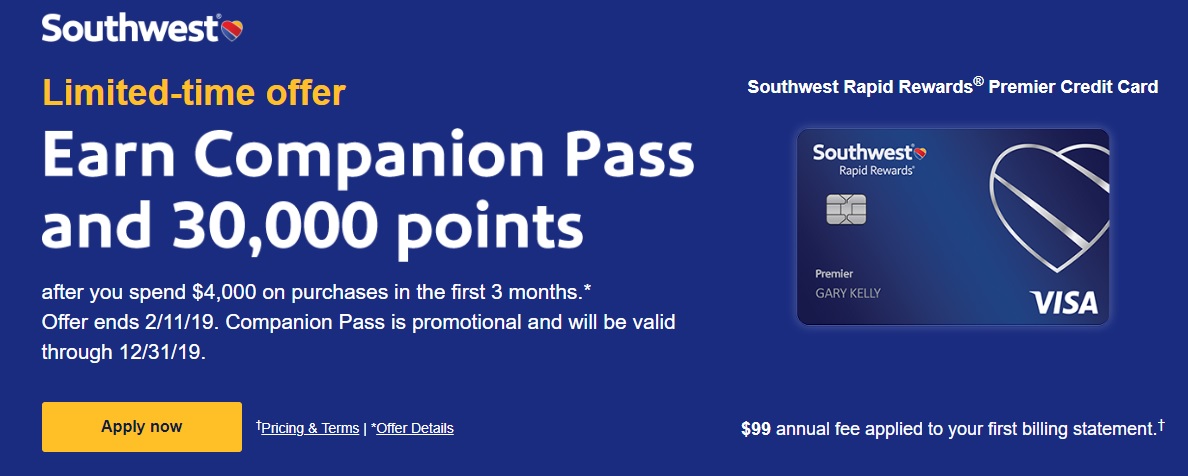

Chase and Southwest stunned the points & miles world yesterday with new offers for their consumer credit cards. Through February 11, all three Southwest consumer cards are offering new cardholders 30,000 points plus a Companion Pass after $4K spend in 3 months. The Companion Pass is valid only through 12/31/19.

Regarding these offers, our own Nick Reyes said: “Wow!” and “this is a great deal if you’re interested in the Companion Pass”.

On the other hand, trustworthy Doctor of Credit said: “I guess if you only have one 5/24 slot and can’t get approved for a business card and desperately want a companion pass then this is a good offer, otherwise I actually think it’s quite weak.”

How could two trusted sources in this community reach opposite conclusions? Are these offers great or weak? First, a bit of background…

Background

The Southwest Companion pass offers incredible value to those who would fly Southwest often with a companion. No one disputes that. Once you have a companion pass, you can add your companion for free (plus fees — usually just the TSA $5.60 per segment fee) to any Southwest flight that you booked for yourself. This is true whether you booked the flight with Southwest Rapid Rewards points or if you paid cash. And there’s no limit to how many times you can use it. You could theoretically fly every single day while you have the pass, and add your companion for free very time.

Normally, the way to get a Companion Pass is to earn 110,000 qualifying points in a calendar year. Points earned from Southwest credit cards, including signup bonus points and friend referral points, do count. Points transferred from a hotel program or credit card program (such as from Chase Ultimate Rewards) do not count.

It used to be possible to easily earn a Companion Pass by signing up for two Southwest credit cards at once when they offered 60,000 point signup bonuses (there were variations too, where both cards offered 50K and it was necessary to spend $10K to round out the 110K required, or one card offered 60K and another 40K, etc.). Unfortunately, Chase made this approach more difficult by introducing new rules: now, you cannot get a bonus on a second Southwest card unless you’ve closed the previous one and have waited 24 months from the last time you got a bonus.

Business cards are the exception. You can sign up for both a Southwest business card and a Southwest consumer card and qualify for both bonuses. This is key to understanding why Doctor of Credit thinks that the new offers are weak.

Why the new offers are weak

- Companion Pass for Two Years: With the old offers, two cards (business + consumer) would get you enough points for a companion pass. And by getting the companion pass this way it would last for the rest of this year and all of the next year. In other words, if you signed up for these cards last week, then once you completed the minimum spend requirements you would have a companion pass good until 12/31/2020 (vs. 2019 with the new offer).

- More Points = Better: With the old offers, you got more points. One could argue that 60K points without a companion pass is better than 30K points with a companion pass. 60K points can get a couple just as far as 30K points with a companion pass, but without having to travel within the next year.

Why the new offers are great

- No business card requirement: It’s not hard to open a business card. You may even have a legitimate business without knowing it (e.g. you own rental property, you sell things on ebay, you drive for Uber, you’re writing a novel, etc.). That said, it’s likely that most people don’t have businesses and aren’t willing to pretend that they do. The new offers make the Southwest Companion Pass an easy get for almost anyone.

- Single card requirement: Most people think of signing up for a credit card as a big step. It’s easy for those of us who sign up for cards regularly to forget this. The point is that most people won’t even consider signing up for two cards at once. The new offers require only one new card.

- Much smaller spend vs. the 2 card approach: The most recent two-card approach required $3K spend with the business card and a whopping $12K spend on the consumer card in order to earn all 60K points on each card. Granted you would end up with far more points and a much longer lasting Companion Pass, but $15K spend is simply not feasible for many people. The new offers require $4K spend in 3 months. That can still be a stretch for many, but it’s obviously much easier to achieve than $15K.

- More time to make the two card option work: Suppose someone signs up for a consumer card now. After meeting the $4K spend requirement they would have 34K Southwest points and a Companion Pass good through the end of this year. Later in the year, they could sign up for the 60K business offer (assuming it’s still available at that time). After meeting the $3K spend requirement for that card, they would have earned a total of 97,000 points. They would only need 13,000 points more to secure the Companion Pass for another year. Those extra 13,000 points can be earned by flying paid flights, additional credit card spend, referring friends to the credit card, earning points through the Rapid Rewards Shopping portal, etc.

Bottom Line

The new Southwest offers are great for most people. But, there are a few buts…

- But 1: For those comfortable signing up for two cards (with one being a business card), and with the ability to put lots of spend on those cards, the new offers are less valuable than before.

- But 2: The Companion Pass is only valuable if you’ll actually use it. The more you use it, the more valuable it becomes. If you don’t use it, it’s literally worthless.

- But 3: None of the offers are any good if you can’t qualify for the cards. If you previously received a Southwest card bonus in the past 24 months, or if you’ve signed up for 5 cards or more from any bank in the past 24 months (the 5/24 rule), then you can’t play this game, regardless of the specifics of the offer.

What do you think? For you, are the offers great or weak? In my case, I rarely fly Southwest so neither the new offers nor the 2 card approach is attractive to me. Plus, I’m over 5/24 so I wouldn’t be able to get these cards anyway.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

See also: Complete guide to the Southwest Companion Pass

![[Back] Costco offering 10% off Southwest gift cards again Southwest-Gift-Card](https://frequentmiler.com/wp-content/uploads/2023/12/Southwest-Gift-Card-218x150.jpg)

[…] a similar offer appeared in January 2019, I analyzed the deal and concluded that the offer is a great one for most Southwest flyers. […]

I have a question since I can’t get a clear answer by reading online. I currently have 2 Southwest cards.

Southwest Plus opened on 5/2017, bonus earned 7/15/2017

Southwest Premier Business opened on 4/2017, bonus earned 5/18/2017

I truly enjoyed using the companion pass which expired on 12/2018 and want to cancel and reapply for both these cards so I can earn it again. I’m confused about the rule about ‘earning bonus the last 24 months’.

Let’s say I cancel both cards next month (March). Does this mean I can’t re-apply for the Business Card until May (1 month after 2 years post account opening) or do I need to wait until June (1 month after 2 years post bonus earned)?

Same for the personal card. Do I need to wait until June or August?

Plus card: August

Business card: June

I spent the last couple of weeks getting four Chase cards off of my credit report (two were my daughter’s and two were my wife’s). Finally did it and applied for the Southwest Chase Business Card. Got the usual we’ll let you know so gave them a call and it was the same “too many Chase cards opened in the last 24 months.” Talked to reconsideration and they said there were eight Chase cards with Experian. Explained the situation and it sounded like I was going to be good to go. She asked a lot of questions and finally said I needed a DBA or a handwritten fictitious name statement from the state or county clerk. Not sure what do do next.

My wife’s Companion Pass expired last month and we really enjoyed it. I just wish I had paid more attention to 5/24 the past few years when I first got into this.

Why not get the DBA?

Wasn’t sure what is involved. I better check into it.

I called the county clerk. Sounds pretty simple. Go up, fill out a short form and give them $30. Thanks!

Got my DBA and emailed it to Chase Saturday. They said to call Monday to confirm they received it which I did. She wouldn’t confirm they received it but hinted they did. She then asked if I had any other Chase cards and what the credit limit was. She then said call back five days after I emailed the DBA which is Thursday. Fingers crossed.

Good luck!

Called back today and was told the DBA wasn’t eligible as a proof of my business. I was really annoyed at the waste of $35 and asked for the escalation department. She said they wouldn’t be there for another hour so I’ll try then.

Called and talked to another girl. She reviewed my DBAs and said they were acceptable. A few minutes later was approved for the card. Hopefully getting a personal card won’t be as much of a hassle.

Thanks for your help and support and keep up the great work on the web page!

[…] New Chase Southwest Card Offers Easy Path to Companion Pass (link) […]

New offer is weak. Sounds like you’re saying some people don’t want to pick up more free money, because it can be tough to carry home. A business card doesn’t count against 5/24, so if you can get the personal card, you can get the business card. No need to cater an analysis of the offers to those afraid of stepping into the hobby with both feet. A fair analysis says the new offer is weak

Comes down to two things. How much you fly with SWA, or wish to, and how often do you do so with a companion. and then of course there’s that pesky 5/24 thing. Each person’s circumstances will be different and for some this will provide a great value and for others, like me, it’s, meh….

[…] FM vs DoC: Southwest Companion Pass with 1 Card. A great deal or quite weak? […]

I think if you want to go to Hawaii this year or next, and have a family, it’s a great option. However, it might cost 50,000 points to get there, but you can pay cash and still get two tickets for 50% with the companion pass.

It’s not for everyone, but it will be very appealing to some people. My only complaint with southwest is it doesn’t go everywhere I want to go. However, I will go back to Hawaii this year if they can get ETOPS certification as we have two companion passes for our family of 4.

Wait One year after ETOPS like I will.

CHEERS

Is the DOC on drugs?

– If any airline allowed a BOGO as part of the signup bonus, we’d all go crazy.

– If the card is at 60k, it’s a good deal.

– The companion pass is worth two cards, and here we can get it with 1 (especially given 524)

Yet, somehow this isn’t an obvious deal?

I guess it depends where you’re standing when you look at the deal. From the point of view of most people, I think it’s fantastic. From the point of view of someone who knows about and can take advantage of the 2 card option, it’s “meh” at best.

Are you on the same drugs as the DOC? :-p

But really? It drops 30k and doubles in value (AND doubles your $ for two years), and meh?

The only argument tho is what you said. If you can totally get both cards at 60k, then you miss out on 30k (which isn’t that much). But anyone who can get both, could use that extra card space to get another Chase card during a peak bonus.

I will say that the companion pass is so great (which is why the card is great) that I easily would use the extra 60k (/90k). But I know lots of people who seem to hardly use it.

Do you know what happens if you make someone with a companion pass a companion? Like you make Pam, your companion, then Pam gets this card and adds Tyler… Then basically the miles are only coming out of your account, so she doesn’t need the points, she just needs the pass.

That would be best high level use of this card… but I’m not sure it’s even possible, but I don’t see why not.

“AND doubles your $ for two years)”. No, it doesn’t. The pass only lasts until the end of this year. So about 10 months for those who sign up now and complete spend in Feb. Meanwhile the 2 card option does last for almost 2 years.

I’m pretty sure you can’t chain companions like that.

Shows I don’t actually read the entire thing.

Okay, 2 years vs 1 is big.

I think someone needs to test the chain thing, at least at the end of a pass use a change.

Let’s B nice here and save $$$ and let WH’s get a trip they always wanted to do .

Just got an Email from a Buddy’s Buddy’s on TLV on where to Stay !!

Game On

CHEERs

You cannot chain Companions. We at Flyertalk thought of that possibility probably a decade or more ago. If that were allowed, we’d have reserved a whole plane by now for one fare just for the heck of it.

We are getting pretty jaded in this hobby. If there weren’t a way to get a 2-year CP with 2 WN CCs, introduction of this new card offer would have greeted with an insane rush of joy by everyone.

And I don’t think it’s a slam dunk that the 2-year trick will inevitably be available late this year.

Nope–the only argument is not the extra miles–(though they are valuable) it’s the companion pass for two years instead of one. By the time you get this card and meet minimum spend and wait for statement to close and companion pass to be awarded, you will have, at BEST 10 months instead of 24 months of companion pass.

Seems a huge waste of a hard pull.

Hey Greg, the title is too sensational, though you have absolute legitimacy to use it.

A better subject is Nick vs. William; otherwise, I had thought my two favorite blogs are falling into argument 🙂

Player 2 and I have had the companion pass for 4 years and just completed requirements to get it again for 2 more years. For us an additional increased value in the “old” method which nets more points is their use to hold reservations. Not just the number of trips I can make with more points but also the extra flexibility with making plans. With 110,000 SW points and a companion pass I can make several tentative reservations for two of us. If I cancel them later the points return and only the taxes go onto “travel funds”. I use the travel funds eventually but even if I didn’t that’s just $5.60 to hold a confirmed reservation. And I believe if I forget to cancel the flight the points are returned anyway. Good marketing tool though, I can see it being attractive to folks who are scared or unable to apply for the business card.

Personally feel it’s a much weaker offer than before because i’ve applied biz card and just 47000 points away from 2 years CP.

I will need to spend more if I sign up peraonal card now ($13000 compared to $6000). I hope chase will at least bring back 40k offer after 2/11…

You left out my two most important buts:

1. The planet is dying and I am going to do my best to limit my carbon footprint.

2. I am old and cantankerous and I HATE economy. Hell I even hate most domestic First Class so this offer reminds me of the bad buffet restaurant in Texas. The food is horrible but the bright side is you can eat all you want!

Now if you could figure out how to get a companion pass on Air France then I am all ears!

I think people with businesses sometimes don’t understand how many people DON’T have businesses.

So Nick for sure.

For those who do, and have the Chase slots, and and want to play this game, sure, go for the 2-year.

I think Chase is going to change the 2-card 2-year CP availability anyway. Or restrict the CP substantially in some way. Like no Hawaii maybe.

Lot of ways u can get a Bus. Card HAD many and 3 left. . Some are wanting a Tax ID number now which I don’t have or want Options for ever one here.

CHEERS