What is this points & miles stuff all about? There’s no good name for our miles/points/deals hobby. Some call it “the game.” Others call it “the hobby.” Regardless of what you call it, there are patterns that define it. In this post I’ll outline those patterns. These are the things we do to earn more points & miles, to get more from our points & miles, to save money, and to get elite perks for less.

Earn more points & miles

The heart of this game lies in earning points & miles, usually without traveling…

Credit card bonuses

Credit card welcome bonuses are the quickest and easiest way to earn crazy amounts of points & miles quickly. It used to be possible to apply for the same exact card over and over again in order to earn the same bonus every few months. Most card issuers have stopped allowing that, but for most of us that’s OK. At any given time, our Best Credit Card Offers page shows over 8 million points & miles up for grabs across dozens of credit cards. And, if you play your cards right (see what I did there?) you may be able to get some of the same cards again. For details on this, see our guide to credit card application rules. See also: Take the stress out of credit card bonus hunting: Travel Freely.

A related technique for earning points is through credit card refer-a-friend offers. Often it’s possible to get large point bonuses when a friend uses your referral to apply for a card. Amex even lets you refer friends to cards you don’t have!

Shopping portals

If you’re planning to buy something online anyway, you might as well earn extra miles, points or cash back by starting your shopping with an online shopping portal. Most airline loyalty programs, and some hotel chains, have their own branded portals. Similarly, some banks have them too. And many cash back portals are out there too. Every portal offers different numbers of points per dollar, and those rates change daily. And they each link to different online merchants. The best way to find the best portal for your needs is to first determine where you want to shop (e.g. Macys, Home Depot, etc.) and then use CashBackMonitor to find the portal that currently offers the best rewards for that merchant.

Credit card bonus categories

Many credit cards offer extra points for spend within certain categories. Examples include the Chase Sapphire Reserve which offers 3X for travel & dining; Amex Gold which offers 4X for restaurants and 4X for US supermarkets (up to $25K per year spend, then 1X); the Citi Premier which offers 3X at supermarkets, dining, gas stations, flights, hotels, and travel agencies; and US Bank Altitude Reserve which offers 3X for travel and mobile wallet purchases (e.g. Apple Pay, Samsung Pay, etc.).

Increase spending without depleting your bank account

It’s possible to increase credit card spend in ways that won’t deplete your bank account. Techniques vary from paying bills that can’t normally be paid by credit card to buying and selling. For details, see our Guide to increasing credit card spend.

Award bookings

Once you’ve earned points and miles, the next step of the game is to use those points towards maximum value.

Transferable points

If you’re interested in booking flights with miles, the best option is to collection transferable points. These are points that can be transferred to any of a number of different airline and hotel programs. And that’s important because award prices vary tremendously from one program to another. In fact, when booking an award flight, it can sometimes be dramatically cheaper to book that flight with partner miles rather than with the airline’s own miles. Here are the top transferable points programs:

- Amex Membership Rewards

- Capital One “Miles”

- Chase Ultimate Rewards

- Citi ThankYou Rewards

- Bilt Rewards

- Wells Fargo Rewards

For help with finding great award prices, see these posts:

- Flights: Which award search tool is best?

- Hotels: Which hotel award search tool is best?

Sweet spot awards

Many loyalty programs have hidden “sweet spots” that make it possible to get far more value from your points. One example is the ability to use ANA miles (which you can get by transferring from Amex Membership Rewards) to fly around the world in business class for 115,000 miles.

You can find our series of sweet spot posts here.

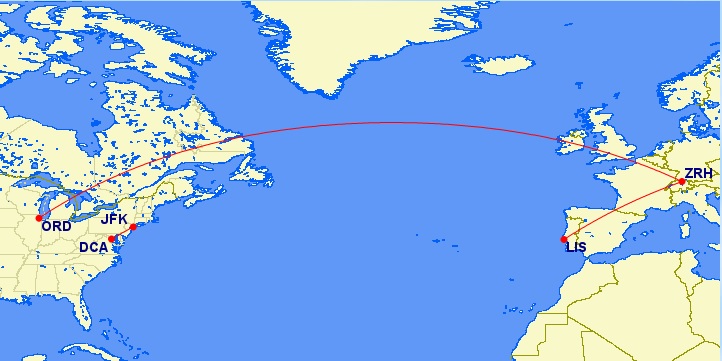

Creative routing

Airline programs often have award routing rules that make it possible to get more value through creative award bookings. For example, when an airline allows both a free stopover and free open-jaw (fly into one airport and then out of another) on the same award, it may be possible to tack on a completely free one-way flight to the end of a regular round-trip award. Another example is with United’s Excursionist Perk which can be used to add a free one-way flight to an award or, in some cases, to make your overall award cheaper. Full details can be found here: Leveraging the United Excursionist Perk to save miles.

Airline programs often have award routing rules that make it possible to get more value through creative award bookings. For example, when an airline allows both a free stopover and free open-jaw (fly into one airport and then out of another) on the same award, it may be possible to tack on a completely free one-way flight to the end of a regular round-trip award. Another example is with United’s Excursionist Perk which can be used to add a free one-way flight to an award or, in some cases, to make your overall award cheaper. Full details can be found here: Leveraging the United Excursionist Perk to save miles.

Another approach to creative routing is to book a one-way award with a layover in your desired destination. Fly just the first leg and then abandon the rest. The reason to consider this is that sometimes it is possible to find much cheaper awards by going past your intended destination. See the section on skiplagging, below, for more information (including warnings about this approach).

Deal seeking

Often, this hobby is purely about seeking the best deal. Usually these deals are travel deals, but not always.

Travel deals (and mistake fares)

Travel providers often run big loss-leader deals to gain attention, increase market share, fill planes, etc. Sometimes they do this unintentionally (with flights these deals are referred to as “mistake fares”). We regularly publish the best of these deals here at Frequent Miler. Additionally, many websites are designed specifically to publish the best travel deals.

Skiplagging

Historically this trick was referred to as “hidden city ticketing,” but with the Skiplagged web site making this trick easier for everyone, some of us have started calling this “skiplagging”. The idea is this: sometimes when the price to fly from point A to B is very expensive, it is much cheaper to fly from A to C with a layover at point B. So, people buy the cheaper A to C flight and get off the plane at point B. They skip the last leg of their journey.

This approach can save a lot of money, but there are risks. Airlines don’t want you to do this. You have to be careful about checking bags to make sure that your bag doesn’t end up flying further than you do (usually it’s best not to check bags at all). And you can only skip the last leg of the journey. Otherwise, the airline will cancel the rest of your ticket. For full coverage of this technique, please see my post: Skiplagging for the best flights at the best price.

Note that skiplagging works with both paid and award flights. Unfortunately, it’s much harder to find award flights where this works since tools like Skiplagged only work with paid flights.

Non-travel deals

If you like travel deals there’s a good chance that you’ll like everyday money saving deals too. Luckily, the two pursuits complement each other. For example, in your pursuit of airline miles or hotel points, you’re likely to have picked up an Amex card or two (or three, or four…). And Amex is often the key to unlocking great deals. When you log into your Amex account, you’ll find “Offers for you” which include many, many deals of the type “spend $X at store $Y and get $Z back”. Often you’ll find automatic rebates for merchants that you would have spent money at anyway. So, simply by loading the offer to your card, you’ll save real money. See also: Current Amex Offers. Other card issuers like Chase, Bank of America, Citi, etc. offer similar deals tied to their credit cards.

Elite perks

Airlines offer their top elite members free upgrades to first class, priority boarding, waived fees, lounge access, and other perks. Hotels similarly offer their top elites room upgrades, waived fees, late checkout, free breakfast, and more. These perks are supposed to be reserved for their best customers (those who spend the most), but there are many ways to get the same or better perks with far less financial commitment…

Credit card status

Some credit cards offer elite status just for having the card. Here are some examples:

- The Platinum Card® from American Express: Hilton Gold status, Marriott Gold status, and multiple rental car agency elite statuses.

- Wyndham Rewards Earner Business Card: Wyndham Diamond status (matches to Caesar’s Diamond Status)

- Hilton Honors American Express Aspire Card: Hilton Diamond status

- Marriott Bonvoy Brilliant® American Express® Card: Marriott Platinum Elite status

- IHG One Rewards Premier Credit Card: IHG Platinum status

Credit card perks

In some cases credit cards offer elite-like perks instead of status. Here are some examples:

- The Platinum Card from American Express: The Platinum card gives the cardholder access to Delta SkyClubs when flying Delta (starting 2/1/25, 10 visits per year), Centurion Lounges, Escape Lounges, Plaza Premium Lounges, and Airspace Lounges. Additionally, you can enroll in Priority Pass Select for access to even more lounges.

- Delta Reserve: Complimentary upgrades; Delta SkyClub access when flying Delta same-day (starting 2/1/25, 15 visits per year); priority boarding; and free checked bags.

- AAdvantage Executive World Elite MasterCard: Admirals Club membership for cardholder and access for guests traveling with cardholder. Free 1st checked bag for cardholder and up to 8 travel companions.

- United Club Infinite Card: United club membership. Priority check-in, security screening, baggage handling, and boarding. Free 1st and 2nd checked bags. Hertz President’s Circle Elite Status,

Status through credit card spend

Often, it’s possible to earn hotel or airline elite status with credit card spend. Most major airlines and hotel programs offer ways to earn elite status through big spend with their branded credit cards.

Status matching / status challenges

If you have elite status with one loyalty program (even if it’s from having a credit card), you can sometimes get equivalent status with another simply by requesting a status match. Usually your new status will last at least for the rest of the current year. Often, if you request the match in July or later, your new status will last the rest of that calendar year and all of the next.

Often you won’t be able to get a free status match, but will be offered a status challenge. With airlines this usually means that you can obtain a year of status by flying a certain amount within 90 days. Similarly, with hotels, it often means that you can obtain a year of status by staying with that hotel chain for a specified number of nights.

StatusMatcher.com is a useful site for finding out what status matches work and don’t work before trying yourself.

Mileage running & mattress running

Mileage running is the act of flying, not to get anywhere, but to earn elite status and redeemable miles. Mileage runners often do “same day turns” which means that they return from their ticketed destination on the same day that they arrived. The key to mileage running is in finding the cheapest fares that offer the most progress towards elite status. In recent years many airlines have tied elite credits directly to the fares with the probable intent of wiping out mileage running. Despite that, there are sometimes workarounds available such as flying a partner airline but crediting the flight to the airline where you’re seeking status.

Hotel mattress running tends to be more straightforward. Most hotel chains award status based on how many nights you’ve stayed with them within the calendar year. So if you can find crazy good deals or mistake rates you may be able to earn elite credits cheaply. Usually it is necessary to go to the hotel to check in to earn elite night credit, but it’s not necessary to actually stay overnight.

It rarely makes sense to seek elite status entirely through mileage running or mattress running. It simply takes too much time and costs too much to be worth it. However, if you’re close to the next level of status, it may pay to do a little mileage run or mattress run to get to the next level.

[…] in each place).We’ve obviously also used a large chunk of miles and points. We write about the games we play and the tools we use to earn those and I will include those costs also below, but what has stood […]

[…] avons évidemment aussi utilisé un grand nombre de miles et de points. Nous écrivons sur les jeux auxquels nous jouons et les outils que nous utilisons pour les gagner et j’inclurai ces coûts également […]

I managed to hit high hotel status with all the Big Four this year. I have a pile of points and will try to enjoy some luxury stays before the whole system devalues.

Excellent write up, well done and thanks due from the community.

The ‘Hobby’ moniker came from a label given by a journalist who wrote an article based on OMT’s work. Hated it at the time, but it’s softened with time.

In our house my wife calls it my ‘Points shenanigans’.

It is a hobby when you actively participate, and there is a game-like feel to outsmarting points and mileage programs.

[…] the hunt for bargains as much as the savings themselves. And given that we use these tools to win at the games we play, the thrill can be in knowing that you have increased opportunities to travel the world in comfort […]

[…] follow and like us: The Tools We Use (for playing the game). 2020 Edition. The post “The Games We Play,” outlines approaches we use to earn more points & miles, to get more from our points & […]

[…] value from those miles & points. Repeat… Travel… Enjoy… See “The Games We Play” for more […]

[…] value, and keep my eyes peeled for ways to increase rewards. In short, I’ll keep playing the games we play — I just might keep a closer eye on cash in the […]

[…] blog is usually all about points and miles. The game we play involves acquiring points & miles, usually without traveling, in order to travel nearly for […]

[…] cost and effort, and then we figure out how to get the most value with those points and miles (see: The games we play). While I usually write about points & miles techniques, it’s not lost on me that many […]

Hi Greg,

This is the best overall summary with links to the details of maximizing the benefits associated with travel.

A great “just the facts ma’am’ article that should be in every traveler or want to be traveler’s personal library.

Job well done!

Thanks!

[…] post “The Games We Play,” outlines approaches we use to earn more points & miles, to get more from our points […]

” The Game ” works for me .Travel Hacking No Thanks we are doing nothing wrong Just using their rules ..Remember we are getting the Points from the Banks not the Airlines . The airlines are making Billions of dollars per year by selling award points to banks.. By the way Banks pay like 1% to savers and charge like 5% for a mortgage + Fees and like 8% for a HELOC too…So 400% profit on the first and 700% on the other Poor Bankers lets help them..

CHEERs

[…] The games we play […]

Greg – I pulled the plug on applying to Amex Plat card today. Good timing or should have waited a little longer?

Great timing. You’ll still have time to get the $200 in airfare credits, $40 in Uber, and $50 Saks before the end of this year, and then get all the credits again next year.

I think for Uber it’s $15/m but Amex PLN is throwing an additional $20 for Dec. so $35 for Dec only.

My wife is the primary on the Amex, I’m just an add on on her Amex, I don’t get the $200 airline credit and some other benefits (my wife get them), but I already have the highest tiers with Hotels, Cars, and Airlines (travel every week).

Thanks for sharing your article. Good info.

Yep, $35 Uber in December. Thanks for the correction.