In the post “how to get approved for Sapphire Reserve 100K offer” I suggested that people who have signed up for 5 or more cards with any banks in the past two years should start by going in-branch to Chase to see if they are pre-approved. In-branch pre-approval has proven to be an effective antidote to the 5/24 Rule. In that same post I also recommended that if your application goes pending, you should wait until you get an official decision before calling for reconsideration. I wrote:

When you apply for a card, you essentially have three chances for approval: 1) automated instant decision; 2) automated decision after application goes pending; and 3) reconsideration.

Those who call for reconsideration before step 2 is complete force Chase to bypass that step. It is possible that a recon agent will deny an application that would have been approved by the the automated process in step 2.

If you wait, you have an extra chance of approval. If that process results in a denial, you can still then call to try to overturn the decision. In fact, I recommend calling several times if the first time isn’t successful.

I bypassed both of my own recommendations. I didn’t go in-branch, and I didn’t wait to call.

Applying online

In exchange for the $450 annual fee and meeting the card’s $4K spend requirement, the Sapphire Preferred card makes it possible to get at least $2,100 worth of travel in your first 12 months of card membership: 100,000 points worth at least $1500 in travel + $300 in travel credits this calendar year (until your December statement closes) + $300 in travel credits next calendar year. So, regardless of whether you intend to keep the card long term, it’s an amazing deal.

Obviously I wanted both my wife and I to sign up for the card. I thought about having one of us sign up now and the other sign up a year from now, but I wasn’t at all certain that the 100,000 point signup offer would still be in place. Instead I decided to go for it immediately.

Unlike most people who are well over 5/24, we didn’t need to go in-branch because we have Private Client status. Officially you need to have $250,000 on deposit with Chase to qualify for Private Client status. And I did have that much briefly in my Chase checking account when we sold one house before buying another. At that point I was invited into the Private Client program, and immediate family members were included.

As I’ve shown by being approved for the Sapphire Preferred card, the Marriott personal and business cards, the United Mileage Plus card, and the Ink Plus card all in 2016, Private Client status makes my wife and I exempt from 5/24 rules. For us, there was no reason to go in-branch to apply and we’ve been more crazy busy lately than usual, so applying online seemed like the thing to do.

UPDATE: Private Client status no longer exempts you from 5/24 status, but it did at the time that I wrote this post.

We finally found a few minutes to submit our applications on September 3rd (the Saturday of Labor day weekend). Both applications went pending.

Deciding to call

Last week I published “Do Chase Business cards add to your 5/24 total?” I argued that I thought that they didn’t count because they don’t appear on your personal credit report. Most reader comments supported that theory, but a few went the other way.

A reader named Jonathan offered an interesting theory that supported most of the evidence. He suggested that maybe Chase does include Ink cards in the 5/24 count, but not co-branded business cards such as those from Southwest, United, and Marriott. I still think that a simpler theory is more likely (that they only count cards on your credit report), but I couldn’t rule this new theory out.

I’ve personally opened both a Marriott business card and an Ink Plus business card this year, so I could potentially be a great test subject for Jonathan’s theory. Some readers with Private Client status have reported being initially denied due to 5/24, but they were able to overturn the decision through reconsideration calls. My hope was that the same would happen to me. I wanted to be told no due to 5/24 so that I could ask which cards they included in the count. This would have given me evidence to support or refute Jonathan’s theory.

So, I called.

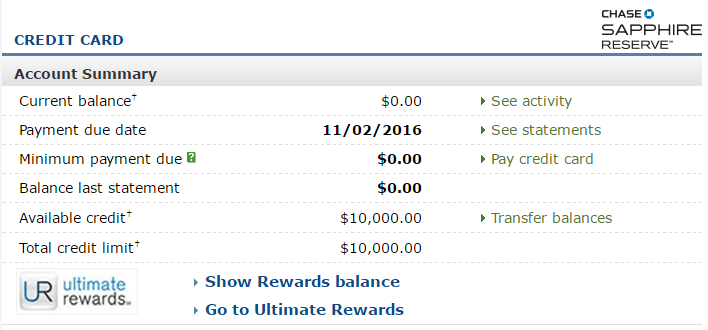

The agent I spoke with never mentioned 5/24. In fact, he quickly said that he would approve my application but that he couldn’t add to my overall credit line with Chase. He asked me if he could move credit from another card. I said yes, he could take $10K credit from my $25K Sapphire Preferred credit line, and we were done.

Almost

When he tried to finalize approval, he hit a snag. For some reason my application had to go to the “verification department”. He tried to conference them in, but there was a very long wait. Instead he gave me their direct number and a reference number. I called and waited on hold for 10 or 15 minutes. When an agent finally got on the line she verified me simply by sending a text code to my mobile phone which I then read out to her.

Done. Approved!

Waiting for decision #2

For my wife’s application I’m going to wait it out to see what happens. Hopefully she’ll get approved automatically. If not, she’ll have to call and maybe get verified as well, but I’m sure she’ll ultimately get approved.

UPDATE: My wife was approved automatically!

So what happened with your wife’s application? Any updates?

Sorry for the very late update. Yes, she was automatically approved. Unfortunately having private client status no longer exempts you from 5/24 so the same thing wouldn’t work today.

Went to bank to check if I am pre-approved.

I was told that I was and then I applied. Approved for 28K

This Greg is a stupid idiot. Now, for the rest of us “common folks” without CPC, and a branch in our state who are MS’ers/churners who are waaaaaaay past 5/24. I opened up 25 Cards already This Year alone. What do WE do? Hmmmm?

Data Point:

Was at 5/24 on 08/22/16 when I applied and got denied because of too many accounts in a 24 month period. Two of those 5 accounts “dropped” off on 09/16/16. I called to see if they could re-consider my application and was told that I would have to wait until October, 2016 for it to officially be outside that 24 month requirement. At that point I could call or simply re-apply.

Re-applied on 10/05 and application went into “pending”. Called on 10/06 and rep moved some credit around (minimum $10k to open Sapphire Reserve) and got card approved.

Was worried about the time in between Chase application, but turned out to be non-issue.

Hi Greg,

I got denied the first time I apply CSR online due to 5/24. Then I went into brach 9/15 to check see if I have pre-approval, luckily I do. I applied it right away, but didn’t approve right away. Still waiting for the result… Do you think I can get the card??? I check with the branch banker today and he said he called chase support team for me, it says that there are 3 stages of reviewing processes, I past the first two and now is on the final stage. I don’t know whether it’s true or not, but hopefully I can get the card…

Yes, since you were pre-approved I think you have a good chance

Greg, I am CPC..applied in branch today, no automatic approval. Banker told me to come by tomorrow to find out whether I was approved. Should I call the reconsideration # or should I wait till tomorrow?

As CPC it probably couldn’t hurt for you to call yourself if you want to skip a trip to the bank. If you have any problems with the call, then go in

Are you saying once you make CPC you retain that status if you go under 250k?

That’s been my experience, yes, but I can’t promise that it will last forever

I don’t even have $25 K in Cash, so that’s out. Next.

Too bad some people couldn’t get over the denials they’ve got and had to rant about it. I read this post as an interesting story about a tiny setback in the many experiments FM has been doing and sharing. Well, perhaps cuz I just got my CSP and wasn’t even thinking about CSR…

Been a quiet reader and supporter for a couple of years. Keep up the good work!

Thanks Max

Idiot, many people here don’t have $250 G’s in a bank to get CPC. Pretentious bastard.

DP on Ink+ and I had the exact same experience as you did. I was right at 5/24 (including Ink+, which was under my SSN), applied online a few days ago. Called recon as soon as I saw the pending message on the website as you did. I was also transferred to the verification department and was approved after a 10 minute hold. No mention of 5/24 at all.

So this leads me to believe that Ink+ is usually NOT counted towards 5/24, but I also have a sense that people on the fringe (right at 5/24 or maybe even 6/24), they probably look at other factors as I have excellent credit history and a FICO of 800.

As a follow up, Ink+ was my only biz card, I’m not a CPC and w/in my 5/24 count was 2 other Chase cards (Hyatt + CSP), Discover IT and Citi Prestige.

Yay! My profile was change to CPC today and called recon to reconsidered my denial letter from 8/23 for to many open accounts 12/24 to be exact. Approved for $10k time to let the wife to call later that’s going to be the hard part. I do all the application, she’s not into this hobby.

When did you become CPC? How long it took after you became CPC and saw the profile updated? Thanks.

you are approved simply and only because of your CPC status. You know that, but you don’t want to mention it at all just in order to do the bait trick. Surely i won’t blame you for doing that.

As many other people posts , most of them are annoyed ,bcoz of too many CSR articles in the blog. And i mentioned the same in ur 5th year blog anniversary thread.

Any how i went to my branch to check for preapproval. I am not , but my spouse was pre approved for slate and unlimited card. She just opened her 5th card – CSP in aug , but yet to be reported in the Credit reports. She is having around 2 or 3 Au cards in the report. We took a shot and applied thru the banker and got the 7-10 message. Came home , called recon. Straight denial . Told the rep other account are AU.He ran the recon process , half success and he informed to us that we need to move some CL from other 2 cards Freedom and newly opened CSP. So he is aware that there are 4 new cards in the report and there is a 5th card with Chase. Inspite of that he was able to run the recon and get it to nearby approval. We have the last step of verifying the home address id verification. Hopefully we will get it approved

Thanks, that’s useful info!

First time poster, long time lurker. I personally find this and other sites like DoC very helpful. We all benefit from shared information and I think it’s a little rich for people to benefit from Greg’s advice and then trash him on an article’s title. The problem is NOT the title, but the fact that some people get a new credit card every other week and then when a good one comes along, their screwed because they get denied. Maybe think first before hitting Apply Now!

Greg, quite a few folks didn’t get approved for the Reserve card and they’re not happy about it. I’m one of them. The number of posts about this card and its hype is getting to the point of “annoying” if you’re the one who is out of luck. I am trying to exercise my freedom not to read them, but every time there’s an enticing title suggesting there’s a way, you end up reading it, just to find out that uh, no, there’s no new way, at which point you get annoyed even more. So quite naturally, the result would be the comments you see. Please consider that next time you think of a title : )

P.S. Still love the site though, a lot of good stuff, especially for the beginners !

Thanks voyager10, that does help me understand the anger.

Did you go to a Chase branch before applying? That seems to be the option that gives people the best chance of overcoming 5/24.

Thanks for the suggestion but at this point Chase is not approving me even for the cobranded cards that are said in blogs to be “exempt” from the 5/24 rule, like the IHG Hotels card. I followed your article which described how to become an IHG Gold Status member and I got a link for the 80k offer. Got my hopes up, but Chase said Not So fast. Called reconsideration line, again, following your advice, but at this point the only thing I hear is something along the lines “Sir, you have opened 21 accounts in the past 6 moths, are you effing kidding me? ” Ha Funny only 6 months ago Chase was bombarding me with spam letters to get their credit cards, now they don’t want to see me. Can’t blame them, really. I’m one of those guys who read your blogs and went “I can travel the world for free! YAY! Sign me up!” I got good deals, no doubt, but reached the bottom, I think. Just need to chill for a while, unless I open up some business and go for the business cards. I just opened up Citi Prestige, and that was quite an effort, involved going to the branch and convince the banker to help me out, this is going to be the last one for now. Unless you can suggest a thing or two : )

I’m curious about your CPC status. With some effort I could scramble $250K for a short term deposit, but sounds like that status is not really guarantee for anything, so it’s a betting game, and I’m not sure I’ll end up winning it, especially given that I have no Chase branch in my area, and from reading your blog, it sounds like I would need to establish a relationship with a banker. Thanks for listening ! : )

I agree that CPC isn’t a guarantee, but I honestly don’t know anyone with CPC who hasn’t been able to get the Reserve card whereas I know many people with CPC who were approved.

There is no freaking branch in many states. DO u not get that? I live in North Dakota. What am I supposed to drive 1500 miles to a branch?

BEWARE: CPC does not guarantee anything.

FM is doing a disservice to its readers by casually mentioning: “Some readers with Private Client status have reported being initially denied due to 5/24, but they were able to overturn the decision through reconsideration calls.” What FM doesn’t want to tell you is that some people with CPC have actually been denied for 5/24, even with repeated calls to recon. Of course, FM has a conflict of interest because he encourages his readers to apply with his credit card affiliate links.

Never trust a blogger’s opinion regarding credit cards if s/he has credit card affiliate links for that product.

I have to agree. Frequent Miler is no different than any other blogger. This latest article proves it.

I’m not aware of any cases where those with CPC were denied even after repeated recon calls. If I was, of course I would publish details.