Note: As of October 13, 2015, the Target REDcard (REDbird) can only be loaded with cash in-store at Target. Gift cards and/or debit cards no longer work to load REDcard. For more info, see: Here is the REDbird memo, “Cash is the only tender guests can use”

Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

Bluebird, REDbird (the Target Prepaid REDcard), Serve, and Serve with Softcard… These are prepaid reloadable American Express cards intended to be viable fee-free checking account alternatives. Even better, they are all good choices for those who primarily want to earn miles and points. The problem is… each person can have only one. And, each has its own strengths. For details see:

- Bluebird, Redbird, SoftServe… Which is best?

- The complete guide to Bluebird, REDcard, Serve, and SoftServe

So, what if you decide you want to switch from one type of card to another? The key is to close the old account and then open a new one. You can’t simply call Amex and ask them to switch you over.

Here are a few pointers:

1. Optional: Max out your old card early in the month

Each card has a $5,000 in-store + reload card load limit per calendar month. If you want to maximize reloads within one month, you can load up the full $5,000 to your old card before switching to the new card. If you initiate the switch early enough in the calendar month you should have time to take advantage of the new card’s $5,000 limit as well.

I do not recommend switching back and forth every month in order to load $10,000 every month. I believe that would be a sure way to get flagged by Amex. They would most likely stop approving any new cards for you.

2. Empty your old account of all funds

Before you switch cards, you have to empty all funds from your old account. The quickest way to unload up to $2500 is to send the money to a friend or family member who also has one of these cards. Keep in mind that all of these cards can send money to each other: you can send money from Bluebird to REDbird; from REDbird to Serve; from Serve to Bluebird; etc. Each card also has a calendar month $2,500 limit for these “Send Money Transactions”.

You can also unload funds through ATM withdrawals up to $750 per day and up to $2,000 per month. With Bluebird and Serve, MoneyPass ATM withdrawals are fee free. With REDbird, Allpoint ATM withdrawals are fee free. With all three, the ATM machine may say that it is going to charge you a fee, but you’ll see on your receipt that it did not.

If you use Bill Pay or withdraw to your bank account to empty your account, it’s a good idea to wait for those transactions to completely clear before cancelling your old card just in case something goes wrong.

3. Cancel your old account online

For some strange reason, when people call to cancel accounts, those accounts often seem to get stuck in a state of limbo somewhere between open and closed. This can make it difficult to open a new card. As a result, I highly recommend cancelling online.

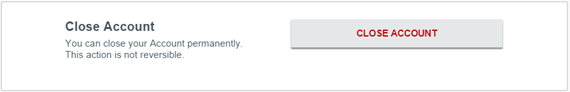

To cancel REDbird or Serve online, log into your account, click on the menu button and then click “Profile”. Scroll to the bottom of the screen until you find something like this:

Click the “Close Account” button and follow the instructions on screen.

With Bluebird, it’s just a little bit more complicated. Bluebird doesn’t show the Close Account option online, but there’s a simple work-around. Please see: How to cancel Bluebird online.

4. Consider using a new email address for your new card

Many people have successfully switched from one type of card to another without changing their email addresses, but others have had trouble until they tried using a different email address. If you use Google’s GMail, you can change your email address without changing where the email goes by adding a period somewhere in your email name. For example, if your email address is someonecool@gmail.com, you can use someone.cool@gmail.com instead. Emails sent to either address will go to the same inbox.

UPDATE 9/7/2015: Several readers have told me that the process actually works more smoothly if you use the same email address as you used before.

5. Sign up for your new card

Each type of card has a different process for signing up:

Bluebird:

-

Browse here: www.bluebird.com.

-

Press “Register”

-

Click “No” to the question “Did you purchase a Temporary Card at Walmart?” (unless you did buy a temporary card at Walmart)

-

Answer all of the remaining questions. It’s OK to use the same information as you used with your old card (but see step 4, above, regarding email addresses).

-

If all goes well, it should take somewhere between a week and 10 days for your new card to arrive

Serve:

-

Browse here: serve.com.

-

Press “Get a Card”

-

Click “No” to the question “Did you purchase a Temporary Card?” (unless you did buy a temporary card)

-

Answer all of the remaining questions. It’s OK to use the same information as you used with your old card (but see step 4, above, regarding email addresses).

-

If all goes well, it should take somewhere between a week and 10 days for your new card to arrive

Serve with SoftCard:

Serve with SoftCard is just like Serve, but with higher online load limits. To sign up for Serve with Softcard, you must have the SoftCard app and you must sign up for Serve within the app.

REDbird:

REDbird (more precisely known as the Target Prepaid REDcard) requires buying and activating a temporary card in-store before you can register online for your permanent card. Unfortunately, the temporary card is currently available only in certain test markets. In about half of the test markets the card is fee free. In the rest, they charge a $5 fee to purchase the card. It is fine to get the temporary card before cancelling your old Bluebird or Serve card, but you must cancel the old card before registering the new card online.

See also:

No need to wait

After canceling your old card you can order (or register for) your new card immediately.

![[EXPIRED] Serve One VIP to be discontinued Switch REDbird to Serve](https://frequentmiler.com/wp-content/uploads/2015/09/SwithRedbirdToServe.png)

[…] who primarily want to earn miles and points. The problem is… each person can have only one. Read More for some great […]

The date in the second note below the title needs to be updated to 2016…

Seeing 2015.. made me wonder whether they were having a yearly crackdown process running towards end of every year…

LOL, thanks. I can’t believe we didn’t notice that before! Fixed.

Hello,

I just came out an idea. Can I open a new serve account and load 5k and close it and buy another temp one at walmart and load another 5k? therefore I may load more than 5K/month with one SSN? Thanks.

Yes that would work but I expect that they would shut you down if you do it often

No need to wait? I just spent an hour on the phone only to have them repeatedly tell me I cant open for 30 days after I close.

They’re wrong. Just make sure to use the same email address that you used with Redbird.

[…] Switching between Bluebird, REDbird, and Serve […]

Closed my Bluebird using the /Profile/CloseAccount url

Attempted to register REDbird using different e-mail address and same / different phone number – both failed because of open Bluebird account.

Called 855-306-7395 and was told to wait a couple of hours for Bluebird closure to complete.

Tried registering again, with same results as above.

Called again, gave Bluebird account number, and verified that all payments had completed successfully. Was told to register REDbird using same e-mail address as Bluebird; phone number is not important.

As soon as I (successfully) completed the registration the CSR said “Now your Bluebird account is completely closed” – so there must be some linkage using the e-mail address which is used for final closure.

Thanks! Very helpful info!

Same here – cancelled Redbird and tried to open a Bluebird with different email and phone #.

Not possible – the message states I still have a Redbird account.

Any solutions to this hiccup, except calling ?

One person reported that they were successful only after using the exact same info (phone number, email) as they had used with Redbird. I have no idea if that would work, but its worth a try

I cancelled Redbird via the method above and then applied for BB again. It says that I still have a RB account. I guess I will need to wait or call.

Same here. Closed my Redbird online four days ago, but I’m unable to create a serve account due to the same reason.

I have a bluebird account with my wife having sub account. Can she get a red card and keep sub account? Or do I have to cancel her sub account with bluebird first? I assume I can still keep my bluebird account? Thanks

Yes, your wife can get a Red card without canceling her sub-account. Yes, you can keep Bluebird

Can I get the temporary red card in the store on a state where they have it available (nee mexico) but then register and have the new permanent card delivered on a state where there is no red card available yet (houston, texas, to be more precise)?

Yes

When you load your redbird at Target using a credit card, does it always show up as a purchase or do they code it as a cash advance? Are there any strategies there for which card to use (I want to use my citi 2% card and then pay it back). Does this still work?

Does the loading strategy (3 transactions at the cashier (1K,1K, 500), 1 cc swipe) still work for their daily allowances, and will redbird only charge you 1 $3 fee for this?

Thanks!

Citi card has worked for me, no cash advance for REDbird.

1. It always shows up as a purchase.

2. That will work (use Citi 2% and pay it back)

3. No, Target registers now only allow one load per transaction, so you’ll have to pay separately $1K, $1K, $500. There is no $3 fee with Redbird (that’s a fee for reloading Amex for Target, which is a different animal)

[…] Switching between Bluebird, REDbird, and Serve by Frequent Miler. I think I must be the only blogger still using Serve and patiently waiting for Softcard to start offering some promotions again. […]

[…] who primarily want to earn miles and points. The problem is… each person can have only one. Read More for some great […]

Do you have a working link to close BB? The one you have on the previous blog about closing BB online has stopped working, thx!

Were you logged into your BB account when you tried the link? You would have to use the link in the same browser that you logged into BB with.

Yes, I was logged in. Does anyone have a new, working link to cancel BB online? This one apparently died as of today, as yesterday someone on the other related thread cancelled theirs through it as recently as yesterday.

I’m running into same problem trying to close a BB account today. The link from FM October post doesn’t seem to work any more. Looking for a new link to do it online and coming up empty. Anyone have a link to do this???

I, for one, appreciate all the work Greg puts into his posts. There is much to learn and he has done the advance legwork. In response to Matt’s comment about the “Bigger Bloggers” not writing about the REDbird……..Perhaps they are loathe to write about something that pays no referral fee?

I second this. I started with a “bigger secret spreading blogger” and it took me a week or so to understand the whole game till I bumped into Greg’s blog and boom, the whole picture is crystal clear. The big bloggers talk extensively about credit card sign up bonuses (which gives a referral bonus) without clearly explaining how can we meet the spending requirements. Greg is awesome for someone who started to learn and also he is quick to find deals.