Chase’s new Freedom Flex card is coming very soon (September 14th or 15th). This new fee-free card will offer the same Ultimate Rewards points and rotating 5X categories as the current Freedom card, but with additional uncapped bonus categories: 3X dining and drugstores, and 5X travel booked through Chase. In almost every way, this new Mastercard is superior to what I’ll now call the “Freedom Visa.” That said, we’ve been told that after September 14th, the Freedom Visa will no longer be available to new applicants. Current cardholders, though, will be able to keep their cards longer indefinitely. Should you get one now before it’s too late?

I started writing this post with the expectation that I’d argue that you should try to pick up one (or more than one via product changes) now while it’s still possible. As I finished up the first version of the post, though, I convinced myself the opposite — that for most of us there’s no reason to hurry. Then I learned that Chase claims that people won’t be able to hold multiple Freedom Flex cards, even though it is possible today to hold multiple Freedom Visa cards. This changed the equation for me and forced me to rewrite parts of this post. Now, I think that those with Chase Slate cards or unneeded Sapphire cards should product change to the Freedom Visa before it’s (potentially) too late.

Here are the reasons to consider getting the Freedom Visa while it’s still an option:

- This is the last chance to get the welcome bonus for the Freedom Visa. It’s theoretically possible to triple welcome bonuses by signing up for the Freedom Visa now, then at any time going forward sign up for the Freedom Unlimited and Freedom Flex. As I write this, the welcome bonuses for all three cards are identical: 20K points after $200 spend in 3 months and 5X points on grocery purchases in the first year (max $12K grocery spend).

- It’s the best way to expand your 5X limits (e.g. having both a Freedom Visa and Freedom Flex gives you twice us much potential spend each quarter towards 5X categories).

- It’s a Visa card and so it’s better than the Freedom Flex Mastercard at Costco. Costco stores accept only Visa cards. And Chase is known to occasionally offer 5X at warehouse clubs as a quarterly bonus category.

It may have different rotating categories than the Freedom Flex. There may be quarters where the Flex has unattractive 5X categories, but maybe the Freedom Visa will have better options. We have since learned that the rotating categories will be the same.

In the sections below, I explore each of these arguments…

Last chance welcome bonus

If you don’t currently have a Freedom Visa card and you haven’t received a welcome bonus for the card in the past 24 months, then you can sign up now to get the best welcome offer we’ve ever seen for this card. Both the Freedom Unlimited and Freedom Flex have the same offer, but it’s at least theoretically possible to get all three bonuses.

Counterpoint: Those over 5/24 are ineligible for Chase welcome bonuses. And those who are just slightly under 5/24 may prefer to pick up a different Chase card while they can.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

The best way to expand 5X limits

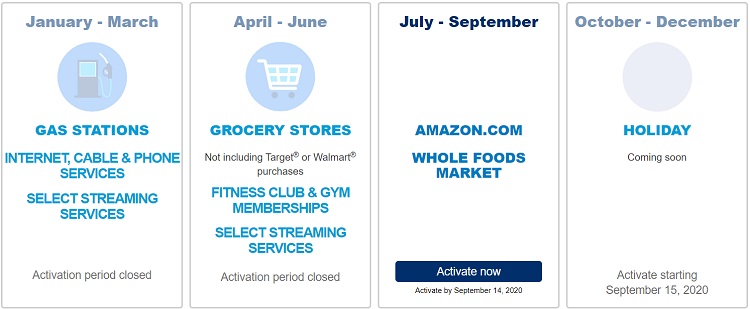

Every three months, Chase offers Freedom cardholders different categories of spend that earn 5X rewards. Through the end of September, for example, Freedom cardholders earn 5X for purchases at Amazon.com and Whole Foods. 5X earnings are limited to $1,500 spend each quarter.

Those who spend a lot in 5X categories, especially those who manufacture spend, may want more capacity than $1,500 spend per quarter. One way to achieve that is to own multiple Chase Freedom cards.

If you already have the Freedom Visa card, Chase won’t let you sign up for a new one. Additionally, if you’ve earned a welcome bonus for this card in the last 24 months, you won’t be eligible for a new welcome bonus. However, the Freedom Flex Mastercard will be considered a separate product. Doctor of Credit has confirmed with Chase that you will be able to keep your Freedom Visa card and sign up new for the Freedom Flex (and get a new welcome bonus).

Starting New

If you don’t yet have a Freedom Visa card and if you’re under 5/24, then signing up now for a Freedom Visa may be a good way to go. The idea is that you can sign up now for the Freedom Visa and then later sign up for the Freedom Flex. Boom. You will now have $3,000 to spend each quarter on the 5X categories.

Product Changes

Those with a qualifying card (Freedom Unlimited, any Sapphire card, or Chase Slate) may want to product change now to the Freedom Visa while it’s still possible. Note that you must have your account open for a year before Chase will allow these changes. Also note that Chase doesn’t always offer the card you want as a target for your product change. It is sometimes necessary with Chase to product change to a different card and then immediately call back to change to the card you want (weird but true).

Let’s look at a couple of scenarios where product changing to the Freedom Visa may make sense:

- You are over 5/24 and you already have the Freedom Unlimited, Freedom Visa, and Sapphire Preferred: One approach is to convert the Freedom Unlimited and Sapphire Preferred to the Freedom Visa now before it’s too late. In this way, you’ll end up with $4,500 in 5X spend each quarter. You can then later product change one of these Freedom Visa cards to the Freedom Flex so that you’ll also get the benefit of 3X dining and drugstores.

- You are under 5/24 (3/24 or less) and you already have the Freedom Unlimited and Sapphire Reserve: Sign up new for the Freedom Visa. Then, after approval, product change the Freedom Unlimited and Sapphire Reserve to the Freedom Visa before it’s too late. Then, next month, sign up for the Freedom Flex. In this way, you’ll get two welcome bonuses and you’ll have a total of four Freedom cards that offer 5X quarterly bonuses. That’s $6K of 5X spend per quarter. If you were able to max out this spend every quarter, that would add up to 120,000 points per year.

- You are at 4/24 and you already have the Freedom Unlimited and Sapphire Reserve: Product change your Freedom Unlimited and Sapphire Reserve to the Freedom Visa. Sign up for the Freedom Flex once it is available on September 15th.

The above scenarios are a bit unrealistic in that they assume that you’re okay giving up the features offered by the Sapphire Preferred or Sapphire Reserve card. But, of course, if you do product change these to the Freedom Visa it should (theoretically) be possible to product change back if/when you change your mind.

Counterpointed Assumptions

The strategies of accumulating multiple Freedom cards through new applications and product changes are useful only if certain assumptions hold:

Assumption: Chase won’t allow product changing to the Freedom Visa once the Freedom Flex is available. We don’t know this to be the case. Last I checked, Chase has still allowed product changes to the fee-free Sapphire card even though that card hasn’t been available new for a very long time. If Chase does allow product changing after the fact, then there’s no rush to do so now.

Assumption (Part 1 of 2) Chase won’t allow product changing to the Freedom Flex from the Freedom Unlimited or Sapphire cards. We know that Chase will allow product changing from the Freedom Visa to the Freedom Flex. We don’t know if that product change capability extends to other consumer Ultimate Rewards cards. My bet is that Chase will allow product changes from the Slate, Freedom Unlimited and Sapphire cards to the Freedom Flex.

Assumption (Part 2 of 2) Chase won’t allow people to acquire more than one Freedom Flex card via product changes. We know that it is possible to have multiple Freedom Visa cards through product changes (my wife and I each have three), so I’m not convinced that things will be different with the Freedom Flex just because Chase has said so. If both of these assumptions prove false (parts 1 and 2) then there’s no hurry to product change to the the Freedom Visa since we’ll be able to product change to the Freedom Flex instead.

Assumption: Chase will allow signing up new for a Freedom Flex if you already have the Freedom Visa. This has been confirmed by Chase and there’s good reason to believe them. At the time of this writing, the offer details for the Flex card state “This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.” I think that Chase is smart enough to explicitly list the Freedom Visa in this sentence if they mean for it to be a barrier to getting the Flex card.

Visa is better for Costco

Costco stores only accept Visa cards. The Chase Freedom card usually isn’t the best option for Costco purchases anyway since it usually offers only 1X rewards. However, when Chase includes warehouse clubs as a Freedom 5X category, it’s a great choice. So, if you want to preserve the occasional ability to earn 5X at Costco, having a Freedom Visa makes sense.

Counterpoint

Costco accepts Mastercards online. Costco members with the Freedom Flex Mastercard can buy Costco gift cards online and then use those cards to pay in-store or for gas. This may be the preferred option for most frequent Costco members anyway since you can jump online and max out your $1,500 5X spend in one shot and then use the $1,500 credit going forward even after the 5X quarter has passed.

Different rotating 5X categories

Some have wondered whether Chase will offer different rotating 5X categories for the Freedom Visa vs. the Freedom Flex. I think that’s extremely unlikely. Why would Chase want to manage two different 5X calendars?

In the unlikely case that they do offer different categories, it’s debatable whether or not that’s a good thing. Those with both a Freedom Visa and Freedom Flex would be worse off with different calendars when the Flex offers an easily maxed out category and the Freedom Visa does not.

Chase explicitly told Doctor of Credit that the rotating categories will be the same.

Conclusion

Here’s a summary of the arguments and counterarguments:

- Argument: It’s a good way to get an extra welcome bonus. Counterargument: This only holds if you’re under 5/24, haven’t received a bonus on the Freedom Visa in the past 24 months, and plan to also take advantage of the Freedom Flex welcome offer.

- Argument: It’s the best way to expand your 5X limits. Counterargument: Whether or not this helps depends upon several assumptions. If Chase allows product changing other cards to the Freedom Flex and if they allow multiple Freedom Flex cards as a result of product changes, then you can do just as well waiting for the Freedom Flex. That said, the multiple Freedom Flex route is unlikely to pan out (in my opinion), so acquiring one or more Freedom Visa cards now (through new applications or product changes or both) is probably the best way to ensure expanding your 5X limits.

- Argument: It’s a Visa card and so it’s better than the Freedom Flex Mastercard for Costco shopping. Counterargument: You can use the Freedom Flex at Costco online to buy Costco gift cards that can be used in-store.

- Argument: It may have different rotating categories than the Freedom Flex. Counterargument: We have since learned that the rotating categories will be the same.

The bottom line is that if you are well under 5/24 and hoping to get multiple Freedom welcome bonuses, then going for the Freedom Visa makes sense. Alternatively, if you’re eager to expand your 5X capacity, it makes sense to acquire one or more Freedom Visa cards now through product changes and (if you’re well under 5/24) a new sign-up.

Product changing to the Freedom Visa now especially makes sense for those who have qualifying cards that they don’t otherwise want. This would likely include a Chase Slate or fee-free Sapphire. Similarly, if you want to get rid of your annual fee from your Sapphire Preferred or Sapphire Reserve, the Freedom Visa might make sense for you (although if you don’t already have the Freedom Unlimited, that might be a better choice depending on your situation).

Did I miss any good reasons for or against getting the Freedom Visa card? Please let me know! Comment below.

So has anything changed with Covid and Chase5/24??

Background:

I decided to go for a freedom unlimited before it switches to the “flex”. I haven’t applied for a personal Chase card in quite some time. I PC’d my CSP from 2016 last year to a freedom.

There denial reasons were to many open accounts/too MUCH available credit

Too many inquiries

And For some other reason

So…… in the past 2 years when I started this Ive done 4 ink’s in two separate LLC’s and a SW biz with SSN. All the Inks were almost 18 months ago or older.

Outside of chase it’s been a an Amex BLue Business, Ames Biz plat and Amex personal gold

Therefore I should be under 5/24 anyway……….

When I called recon they asked about other recent inquiries from banks regarding refinance of different business debts and used that as an excuse as well zzz

Just seemed very odd…. The whole thing.

Thoughts?

They definitely tightened up on approvals for business cards, but I haven’t heard the same regarding personal cards. I don’t think they’ve changed any rules (such as 5/24)

So I got the denial letter.

Too many active accounts/too much available credit

Too many recent requests/reviews of credit (which they attributed to business refinancing)

New Chare Business Card Recently Opened.

I am Not sure what they mean by recent, that was almost a year ago since I’ve even applied for anything Chase. Very odd

Is there any reason to have the Sapphire Free Version? Does it have any travel insurance benefits that Freedom doesn’t? I have 2 freedoms and an Ink Unlimited already.

Nope. It’s an inferior card to either Freedom. The main reason to change to it is that sometimes it’s the only option Chase will give you for downgrading from the CSP or CSR. So downgrade to the Sapphire then product change to Freedom

[…] Should you get the Chase Freedom Visa before its too late? […]

[…] wrote this morning about whether or not you should consider applying for the Chase Freedom (Visa) card right now given that applications for this card will no longer be available after September 14th — in […]

I’m 3/24 I think and have an old Ink Plus and got United personal on 08/12 (recon approval day, 08/10 app day)

(off top dp. They’ve denied my United at first, recon said there is no place to transfer 5K minimum required credit from only personal cards could be considered for credit transfer but I’ve lowered one of my Chase business card’s limit by 30K and called for reconsideration after a day again and it worked w/ 10K approved).

Now, AFAIK, freedom has $500 minimum but with such a low limit would be hard to maximize on grocery spend, etc for me. I’ve never had a freedom card should I get it? With CSP? Will have to call and transfer the limits from my new United. Does Chase still count two apps in a day as one? Also in terms of the 2 cards in the month rule?

Thanks

It’s $1,500 per quarter, $500 a month would technically work ($600 would be even better)

I can’t answer for you whether you should get it, but it is a solid choice. It doesn’t sound like you’re looking to get several Freedom cards, though, so in your case I wouldn’t rush to get this card now. The Freedom Flex will be fine whenever you’re ready to sign up for it.

I don’t know if Chase credit pulls still combine into one when done on the same day. Maybe?

I currently have an chase ihg mastercard, and only hold onto it for the free annual night for the annual fee. Im not an ihg elite, nor do I need to be. Im high elite level in Marriott and Hilton.

I cant apply for the new MC flex as a new app as im subject to 5/24. But what about I ask for a product change to mc flex. What do yiu think?

No, Chase definitely does not allow product changes from co-branded cards to Ultimate Rewards cards or the other way around.

One caveat to the Costco discussion above. Warehouses are an infrequent quarterly bonus category (once since 2018), so the Visa/Mastercard issue will likely not come up that often. However, gas is a frequent bonus category (5 times since 2018), and at least in my area, Costco is by far the cheapest place to get gas. The gift card trick above will not solve the Visa issue for buying gas at Costco. For those questioning it–Costco gas definitely codes as gas, not as warehouse (similarly, Costco gas purchases won’t get 5x when there is a warehouse category, I’ve definitely tried it). As someone who drives a lot for work, I love the gas bonus category, and am not changing to the Freedom Flex for this reason.

The recent events do make me wonder whether there will be any effect on the upcoming bonus categories. Will there be a Warehouse category, if you can’t use it in store at the largest warehouse chain? Will the usual second quarter Grocery category be back, since many people will already have 5x as part of their signup offer?

You make a good point. Small correction: There are more Sam’s Clubs stores in the US than Costco stores, so not quite the largest warehouse chain for US shoppers. Still, it’s a close second place (Costco feels more distantly second to me because they only operate two clubs in all of upstate New York, which is a large land area, but I know that on the west coast they are ubiquitous).

At any rate, your point stands. I could certainly see that bonus category not coming back. As to the quarterly category, I don’t know — it doubles up right now (I got 9x at Whole Foods as I’ve previously posted). I could see that happening again.

Ahh, yes, Sam’s Club does have more locations in the US. Costco has more locations overall, but international locations are not relevant for a card with foreign transaction fees. In my area (PNW), Sam’s Club closed up shop a couple years ago, while Costco keeps opening new locations, so I guess I have the opposite impression.

Good point on the categories doubling up with Whole Foods now–so maybe Quarter 2 Grocery bonus will be back.

Is Chase solid on the one year rule for product changing my Unlimited and Sapphire to Freedoms? They are both about 10 months old.

Also, Would two product changes hurt my chances at applying for the Flex later this month?

It may be possible to product change your Freedom Unlimited to a Freedom under a year from opening. I don’t believe it will be possible to change a Sapphire Preferred or Reserve to a Freedom before a year has passed.

The reason for the rule has to do with a provision in the CARD Act that prevents an issuer from changing your annual fee in the first year. I haven’t read the exact wording of the act, but I believe the provision was meant to prevent an issuer from increasing your annual fee shortly after you’ve opened a card (basically a consumer protection against predatory lenders), but I believe that issuers have interpreted it to mean no change in your annual fee in the first year (easier for them to keep a blanket policy to avoid running afoul of the law rather than making individual decisions about what should probably be OK).

Since the Freedom Unlimited has no annual fee, you may therefore be able to change it to a Freedom, but I don’t think they’ll let you change a Sapphire Preferred or Reserve until the year is up.

Thank you, appreciate everything you do for us.

So as Greg wrote in the article and as you pointed out here, Nick, it is possible to product change a CFU to a Chase Freedom. When I tried Googling this, I only saw posts affirming PCing from a Freedom to a CFU, and not the other way around.

Greg, is there a referral bonus (to a friend, family, etc.) for the current Chase Freedom? I don’t see it on their referral link but have read some bloggers claiming it can be done but didn’t mention how.

I’m not aware of any way. If we knew how, we would list our referral link on our site instead of a direct link that doesn’t do us any good.

As Greg said, we would list it if we knew of any way to do it. I guess you use your Freedom to generate a referral link to the Freedom Unlimited and the person opening the card could later product change to a Freedom — but probably not before 9/14. Also note that as far as I know, the referral offer does not include the 5x first year grocery bonus.

So impressed by how you hold all this together. Head spinning and a bit breathless! Which is why I follow you closely. Advice please for 2 player mode? Player 1 is 3/24, with the 3 being Freedom Unlimited just taken out due to the 5x on groceries (we are astronomical grocery spenders, like $2.5k+/month. Don’t ask). Card 2 is a CSP, just over one year old. Player 2 is 2/24 with a one year old CSP, whose fee has just posted. Like the brainlessness of simple 1.5x of the Unlimited, but am I missing something?

Thanks! There’s definitely no reason to keep two CSPs. You can always have one of you add the other as a free authorized user if you want to use the card. And I do think having at least one CFU is a good idea unless you have a better “everywhere else” card.

As to Freedom, not everyone wants to have lots of 5X rotating quarter capacity, so think hard about whether you’ll really make use of it before using up multiple 5/24 slots. Assuming you do want that capacity, how about this:

P1:

P2:

You’ll have a total of 4 cards with the 12 months of 5X grocery (your existing CFU, two new Freedom Flex’s, one new Freedom Visa). If that’s too much 5X grocery capacity, you can wait quite a while to sign up for the Flex and hope that they keep that 5X grocery sign up bonus around (I don’t know how long that will last). As to rotating 5X capacity, you’ll end up with 4 Freedom cards so $6K per quarter.

Perfect! Thank you. But wouldn’t it make more sense for P2 to convert the CSP to a Freedom Visa as the AF has just posted?

That would work too, yes. How about this for maximizing Freedom cards:

P1:

P2:

Very kind of you Greg for getting back to me in such detail. My remaining gulp concerns using up 5/24 slots for so may Freedoms. But perhaps with my large grocery spend, interest in UR’s. and an already large HH points balance (no use at this point for IHG or Hyatt), in my case the Freedom load would be worthwhile?

Honestly if it was me, I probably wouldn’t try to get so many. I was just spelling out what was possible, not really what I’d recommend.

Thanks again, Greg!

Just going to drop in here to say that $2.5K/month is not astronomical grocery spend in this community. We points-hunters are a hungry lot. 🙂

So re-assuring!

I have a question. About a month back I PCed my freedom to FU to get a new SUB on freedom which I am currently working on. Can I PC my FU back to freedom now? Or I have to wait a year to do that? I already have a FU so my plan always was to PC the second FU to freedom but now because the window may be potentially closing, I would like to move much quicker.

I believe you can PC back right now.

I have the Freedom, but got it via DG from CSP, so no SUB. I’m 3/24. Should I apply for another Freedom now?

You can but first you will need to PC your freedom and then wait at least one week before applying.

If you plan to try to get more than 2 Freedoms long term, then yes. If you’ll be satisfied with two, you might as well just wait for the Freedom Flex and apply for that. As Rohit said, if you want to get another Freedom Visa, you’ll have to change your current one to something else, apply for the Freedom Visa, then change the current one back to the Freedom Visa (all before 9/14). If you wait for the Flex, you don’t need to do any of that.