Last month, it was widely reported that Capital One would be adding transfer partners to its Capital One® Venture® Rewards and Capital One® Spark® Miles cards. That capability has come live today. There are even a couple more transfer partners than we expected — though I’m very disappointed to see that those additions (Singapore Airlines and Emirates) do not transfer at the same ratio as other partners. While Capital One indicates that they intend to add more partners in the future, I think it’s ill-advised to have a complicated scheme of differing transfer ratios. Still, the ability to transfer remains a net win for Venture and Spark Miles cardholders and it’s great to see it come online according to the promised timeline.

Which cards earn transferable miles?

The following Capital One cards earn miles that can now be transferred to airline partners at the ratios shown above (click each card name to see our dedicated card page, where you can learn more and find an application link):

| Card Offer and Details |

|---|

75K Miles + up to $200 in statement credits ⓘ Non-Affiliate Earn 75,000 bonus miles after $4K spend in 3 months + up to $200 in statement credits when you make an Avelo purchase in your first year + priority boarding on Avelo flights for the first year. (Rates & Fees)$95 Annual Fee Alternate Offer: Airport Kiosk offer of 80K miles after $4K spend in the first 3 months See this post for details. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card earns 2 "miles" per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees |

| Card Offer and Details |

|---|

20K miles ⓘ Affiliate Earn 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening. (Rates & Fees)No Annual Fee FM Mini Review: Decent welcome bonus for a card with no annual fee, but other cards offer better rewards for ongoing spend. Click here for our complete card review Earning rate: 1.25X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

| Card Offer and Details |

|---|

50K Miles ⓘ Affiliate Earn a one-time 50K miles bonus when you spend $4,500 in the first 3 months. (Rates & Fees)$0 introductory annual fee for the first year, then $95 Note: Most Capital One Business credit cards (including this one) DO count against Chase's 5/24 Rule FM Mini Review: This card is similar to the Spark Cash Plus card, but it has the advantage that "miles" earned with this card can be transferred to a large number of airline & hotel programs. Earning rate: 2X Miles everywhere ✦ Earn 5X miles on hotel and rental car bookings through Capital One Travel Base: 2X (2.9%) Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees ✦ Up to $100 fee credit for TSA Pre✓® application fee or Global Entry application fee |

| Card Offer and Details |

|---|

50K Miles ⓘ Friend-Referral 50K after $4,500 spend in 3 months from account openingNo Annual Fee Note: Most Capital One Business credit cards (including this one) DO count against Chase's 5/24 Rule Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card is similar to the Spark Cash Select for Business, but rewards are intended to be used to offset travel purchases. This is a good option for business owners who prefer simple rewards with no annual fee, and who value free travel over cash back. If you spend more than $19K per year, though, go for the 2X Spark Miles card. Earning rate: 1.5X miles everywhere ✦ Earn 5X miles on hotel and rental car bookings through Capital One Travel Base: 1.5X (2.18%) Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees |

What are the transfer partners and ratios?

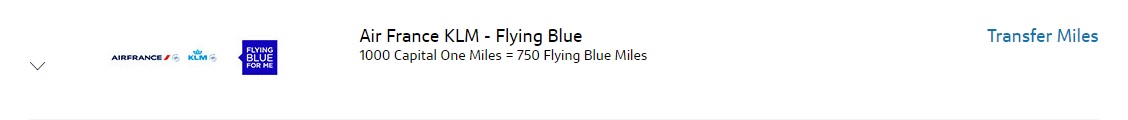

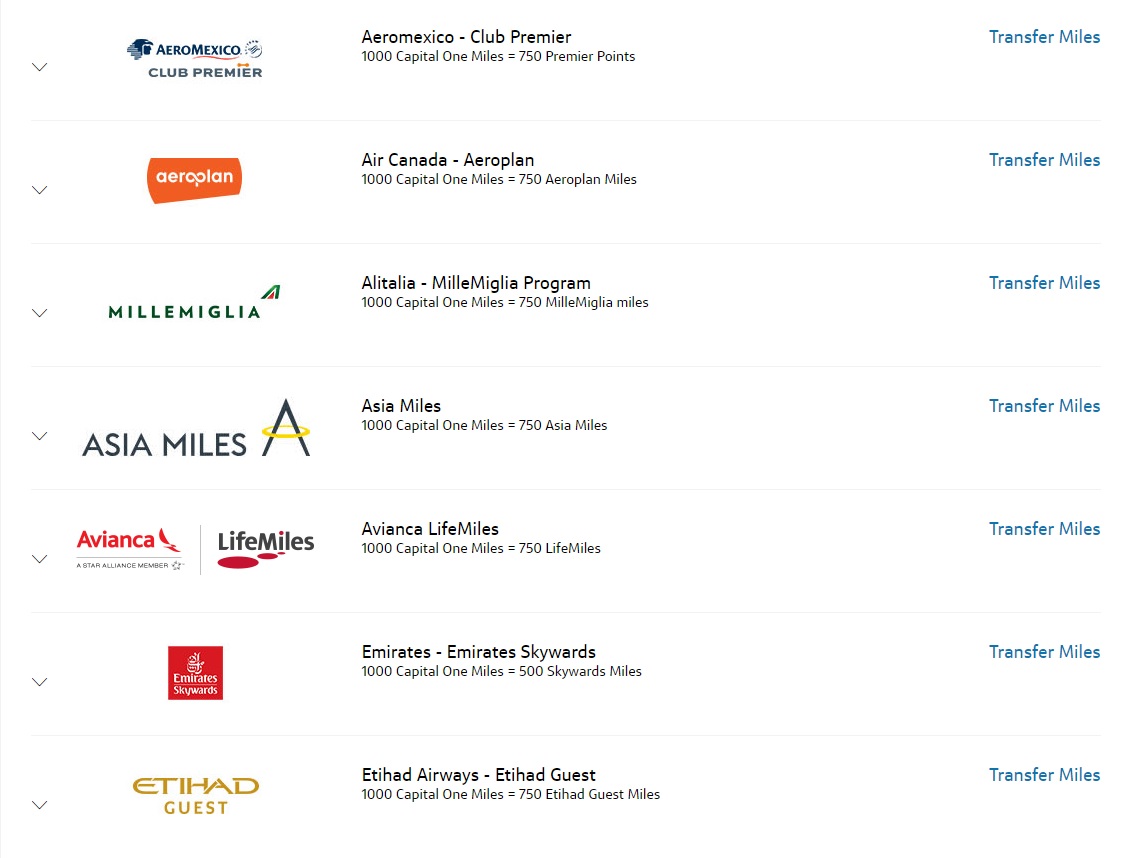

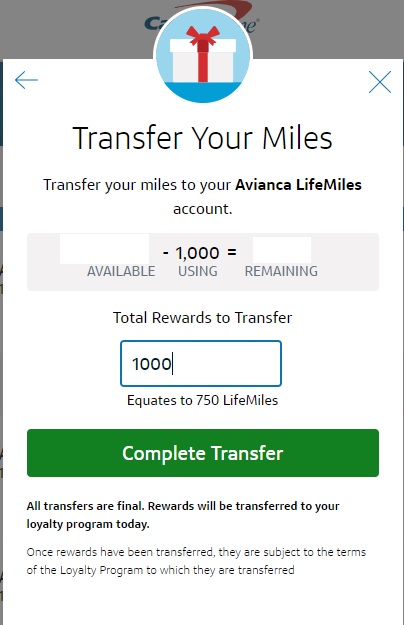

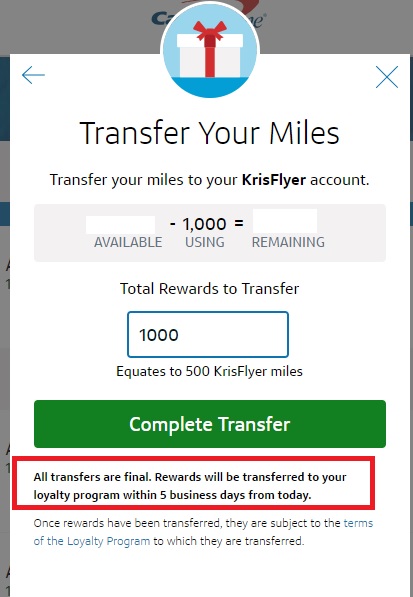

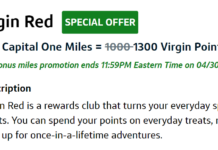

Most of the transfer partners launched today include those we expected and transfer at a ratio of 1,000 Venture / Spark miles to 750 airline miles. However, transfers to Singapore Airlines KrisFlyer and Emirates Skywards will be at a 1,000 Capital One miles to 500 airline miles ratio. Here is the full list of partners and ratios (also see our Capital One Transfer Partners page):

My favorite of the transfer partners are:

- Aeroplan: Great for reasonable award rates to Europe in business and first class, though they do pass on fuel surcharges with some partners

- Avianca LifeMiles: Great for Star Alliance awards without fuel surcharges. Also terrific for domestic United flights within a single region, even with connections (especially if you live on the East Coast or in the middle of the country as it is 7.5K miles one-way within your region). Great for mixed-cabin awards as well since they charge proportionately depending on how much of your journey is in economy vs business, etc.

- Etihad Guest: Great for international travel on American Airlines (old AA award chart) or its niche sweet spots like Prague to Seoul in flat bed business for ~26K on Czech Airlines

- Singapore KrisFlyer: Note that I didn’t put this one in bold…that’s because the weaker transfer ratio makes this generally a poor choice. That said, Singapore has some nice sweet spots (like US East Coast to Hawaii in United business class for 30K), cheap award change/cancel fees, and more premium cabin award space for those booking with KrisFlyer miles. If you’re flush with Capital One miles, transferring here might not be bad

There are without a doubt some values to be found in other programs as well. The key here is that Capital One customers now get to have their cake and eat it too in many ways. For example, I like using Avianca LifeMiles to fly on United as both my home airport and that of the family members I visit most are small market airports. One-way flights are often north of $200. Redeeming Capital One Venture Rewards for a $200 flight would normally cost 20,000 Venture miles. However, if there is saver award space on United, Capital One cardholders will now be able to transfer 10,000 Capital One miles to Avianca and book that same flight for 7,500 LifeMiles plus $30.60 ($5.60 in taxes plus a $25 booking fee on all Avianca award tickets). That’s a much better value.

On the other hand, if I should catch an award sale where I can buy a ticket all-in for $100, I could instead buy my ticket with my Venture card and redeem 10,000 Capital One miles to offset that purchase — avoiding award booking fees and earning miles for my paid ticket.

That will certainly require some analysis in determining which is more advantageous (and you can rest assured that Greg is already working on that post), but it’s a nice change for sure for Capital One customers.

Of course, it’s worth noting that there are cards on the market that offer a better return if you think you’ll mostly be redeeming for paid tickets. For example, if you qualify for the Alliant Cashback Visa, you could be earning 3% cash back the first year and 2.5% cash back in subsequent years with a $59 annual fee. You would earn a greater return that you could then use to pay for flights — or anything else. The strength that Capital One adds in comparison is flexibility to turn your rewards into airline miles. I’d personally view redeeming for paid flights as a backup plan rather than a main focus with these Capital One cards.

As the Capital One® Venture® Rewards card and the Capital One® Spark® Miles card each earn 2 Capital One miles per dollar spent, you’ll be earning up to 1.5 airline miles per dollar spent, which certainly isn’t bad (though not unmatched for most of the partners included). While the Capital One® VentureOne® card, which only earns 1.25 Capital One miles per dollar spent, earns a sub-par return, you’ll also be able to transfer miles from that card to airline partners should you have those miles to spend. The Capital One® Spark® Miles Sect card earns 1.5 Capital One miles per dollar spent and can also now transfer to partners.

Transfer times

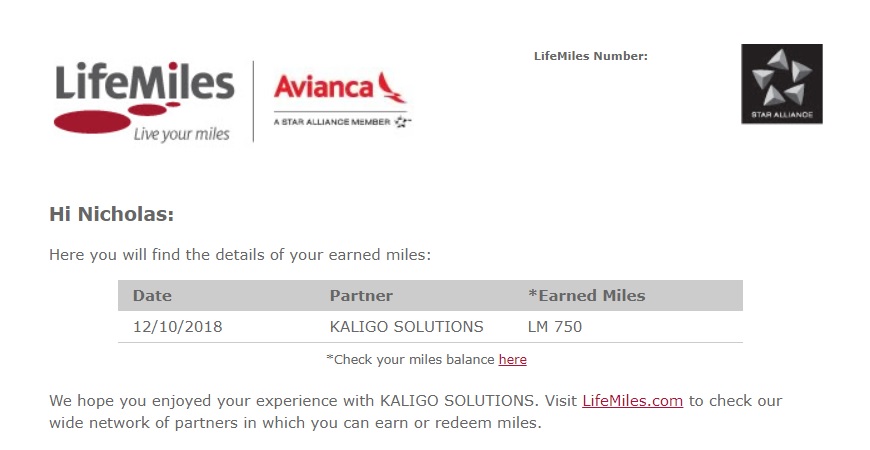

While I don’t have enough miles on hand to test transfers to all of the new partners, it’s worth noting that my test transfer to Avianca LifeMiles indicated that the miles would transfer today — and indeed they transferred instantly.

I assume that most other transfer partners are instant, but check the terms before you transfer. Transfers to Singapore airlines state that they may take up to 5 business days. While I doubt it’s quite that long in practice, transfers to Singapore typically take 12-24 hours from other transferable currencies, so I’m sure it likely is not instant.

Bottom line

Capital One will not replace my other favorite transferable currencies, but this change puts them in position to be more competitive against Amex Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou points. The flexibility to transfer points to partners or redeem them at good value against any travel purchase is definitely a strength. While you do have some ability to use points for travel with the other major transferable currencies, Capital One’s strength is in being able to book when and where you want and then redeem your miles to cover the purchase after the fact (and they also include some types of purchases that you can’t currently buy with other bank points). While using your points for a value of $0.01 each towards travel doesn’t eclipse the return you could get on a cash back card, it’s a competitive return while now adding the flexibility to transfer to partners, which I think makes the Venture Rewards and Spark Miles Business cards potential keepers. My main hang-up here is the surprise addition of Singapore and Emirates at lower transfer ratios. Barclays tried something similar with the Arrival Premier card and we all know how that worked out. That said, Capital One is offering some monster welcome bonuses on the most desirable of these cards, which is a key differentiator from that failed product.

[…] to Capital One’s Rewards miles programs (with the Venture and Spark Miles cards, which now transfer to airline miles, can be combined easily with your other miles-earning cards or even with other Capital One […]

[…] including Chase Ultimate Rewards, Citi ThankYou Points, and Amex Membership Rewards. Now that Capital One has added transfer partners and initiated the ability to transfer Capital One “miles” to anyone with an eligible […]

[…] morning, Capital One added the capability to transfer your Venture Rewards or Spark Miles to airline partners. What I also noticed — and perhaps this existed before and I hadn’t noticed, but it was […]

If I accrue Capital One miles and transfer them to Etihad to get a domestic ticket on American, will anything that comes with my AA Platinum status pass through while using that ticket on AA (more legroom, free baggage, priority check-in, etc.)? Similar question with transfers to Avianca for use on United–will any of my United Silver privileges be usable on an Avianca ticket for a United flight? Thanks!

You should transfer 1,000 to every partner for science.

I’m happy that Aeroplan is a transfer partner. I use them most for last minute United flights. They don’t charge the $75 late booking fee.