Kenny Rogers once said that you’ve gotta know when to hold ’em, know when to close ’em. Hmm…maybe that wasn’t exactly right. It was something close. Yesterday, Greg and I talked to a reader named Jim. One thing I know about Jim is that he is not a Kenny Rogers fan: he came to Greg and I holding credit cards with cumulative annual fees of $4,523. He needed an intervention. It was time for Card Talk.

Jim’s situation is admittedly much different than the average reader because he travels so much — but Greg and I were able to help Jim cut out $2,897 in annual fees. Here’s what Jim had, what we recommended, and what you can learn from it.

Jim’s burgeoning wallet

I’m sure that Jim doesn’t actually carry a George Costanza-esque wallet (though if he did maybe necessity would have taken care of what we did yesterday without our help!). It’s also worth noting that Jim is playing in 2-player mode, so not all of these cards are in his name. Still, here’s the list of cards he and his wife were holding, written as a general outline (I’m adding up cumulative fees over various cards in each instance as the individual cards don’t much matter in some cases):

- 4x Southwest Airlines credit cards (3 business, 1 Priority) ($546)

- 2x Ink Plus ($190)

- 1x Ink Business Preferred ($95)

- 5x Marriott Bonvoy credit cards (including 2 biz, 3 personal) ($509)

- 2x Hyatt (old credit card) ($150)

- 2x IHG Select (old credit card) ($98)

- 1x IHG Premier ($89)

- 1x Mileage Plus Explorer ($95)

- 2x Chase Freedom ($0)

- 2x Chase Sapphire Reserve ($1100)

- 5x American Airlines credit cards (4 Citi, 1 biz, 1 Aviator) ($481)

- 1x Delta Gold credit card ($95)

- 1x Amex Platinum ($550)

- 1x Hilton Aspire ($450)

- 1x Choice Privileges ($0)

- 1x Radisson Rewards ($75)

Again, those are total cards between two people. For almost anyone looking at this, $4,523 is a lot in annual fees. It’s worth noting that Jim readily admitted that he opened most of these cards for welcome bonuses and then just didn’t cancel them. Most of us playing this game have been guilty of the same once or twice. Heck, I just wrote last week about how hard it was to break up with the Citi Prestige even though I knew its time had come. So I held no judgment for Jim. He knew it was time to ask for help in reducing these expenses and we were glad to do it.

What we recommend

Before we got started on Jim’s intervention, I had two initial questions to resolve at the very beginning:

- How often do Jim and his wife travel? (i.e. how many times per year / for how many nights)

- Where do they usually stay?

My curiosity on these two points was tied to why Jim had so many different hotel credit cards; I’d think that most people would have difficulty using the 11 free night certificates they received annually without dedicating travel almost entirely to free night certificates. If his travel was centered around free night certificates, that might make a difference in terms of which points he should collect and which cards to keep/cancel.

Ultimately, Jim’s answer made a lot of difference in how we handled everything: Jim told us that he and his wife are retired and travel about 6 months per year, usually cruising to and from Europe, flying almost exclusively Southwest domestically and rarely flying long-haul (since they usually cruise across the ocean). That made a huge difference. If you spend 180 nights per year away from home, it is suddenly much easier to imagine using 11 free night certificates well.

Jim was firm that they get far more than the annual fee in value from each of the cards with free night certificates (other than the Aspire card). Since they spend so much time traveling, we accepted that the hotel cards made sense for Jim.

But here’s where we trimmed the fat from his credit card collection:

Southwest

Jim currently has a Companion Pass valid until 12/31/21 and he and his wife have alternated getting a companion pass via credit cards every 2 years for some time (See our Southwest Airlines Companion Pass Complete Guide for more on this benefit).

Greg told Jim that he should get rid of all four Southwest credit cards at next annual fee. I argued that it may be worth keeping the Southwest Priority card because they fly Southwest several times each year. At an annual fee of $149, the card offers a $75 Southwest Airlines credit, 7,500 Rapid Rewards points, and four A1-A15 boardings per year. The points will buy about $110 in airfare (give or take) and the $75 Southwest credit is pretty easily usable if you ever pay for your ticket and/or you pay for drinks on board. To me, that makes the card a pretty easy keeper even without the four A1-A15 boarding credits — though I’d be happy to take that four times per year (or really twice per year assuming you’re using it for two passengers each time). Given that Jim has the Companion Pass now and won’t need to think about new Southwest credit cards for a couple of years (at which point it’ll be his wife’s turn to go after the cards), it might be worth keeping the Priority Card that’s in his name despite its $149 annual fee. The rest of the Southwest cards don’t serve him a long-term purpose. (Saved: $397)

Chase Ink cards

Jim and his wife had 2 Ink Plus cards and one Ink Business Preferred card between them. He noted cell phone protection from the Ink Business Preferred but agreed that he probably didn’t value that at $95 per year.

The Ink Plus is an older card that is no longer available. It offers 5x on cable/Internet/cell phone and 5x at office supply stores on up to $50,000 per year in combined purchases (and 2x on gas). If that sounds familiar, that’s because it has the same earning structure as the Chase Ink Business Cash card. The only two differences are:

- The Ink Business Cash has a limit of $25K in purchases per year that earn 5x

- The Ink Business Cash does not have the ability to transfer Ultimate Rewards to partners. You need to first move points from an Ink Cash to an Ink Business Preferred, Sapphire Preferred, or Sapphire Reserve and then you can move them to partners.

In Jim’s case, he was not utilizing the $50K cap on 5x purchases on one of his Ink Plus cards — let alone two. Furthermore, it doesn’t sound like he spends much in the 3x bonus categories of the Ink Business Preferred.

Therefore, if he’s going to keep a Chase Sapphire Reserve (and we thought he should), then there is no sense in paying nearly $300 in annual fees on these Ink cards. Instead, we recommended he take his two Ink Plus cards and one Ink Business Preferred and:

- Downgrade at least one to an Ink Business Cash (no annual fee)

- Downgrade at least one to an Ink Business Unlimited (no annual fee)

- Either close or downgrade the third Ink card to another Ink Cash

If he wants more than $25K in 5x bonus category spend, he could downgrade two cards to Ink Cashes to get two Ink Cash cards.

The Ink Business Unlimited would give him a 1.5x-everywhere card that could be used as a good “everywhere else” card given that he din’t have another card in his wallet to fit that need.

Again, moral of this story was to downgrade all three. (Saved: $285)

Marriott Bonvoy cards

Jim has 5 Marriott Bonvoy credit cards (a mix of Amex and Chase) and says that he uses all 5 free night certificates for better value than the cost of the annual fees each year. If they save him money over what he would have otherwise spent, it makes sense to keep all 5 cards.

Notably, Jim and his wife each have at least 1 business and 1 personal Bonvoy card.

While you can only get 15 nights of elite credit for having a personal Marriott card no matter how many personal cards you have and you can only get 15 nights of elite credit for having a business card no matter how many Bonvoy business credit cards you have, it is possible to have at least 1 personal card and 1 business card and get 30 nights of elite credit.

Since Jim has 1 business and 1 personal card in his name (and 3 total cards in his name), I recommended he may want to focus his hotel efforts on getting Marriott Platinum status. The credit card elite nights give him 30 nights toward status and the 3 free night certificates in his name can get him 3 nights closer. That leaves him needing just 17 nights to earn Platinum elite status (which ordinarily requires 50 nights). Platinum status will give him free breakfast / lounge access and 4pm checkout at Marriott properties (note that there are some properties, like Courtyard and AC Hotels, that only give a dining credit per person and others like Ritz-Carlton that don’t offer breakfast at all, but most Marriott properties give free breakfast to Platinum members). See our guide to Which Marriott elite benefits apply? to know what you get at each brand.

Jim is keeping all of the Bonvoy credit cards.

Hyatt

Jim and his wife have the older (no longer available) Hyatt credit cards with a $75 annual fee. He says he definitely gets good value out of the annual Cat 1-4 free night certificate, so he’s keeping these.

IHG

Jim and his wife each have the IHG Rewards Club Select card that is no longer available for new applicants ($49 annual fee) and as is the case with the other hotel cards, they use the free night certificates to good value (those certificates are each valid for 1 night at a property charging up to 40K points per night). I think the $49 card is a pretty easy keeper as even a relatively poor use of the free night certificate is likely to be pretty good.

Jim also has the $89 IHG Rewards Club Premier card. This one makes less sense to keep as it awards the same 40K free night certificate each year. At $89, that can still be a deal, but I’m less excited about it. Here’s why:

IHG frequently sells points for half a cent each. We’ve also seen many opportunities to buy points for less than half a cent each with the old points-and-cash trick. A 40K certificate is therefore worth, at best, $200 (the cost if you were buying points at half a cent each). Given that points don’t expire in a year (if you maintain activity) and they can also be used for multiple nights at cheaper properties, I would value the equivalent points more than a free night certificate that can only be used for 1 night and expires in a year. Therefore, the 40K certificate is worth less than $200. If you end up using it at a property that would have cost 30K points, you could have bought the (clearly more flexible) points for $150. That’s still not a bad value for $89, but if it’s going to also mean giving up elite benefits like the free breakfast you could have had at Hilton or Marriott so you can make use of your IHG free night before it expires, maybe the win dwindles a bit more. It’s not necessarily a bad deal, just not a definite home run.

Jim also mentioned the fact that the card comes with the IHG fourth night free benefit (on award bookings). That’s true — but the IHG Rewards Club Traveler card, which has no annual fee, also comes with the same fourth night free on award stays. If that benefit matters to Jim more than the additional free night certificate, he should consider the Traveler card and save a few bucks (Saved: $89).

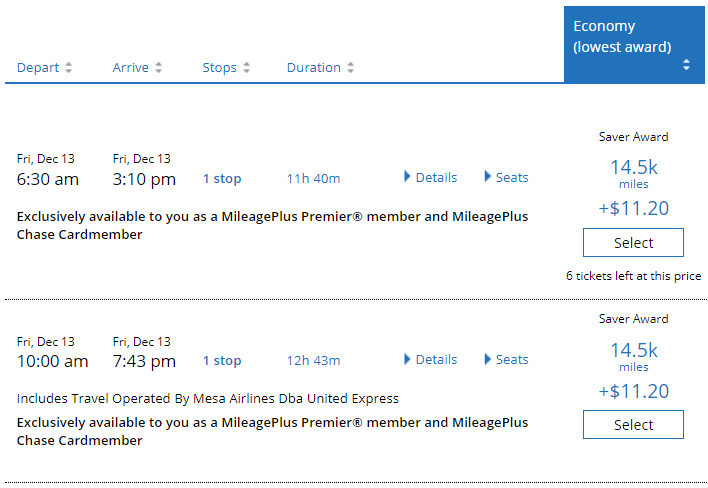

Mileage Plus Explorer

Jim and his wife rarely fly anything other than Southwest domestically and rarely fly long-haul internationally, so they don’t need the free checked bags that come with the United Explorer card.

Rather than cancel this card, Greg and I recommended he downgrade to the United credit card that has no annual fee. This older card that isn’t available for new applications is still available for product changes. The card only earns 1 mile per $2 spent, so you won’t want to spend on it, and it doesn’t come with any other useful benefits except for one: the cardholder gets access to the same expanded award availability as other Chase United credit card holders. It’s worth keeping that just in case the expanded availability comes in handy since you can get it with no annual fee. (Saved: $95)

Chase Sapphire Reserves

Jim and his wife both had Chase Sapphire Reserve cards. That’s overkill in most instances. Since they are retired and are usually together when spending money on travel and dining (the 3x bonus categories on this card), there is no need for them to have two Sapphire Reserve cards.

Keep in mind that you can combine Ultimate Rewards points within your household, so as long as either Jim or his wife has a Sapphire Reserve, they can pool points from all of their cards that earn Ultimate Rewards onto that one Sapphire Reserve card in order to transfer to partners or use points at a vale of 1.5c each to book travel.

We recommended they downgrade one CSR to another Freedom card for an additional $1500 per quarter rotating 5x categories. If they did not downgrade an Ink card to the Ink Business Unlimited, the Freedom Unlimited would be another option here.

Note that while the CSR’s newly-increased $550 annual fee isn’t a fit for everyone, we determined that it likely is a fit for Jim and his wife since they cruise to and from Europe every year and spend about 6 months in hotels / Airbnbs / Vrbos / on cruises. They likely spend plenty to justify paying the difference in annual fees for the extra point per dollar of the CSR over the Chase Sapphire Preferred (that is to say that they will earn more in points than they will spend in net fee difference). (Saved: $550)

American Airlines credit cards

This was easy: since they don’t fly AA domestically and only occasionally maybe fly them internationally when they can’t find a cruise home from Europe, it just doesn’t make sense to keep any of the American Airlines credit cards. Perhaps some would choose to keep one for free checked bags, but even that probably isn’t useful enough here. Note that if you close the cards but have miles in your account, you’ll want to make a small purchase through the shopping portal each year to keep your miles alive with new activity.

I recommended that Jim consider product changing a Citi American Airlines credit card to the no-annual-fee Double Cash card to give them an additional “everywhere else” card. Short story: cancel the AA cards (Saved: $481)

Delta Gold

Simple recommendation here: cancel. They don’t use the benefits and it’s taking up an unnecessary Amex slot. Gone. (Saved: $95)

Amex Platinum

It didn’t make sense to me that Jim had a Platinum and no other cards that earn Membership Rewards since the Platinum isn’t very rewarding in most spend categories. He further reported that they don’t have lounges at the airports they frequent and haven’t fully used the airline credits every year. This card is too expensive to justify if you aren’t squeezing out every bit of annual benefit. Our recommendation was to cancel (though Jim will want to first transfer out any existing Membership Rewards points or consider opening the Blue Business Plus, which has no annual fee and would keep his points alive / preserve the ability to transfer to partners. (Saved: $550)

Hilton Aspire

Despite the fact that I’ve often said that this is the one no-brainer ultra-premium card, our advice was ultimately that Jim should probably downgrade to the Hilton Surpass, which carries a $95 annual fee. That’s because Jim said he didn’t use up the entire airline credit, doesn’t usually use the annual Hilton resort credit because they don’t stay at Hilton resorts, and the benefit he valued most was Diamond status for free breakfast, lounge access, and room upgrades.

Since Hilton Gold gives you breakfast at Hilton properties and will sometimes get you an upgrade to a club lounge room and since Jim isn’t really maximizing the other benefits on this card, it makes more sense to downgrade to the Hilton Surpass. Note that if Jim had never had the Surpass before, he’d be better off opening it as a new application in order to earn the welcome bonus — but since he isn’t eligible for the welcome bonus, the downgrade makes sense. (Saved: $355)

Radisson Rewards card

Jim also has a Radisson card with a $75 annual fee. I mostly stayed quiet on this one as Greg talked it through. It sounds like they use the anniversary points from this card for more than $75 in value, so I guess it’s a keeper. I have the $75 Radisson card and think it can be a fit for some, but I may have questioned them harder on this in hindsight. Still, we ultimately said to go ahead and keep it.

The unfiltered conversation

The above re-hashes what we spoke about with Jim, but if you’d like to actually hear it all play out, here is the unedited full discussion. Note that Jim under-estimated his current annual fees a bit since some had likely gone up since he last wrote out his list, so you’ll hear him reference a slightly smaller total cost.

Bottom line / what we can learn

Greg and I wanted to take an opportunity to do a consultation with a reader to answer their questions about points and miles and Jim came at us with a need for an immediate intervention: he was paying far too much in annual fees. Assuming he takes our recommendations, Jim will still be paying a pretty heft sum in total annual fees (just over $1600 per year), but that is a far cry from the $4500+ where we began. Given that he and his wife travel for about 6 months per year, that sum becomes more reasonable since it will save them actual dollars and cents over paid nights in many cases.

Given the current environment and severely reduced travel, many of us could stand to take a look at our credit card portfolios and consider which cards can be downgraded or cut from the pack. In many cases, it’s relatively easy to bring those cards back via future upgrades or new applications, so it may be time to have an intervention of your own.

[…] this hobby that we created a Youtube show to provide credit card interventions (we kicked it off by helping Jim eliminate almost three thousand dollars in annual fees). How much is too […]

[…] Frequent Miler’s Card Talk is a new bi-weekly series in which Nick and I meet with a reader to do a credit card intervention. What credit cards should you get and which should you dump? Our goal is to help! We started Card Talk originally with a test card intervention with reader Jim. Jim had way too many credit cards with high annual fees. We successfully talked Jim through almost $3,000 in savings! Read about the original Card Talk episode here: Saving $2,897 in annual fees: a Card Talk intervention. […]

[…] description appealed to us because we spent the first couple of Card Talk episodes with Jim and then Jen focusing more closely on trimming down wallets that had gotten a little unruly with […]

[…] New Card Talk series. We will soon release a new video and blog post series called “Card Talk” where we have a credit card intervention with a real person who needs help deciding which credit cards to get or to cancel. In a trial version of this we helped one person save nearly $3,000 (see this post for details). […]

[…] Saving $2,897 in annual fees: a Card Talk intervention […]

just wondering how anyone can get so many cards in their name. I have about 6 cards which puts me over the chase rule and I have been turned down for 2 cards in the last several months because of this. Amex has turned me down also. my credit score is over 800 so that is not a problem at all. I just keep hearing from the banks that I have too many credit cards. that being said good for this person to really use credit cards to his advantage.

As an alternate way to get platinum status with bonvoy could I do the Platinum challenge which requires 16 nights in 90 days? Apparently I could use free nights with points toward those 16 nights. Theoretically, with enough points I could get the Platinum Status at no out-of-pocket cost. Does that sound right?

To my knowledge, status via a challenge has historically required paid stays. Award stays count towards earning full stats with 50 nights, but awards days usually don’t count for a challenge. If they did, one could just look for an off-peak Category 1 and complete the challenge for about 65K points after 5th night free.

I didn’t see a post when searching FM, but I’d love something on downgrading and upgrading cards. What are the guidelines, are there different rules depending on the issuer, how long do you have to stay downgraded before you can upgrade again (and can you always upgrade again), do these moves affect your credit (I assume not), can you do it more than once a year, etc. Especially in these non-travel times, I’m joining others in a critical analysis of all cards. Unfortunately, I wasn’t targeted for the Amex Everyday upgrade (boo!) but it has me rethinking each account. Thanks!

The savings by dropping one CSR should only be $250 not $550, right? You said they could each easily qualify for the $300 rebate. So $550-300=$250.

I have an idea for a new revenue stream for you – credit card culling! I would gladly pay you a couple hundred bucks for a Jim like consultation to help save thousands of dollars. Sometimes hearing from others gets you past some analysis paralysis. Kind of like how I am finding my kids don’t listen to me home schooling them nearly as well as they take direction from their teacher.

Hello – Do you know if the downgrade card for the United Mileage Plus is the TravelBank card? That seems to be the only one they offer (“they” being the reps from other card products that are helping out). I asked about the United Explorer no fee and they couldn’t identify it… Thank you in advance to anyone that has an answer for this!

I was finally able to get a rep that downgraded me to the United no-fee card. So it is NOT the United TravelBank, this is a separate product in and of itself…

No, you don’t want the TravelBank card. You want the United MileagePlus Card. It’s no longer available to new applicants but you can product change to it. Here’s the benefits page: https://www.chase.com/personal/credit-cards/united/mileageplus/benefits

Thanks Greg!

On a separate topic, I paid my $495 Citi Prestige fee in October, I’ve used so far $100 for Global Entry renewal but haven’t used my $250 airline credit yet. I called and they have no incentives or offsets to annual fee…Ouch!!… Thinking of product changes… I don’t currently have the Premier card, I cancelled it in June 2018; I initially earned the Citi TY bonus for both the Prestige and Premier bonuses in June 2015, but I’ve only left the Prestige open (I did take advantage of a few 4th night benefits)… So, if I were to apply for a new Premier card and subsequently do a product change to the Citi Premier (from my Prestige), ending up with 2 Premiers, would I earn the bonus on the Premier on which I just applied? (I think you mentioned in either one of your posts or on one of your podcasts, that one can hold multiple Premier cards)… Is there any other way to approach this?

Thanks

Just catching up on old comments & questions… Did you get this answered? Yes you can have two Premiers (and yes you should get the bonus), but why would you want two? Why not prod change the Prestige to Rewards+?

This was a very helpful article. I’d like to see some analysis of whether it’s worth keeping the Amex Platinum. Mine is coming up for renewal next month. Unless I get a really good retention offer I’m planning to close it.

I think this is a good reminder to take a step back and look at things holistically every once in awhile. I just summed up the annual fees on all my cards and was surprised to find that the total was $1,885! Now $349 of that is cards I’ve gotten in the last year that are gonna be canceled when the annual fee comes due again, but it’s still higher than I expected it to be. For me, that’s offset by $600 in annual travel credits and 5 free hotel nights that I get full use out of, so it’s not as bad as it looks even before the points earning and ancillary benefits.

I do have one card that I’m on the fence about. The annual fee is probably more than the value I get from it, but only by ~$15. And it’s from Barclay’s, and I feel like keeping it and putting some spending on it increases my chances of Barclay’s approving me for other cards in the future.

Nick and Greg, could you give your thoughts on the high-end Chase Ritz card without Marriott Platinum or higher status? And on the Ink Business Preferred — it says above that the cell-phone protection wasn’t valued at $95/year by Jim — is that your opinion as well? Thanks!

Nice job. I have one question. How would you go about downgrading cards ? I assume you either have to call, or do it via some chat tool. And right now aren’t the hold times extremely long?

If you could do it online w/o any interaction that would be nice but while I’d like to save some money, I can’t imagine sitting on hold for 1 hr+ just to downgrade a card. I’d go the lazy (and not the best route) and simply cancel them. Especially if I had to do this with multiple cards from multiple banks. My BP is rising just thinking of being no hold.

Call like 4am I usually get in @ CC’s and Airlines too . I got in @ Comcast after hanging up 5x too @ opening hrs..

#stayincave

Typically, yes, via phone.

Chase used to do it via secure message but stopped. If the situation with long hold times persists, I wonder if they may start allowing that again.

Maybe it’s possible to do via chat with Amex? Not positive.

I called Citi last week to product change my Prestige call. The entire call was 8 minutes and 36 seconds start to finish. I probably just got lucky as I’ve heard of long hold times also, but maybe you’ll get lucky. I called around 10:30pm on a weekday. Not sure if that helped.

I’m sure this is going to take Jim a while and maybe he won’t even do it all right now. In many cases, there won’t be a reason to downgrade or cancel before the annual fee is coming due, so it doesn’t necessarily have to all be done right now.