In 2016, I exchanged 1.2 million Virgin Atlantic miles for an all-inclusive week on Richard Branson’s Necker Island. My wife and I loved it. The experience was incredible. It was absolutely worth the high price. You can read my 2016 review here.

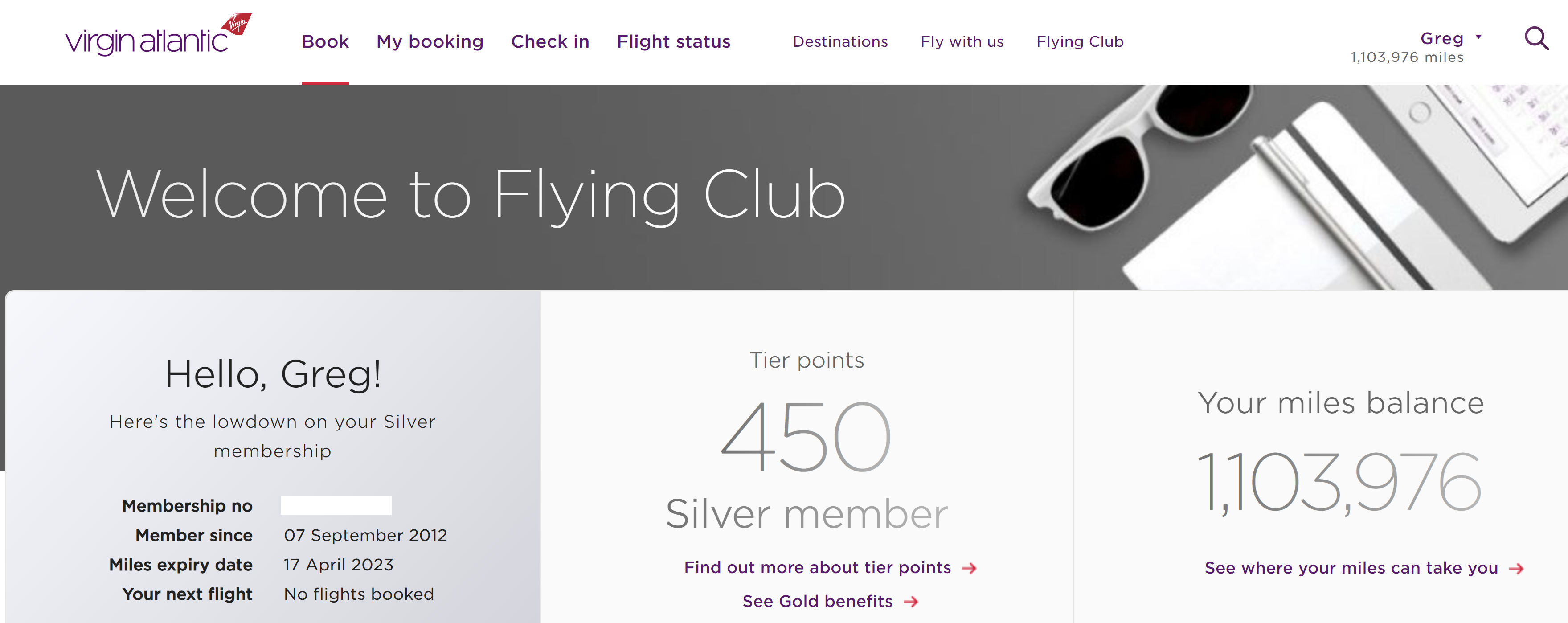

Our Necker Island trip was so great that we wanted to do it again. Soon after the trip, I began saving up Virgin Atlantic miles for a return visit. I have two Virgin Atlantic credit cards and so I setup a process to automatically spend $2500 on each card every month. Thanks to mileage bonuses granted for high spend, this process results in my earning 120,000 miles per year. Plus, the card offers elite tier bonuses with spend and so I automatically get and keep Silver elite status, which is now necessary for booking Necker Island with miles. You can read more about maximizing value from the Virgin Atlantic credit card here.

In addition to earning 120K miles annually with the credit cards, I’ve taken advantage of frequent 30% transfer bonuses to Virgin Atlantic from Amex Membership Rewards and Citi ThankYou Rewards. The result was that I pretty quickly got my balance back within striking distance of a return to Necker Island.

In 2017 hurricane Irma destroyed the island and so we put off thoughts of returning. The island reopened last year, but it wasn’t yet fully restored.

In the meantime, while I continued to earn Virgin Atlantic miles, I also continued to spend them. For example, I used 60,000 miles per person to book three of us one-way from Japan to Detroit on Delta One Suites (pictured above). I also used 75,000 miles per person to book three of us round-trip from Detroit to Hawaii on lie-flat Delta One. Every now and then, when Delta’s prices have been very high, I’ve used Virgin Atlantic miles to fly non-stop domestic Delta flights for 12,500 miles one-way economy or 22,500 miles first class.

Despite regularly using my miles, my balance is still very high. I’m currently sitting on 1.1 million Virgin Atlantic miles!

Virgin Atlantic’s financial crisis

Over the weekend, The Telegraph announced that after failing to secure a £500m government bailout loan, Richard Branson was looking to sell Virgin Atlantic (hat tip: Rene’s Points). Bloomberg, however, reported that Branson’s spokesman disputed this. They wrote:

Britain’s Telegraph newspaper reported earlier that Branson was seeking a buyer for Virgin Atlantic, something his spokesman disputed.

“Richard is committed to investing in Virgin Atlantic,” Fox said. “He and Virgin Group are fully supportive of the process the airline is going through in seeking prospective investors.”

Regardless of the specifics, there’s no question that Virgin Atlantic is in serious financial trouble. Richard Branson even offered up his own Necker Island as collateral to try to secure a loan to keep the airline afloat.

As a result, those of us with Virgin Atlantic miles may be getting worried. Is there a chance that our miles will become worthless?

Earn or burn?

The price to book Necker Island has recently gone up. It now costs 1.5 million Virgin Atlantic miles to book a Celebration Week on the island. This is still arguably a good deal compared to the $35,000 cash cost (2.33 cents per mile value), but it’s more than I currently have available.

Rather than earning more miles, though, the question on my mind is whether I should burn the miles I have. With Virgin Atlantic on shaky ground, are my miles at risk of becoming worthless? If so, is there a way to get value from them now even though I don’t have any travel plans in the near future?

The Hilton Honors exit strategy

This idea came to us from a follower named Brad who asked if he should convert his Virgin Atlantic miles to Hilton points. Nick and I discussed this on our recent Frequent Miler on the Air episode:

In that conversation, I confidently stated that I believe that Virgin Atlantic Flying Club miles will retain their value. That’s my best guess. But still, it’s worth discussing Brad’s suggestion…

Virgin Atlantic miles can be transferred to Hilton at a 2 to 3 ratio. 10,000 Virgin Atlantic miles convert to 15,000 Hilton points. One reason to consider making this transfer is the belief that Hilton is much less likely to fold than Virgin Atlantic.

There are two important reasons not to convert Virgin Atlantic miles to Hilton:

- It’s a one-way conversion. Sort of. OK, yes, it’s possible to convert Hilton points back to Virgin Atlantic miles, but only at a terrible ratio of 10,000 Hilton points to 1,500 miles. In other words, If I converted a million Virgin Atlantic miles into 1.5 million Hilton points and then later converted back to miles, I would end up with only 225,000 miles.

- It’s like cashing out at only 3/4ths of a penny per mile. By using Virgin Atlantic miles for high value awards, it’s easy to get far more than 1 cent per mile value. Hilton points, however, are almost always worth about half a cent each. There are exceptions (especially at very low-end or very high-end properties) where you can get more value from Hilton points, but Hilton often puts their points on sale for a half cent each so it doesn’t make sense to value them higher than that.

If you think that it’s likely that Virgin Atlantic miles will soon become worthless, then the Hilton exit strategy makes a lot of sense. Getting 0.75 cents per mile is obviously far better than nothing at all.

Other exit strategies?

I’ve looked through Virgin Atlantic’s award options and failed to find any other good exit strategies besides Hilton. You can convert your miles to IHG, but the transfer ratio there is only 1 to 1. That’s not good at all.

Booking flights to use up points doesn’t make sense either. First, at this point in the COVID-19 disaster, we don’t have any way of knowing whether any booked flights will happen at all. And if Virgin Atlantic goes under, any award flights booked on Virgin Atlantic will obviously become worthless. Even flights booked on partners would most likely be lost (more on this later in the post).

If we knew that travel would soon become possible, I suppose that burning points on a return to Necker Island would make sense. But, in my case, that would require converting an additional 400,000 transferable points to Virgin Atlantic to book a trip that might not even be possible. No thanks. There are other Virgin Group properties that can be booked with fewer miles (including two luxury safari properties in Africa), but again, we don’t know when it will be possible to journey to these locations.

What does a thought leader think?

The tagline for the blog View from the Wing is “Thought leader in travel”. And I buy it. While Gary Leff doesn’t always write “thought” pieces for his blog, I highly value his opinion when he does. He’s been writing about travel far longer than me, and his background in finance makes him uniquely suited to give advice about what may happen in situations like this with Virgin Atlantic.

I emailed Gary to get his take on the Virgin Atlantic situation. Here’s his reply:

I thought devaluation was on the horizon for Virgin Atlantic Flying Club even before the current crisis. My assumption, for instance, is that when their bilateral agreement with ANA was up for renewal that those great values would disappear (the way the London – Beijing Air China value did).

Of course there’s risk to the miles now, as there is to many currencies. An airline bankruptcy does not mean the end of an airline’s miles. Traditionally the first thing an airline does in bankruptcy is re-affirm their commitment to their mileage members. They will need their customer base to come back. As long as an airline doesn’t liquidate, miles should generally be fine.

And while you can expect a troubled carrier to print a lot of miles, trying to market their way into selling more tickets, and that will eventually lead to devaluation (more miles chasing fewer seats once the carrier recovers) that’s not a near-term concern.

The risk to a loyalty program comes in liquidation. If the airline goes out of business, the miles may become worthless. A true liquidation would mean another airline picks up pieces (perhaps routes, slots, aircraft, gates) on the cheap. An acquisition of some kind probably includes acquiring an airline’s customers, and mileage liability. Remember that the loyalty programs, in normal times, have been profitable – indeed, we learned when United went into bankruptcy after 9/11 that Mileage Plus was the only profitable part of their business at the time.

In summary, Gary says that a devaluation is likely (especially with award bookings on ANA) regardless of what happens with Virgin Atlantic’s financing (I’ve been known to predict the same). But, he goes on to say that we only have to worry about miles becoming worthless in the situation in which the airline goes out of business entirely and its assets are liquidated. I followed up with Gary to try to get him to guess how likely this is. Here’s what he said:

My confidence in my bets about the world right now are lower than in normal times, however I am guessing they will not be liquidated. The politics of a bailout have been harder for Virgin than for many airlines with Branson living in the BVIs and Delta’s 49% stake. Nonetheless now that Air France is getting a bailout, and once Lufthansa does, the chips will fall and the UK government will decide to support a second long haul carrier at Heathrow.

In any case I’d guess that a restructuring is more likely, given the eventual value of airport slots that they hold (which will be more valuable in the future than in liquidation). The lack of DiP financing the way the U.S. has is the only thing that in my mind makes this other than a certainty.

In other words, Gary thinks it’s unlikely that Virgin Atlantic will go out of business entirely, but he’s less confident than usual about his predictions.

Read more from Gary:

- Are Partner Airline Redemptions A Hedge Against Bankruptcy? Gary explains that booking partner flight awards won’t protect your miles because tickets issued on a liquidated airline’s stock won’t be paid for and aren’t likely to be honored.

- Star Alliance Airline Avianca Warns It May Go Bust, Are Your LifeMiles Safe? Gary covered a very similar situation with Avianca. In this post Gary says that his advice has “long been to buy what you need to use right away, not to invest in the program long term.” But he goes on to say that he thinks that “the airline will continue even if going through bankruptcy. As long as it remains operational, LifeMiles should be safe and retain value.”

- With Virgin Australia In Bankruptcy, What Happens To The Miles? Here Gary reports that “Virgin Australia’s Velocity Frequent Flyer program has suspended redemptions even though it is a separate company and not included in the administrative restructuring.” He goes on to say “So what happens to Virgin Australia Velocity? If the airline survives, the program survives. If the airline doesn’t survive, assume that the miles become worth very little.”

What will I do?

I agree with Gary that Virgin Atlantic is likely to survive one way or another and that their miles will survive too. I also agree that it’s likely that we’ll eventually lose the sweet spot award on ANA (round-trip first class to Japan for only 120,000 Virgin Atlantic miles), but that prediction has nothing to do with their current financial troubles. It will be disappointing if I never have a chance to use my miles for this incredible sweet spot, but that alone doesn’t affect my decision.

Personally, I’ve been getting great value from Virgin Atlantic miles, not just from Necker Island, but also from partner award flights on Delta. My bet is that those award prices won’t change materially any time soon. Plus, Virgin Atlantic recently added the ability to use miles on Air France and KLM. I found that Air France Premium Economy awards can be booked very cheaply with Virgin Atlantic miles, and award availability has been fantastic.

On the flip side, I’m also sitting on 890,000 Hilton points. Do you remember when my Hilton account was hacked? I had less than 400,000 points before getting hacked. When my points were finally restored, I magically had over 900,000. Yes Hilton, if you’re reading this, feel free to take back the extra points. Unless that happens, though, I have more Hilton points than I know what to do with. So, transferring from Virgin Atlantic make no sense at all for me.

I’m going to keep my Virgin Atlantic miles as-is. For now, I’ll probably even keep earning miles through their credit cards (more due to laziness than anything else — I don’t want to turn off my automated process). But if a new transfer bonus comes along, I won’t transfer points to Virgin Atlantic. Not unless travel to Necker Island opens back up that is…

[…] would be little more than a footnote except for the interesting timing. In a recent post about Virgin Atlantic’s financial ruin (April 27th 2020), I stupidly poked the […]

Great information. It appears, at least in my case, we have a “reverse stock split” using Virgin Atlantic miles to book a Delta flight. Virgin’s chart shows 50,000 miles for a domestic flight (US) and going directly through Delta’s website shows 24,000 miles. Oh well…

Which route charges 50K for a domestic Delta flight? Maybe you accidentally looked at their “Route (to/from UK)” tables?

totally forgot about my VA miles as it relates to their financial status. Not worried about AA, United, Alaska, etc…thanks for the reminder. Only have a measly 65,000 or so…if they go poof…there would be worse fates in this game.

It’s still is worth $$$$$$$$$$$$$$$ do something ..

[…] How should you deal with Virgin Atlantic miles given bankruptcy risk? […]

Pardon this question as it’s not directly related to this topic, thought it falls under the general ‘what to do about future travel planning’ for sure. I’m planning a huge around the world trip for my son and I for next March – LAX-DUB-DEL-BKK-SGN-SYD-LAX. Using miles for the first 2 legs (Alaska on Emirates), SGN-SYD (KrisFlyer on Singapore) and SYD-LAX (probably with Hawaiian miles to Honolulu and then find a way to get home from there since I’m not having luck with any other award space -including VA). I know you’re not a future teller – but how difficult is that going to be to reschedule if this continues. Singapore and Hawaiian I’m using their own miles so that would seem easy to reschedule. It’s the Emirates/Alaska one I’m unsure of. It’s a year from now so I’m hoping all will be good by then, but who knows. That’s almost half a million points I’m spending here. I have to pull the trigger on the Alaska miles in the next few days before it starts to disappear. Any thoughts would be great. Thanks.

Personally I think you are crazy to try that complicated of a trip at this time. I consider all travel for the next 18 months to be speculative at best. I am booking trips but they are simpler ones that are fully refundable (points only). Having unwound several trips for this year I wouldn’t want to unwind what you are talking about.

Alaska is very good about changes even with partner awards so I wouldn’t be worried about that part of it. A bigger issue is having to deal with many different airlines if you end up having to cancel the whole thing. Have you considered booking a round-the-world award entirely with ANA miles? https://frequentmiler.com/ana-around-the-world-ticket-sweet-spot-spotlight/

Good to know about Alaska. I have looked briefly at the around the world ANA trip – but haven’t specifically played around with actual dates/destinations, etc… This trip’s purpose wasn’t specifically to be around the world, but Dubai and Sydney are must stops on the trip and I figured given their location I might as well hit SE Asia while I’m there and make it around the world. Wasn’t sure Dubai and Sydney would work well with an ANA round the world trip, but I’ll look into it (and we hit all of Asia/N Asia last year so not interested in going back there so soon). I work in education so my windows for taking these longer trips are very specific – spring break (2 weeks), xmas break (3 weeks) and summer (2-3 weeks). Missing this window means I have to wait until Xmas 2021 as summer 2021 is out for other reasons. I guess cancelling in January (if I needed to) would be perfect timing for award space opening up in Xmas 2021.

Appreciate this site and all the info – it’s one of the best and must reading for me every day.

Scott, you might have luck with Award space thru Fiji – NAN-LAX, NAN-SFO or . Fiji is just a short hop from SYD.

MEB–YVR, SYD-YVR on AC (UA or other partners). Vancouver is the lesser beaten path from Australia.

[OT] Any word on how their handling award flight cancellations? My flight (on DL metal from USA to CDG) isn’t until July but I’m hoping to get the points redeposited for free if it’s cancelled.

I had a cancelled Delta flight and refunded me for no fee. Points were back instantly but taxes and fees are being quotes as anywhere from 60-100 days.

I was able to cancel an April DL booked with VS miles via their text message service. Took hours for them to respond but it was pretty easy & better than waiting on hold.

I also cancelled a July booking on DL via text message. They didn’t charge me anything to cancel and redeposit the miles.

Yeah burn your miles like you burned BOA for everyone by telling everyone on your blog to apply for multiple cards at the same time

The other question for Gary is how does the Delta 49% ownership help or hurt the Virgin Atlantic survival? Seems they want to protect their investment or would they push for liquidation to get the slots?

Delta’s CEO is on record as saying no more help will be coming from them due to the fact they need all the cash they have to keep Delta going and the fact that accepting US government aid has effectively tied their hands. My understanding is the LHR slots are already collateral for prior loans so not sure liquidation helps all that much since they’d be sold to the highest bidder.

U have unions in there too so they have to agree to whatever. Warren Buffet brought and sold all of his Delta shares in like 3 months a dead horse. I think Branson can only sell to a EU member

A newbie comment here, after reading this post, I traced it back for several other VA posts on this site, all very helpful and interesting. I am in Detroit (Delta hub) and I fly once or twice a year, so getting a Delta card seems overkill. VA mile transfer is much better alternative (I learned it here, thank you!). My comment is, why even bother with a VA card when I can use Amex Blue (2% up to $50K) and transfer to VA instantly, with no AF? Plus VA cards do not give you elite status which doesn’t bother me much coz I do not fly often. I understand your post is about the miles, not the card specifically, but anyhoo, just a comment :-). PS, will seriously consider to put $50K/year and use transfer (with bonus hopefully) to redeem Delta flight(s),

Great question. For most people the Amex Blue Business Plus is a better bet. You’re right. Another great option is the Citi Double Cash paired with the Citi Premier. Either way, you’ll get 2X points everywhere which are then transferable to Virgin Atlantic (VS) and many other airlines. In my case, by spending $2500 per month on each card, I average slightly more than 2X miles plus I get Virgin Silver status ($2500/month spend results in 25 tier points)

Lu Lu – If you are in the US and want a good card for VS transfers try an Amex Gold, it earns 4X at food stores and restaurants, and transfers to 19 airlines.

@Greg

I’ve been mulling the Kiva 12 Month automated spend, rinse, and repeat. I like the idea of the win-win of helping developing world (l spent 5 years in developing nations) and also banking either status or points/miles.

While less of an issue, but still an issue – not sure if one could simply write off losses from a Kiva loan default, its still a risk, but I imagine you can spread the risk with more but smaller loans.

Kiva, overall, has a low default rate. The current average per Kiva user is 1.26%.

I am curious to see how COVID-19 will effect the default rate, if anything the loans are probably needed even more now than ever. Have you seen anything impact or is the lag time still to great.

On a side note – talking charities and the Platinum Business shipping credit and if you itemize your deductions and exceed the standard $12K/24K or have rollover to your state tax return.

Donating the Forever stamps – would make a nice charitable deduction (YMMV) – as a some charities still raise funds (targeting boomers who still use write paper checks and mail letters) so they will included a pre-stamped letter to mail.

I think it’s way too soon to know how COVID-19 will affect default rates, but it would be surprising if they don’t go up.

Great idea about donating stamps.

I was ready to pull the trigger on booking an ANA flight back in March with VA miles for Feb 2021, then held off. Now cannot get a hold of anybody at VA to book it. Left on hold and nobody ever answers. Transferred during the 30% Amex transfer bonus. If I loose the 120K, I can live with it. I still have my health.

Don’t give up the Ship. Just got an 18-month voucher from a Non-Refundable hotel deal in France been @ that hotel 5x. Just 3 more to go on that trip for ZERO cost .

CHEERS

I was on hold for almost 2 hours to transfer my meager Virgin Atlantic miles to Hilton a little over a week ago. I had very few miles and need to bulk up my Honors account for a planned trip in February 2021.

I’m a little disappointing that few bloggers address that hotel transfers HAVE to be done over the phone. I think texting may be a possibility, but my text didn’t get a response for nearly 24 hours (and I had completed it telephonically by then).

Also, I was told it could take up to 30 days for points to appear in my Honors account, but they appeared today (so 7 or 8 days)

I spent 30 min on hold to get an Award flight redeposited earlier this month – 120K – that was transferred from Citi/Amex points for a pair of Delta One suites SEA-PVG for a trip later this summer.

Was then debating a 3-4 day trip later this summer or fall PDX-AMS-PDX in Delta One to burn the miles 90K RT – but all this talk of VS – on the fringe and with the recent Virgin AU going into Administration (BK).

Decided to transfer out to Hilton figured that I can at least recoup some value (180K HH points) from my TYP/MR – spent about 90 min on hold.

I remember when you wrote your trip report on Necker Island and that’s when I, too, started saving up for a trip there someday. At that point I had been saving them up for Virgin Galactic (back in 2014 the redemption was 2 million but when they turned it into an entry for a lottery I gave up on that idea and started redeeming them on flights.) I’m sitting on hundreds of thousands of VS miles gained through a mix of cc bonuses and flights but I’ve also mentally prepared myself that I may lose them — and that’s ok. VS Flying Club miles have been very good to me in that I’ve redeemed a good number of flights on VS, DL, NH, and even Virgin Australia in the past 10 years… plus all my flights on VS metal have been fantastic from check-in to the crew to the arrivals lounge at LHR.

I really hope Virgin Atlantic will survive this crisis.

Joey

Aim high good for u that was my baby Virgin Galactica watched it for years. The trouble with that to get the Wings u need 62 miles UP so Sir Banson changed it to ” Edge of Space “. No Thanks, $250,000 that’s why he sold half to the Arabs will soon be BK too.

#stayincave LOL

Necker Island will be sold I bet a house of cards he is.

Branson #stayedinwinecellar and almost died.

Remember when things are going well anyone can run VA when it turns to Dung let’s see how he does.

Cheers

Regular people want to take away his KnightHood ..