Update 12/21/23: After re-launching, Amex cards had once again stopped working on Plastiq. It appears that it was just a brief technical issue and...

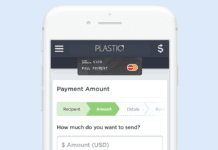

Plastiq is an online bill payment service that lets you pay almost all of your bills by credit card. This can be a good...

How to buy Disney tickets with Capital One miles, a Jamaican resort offering a psychedelic wellness plan, a new St Regis tries to bilk...

Several readers reached out this week after receiving emails from Plastiq regarding their auto loan payments. Visa business cards can no longer be used...

Separately, I posted How to Earn Rewards by Paying Rent. There aren't as many ways to earn rewards from paying your mortgage, but it...

Bad news for anyone who's been using Plastiq to make payments using debit cards - they've increased the fee that you'll pay.

We started seeing...

Plastiq reached out today to let us know that there is now a newly-reduced rate on Plastiq payments made with a Brex card. While...

Miles Talk reports on an interesting statement from Eliot Buchanan, the co-founder of Plastiq. There had been some concern over the last few months...

There is good news today for Plastiq and Amex fans: Plastiq sent an email last night indicating that Amex cards can now be used...

Update 4/7/21: This is just a quick reminder that Chase's changes regarding what's classified as cash-like transactions comes into effect in a few days...

Update 6/23/21: This offer was due to have expired back on March 31, 2021. The landing page on Plastiq's website still shows that as...

Plastiq is an online bill payment service that lets you pay almost all of your bills by credit card. The usual fee is 2.85%, but they sometimes...

The hits keep coming. There was bad news for manufactured spending a couple of days ago when GiftCardMall announced that they'd be limiting the...

This news came out about 10 days ago and we changed our Plastiq Credit Card Payments Complete Guide accordingly, but I just realized that...