| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

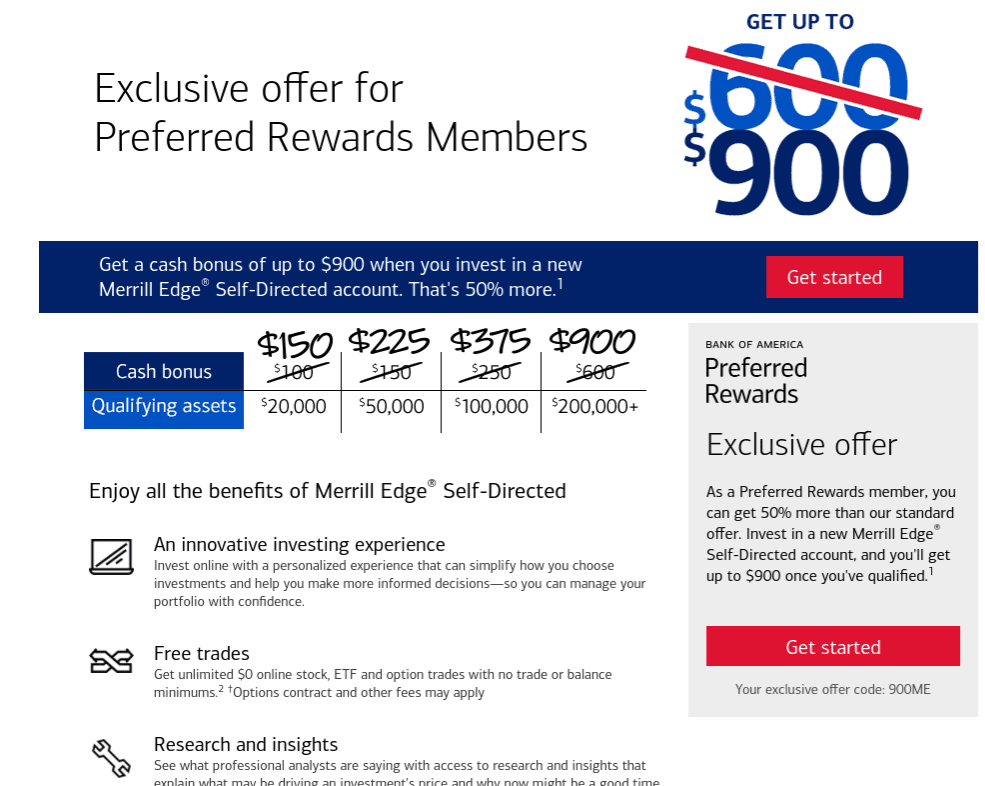

As was the case when I wrote about my retirement planning mistakes, Merrill Edge currently again has increased new account bonuses for those who become “Preferred Rewards” members (which requires a minimum of $20K on deposit with Bank of America / Merrill Edge). These bonuses add 50% to the standard bonuses and are available for those who open accounts by April 15, 2021, fund within 45 days and enroll in Preferred Rewards within 90 days. Unlike the offer I did last year, it looks like the current offers does not include a fast track to Preferred Rewards status.

The Deal

- Bank of America

- Deposit $20K, get

$100$150 bonus - Deposit $50K, get

$150$225 bonus - Deposit $100K, get

$250$375 bonus - Deposit $200K, get

$600$900 bonus

- Deposit $20K, get

- Link to this promotion

Key Terms

- 1 Offer valid for new and existing individual Merrill Edge IRAs or Cash Management Accounts (CMA) opened before April 15, 2021. Cash bonus offers, in the aggregate, are limited to one CMA and one IRA per accountholder. Eligible Merrill Edge IRAs limited to Rollover, Traditional, Roth and owner-only SEP IRA. The Merrill Edge IRA or CMA may be a Merrill Edge Self-Directed account, Merrill Edge Advisory Account or Merrill Edge Guided Investing account. You may be eligible for a different or better offer. Please contact us for more information.

- Offer Limitations: This offer does not apply to business/corporate accounts, investment club accounts, partnership accounts and certain fiduciary accounts held with Merrill, or to any types of accounts (including IRAs or CMAs) held with other business units of Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S). Merrill reserves the right to change or cancel this offer at any time, without notice. This offer may not be used as an inducement to sell any kind of insurance, including annuities.

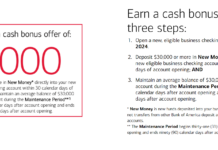

- How it Works:

- You must enroll by entering the offer code in the online application during account opening or by providing it when speaking with a Merrill Financial Solutions Advisor at 888.637.3343 or at select Bank of America&174; financial centers. You are solely responsible for enrolling or asking to be enrolled in the offer.

- Fund your account with at least $20,000 in qualifying net new assets within 45 days of account opening. Assets transferred from other accounts at Bank of America, MLPF&S, Bank of America Private Bank, or 401(k) accounts administered by MLPF&S do not count towards qualifying net new assets.

- You must be enrolled in Preferred Rewards as of 90 days from meeting the funding criteria described in Step 2.

- After 90 days from meeting the funding criteria described in Step 2, your cash reward will be determined by the qualifying net new assets in your account (irrespective of any losses or gains due to trading or market volatility) as follows:

Qualifying net new asset balance:- $20K, get

$100$150 bonus - $50K, get

$150$225 bonus - $100K, get

$250$375 bonus - $200K, get

$600$900 bonus

- $20K, get

- For purposes of this offer, qualifying net new assets are calculated by adding total incoming assets or transfers (including cash, securities and/or margin debit balance transfers) from external accounts, and subtracting assets withdrawn or transferred out of the account within the preceding 52 weeks.

- Your one-time cash reward will be credited to your IRA or CMA within two weeks following the end of the 90 day period. If your account is enrolled in an investment advisory program, such as Merrill Edge Advisory Account, Merrill Guided Investing or Merrill Guided Investing with an advisor, any cash reward deposited into your account will be subject to the program fee and other terms of the investment advisory program.

- Customers not enrolled in Preferred Rewards as of 90 days after funding will receive the cash reward without the 50% bonus: assets of $20,000 to $49,999 in cash and/or securities receive $100; for $50,000-$99,999, receive $150; for $100,000-$199,999, receive $250; for $200,000 or more, receive $600.

Quick Thoughts

This deal has been periodically coming and going for the last couple of years. The current end date is set at 4/15/21 and that may just be the end date for this iteration (with a new one to follow at some point). However, given the Bogleheads comment referenced above, it seemed worth reporting just in case it goes away for a longer period.

The bonuses here are pretty good for investment accounts or particularly good for those who have money in an IRA that can be moved in-kind entirely (i.e. without selling any shares / no tax consequences — check your situation before you make any decisions as YMMV). For me, there was virtually no downside and a couple hundred bucks of upside (in addition to the fact that I already wanted to make changes to my IRA that fit well with Merrill Edge).

Greg has written a lot about the Preferred Rewards program before (See: Bank of America credit cards: awesome if you have $100K lying around). As you’ll see in term #2 above under the last section This offer would put you on the path to Preferred Rewards status in 90 days.

Keep in mind that to enroll in Preferred Rewards and therefore be eligible for the increased bonuses above, you’ll also need a Bank of America checking account. You could likely open that later if you do not yet have one – but keep in mind that if you don’t enroll in Preferred Rewards within 90 days, you’ll only qualify for the lower bonuses (the ones that are crossed out in the screen shot above).

I’ll note that my wife and I did 3 accounts between the two of us with this promotion last year (one IRA each and one brokerage account), so we earned 3 separate bonuses. For some reason, the bonus on the brokerage account didn’t post automatically. I had to follow up a bunch of times. I got no response via email with a couple of different reps and eventually wrote a letter that I attached as a document to a secure message and that finally did the trick — we got the bonus and several follow-up letters apologizing.

Overall, these bonuses could be a decent incentive to open an account and now might be the time to go after them if they really do all end on April 15th.

I’m really confused how this works in practice for people who are not preferred rewards members before they apply. The terms say you have to be a preferred rewards member no later than 90 days after funding to get the extra 50 percent. What is clear as mud from the B of A website is how the 3 months to preferred rewards works. Let’s say you open a Merrill account and fund it with $50k. Does that fast-track your preferred rewards status? If you look at it like this it should: Month 1 $0. Month 2 $50k. Month 3 $50k. After 2 months the trailing three month average balance is $33k and so should be enough to qualify you for gold. And so you get in under the 90 days. Any idea if that’s actually how it ends up working?

I am 90% certain that’s how it works, yes. I say that because when I opened, I was initially at Gold based on the 3-month average (which wasn’t actually correct because when I opened mine, it was supposed to include a fast-track evaluation for status in 45 days based in current balance at that time, but it didn’t much matter to me as long as I had status for the 50% increase on the bonus).

Has anyone received a bonus in a retirement account? I just received my $900 bonus in my ROTH IRA account. Merrill says it is not considered an IRA contribution but they will send me a 1099 for the amount. That actually sounds too good to be true – i.e. I can still contribute the full amount to my IRA.

Sorry – I somehow missed this question. I brought this up at a conference recently and others told me the same – it would not be considered an IRA contribution. I’m not a CPA, but I’ve heard the same thing.

It was not considered an IRA contribution and no 1099 was issued. Best of both worlds!

[…] saved up and needed to put into long-term investments). The same day I published that post, I also posted a bonus offer for opening a new Merrill Edge account and depositing new funds within 45 days and keeping them on deposit for 90 days (that offer has […]

Doesn’t allow non-PR, non-citizen open account, even if tax resident. Sigh….

but it is with BOA not my fav bank and in many cities they are all closed for now!!!

Hi Nick,

Since you are about to make this switch, does that mean a BoA Premium Rewards CC is in the future soon? Does that affect your points strategy?

It certainly is. Here was my morning post with more detail:

https://frequentmiler.com/retirement-planning-mistakes-fixed-by-credit-cards/

Not sure how well known it is but you may have multiple cash rewards cards. We have 3. Each can have a different category selected and the ability to change category once a month is really powerful. Having 5.25% in 3 of online/home improvement/dining/gas/travel and 3.5% at grocery stores and warehouse and 2.625% everywhere else means we almost always have a BofA card in our wallet…or 4.

We’ve churned a lot and still do. Between those though, BofA has won a lot of our normal spending (outside these strange covid bonus times).

You can only rollover an IRA once every 12 months, correct? Once you’re in BoA…you’re stuck for 12 months. Make sure you are happy with them and not doing it for just the bonus (hoping to rollover to the next, great, bonus).

No.

You can only do one *indirect* rollover, that is, withdraw cash from IRA #1, then within 90 days deposit that amount to IRA #2. (If you could repeat this after that 90 days, then you could effectively withdraw any cash without paying taxes!)

There is no limit to direct IRA custodian-to-custodian transfers, or 401k to IRA transfers.

Hey Nick, a couple questions:

1. How do you find the online platform/UI/usability of the Merrill Lynch edge platform? I find BofA’s normal banking platform to be very antiquated and a pain in the ass to use. So I’m wondering if the same issues exist with edge?

2. Do you know anything about how things like cost basis (for purposes of calculating capital gains) get transferred from one brokerage account to another? IE if we were to transfer from our existing brokerage to Edge will they still be able to accurately calculate capital gains when we eventually sell the asset down the road?

I do the some investing in the side so I’m not an expert by any means. My personal experience is that the interface is pretty old and clunky, it’s not flashy but it gets the job done. It does have more trade options compared to something like SoFi. ETFs and stocks are free with Plat Honors but mutual fund trades cost $19.99 I think.

I think it has an app too but I haven’t looked into that.

I called in for support about something and the service was prompt and professional.

Good questions.

1) I’ve only been using it for a few days, but it seems as antiquated as BofA — more or less the same old looking interface. It’s definitely not sleek and modern like Robinhood or something of the same. That’s not really important to me though — I don’t plan to day-trade, I plan to let the money sit and grow, so I don’t really care much about whether or not it looks pretty. I don’t anticipate liking it, but neither do I anticipating caring whether I like it.

2) I don’t know anything about this, sorry. However, I’ve found their chat reps to be surprisingly helpful. If you click through to the promotion (or just go directly to their website), I think you’ll see a “Chat” button in the bottom right corner. Agents there have been surprisingly quick and good.

Thanks for the feedback.

Re Q2, I googled it and found the following (bolding mine):

https://www.mybanktracker.com/blog/investing/transfer-brokerage-account-303243

“In-kind transferAn in-kind transfer is generally viewed as more complex than a cash transfer.

Your old brokerage firm has to transfer each individual investment position you have to the new brokerage firm.

If you owned 100 different individual stocks, each of those stocks would have to be transferred.

This includes information about how many shares you own. It should also include your cost basis in your investments. “

“Before you start the process, you should do a few things to prepare.

-Save your statements-Technically, cost basis information should be transferred.

-However, the information is so important that you should keep your own records. This way you have the information in case there are issues during the transfer.”

Robinhood despite its promise of no fees delays trades by milliseconds and gains the change in price for itself. It’s a potty that all the traditional brokerage house have terrible UI

Hi Hoko, let me answer your questions.

1) ML interface is not that great but it works. As you can guess it’s on par with bofa.

2) yes. your cost basis would transfer if you do an in-kind transfer. I moved my schwab and robinhood assets into ML. Don’t panick if the cost basis doesn’t show up immediately though. It may take a while even after the holdings show up on ML.

Cost basis transfers but generally only from purchases in 2012 and onward. Prior to 2012 brokerage firms were not required to keep track of cost basis like they are now.

Can i move my 401k with my employer to BoA?

You can roll an old employer’s 401ks to an IRA (for example at BofA/ME), but not your current employer’s 401k.

What Lrdx said is what I’d have guessed.

It’s rare the plan allows it but a rare few do. The term is an in-service distribution I believe. If you happen to have a simple-ira (not to be confused with a Roth or traditional) at work, I believe those are required to allow an in service distribution 2y after the account is opened.

Lrdx is very likely right but it doesn’t hurt to ask.

Merrill edge gets two thumbs up from me as well. Customer for perhaps 6 years now. The preferred rewards program is really great at the upper level.