January 4th is the big day for the Citi Prestige card. Starting today, the Citi Prestige Card earns 5X for dining, 5X for airfare, 5X for most travel agencies, 3X for hotels, 3X for cruise lines, and 1X everywhere else. Here’s Citibank’s page detailing the changes.

We previously published the Prestige card changes rolling out this year, but for your convenience, here’s a summary of all of the changes and when they are expected:

| Old | New | Date Expected | |

|---|---|---|---|

| Annual Fee | $450 ($350 with CitiGold Checking) | $495 ($350 with CitiGold Checking) | September 1 2019 (for existing cardholders) |

| Bonus Categories | 3X airfare, hotels, and most travel agencies 2X dining and entertainment |

5X airfare, dining, and most travel agencies 3X hotels and cruise lines Entertainment drops to 1X next September (9/2019) |

January 2019 |

| ThankYou Point Value | 1 cent per point for cash 1.25 cents per point for airfare booked through the ThankYou portal |

1 cent per point | September 2019 |

| 4th Night Free Benefit | Uncapped | Limited to twice per calendar year | September 2019 |

| $250 Travel Credit | Airfare Only | All Travel | January 2019 |

| Cell Phone Protection | N/A | Covers damage & theft | May 2019 |

| Lounge Access | Citi Proprietary Lounges & Priority Pass Select | Unchanged | |

| Global Entry Fee Credit | $100 | Unchanged | |

| Missed Event Ticket Protection | Reimburses event tickets, up to $500 per year if you miss the event due to a covered reason (tickets lost or stolen, weather conditions, etc.) | Unchanged |

Amex Gold Too

The Prestige card isn’t the only one that has rocked my wallet recently. In October, the Amex Gold Card (previously named “Premier Rewards Gold”) began offering 4X at US grocery stores, up to $25K annually, and 4X at US restaurants. My wife already had the Gold card and I already had an authorized user card, so I hit the ground (restaurants and grocery stores) running.

My wallet, before

Before the Amex Gold and Citi Prestige changes, and after the SPG card became a dud, my wallet looked like this:

- Chase Sapphire Reserve: 3X Dining & Travel

- CNB Crystal Visa Infinite: 3X Grocery & Gas

- US Bank Altitude Reserve: 3X Apple Pay (not in my physical wallet, but still used often)

- Amex Blue Business Plus: 2X Everywhere Else

- Chase Freedom Unlimited: 1.5X Everywhere Else (when Amex isn’t accepted)

My wallet, now

Now that the Prestige and Gold cards have earned spots in my day to day wallet, here’s my current lineup:

- Citi Prestige: 5X dining, airfare, and travel agencies

- Amex Gold: 4X US Grocery

- Citi Premier: 3X Gas, 2X entertainment (I’ll use this until the annual fee comes due)

- US Bank Altitude Reserve: 3X Google Pay (I switched from iPhone to Google Pixel recently)

- Amex Blue Business Plus: 2X Everywhere Else

- Chase Freedom Unlimited: 1.5X Everywhere Else (when Amex isn’t accepted)

Note that I keep many other cards at home, or in my manufactured spending wallet (a wallet for buying and storing gift cards), or in my travel wallet (read about my travel wallet here).

The wallet I want

I don’t like carrying so many cards in my physical wallet but I continue to run into stores that don’t accept Google Pay or Apple Pay so I keep all of the best earning cards with me.

My dream wallet is as follows:

- Citi Prestige: 5X dining, airfare, and travel agencies.

- Samsung Gear S3 Watch or a Samsung phone: Either way, Samsung Pay would work at almost all credit card terminals. I would load the watch or phone with the following cards (at a minimum):

- US Bank Altitude Reserve: 3X for all Samsung pay spend

- Amex Gold: 4X US Grocery

- Chase Freedom: 5X rotating categories

- Discover It: 5% rotating categories

- Bank of America Premium Rewards Card with Platinum Honors Preferred Rewards: 2.62% cash back everywhere and 3.5% for dining and travel. This would be my backup for the rare occasions when I couldn’t use Samsung Pay and when the Prestige card doesn’t offer the best value. This would be a far better backup than my current Amex Blue Business Plus and Chase Freedom Unlimited combo because the Bank of America card doesn’t charge foreign transaction fees.

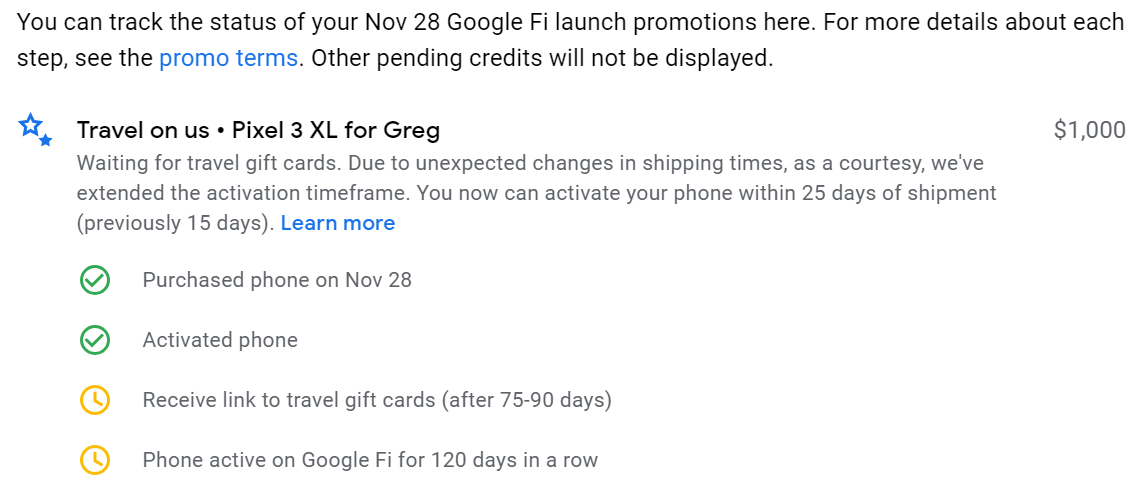

To make the above happen, I may need to get over my reluctance to wearing a watch. I haven’t worn one for years and I’m not eager to start. An alternative is to switch to a Samsung phone in a few months once I’ve satisfied the conditions of the deal in which I bought my Pixel phone.

I activated my Pixel phone on December 10th and so I need to keep the phone active until April 10th or so in order to meet the terms of the deal. At that point I may decide to sell the Pixel and buy a Samsung phone or go back to iPhone land if I continue to lose out on messages from iPhone friends (see: iPhone withdrawal symptoms when switching to Android Pixel).

What about the new Citi Rewards+ Card?

The new Citi Rewards+ Card, which we wrote about yesterday, will feature 2X ThankYou points at supermarkets and gas stations, for the first $6,000 per year. That’s not exciting at all. What is interesting is that the card will round up rewards on all purchases to the nearest 10 ThankYou points. This means that the card will earn at an astounding rate for small purchases:

- $0.10 (10 cents) purchase: Earn 10 points = 100X rewards

- $0.50 (50 cents) purchase: Earn 10 points = 20X rewards

- $1 purchase: Earn 10 points = 10X rewards

- $2 purchase: Earn 10 points = 5X rewards

So, with any purchase of $2 or less you’ll do as well or better with the Citi Rewards+ Card than with any other card in your wallet.

If this card lasts long enough, it will earn a spot in my virtual wallet, but I don’t know if it will make it to my physical wallet. I don’t have high hopes of it sticking around. See: Perk abuse, coming soon.

[…] for all restaurant and airfare spend when they introduced new 5X awards in those categories (see: Prestige rocks my wallet for 2019). The main downsides were that Citi increased the card’s annual fee and nerfed the Prestige […]

[…] airfare, and travel agencies, the Sapphire Reserve has lost its coveted spot in my wallet (see: Prestige rocks my wallet for 2019). I’ve temporarily moved the card to my travel wallet, but I’m not at all sure it […]

Does 5X on OTA include hotels or rental car? or just airfare only?

Should include hotels, rental cars, cruises, etc.

Note: that’s if cruise fare is paid too the travel agency. As you can see, cruise lines earn 3x. I mean to say that 5x travel agencies is not limited to airfare.

DP: I was grandfathered for Citi Gold (cancelled the gold after 1 year) and just got the same $350 annual fee posted on my account yesterday. We will see what happens next year!

I love Citi Prestige card and using it more than ever now!; Replaced Amex platinum with Prestige for all airline purchases and replaced Amex gold with Prestige for all dining. Just got 3000 points posted for dining ($600) from the last month.

Greg, I am trying to see if prepaying on Booking.com or hotels.com (??travel agencies) will earn 5 points on hotel bookings compared to 3 points when we pay after the stay.

Awesome. I hope the grandfathering keeps going on!

Yes, I’m betting that prepaying for hotels on an OTA will earn 5X. I haven’t tested it yet though

[…] Prestige rocks my wallet for 2019 […]

@Greg, Do you value the points/cashback from BoA Premium Rewards > BBP/CFU? Even if you’re Platinum Honors, you are getting 3.5% on dining/travel, which you would use Citi Prestige for and 2.625% everywhere else. Isn’t 2x MR > 2.625% cashback?

Is 2X MR greater than 2.625% cash back? My answer: It depends. Using BBP instead of BOA is like buying MR points for 2.625 / 2 = 1.31 cents each. If I was low on MR points, I would prefer MR. But I’m not. So, I’d prefer to find opportunities where the trade-off is like buying MR for less than a penny each.

I think you mean Cash Rewards 3x gets 5.25%

Oops. No, I was thinking that the card has base 3X categories, but they really are 2X. That’s what I get for not double checking as I type. I’ll edit that part out of my answer.

Yes, it’s 2x 9n travel/dining, 1.5x everywhere else. It’s kind of like a cross between a Freedom Unlimited and a Sapphire Preferred.

Sorry to be the bearer of bad news, but when I checked with Citibank, they told me they have suspended taking new applications even though I am Citi Gold. They could not give me a date when they would resume.

That’s correct. They stop taking new applications back in September. The card is expected to relaunch this month.

@Greg, Do you really think the Amex Gold is worth the fee if you have Citi Prestige? There are a number of cards where you can earn 5% or so at grocery, a la the Blue Cash series. On top of that, for those that shop at Whole Foods, the Square Cash Debit card offers 10% back.

If you have the Prestige, then the Amex Gold is probably only worth it for those who would manufacture points at grocery stores. If you can manufacture spend $25K per year, that will get you 100K Membership Rewards points per year. If you’re not going to do that, then I’d agree that the Amex Gold isn’t worth it on top of the Prestige.

I use OBC for groceries and have 2.

[…] Prestige rocks my wallet for 2019 […]

“Reticence” and “Reluctance” do not mean the same thing.

Thanks. Fixed.

I had the Premier 2 years ago and dropped back to the no fee version. Based on their rules, assume that would make me ineligible for the Prestige?

If you kept the same account number when you dropped to the no fee version, then you should be good to go if you haven’t opened or closed any ThankYou cards in the past 24 months.

Is there a way to check how many TY points you are getting per transaction? I usually only see the total but can’t see transaction level TY points like I can with my chase reserve or freedom

Previously you could only figure it out by process of elimination/guessing looking at statements. (Hmm, $3000 got bonus points but $456 did not….oh look, a single $456 charge, or these 3 charges that sum to $456 that all were from that funky merchant). I think Citi has been piloting a better interface, haven’t seen it personally

If you can’t figure out how many points it is, you can write them a formal letter requesting and explanation and they’ll eventually get back to you on it.

Hi, not sure I’ve seen 5X points on travel agencies anywhere before? Are you sure about this? Also, I believe the annual fee changes in September not now.

Please confirm. Thank you

Yes, to see 5X for travel agencies, see: https://information.citi.com/prestige/intro, and look in the footer for this:

1

Beginning 1/4/2019 Citi Prestige cardmembers will earn 5 ThankYou Points for each $1 spent on purchases at airlines and travel agencies. 5 ThankYou Points for each $1 spent on purchases at restaurants (including cafes, bars, lounges and fast food restaurants). 3 ThankYou Points for each $1 spent on purchases at hotels. 3 ThankYou Points for each $1 spent on purchases at cruise lines. 1 ThankYou Point for each $1 spent on other purchases.

Regarding the annual fee, you are correct. I’ll update the post

You won’t regret picking up the Gear S3 or other Samsung phone. I only carry two cards with me in my phone case and everything else is loaded to Samsung Pay. It’s by far the best way to maximize having an Altitude Reserve.

I like the Gear S3, but one question, I found the SmPay from the watch will not be counted into your monthly stats in your SmPay account…Do you have any idea?

It should count, but may not update until your watch syncs with your phone. That said, Samsung Pay rewards are pretty much useless now, so it’s not a huge loss if they stop counting.

OK I’ll get one 🙂

Greg, if you get the watch and use it with the Pixel 3, could you please write about your experience. Have heard mixed reports of it working well. Thanks!

Mixed reports of it working well with the Pixel 3 in particular? My Gear S3 is still synced with my LG V30+ as that is still my primary phone and it has been working fine with that phone. I haven’t linked it to my Pixel 3. I wouldn’t expect it to be different — unless you’re saying there is an issue specifically with that phone?

Not just with the 3, just seeing reports on glitchiness like this: https://www.reddit.com/r/GearS3/comments/7i1lc7/gear_s3_pixel_2_and_samsung_pay/. Curious how things go for Greg.(And good to know about the V30 :)).

I got the Samsung Galaxy S6 Active off eBay for this purpose for around $70. It’s paid for itself in Samsung Pay offers alone, but most of those are no longer available. The main catch with it was that I had to manually upgrade the firmware based on instructions on xda-devs in order to get it up to date, but it does the trick.

Greg, … really enjoy the blog (most of my apps are done through your links). I’m curious, … considering Citi Prestige has bumped the CSR out, … how do you justify the net $150 annual fee (especially if you hold the Ink Preferred)?

I have a hard time justifying it. Full details about my current thoughts will be in my Monday morning post. Here’s what I wrote about the subject a couple of months ago: https://frequentmiler.com/should-i-ditch-my-sapphire-reserve/

Well if you Google around a bit you’ll see it’s possible to waive the annual fee…