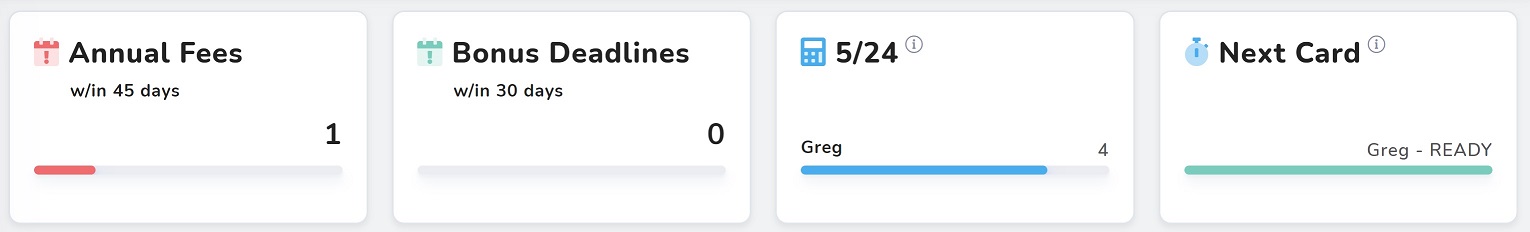

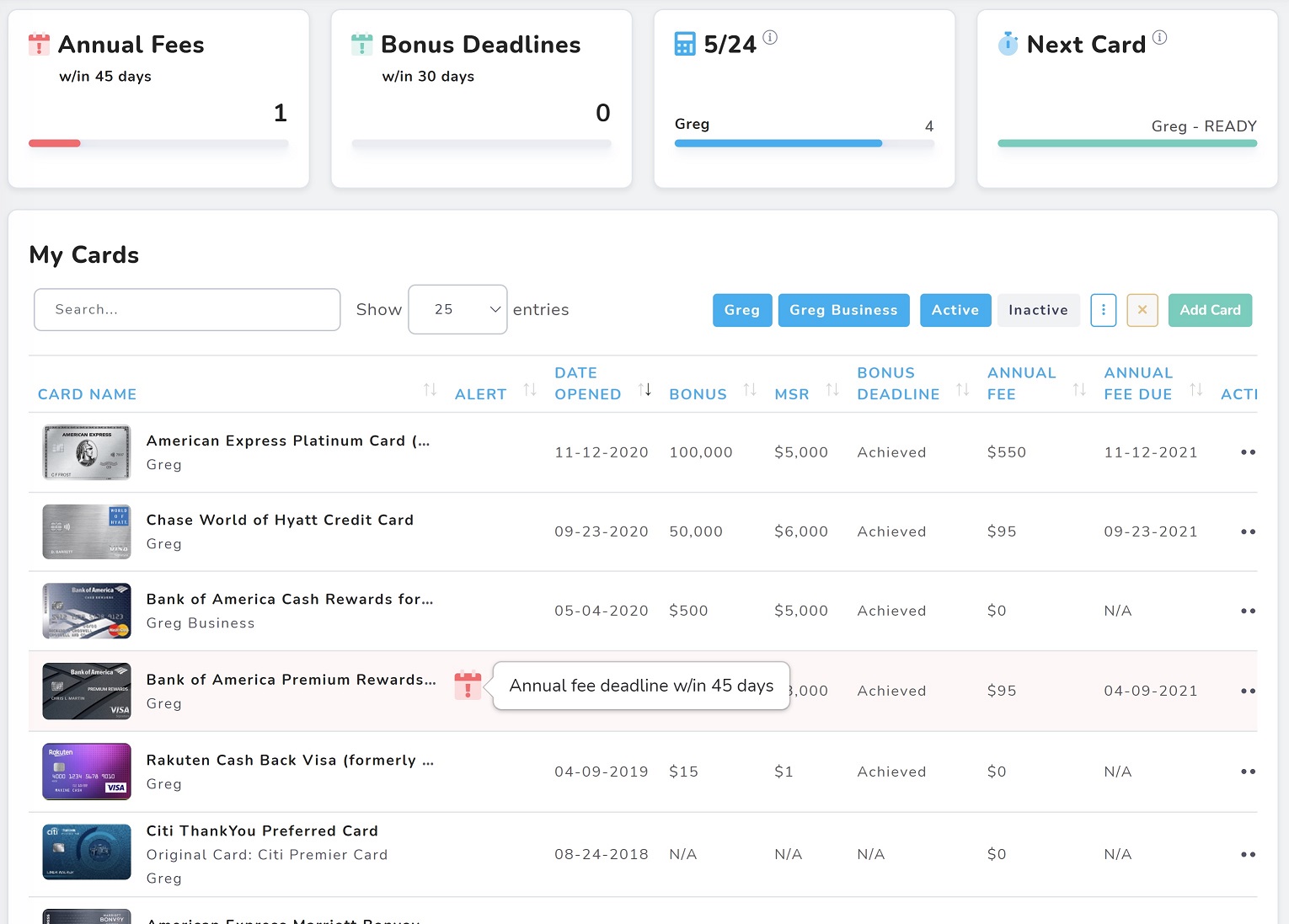

This post was originally published in 2018. Since then, I’ve come to rely more and more on Travel Freely for managing my family’s credit cards and card bonuses. Mostly, this free tool is set and forget: when anyone in my family signs up for a new card, I enter basic info (card name, date opened, signup bonus) into Travel Freely and then forget about it. Travel Freely then sends email reminders as needed: don’t forget to complete minimum spend requirements; a card’s annual fee is coming due and so you may want to product change or cancel; now is a good time to sign up for a new card; etc. It’s simple stuff, but I find it incredibly helpful. I especially love being able to see my Chase 5/24 status at a glance, including information about when I’ll drop below 5/24.

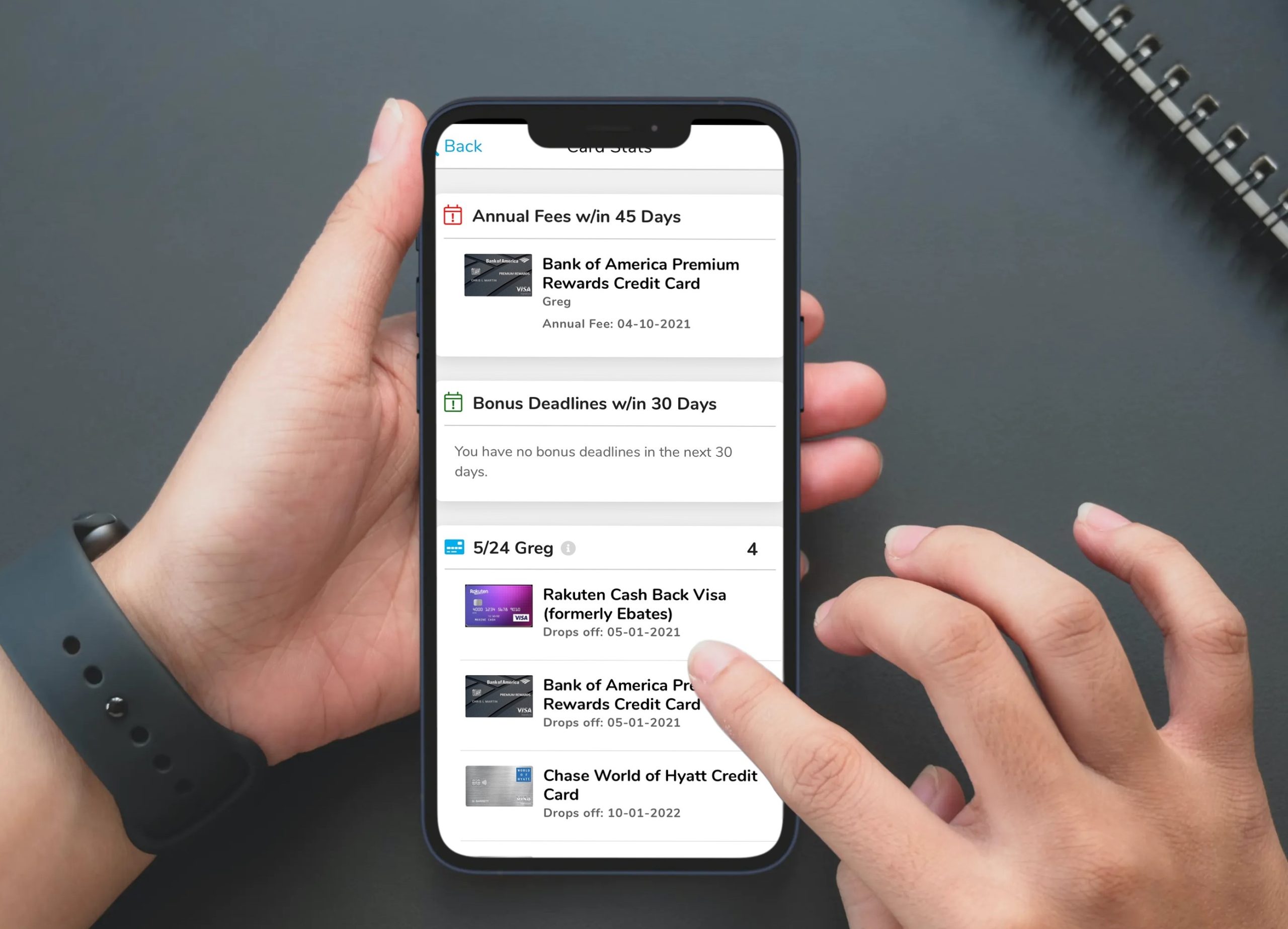

Until recently, Travel Freely was available only on the web, but it’s now available as an app too. Personally, I still use Travel Freely on my laptop (I’m old-school when it comes to managing credit cards), but I’m sure that many will find it convenient to use the tool on their phone. Of course, you can use both: all of your info shows up either way. Down the road, Travel Freely may add additional features that will make it essential to have on your phone (such as helping you decide which card to use for a purchase).

Original post follows…

Travel Freely does one simple thing: it guides you through the steps involved in earning points and miles through credit card bonuses. Travel Freely recommends cards for you based not just on the current best offers, but also based on what cards you’ve signed up for previously. And it’s aware of most of the known multi-card rules. For example, it won’t recommend the Chase Sapphire Preferred or Sapphire Reserve if it has been less than 48 months since you obtained a signup bonus for either one. Once you sign up for a card (and enter it into the website), you’ll get periodic emails reminding you of the due date for meeting minimum spend. Later, Travel Freely will notify you when it’s a good time to sign up for another card. Travel Freely will also notify you when an annual fee is coming up so that you can plan to downgrade, cancel, or seek a retention offer if the card’s benefits don’t outweigh the fee.

You might wonder why I would want to use a tool like this. Isn’t this way too basic for me? The truth is, if it was just me, I wouldn’t. I’ve long kept all of my credit card info in a Google Doc spreadsheet and I’ve been fine using that to track my card applications.

For a novice or intermediate user, though, or for someone who doesn’t have the time to track their cards and to keep up with the latest application rules, I think it’s great. In my case, I like it because I manage card applications for multiple family members. Remembering to meet minimum spend and monitor annual fees for my own cards is easy. Remembering this for each family member is tough. I like that Travel Freely can do that for me.

Readers often ask whether they are eligible for various cards based on what cards they already have. We’ve done our best to answer that question with application tips on each of our individual credit card pages and in our Best Credit Card Offers page, but that’s not enough. It can be challenging for the average person whose life isn’t dedicated to miles & points to keep track of these rules: To get a similar card again, do they need to wait 24 months from sign up, cancellation, or the day they got the sign up bonus….or does this count against 5/24 or is it subject to 5/24, etc. Travel Freely is a tool that knows. And when something changes unexpectedly (such as when Chase suddenly changed the rule for getting a second Sapphire bonus from 24 months to 48 months after the previous bonus), this tool knows and won’t recommend a Sapphire card if you’ve received a bonus within the past 48 months.

Travel Freely lets you manage two people’s cards within one log-in. In my case, I decided to create a separate log-in for each family member. I already use the Google Chrome Switch Person capability (see my post about that here), so it’s natural for me to sign up for Travel Freely separately within each log-in.

Travel Freely makes money primarily through credit card affiliate links. That’s true for most points & miles blogs too (including Frequent Miler). But, unlike most blogs, Travel Freely has agreed to do things the Frequent Miler way: If a better public offer exists, they have promised to show that better offer even if it means getting no affiliate commission for that card.

Here’s the link to sign up: Travel Freely. It’s free.

After you try it out, please post your reactions in the comments here. Zac, the owner and founder of Travel Freely, is determined to make the site as useful as possible and is eager for feedback.

How does this compare to WalletFlo ?

I had never heard of WalletFlo until your question and I still haven’t tried it. But based on their website, it looks to me like WalletFlo is mostly centered around how to get the most value from cards you have whereas Travel Freely is centered helping you get the most rewards from signing up for new cards.

Thank you

Sounds like something worth definitely giving a try. Thanks for all the info. Just signed up 🙂

Awesome site. What about adding the capability for people with more than one business to distinguish business 1, business 2, or business 3, etc. when they add their business card. Much like user 1, 2, etc.

Great site! I like it a lot! However, I did not see an import capability, I saw this mentioned in the comments 2 years ago. I have over 50+ cards to manually type in 😐

Just signed up to test this out. One issue I’ve come across is that there doesn’t seem to be a way to update the terms of a bonus offer, particularly if there are tiered spending bonuses. I signed up for the Barclays JetBlue Plus card when there was a 100k bonus – while I can change the bonus to 100k, it’s showing that my bonus deadline is up within 30 days. That’s correct for the first tier ($1k within 3 mos), but then how does the second tier ($6k within 12 mos) get reflected?

Hey Darin, Zac here. Thanks for commenting. We are currently working on multi-tier bonuses so you can track both of them. This should be coming very soon as it’s in the top 3 of current improvements I’m working on.

For now, it will only track one signup bonus that I put in the system. Most of the time, I choose to put the first bonus in the system if the second one is much longer. Definitely not ideal, so that’s why I’m working to get this added asap.

As more multi-tier bonuses came out this fall, I started working on this improvement because it’s obviously a trend with more cards. So it’s been a long time in the works and should be coming very soon.

Zac

p.s. In the future, I’m hoping users can also add their own custom tasks and reminders so you can include special upgrade offers, targeted retention offers, etc.

Maybe I will give it another try. I had issues with it the first time around but I don’t remember them exactly. I think they related to the annual fee tracking dates, how it handled cards cancelled in the past, and calculation of new bonus eligibility for situations where the new bonus date is calculated from bonus received date or card closed date. I also recall it was not sophisticated enough to pick up tracking for citi eligibility when doing a product change with or without a new card number. Like I said I will try again.

Thanks, Larry. I think we have the functionality you are talking about now. Please email me anytime you have a suggestion or to give feedback (support at travelfreely.net).

[…] cards, and to intelligently recommend new cards. You can read my take on this tool here: Take the stress out of credit card bonus hunting: Travel Freely.Frequent Miler’s Best Credit Card Offers page: Lists all of the best public offers […]

[…] Credit card signup bonuses are the quickest and easiest way to earn crazy amounts of points & miles quickly. It used to be possible to sign up for the same exact card over and over again in order to earn the same bonus every few months. Most card issuers have stopped allowing that, but for most of us that’s OK. At any given time, our Best Credit Card Offers page shows over 5 million points & miles up for grabs across dozens of credit cards. And, if you play your cards right (see what I did there?) you can often get the same card again. For details on this, see: Can you get the same credit card again? See also: Take the stress out of credit card bonus hunting: Travel Freely. […]

[…] Travel Freely does one simple thing: it guides you through the steps involved in earning points and miles through credit card bonuses. Travel Freely recommends cards for you based not just on the current best offers, but also based on what cards you’ve signed up for previously. And it’s aware of most of the known multi-card rules. For example, it won’t recommend the Chase Sapphire Preferred or Sapphire Reserve if it has been less than 48 months since you obtained a signup bonus for either one. Once you sign up for a card (and enter it into the website), you’ll get periodic emails reminding you of the due date for meeting minimum spend. Later, Travel Freely will notify you when it’s a good time to sign up for another card. Travel Freely will also notify you when an annual fee is coming up so that you can plan to downgrade, cancel, or seek a retention offer if the card’s benefits don’t outweigh the fee. You can read more about Travel Freely here. […]

[…] Here’s the link to sign up (for free) with Travel Freely. Full disclosure: Frequent Miler and Travel Freely have a business relationship, but only because I believe that this tool is truly useful for anyone into signing up for cards for their bonuses. I use it to manage my signups and those of several family members as well. You can read more of my thoughts about Travel Freely here: Take the stress out of credit card bonus hunting: Travel Freely. […]

[…] Here’s the link to sign up (for free) with Travel Freely. Full disclosure: Frequent Miler and Travel Freely have a business relationship, but only because I believe that this tool is truly useful for anyone into signing up for cards for their bonuses. I use it to manage my signups and those of several family members as well. You can read more of my thoughts about Travel Freely here: Take the stress out of credit card bonus hunting: Travel Freely. […]

[…] Travel Freely: Use this free website to track your credit card signups, to remind you when to cancel cards, and to intelligently recommend new cards. You can read my take on this tool here: Take the stress out of credit card bonus hunting: Travel Freely. […]

I may have missed this being mentioned, but it would be nice to include anniversary points and annual spending bonuses.

I understand the focus on points/miles but still curious as to why there are no similar trackers for credit card benefits. For example, which card that I have (or don’t have) would be best for primary coverage on a personal car rental, or which card would extend the warranty most on a laptop purchase. I don’t always remember which card to use and find that I have to spend time looking them up again, plus the rules could have changed, ugh.

That’s a great idea!

Tried it out. Says I’m at 5/24 after I added Chase IHG® Rewards Club Premier Credit Card. I thought that it wasn’t part of 5/24?

HI Kim, Zac here. I follow Doctor of Credit and Greg for the most accurate info on 5/24 and data points. To clarify, I track two things for each card regarding 5/24: a) Will you be approved at 5/24+?; and b) Does it count towards your 5/24 number? For the IHG cards, data points are showing you can get approved over 5/24, but it will still count towards your overall 5/24 count. Recent reports are saying you may no longer be able to get approved for IHG (and Hyatt apparently) over 5/24. p.s. The CardGenie has these rules built into them as well. Feel free to reach out with any other questions or feedback. Trying to make this as useful as possible for beginners or advanced users. Data points certainly help me with the accuracy, too. – Zac

.