Last week we reported that Chase is offering a 60% bonus for transferring Ultimate Rewards points to IHG. This deal is valid through the end of August. Nick described this as a terrible deal. Was he right?

In this post, I take another look at the deal. There are ways to stack things to make it better than it first appears. I ultimately conclude that it’s still not worth doing in most cases, but it’s not as bad of a deal as it looks.

Nick’s post didn’t consider that it’s possible to stack a few things to make the deal better than it appears:

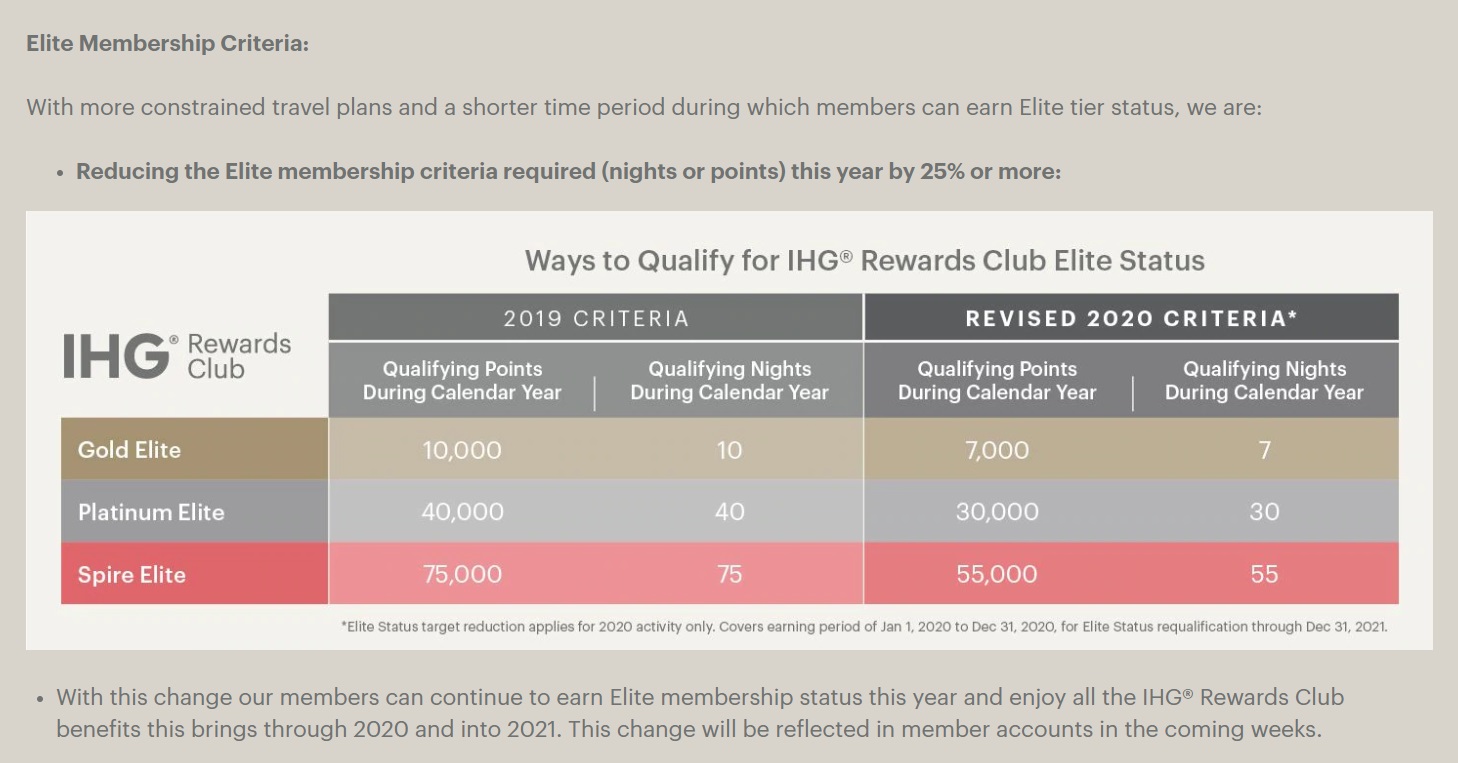

- Points transferred from Chase Ultimate Rewards are elite qualifying points (but the 60% bonus points are not).

- Thanks to COVID-19, IHG members only need to earn 55,000 qualifying points this year in order to earn top-tier Spire Elite status (Spire status normally requires earning 75,000 qualifying points).

- Spire Elite status offers a valuable Choice Benefit: 25,000 points.

Maximizing the deal

By transferring enough points from Chase Ultimate Rewards to IHG to earn Spire elite status, and by picking the 25K points Choice Benefit, the transfer ratio gets better. Let’s say that you’re starting with zero qualifying IHG points. In that case, you can transfer 55,000 points to IHG and you’ll end up with a total of 113,000 points. That’s a transfer ratio of slightly more than 1 to 2.

- Immediate transfer: 55,000 points

- 60% bonus: 33,000 points

- Spire elite status

- Choice Benefit: 25,000 points

- Total: 113,000 points + Spire Elite status

Is this worth doing? The answer depends upon how much you value Chase Ultimate Rewards points on the one hand, and how much you value IHG points and Spire Elite status on the other hand.

What are 55,000 Chase points worth?

Thanks to Chase’s Pay Yourself Back feature, Ultimate Rewards points can be cashed out for grocery, dining, or home improvement spend at 1.5 cents each for those with the Sapphire Reserve card or 1.25 cents with the Sapphire Preferred card. With that, we can easily determine the cash value of 55,000 points:

- Sapphire Reserve Cardholders: 55,000 Chase points X 1.5 cents each = $825

- Sapphire Preferred Cardholders: 55,000 Chase points x 1.25 cents each = $687.50

What are 113,000 IHG points worth?

I recently determined that IHG points are, on average, worth about 0.65 cents each towards free nights. On the other hand, you can often buy IHG points for only a half cent each. When that’s true (and it is true at the time of this writing), then I think it’s fair to say that points are worth half a cent each. So, we can calculate two potential values for 113,000 points:

- Based on the 0.65 redemption value: 113,000 points x 0.65 each = $734.50

- Based on the 0.5 cents sale price: 113,000 points x 0.5 = $565

Not counting the value of Spire elite status, the above numbers show that you would usually be better off keeping your Chase points. The value of the resulting 113K IHG points is lower than the cash value of the 55K Chase Ultimate Rewards. The only exception would be when the half cent point sale is not available and you do not have the Sapphire Reserve card. With that combination (Ultimate Rewards points cash value of only 1.25 cents each, and IHG points worth 0.65 cents each), you do come out slightly better with 113,000 IHG points ($734.5) rather than 55,000 Chase points ($687.50). Even then, most people value Ultimate Rewards higher than the cash value (since points can be transferred for other high value uses to Hyatt or United for example), so it’s still not a great deal.

What is Spire Elite status worth?

The math above shows that you shouldn’t transfer Chase points to IHG for the points alone, but what about elite benefits? If Spire elite status is worth a lot, that could make this deal worth pursuing.

To determine the value of Spire status, let’s look only at the added benefits of Spire status compared to Platinum status. Platinum status can be had simply by signing up for Chase’s IHG Rewards Club Premier Credit Card. Even though that card costs $89 per year, you get a 40K free night certificate on each card anniversary, so we can think of Platinum status as being essentially free.

Spire advantages over Platinum status:

- 100% bonus points on stays (vs. 50%)

- 10am early check-in, based on availability

- Hertz Gold Plus Rewards® Five Star® Upgrade

- Choice Benefit (e.g. 25K points)

- Ability to earn Kimpton Inner Circle status. Note that you don’t get Inner Circle status automatically (you need to stay often at Kimpton hotels for that), but Spire status is a prerequisite.

We’ve already accounted for the Choice Benefit value in the math above when we assumed that one would pick the 25,000 point option (the other option is to gift Platinum status to someone). Most of the other perks are nice-to-have, but I wouldn’t pay extra for them:

- 10am early check-in: Personally I’d value this a lot if it was a guaranteed benefit, but since it’s based on availability it doesn’t seem too valuable.

- Hertz Five Star status: This could be valuable if you rent from Hertz often. Personally, I more often rent from National.

- Kimpton Inner Circle: Inner Circle has some cool perks, but the exact criteria for reaching this status level are unknown. If I stayed in Kimpton hotels enough to have a chance of earning Inner Circle status, then I suppose I’d value Spire status more since it is a necessary prerequisite.

100% bonus points on stays:

The only benefit with concrete value is the 100% bonus points on stays. IHG members earn 10 base points per dollar at most IHG hotels. With Spire status, members earn 20 points per dollar. Compared to Platinum status (which gets a 50% point bonus), this means getting an extra 5 points per dollar during IHG stays. If we generously use the 0.65 value for IHG points (rather than the half cent sale value), then we can say that Spire status offers an extra rebate worth 3.25% of the cost of your stay (5 x 0.65). How good is that?

- If you spend $1,000 at IHG hotels, it’s like an extra $32.50 rebate

- If you spend $2,000 at IHG hotels, it’s like an extra $65 rebate

- If you spend $5,000 at IHG hotels, it’s like an extra $162.50 rebate

- If you spend $10,000 at IHG hotels, it’s like an extra $325 rebate

In short, you would have to spend thousands of dollars at IHG hotels to make Spire status worth pursuing.

Conclusion

By transferring enough Chase points to IHG to earn Spire status, the Chase transfer bonus is a much better deal than it appeared to be at first. That said, for most of us it’s still a bad deal. I don’t recommend transferring 55,000 Chase points to get to Spire status and 113,000 IHG points. Those with the Sapphire Reserve card could, instead, cash out 40,000 points for $600 and use that $600 to buy 120,000 IHG points while they are on sale for a half cent each. Converting 40,000 Chase points into 120,000 IHG points is obviously way better than converting 55,000 Chase points into 113,000 IHG points.

What if you have already earned IHG qualifying points this year? In that case, the closer you are to Spire status, the better this Chase deal becomes. For example, if you’re only 10,000 points away from Spire status, you could transfer 10,000 Chase points and get a total of 41,000 IHG points (10,000 base + 6,000 bonus + 25,000 Choice Benefit). That would be a great deal.

![[Reminder: Marriott GCs on 4/23] Daily Getaways 2024: Complete preview of all the deals Daily Getaways 2023](https://frequentmiler.com/wp-content/uploads/2023/06/Daily-Getaways-2023-218x150.jpg)

[…] Top tier status via Chase’s IHG transfer bonus […]

I’m unclear on a point. If I buy miles does that count toward Spire status? I thought it only counted on the transfer.

Points purchased from IHG are not elite qualifying.

I read a report finding that there will be (2) choice benefits given out next year for qualifying for spire this year. This would potentially translate to 50K IHG bonus points instead of 25K.

From IHG T&C “Upon qualification for Spire Elite, Members may choose to either receive a 25,000 annual point bonus or…” The word annual would indicate you get the 25K for each year that you have spire. Since the status would last until at least January 2022, you might get the choice benefit twice. But with the 60% transfer bonus not being elite qualifying, it takes 55K UR (assuming you are at 0). So even if you get the 25K twice, you get 138K IHG for 55K UR. Using values of 0.5 cent and 1.5 cent respectively, it ends up costing $135 for spire. Given the lack of spire benefits (other than the choice benefit included above), not worthwhile. Now if IHG would wake up and add breakfast…

No, I think IHG will be giving out 2 choice benefits next January for existing spire members who re-qualify. It makes sense to incentivize existing spire members who do not need to qualify again for next year.

I would just like to chime in and mention that Spire isn’t always worthless, especially abroad. For example, Crowne Plazas in Israel give Spire lounge and/or breakfast, and an upgrade – guaranteed. I think some countries in Europe also operate this way.

As a Spire, let me tell you that it does not work that way. A member gets the Spire bonus when they cross the threshold to Spire. You would not earn Spire once and get the bonus in two calendar years. They are not idiots.

Also, the benefit does not usually post automatically. Usually I have to contact IHG after making Spire and remind them to give me the 25,000 points.

Technically you have to choose the 25K points. You can do it online in your account without calling. I think the other choice you have is to gift someone Gold status or something useless like that, so the 25K points is the de facto choice, but that’s why you haven’t seen the points post automatically.

IHG does send out an e mail announcing that the member has earned an annual choice benefit, but unfortunately those e mails are hit and miss, more miss, and otherwise the choice is in a hard to find location in the online account. I had to get instructions from another blog to find it.

OK, thanks for clearing that up. I guess their T&Cs are just poorly written. I don’t see any other support for Philip’s comment about getting the 25K twice. It’s all academic anyway because its not worth doing either way.

I did not qualify for spire 2020 last year, but IHG extended my spire anyway as a courtesy for my loyalty. I was still given a choice benefit this year.

haha, if chase were to offer 100% bonus, i’ll do it.

You do not get inner circle status from spire elite.

True. That’s why I wrote: “Ability to earn Kimpton Inner Circle status. Note that you don’t get Inner Circle status automatically (you need to stay often at Kimpton hotels for that), but Spire status is a prerequisite.”

My only comment is that IHG properties don’t always honor the Spire and Platinum benefits so they are of questionable value IMHO. I’m Platinum (by having their Chase Mastercard) and thought about pushing for Spire. However, I also am lifetime Titanium on Marriott and Diamond on Hilton so I have other options for status typically at properties that offer more. Don’t get me wrong, I value IHG and use their points a lot – I especially like the 4th night free (as opposed to Hilton’s and Marriott’s 5th night free) when you use points as that works better for me on many domestic trips. However, I usually end up staying at Holiday Inn Express or a similar mid-tier property and really don’t get the potential benefit of Platinum, let alone Spire, membership. On the other hand there are plenty of Hilton and Marriott properties with lounges (when allowed again under COVID restrictions) and other amenities where I can better utilize my status.

Funny — I have virtually ZERO interest in IHG or their “top-tier” status, and yet I read this entire article with interest. Excellent analysis, as always.

Thanks!

Agreed. It’s the thoughtful analysis that makes it worth reading. I’m not an IHG guy either, but I find that following Greg’s thought process in the analysis provides an excellent understanding of how to think about these things.

Very helpful!

Thanks for giving me my 2 seconds of fame 🙂

How would the analysis change if someone has the old IHG card that also gives 10% back and/or the new card that gives 4th night free? Still not worth it?

Still not worth it because buying points is still a better deal.