Payments from prepaid cards

- Balance transfers (paying a credit card balance with a different credit card)

- Cash advances: payments from a credit card to a business owner; to the business from its owner; to another entity in which the cardholder controls or has interests). This is also extended to household members and relations.

- Payroll transactions (though freelancers and contractors are supported).

- Pharmaceuticals, including for animals

- Flammables

- Explosives

More examples of payments that are not allowed can be found here.

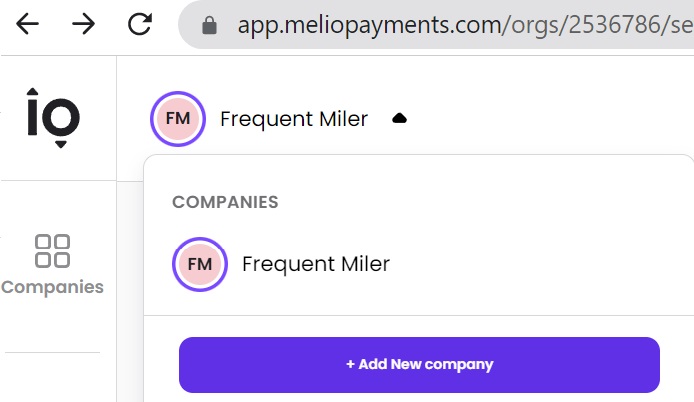

Can I earn multiple welcome bonuses if I have multiple businesses?

Yes. Plus, a cool thing about Melio is that you can add additional companies from a single log-in. Simply click your company name at the top, left of your browser and you should see an option to “Add New company”.

Opened a 2nd Melio account with my other business using EIN, paid a bill, got my $250 iPhone bonus – all automatic, all in a few weeks start to finish. Went faster than my previous $200 Melio bonus. So I recommend doing this if you have an actual business and actual business expenses to pay – they do pay.

Another person who has yet to be paid despite meeting the requirements for the $200 sign up bonus in April. I’ve chatted with their online support twice who said that it would be fixed and was just told that I need to email partners@melio.com

Same here!

I accidentally signed up before clicking the link. Am I able to open a new account for the same business using a different email address? (EIN the same of course)

Last time melio had bonus – in February I think – they never paid me – screw them

What big spend bonuses or benefits/statuses would you say would be worth the fee? I get extraordinary value out of Globalist (seems to be a no brainer between points return and benefits recevied) and could certainly target others that provide exceptional value..just not sure what others to target.

As a business owner this seems like a nice way to siphon some tax free money out of the business and reduce the business taxable income with the additional expense. My Cap 1 card gives me 2% cash back and I pay Melio 2.9% for vendors that do not accept credit cards. So in essence the corporation pays 2.9% for me to get back 2% tax free cash. Seems like a win for a .9% fee overall. This all makes sense in my head but I would love some feedback.

I am right there with you. I wish someone, much smarter than me, could break it down and determine if the benefit outweighs the fee. I’ve been on the fence about eating the fee for the points benefit on business spend but just not sure.

I have been doing it for several months and have gotten quite back quite a bit of tax free cash.

1- improves business cash flow

2- the 2.9% fee reduces the business (S Corp) taxable income.

3- the 2% cash back is tax free.

How much taxes would you pay on that cash if you took it in distributions? And how much more would you pay in taxes without the 2.9% deduction at the end of the year?

If you can put it on a new O%apr Ink card or Amex BBC then it becomes much better.

You misspelled your screen name, it’s Raymond Luxury Yacht

the credit card is paid monthly so there are no interest charges paid

I’ve always wondered about the tax implications of cash back cards for business, which is why I stick to point redemptions. So to me it’s a matter of if 1.5 Chase points or 2 Cap one points can out produce the 2.9% fee (coupled with reduction in taxable profit). I suppose I could just live in a 1 bedroom Vacasa property and come out in a good spot.

My account swears up and down that there are no tax implications. And he is straight by the book

I registered as S Corp back in April via the link below and made several payments to vendors with over $5K in total. Still no deposit or communication of any kind.

Any help would be appreciated!

I forwarded your comment to my Melio contact to see if he can help.

They are not very sole prop friendly. I set up account, tried to make a rent payment, a perfectly reasonable sole prop expense, they rejected payment twice and then shut down my account.

I’ll take my chances with Plastiq.

I also ran into issues trying to pay a normal business bill. Their compliance team flagged it as personal. I ended up going the route of paying my Ink statement – see comments below. Note, they still gave me a tough time even though I uploaded a statement showing I was paying a business credit card. They requested some sort of documentation for proof of a business.

Will this work to pay a Chase Ink credit card bill (partial payment of $200)?

Ooh great idea. As long as you pay with ACH I think that should work

This is interesting, Greg. So let’s say I had a BBC with $6k I’ve been floating at 0%apr that is due next month. Could I open up a new ink or BBP at 0%apr and then use it to pay off the 6K to amex through Melio thus extending my 0% apr deal for another 12 months? BTW I signed up for Melio last month and just got the $200 bonus. Thanks

No. To pay your credit card bill, you have to pay via ACH not via credit card.

How were you able to add chase ink as a vendor?

I still don’t see it (with the correct address), let me know if you figure it out-I’ll keep trying.

I was unable to add my Ink account directly as a vendor. It said invalid account number. However, uploading the statement pdf seemed to work… paid with ACH to send paper check, the payment processed, and was sent. I’ll report back with updates.

did you choose bank transfer (ACH)? I don’t know Chase’s deposit info. Or did you send a paper check for $1.50?

I sent a check because I still had my two free checks for the month.

How long does it take for the cashback to happen? Payment paid on the 15th of May, and nothing so far from Melio

Follow up to prior post 19 days ago – I just received the notification of $200 payment via email titled “Melio – Growth incentives has sent you $200.00 – accept your payment now” and could choose to receive a paper check or ACH. Chose ACH and shows another week or so to be fully delivered. Thanks Greg!!

Great!

Paid out on the estimated date for ACH, so this is fully verified!

What would be the best business credit card to pair with Melio? Would it be the Chase Ink Premier since it has a 2.5% cashback for purchase over $5,000, or are there other better options? I have vendors who only allow payments via check so I am trying to see if I can make Melio work.

That would be an OK choice, but you’d still be losing a bit since Melio’s fee is higher than 2.5%. Best bet is to use Melio to meet minimum spend requirements on any new card that has a large welcome bonus

DP- signed up using the link 4/11. Sent first payment 4/12, sent a second payment 4/13 (both ACH). No fees. 4/12 payment arrived at vendor 4/17. 4/13 payment still pending.

4/18 received email from Melio rep asking to confirm my email and informing me that “the cashback payment will probably be sent at the beginning of next month.” Will update with second DP if cashback received

I recently completed a payment that qualified me for the bonus. I received an email from someone in charge of affiliate marketing with Melio to confirm my email is valid for them to send a payment. Will keep ya posted.

Also a DP – you’re fine paying a business credit card via free check, but I recommend uploading your statement as proof of it being a business card and business expense.

Thanks for that info Troy. Not sure what you mean by the DP. Did you use Melio to pay your business credit card bill?

You’re always welcome! Yes I did, and a previous business expense on a personal card was declined by Melio as a personal payment. So recommend only biz card payments and upload statement so they know it’s a business card. Paid an Amex Biz Plat for what it’s worth.

Upload the statement? Did they ask for such a thing?

Signed up and made a payment that seems to have been sent out. What is the normal timeline for the bonus to be deposited to the bank account?

I’m hoping that readers will report their experiences with that here. Readers: if you made your first payment, have you received the $200 bonus yet? If so, how long did it take?

My first payment was made on the 27th, after there was some delays with the compliance department, but no bonus yet. Since there were no terms and conditions in the referral link specifying the bonus amount or timeline, is it possible to check with your contact at the company to determine what the expected time frame to check on the bonus will be–e.g. 10 days, 2 weeks, 30 days–please? That way, we have an idea of whether there’s a delay or if things are going as scheduled

Signed up using your link last month, payment went through (after some lengthy delays with their compliance department) on the 27th. Nothing yet. I don’t know what the terms and conditions are for the bonus, I don’t know if it’s delayed, or on schedule. Is it possible to check with your contact on the bonus posting timeline, please? Thanks in advance

Sorry for the long delay. I’ll check with my Melio contact. What business name or email did you register with your Melio account? If you reply with your email, the spam filter should catch it and stop it from publishing, but I should be able to see it (if it actually publishes, I’ll delete it as soon as I can)

Got your email and forwarded it to Melio this morning (sorry I didn’t see it earlier)