This was a week of conflict at Frequent Miler. With new life breathed into the Prestige, we debated whether it’s taken the Sapphire Reserve out of our wallets. Meanwhile, I disagreed with Doctor of Credit over the value of the new Southwest offers. Google Fi showed its ugly side in making it impossible for at least some customers to pay their bills. All those stories and more in our Frequent Miler week in review.

FM vs DoC: Southwest Companion Pass with 1 Card. A great deal or quite weak?

Chase shook things up this week by introducing a new welcome bonus: a Companion Pass and 30K points after $4K in purchases on any one of the personal cards. Long-time readers will recognize that the best strategy for a Companion Pass is via two credit card welcome bonuses triggered in January (see our Complete Guide to the Southwest Companion Pass for more on how this works). This new bonus won’t get you as much as the classic strategy – but does that make it a weak offer? Doctor of Credit says it is. I say he’s off his rocker. This offer isn’t better than the classic strategy, but getting $450 worth of points along with the ability to bring someone for free when you use those points – and as many other times as you want for 10+ months (if you meet the minimum spend right away) is in my opinion a monster offer for $4K in spend. This offer isn’t for those who can easily meet the spend on 2 cards and have any sort of a business, but I’d still argue it is the hands down best offer I’ve ever seen on a card with a min spend of $3K-$5K if you use the pass even 2 or 3 times. That’s my story and I’m sticking to it.

Rocking the Prestige more softly than Greg

I’ve been visiting family for the past couple of weeks and I’ve been happy to treat them to dinner a time or two on my Prestige card since it’s now earning 5x at restaurants. And thanks to earning 5x on airfare, I’ll use it for flights I intend to take this year. It’ll rock my wallet in some ways — but it won’t be my go-to card for every flight I book because I’m not sure I’ll keep the card long enough to be able to make use of its trip delay protections should I need them. It looks like I’ll be keeping the CSR long term but rocking this card softly for 2019.

Pay taxes via credit card, 2019 edition

“The only things I have to do are die and pay taxes” — an old cliché that we know holds some truth. But who says you can’t come out a little bit ahead of the game? See this post for how to beat the processing fees so you can get a little bit back this year even if you weren’t expecting a refund.

Tiffany’s Google Fi warning. Time to retreat?

Eeek. That’s pretty much what went through my mind when I read about how getting your Google Pay account frozen can completely prevent you from being able to pay your Fi bill. Gosh — I can’t imagine how unhappy I’d be with my $1K Pixel 3 XL purchase if Google prevented me from being able to pay my bill and thus found me out of compliance with the terms for the gift card promo. In fact, I’m so uncomfortable with that thought that I don’t think I’ll use Google Pay for a single thing for the next month at least while I await the gift cards. This reinforces my feeling that Fi isn’t a viable alternative for me for full cell service — though the last two weeks reinforced that based on coverage. I’ve now repeatedly run into an area where my T-Mobile phone has full service and my Fi phone shows none. I use too much data, the service is not as consistent, and now this. I might keep Fi for international travel (and pause the service between trips), but I now have no intention to make this my main phone service.

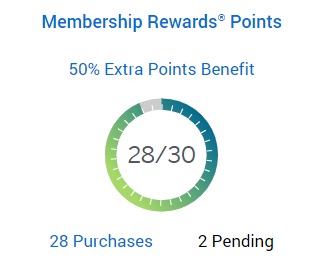

A several-thousand-point mistake when going for 30 transactions in a cycle

In a rookie mistake, I allowed our Everyday Preferred statement to close with 28 posted purchases and 2 pending. That was dumb. But the weirdest part is that those purchases did not count towards last month’s bonus…and they still don’t appear to count for this month’s bonus. They appear to be in limbo. Amex promised to call us back with a resolution….surprise, they didn’t. See this post for which purchases posted more quickly than I expected and why you want to avoid purchases near your statement cut date.

On my mind (Goodbye Sapphire Reserve?)

With the Prestige now offering better rewards on dining and most travel, has the Sapphire Reserve lost its relevance altogether? See Greg’s thought process and what he’s ultimately decided to do. Funny enough, I expected to get rid of our Sapphire Reserve both before and after I read this post on Monday. By Thursday, I had decided to cancel my Prestige instead with some more careful consideration. What do you think? Should you keep the CSR, or ditch it for the enhanced Prestige?

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![Sharpening your coupon-clipping scissors, great value hotels, shopping portal myths, and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/04/Quarterly-hotel-credit-218x150.jpg)

![Qatar’s hierarchy of award access, 3% bonus offers that won’t last, tools you may be forgetting and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/04/hierarchy-218x150.jpg)

![Priority Pass shakeup, how to find regional first & luxury hotels for fewer points, and more [Week in Review] a roller coaster with people on it](https://frequentmiler.com/wp-content/uploads/2019/03/rollercoaster.jpg)