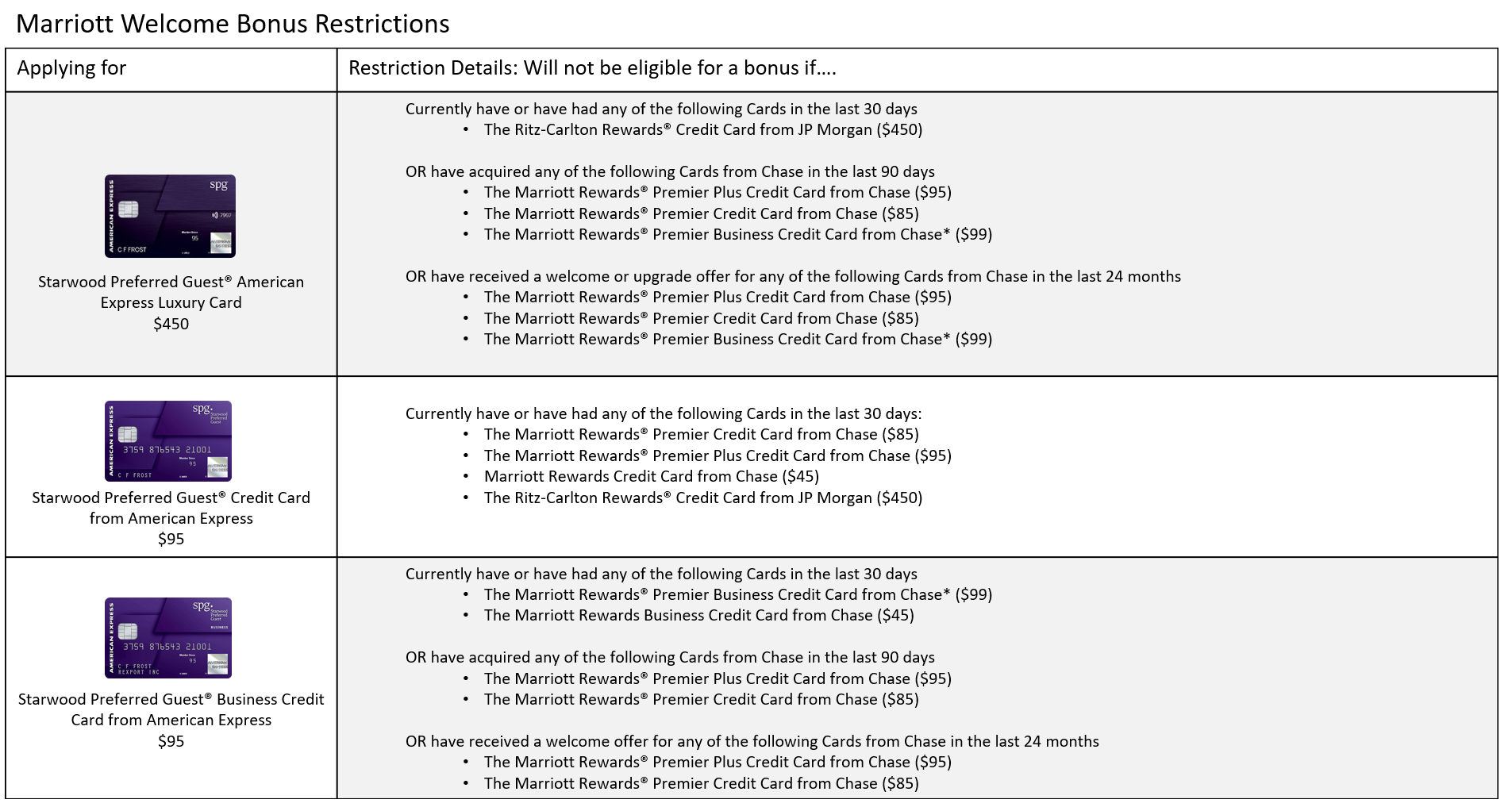

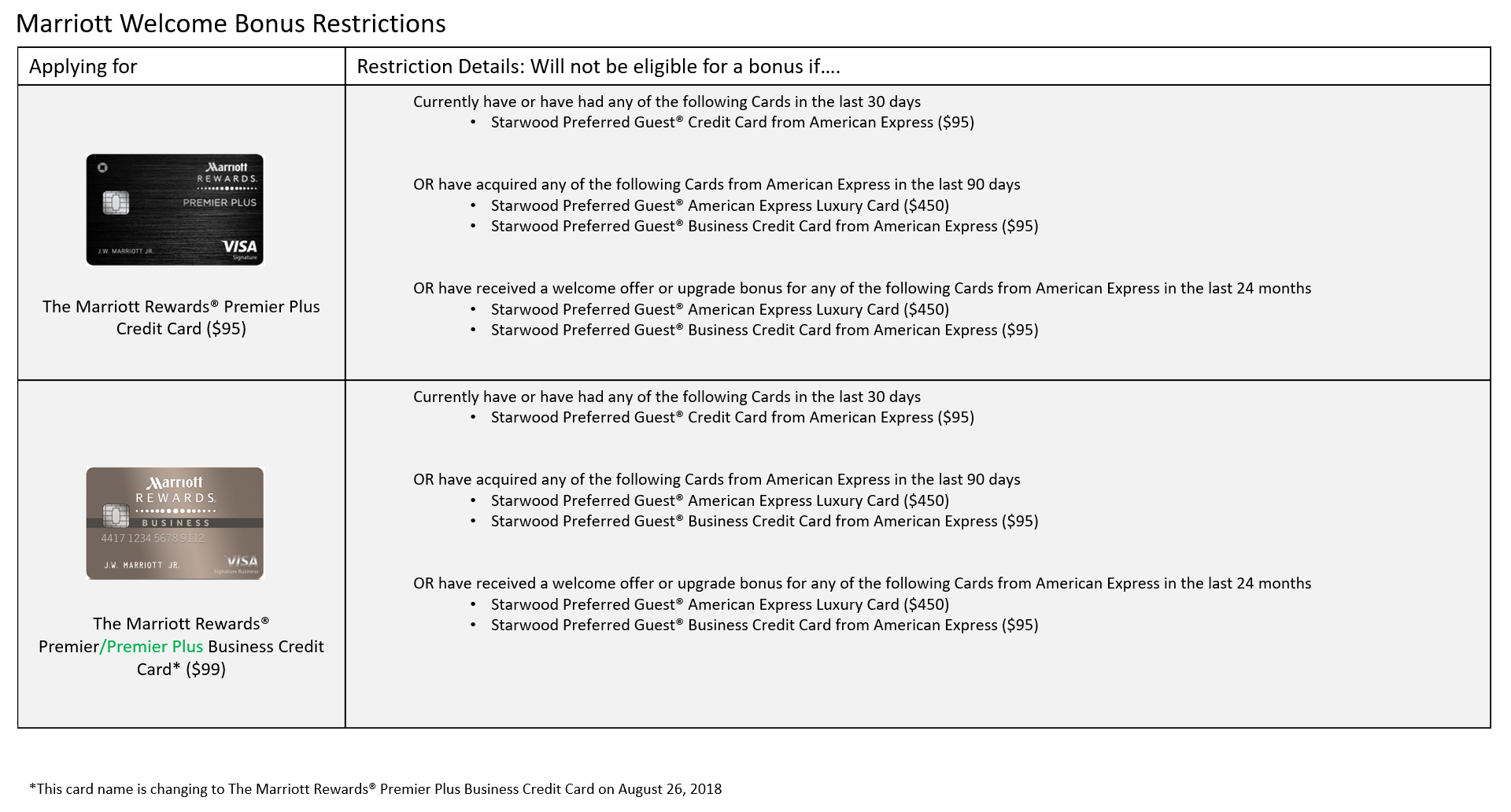

Starting August 26th, Marriott and SPG credit cards will have new rules regarding who is eligible to receive a welcome bonus. View from the Wing revealed these charts from Marriott:

Complicated? Indeed. Thankfully, the above charts aren’t quite as complicated as Marriott’s free breakfast rules, but still…

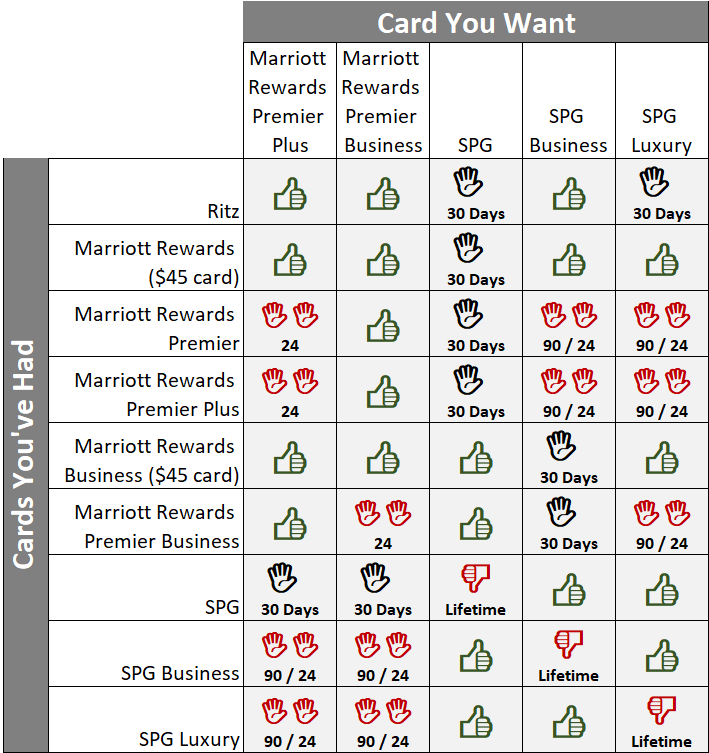

I created a new matrix to try to simplify things. Just pick out the card you want to get (across the top), and then look down to see if you encounter any roadblocks:

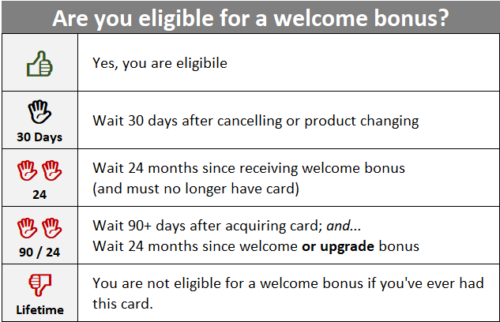

Matrix Key:

Offers Available On/Around August 26th

Sometime around August 26th, we expect the SPG Luxury card to appear on the scene with a 125K welcome bonus. We also expect the four other cards to have 75K bonuses. Here are the anticipated welcome bonuses (click each card link to view current card details):

- SPG Luxury Card: 125K after $5K spend in 3 months

- SPG Credit Card: 75K after $3K spend in 3 months

- SPG Business Credit Card: 75K after $3K spend in 3 months

- Marriott Rewards Premier Plus: 75K after $3K spend in 3 months

- Marriott Rewards Premier Plus Business: 75K after $3K spend in 3 months

Are you eligible before August 26?

The above rules become effective August 26. Until then, the usual old Chase and Amex rules still apply. In other words, with Amex, you can’t get the bonus if you’ve ever had the same exact card before (unless you find a targeted offer that doesn’t have this lifetime language). And with Chase, you must no longer have the card and 24 months must have passed since you last received a welcome bonus. Plus you need to keep in mind Chase’s 5/24 rule which applies to the Marriott Rewards Premier Plus card, but not to the Marriott Rewards Premier Business card.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Is it a good idea to apply before August 26th?

The SPG cards don’t currently have useful welcome bonuses, and the SPG Luxury card isn’t yet available, so don’t bother with those. The Marriott Rewards Premier Plus and Marriott Rewards Premier Business cards, though, are both available with 75K bonuses. Are they worth getting now?

Marriott Rewards Premier Plus: If you get this card now, it would make you ineligible for the SPG Business or SPG Luxury card for the next 24 months after receiving the bonus. Both SPG cards are arguably better options if you can qualify for them after August 26th. Unlike the Marriott card, neither SPG card will increase your chance of a Chase shutdown, and the SPG Business card will not add to your 5/24 count. And the SPG Luxury card is expected to have a 125K welcome bonus (but it will add to your 5/24 count). Bottom line: Only apply for the Marriott Rewards Premier Plus card if you’re under 5/24 and you would already be ineligible for the SPG Business and SPG Luxury cards due to other considerations.

Marriott Rewards Premier Business: If you get this card now, it would make you ineligible for the SPG Business card until you cancel this one and wait 30 days. It would also make you ineligible for the SPG Luxury card for the next 24 months after receiving the bonus on this one. Bottom line: This is a good choice if you won’t be eligible for the SPG Luxury card due to other considerations. And, as a business card, this one will not add to your 5/24 count. If you apply before August 26th, you’ll not only get the welcome bonus but also 15 elite nights towards status. This year only, those 15 nights will stack with elite night credits from other cards.

Post 8/26 Workarounds

In response to Nick’s post about the new Marriott / SPG card restrictions, several readers proposed workarounds. Let’s look at each:

Use a new rewards account

View from the Wing’s post stated that Amex and Chase won’t share data directly, but rather Marriott itself will be the gatekeeper to determine if a person has met the rules. Playerx therefore suggested that it might be possible to circumvent some of the rules by creating a new rewards number for your application. For example, if you want the SPG Luxury Card, but you have recently received a welcome bonus or upgrade bonus for the Chase Marriott Premier Plus card, you might be able to get the SPG Luxury Card by applying with a new SPG account which is not tied to your Marriott account.

This approach would work if Marriott only uses your rewards number to decide if you’re eligible. If they match you with other criteria, then it won’t work. My guess is that it won’t work.

Estimated chance of success: 25%

Multiple concurrent applications

Stannis asks “What if you haven’t had any of these disqualifying cards, could you … get all the cards simultaneously?”

I don’t think this will work. My guess is that Marriott’s determination of whether you are eligible for a bonus will not be in real time during the application process. Therefore, by the time they check to see if you have certain other cards open, the answer will be yes.

Estimated chance of success: 5%

Don’t complete upgrade spend requirement

Via Frequent Miler Insiders, a reader said that they had upgraded from the Marriott Rewards Premier to the Marriott Rewards Premier Plus, but hadn’t spent any money on the card yet in order to receive an upgrade bonus. They wondered if they could get the SPG Luxury card bonus by applying for that card before getting the Marriott Rewards Premier Plus upgrade bonus.

If we assume that this reader had received the bonus on the Marriott Rewards Premier more than 24 months ago, then there’s a chance that they can qualify for the SPG Luxury card bonus. It all hinges on whether or not the upgrade date is considered the date of acquisition for their card. If so, they would have to make sure to wait 91 days from the upgrade date before applying for the SPG Luxury card.

Estimated chance of success: 30%

Don’t complete welcome bonus spend requirement

This is a variation of the upgrade scenario above. Suppose you want to get both the Marriott Rewards Premier Business card and the SPG Luxury Card. The question is whether you can sign up now for the business card, but wait until after getting the SPG Luxury card to meet minimum spend on either.

This one would be extremely tricky to pull off. Once you open the business card, you have 3 months to complete the spend, but you also have to wait 91 days to be eligible to open the SPG Luxury card. This seems to make this approach impossible. In practice, according to Doctor of Credit, Chase is known to give people up to 115 days to complete spend requirements, so it is theoretically possible to get this done. I think the trick would be to wait until the Luxury card is available, then sign up for the Chase business card, and then secure message Chase to ask when is the last day you can complete the spend requirements for the welcome bonus. If the last day is more than 90 days away, you could theoretically go ahead and sign up for the SPG Luxury card on the 91st day after opening the Chase business card and before completing minimum spend.

Estimated chance of success: 5%

Upgrade instead

If you don’t qualify for the SPG Luxury card due to other cards you have, you could get rid of those other cards and wait out the 1 month, 90 days, and 24 month restrictions. Alternatively, if you have the SPG consumer card, you could wait to receive an upgrade offer from Amex. My guess is that an upgrade offer would be something like 50K points. That’s a far cry from the expected 125K welcome bonus, but some bonus is better than none.

My card situation

I’d like to get the SPG Luxury Card, but I can’t qualify for the bonus without getting rid of my Ritz card and then waiting 31 days. I’m not ready to do that yet. It’s been well over 24 months since I’ve received welcome bonuses on any Marriott or SPG cards, so I’d be good to go on that front. The main issue for me is that I want to upgrade my Marriott Premier to the Premier Plus. If I accept the 20K upgrade offer, though, the 24 month clock would reset to make me ineligible for the SPG Luxury Card bonus. That’s not good.

My wife is in a better position to get the SPG Luxury Card. She doesn’t have the Ritz card, and it has been over 24 months since she received welcome bonuses for her Marriott and SPG cards. She just need to avoid accepting the Marriott Premier Plus upgrade offer until after she gets the SPG Luxury Card.

Next, I’ll have to decide whether I want to keep the Ritz card long term (or at least until the card is sunset). A good option for me may be to cancel the card at some point in the future, wait 31 days, and then apply for the SPG Luxury card. This, though, is still contingent on me not accepting the Marriott Premier Plus upgrade beforehand. And that upgrade offer expires at the end of this year. Should I give up an easy 20K points for the upgrade in order to qualify for the likely 125K SPG Lux offer? Yeah, probably.

Another option would be for me to wait to see if a SPG consumer refer-a-friend offers return. If so, even though I can’t get a signup bonus for the card (since I’ve had it before), my wife could refer me to the SPG consumer card (she still has the card open) in order to pull down maybe 20K or so referral points. Then I’d wait for an upgrade offer to the SPG Luxury card. This option requires several pieces to fall into place, though, so I’m not betting on this approach.

I’m pretty sure that I’ll end up cancelling my Ritz card and getting the SPG Luxury card 31 days later.

What will you do?

Please comment below.

[…] read this article regarding the rules of applying for any Marriott/SPG Card if you already have […]

this remains the most concise summary of the rules i’ve found anywhere. a belated thanks for such a helpful post.

Luckily I looked at this before applying for the luxury card. it looks like I have to wait another year since i just got the marriott biz last july 2017

Yep. Wait 24 months from the date when your Marriott Biz signup bonus posted to your Marriott account.

[…] Keep in mind the restrictions that are outlined here by Frequent Miler for the SPG/Marriott Cards: […]

[…] rules that begin 8/26 are complicated, so check out this post for full details: Navigating Marriott’s Byzantine Credit Card Rules. The basic idea is that you may not be eligible for a Chase Marriott welcome bonus if you have […]

greg. appreciate ur new chart, but its way more confusing. maybe its just me, but you really need different icons and a better legend. not talking shit, but im just saying the marriott table with words make a lot of sense vs ur chart.

for example, getting the lux card if you have the RC, u currently note a Hand Sign with 30 days. thats way more confusing. you can NOT currently hold the Ritz OR have cancelled the RC within the last 30 days, BUT its OK if u got the RC bonus within the past 24 months.

now, i dont get the last part. how can getting the RC bonus recently still be OK if its outside of the 30 day window? that must be a mistake. i expected RC bonus makes Lux bonus not eligible. or maybe i didnt read a recent update somewhere.

furthermore, the chart should talk about the potential 3 day window, but make it clear that its just a best guess. that optimistic view doesnt sit well with me because the bonus will come AFTER the 3 day window and after the CC approval which would make u ineligible for the bonus anyway. one could argue the CC was applied for and approved w/ old TC before aug 26th, but the reality is that all CC holders have the new rules apply on the 26th. nobody is grandfathered in. therefore, i dont understand that 3 day window bonus logic.

meaning, if u have the RC then app the Lux before aug 26th then meet spend ASAP, the RAT will see u already have the RC after the 26th. so no bonus. thats my thought.

anyway, i just wanted to mention that because ur chart is really useful but it needs some adjustment.

I appreciate the feedback. It’s likely that some people will find Marriott text descriptions easier to read, and others will find my chart easier to read. There’s nothing wrong with that.

The key explains what the hand 30 means. If you have RC, then cancel and wait 30 days before applying for Lux.

I don’t want to clutter the chart with the 3 day window. That wasn’t a known thing when I created the chart. The chart is supposed to be for the long run to explain which card bonuses you are eligible based on your history with other cards.

makes sense. appreciate the response greg and all that you publish. thank you.

[…] I published “Navigating Marriott’s Byzantine Credit Card Rules,” a week ago, I had resigned myself to the fact that I wouldn’t be able to get the new […]

I have a SPG business card since March and have no Marriott cards. Reading off your chart, you are saying I have to wait 24 months to get the Marriott business? or are you saying I am eligible to get the Marriott business and may get the bonus if I apply before August 26?

Both of your statements are correct. If you apply before August 26th, you’ll be eligible for the bonus (if approved for the card). Otherwise you’ll have to wait 24 months from when your SPG card bonus posted

Great write up! How does this 30 day language work, on 8/26 will it immediately go back 30 days? I have SPG personal and had SPG biz in the past (over 2 years ago). Is my play to open the Marriott personal and biz now, before the 26th, and then SPG luxury when it comes out? Or will applying to the 2 marriott cards exclude me from the luxury for 24 months, even though I got them before these rules officially went into play?

The 30 day language kicks in on the 26th. If you apply on that day or later, you’ll have to have made sure you have cancelled the other card more than 30 days prior.

Yes, you could open the Marriott cards now (You would have to be under 5/24 to get the Marriott personal card though) and the SPG lux card on the 23rd.

What if you are signed up for these cards before August 26th but minimum spend is fulfilled and signup bonus points are actually issued after August 26th?

That’s fine. Your bonus eligibility will be based on the rules in effect at the time you apply

All totally pointless since it only focussed on the USA. These are international brands, why ignore the rest of the world?

[…] Link to Full Article on Marriott Cards […]

Ar one point or another, a number of years ago, I had an SPG Business card that I cancelled (back in 2014). Any idea if I would be able to get the “new” Welcome Bonus on this “new” card? Is it a product change for Amex, or will they hold it to the old rules (i.e. Not In Your Lifetime)?

I expect that it is not a product change, but you could always try and see if the application tells you that you are not eligible

I have the same question about the personal card. Closed my personal SPG on 2014. Now if I proceed to application, it’s showing me 75k bonus. Does that mean I’m eligible? If so, I’ll definitely try to get it before August 26, as I currently have the Ritz Card. Thanks so much Greg for making this nifty chart.

No I believe you have to complete the application in order to see if Amex warns you that you’re not eligible.

[…] helpful post: Navigating Marriott’s Byzantine Credit Card Rules. If only I had an intern to come up with nifty matrix things like […]

Two ways to go for lux if restricted.

1. Hopefully it comes out on the 18th and one would have a one week window before the restrictions take effect 26 Aug?

2. Get SPG personal now and product change when lux comes out.

Would the community weigh in on the viability of either?

Much appreciated!

I don’t think that #1 is at all likely to happen